RateSetter – Australia’s disruptive P2P lender

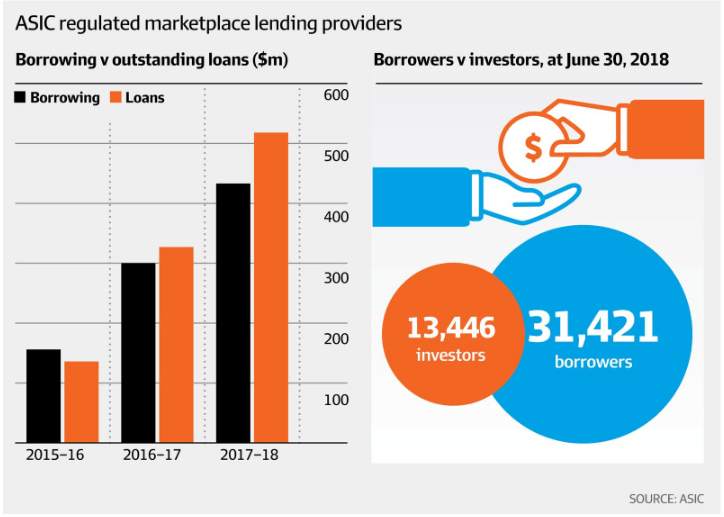

RateSetter establishes itself as the dominant P2P consumer lender in Australia.

RateSetter is Australia’s leading P2P lending platform. P2P or ‘Peer-to-Peer’ lending connects investors with borrowers, offering lenders a portfolio of loans with repayments typically made monthly by borrowers. P2P loans are attractive for borrowers because of the possibility of cheaper interest rates than are on offer by bigger banks. The transacting experience is also far more seamless – P2P lenders often offers more customized credit risk scoring and digital onboarding processes. For investors P2P lending offers access to alternative investment class traditionally reserved for banks.

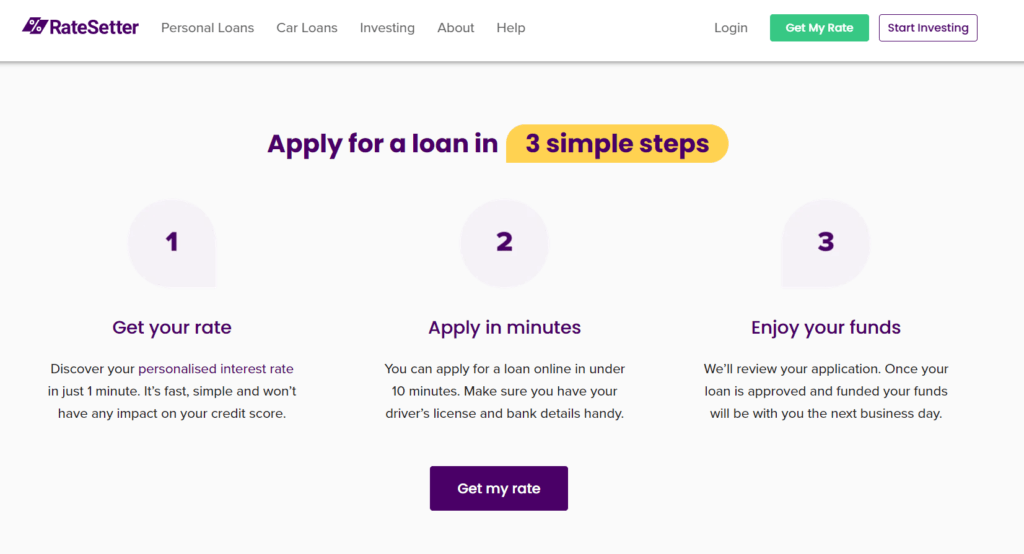

For the 47,000 Australians that have used RateSetter, the platform offers fast, flexible, secured and unsecured personal loans with terms from 6 months to 5 years. Loan amounts vary from A$2,001 to $45,000 and strong credit history is rewarded with highly competitive rates and better terms. RateSetter encourages competition in the personal loan industry (and in turn drives business for its platform) by offering prospective borrowers’ quotes without the application affecting their credit score (typically used by banks use to assess creditworthiness).

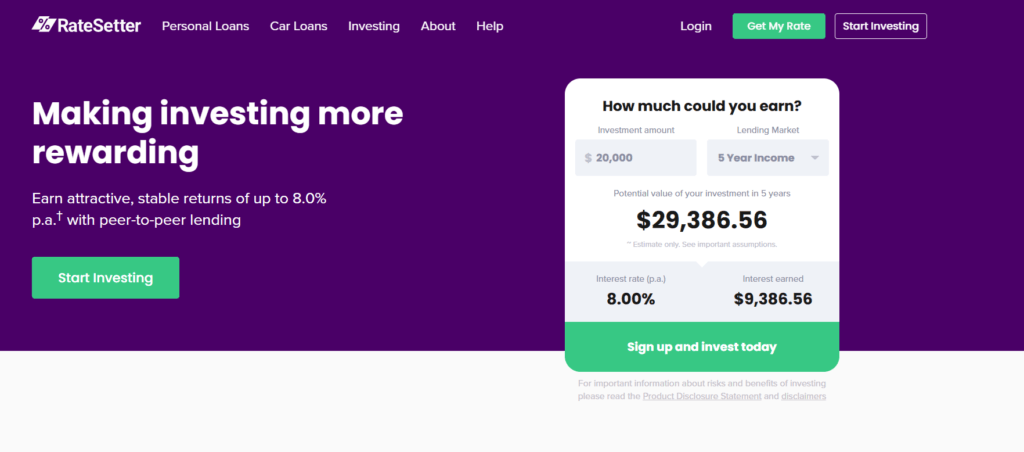

For the 20,000 lenders who loan money through the platform, lenders are empowered to set the rate. RateSetter acts as the intermediary that matches the lenders to an investment that suits the lender’s risk appetite.

Investors and borrowers can have their funds invested, approved or deployed within one business day. The set up is easy and frictionless. The customer journey from application to borrowing or from investing to lending is substantially quicker and simpler than bigger banking rivals who have to rely on cumbersome credit risk scoring models and legacy IT infrastructure before they can make their loans.

What differentiates RateSetter?

RateSetter is unique in that it provides an additional buffer to help manage the risk of loan defaults by investors. Each borrower pays a fee into the, ‘Provision Fund’, a pool of funds held in cash by a separate trustee. In the event a borrower misses a repayment or defaults on their loan, the Provision Fund can step in to protect investors. To date at RateSetter the Provision Fund has a 100% track record of protecting investors. Despite this, the Provision Fund is not a guarantee and thus investors still face a degree of residual risk. Whether this Provision Fund can withstand rapid changes in market conditions – such as those faced across the global economy at present will determine the long term sustainability of this approach.

There is nothing intrinsic to RateSetter’s business model however that suggests it would be hard to challenge in the Australian market. Borrowers can easily ‘shop’ around platforms to find the most favorable rate if it is not offered on the RateSetter platform. This shopping can also lead to adverse selection – lending to those investors who weren’t offered loans at the larger Australian banks. Investors can pull funding if they decide to reallocate the asset or risk allocation of their investment portfolio and competitors can easily replicate their model. In fact RateSetter’s largest competitor in the P2P space, SocietyOne (which holds around 1% of Australia’s consumer lending space) offers a similar P2P lending product.

How does it make money?

RateSetter makes money by charging investors an interest margin fee of an amount equivalent to 10% of the gross interest they receive from borrowers. This is charged whenever an interest payment is received. Furthermore, investors do not earn interest on funds in their holding account, as interest earned on the bank account that holds RateSetter investors’ funds is retained by RateSetter. For borrowers, they pay a one-off fee which for assistance with the loan and a portion of the interest rate.

Some skeptics question the longevity of P2P and whether it will become a permanent feature of the lending landscape. Although P2P lending remains a relatively tiny portion of all loans made in Australia, it is a mainstream business overseas, particularly in the United States and the UK.

Since 2014, Ratesetter has written approximately AUD $750 million in loans. It now is Australia’s largest technology led consumer lender in terms of monthly volumes and the biggest provider of regulated loans for solar panels and household storage batteries. The investor base which includes retail, ‘mum and dad’ investors, fixed income funds, the Australian Clean Energy Finance Corporate, self-managed super funds and the Australian retail superannuation fund Future Super shows it broad based acceptance across the Australian investment community.

Sources:

https://www.ratesetter.com.au/about/

https://www.afr.com/street-talk/peer-to-peer-lender-ratesetter-invites-bank-pitches-20200121-p53t76

Great article! There has been a rise in fintech businesses that offer retail customers seamless access to loans. I have been very worried about the scalability and the sustainability of this model, given the high NPL ratios of this type of business models. A look into the NPL ratio of RateSetter may be very telling about the sustainability of this company. Nevertheless, it is quite impressive that are underwriting up to AUD$750M.