Quantopian – Crowdsourcing Investment Algorithms

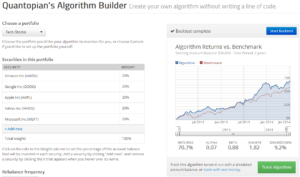

Quantopian has created a programmer-friendly toolkit allowing programmers to profit from trading algorithms

Quantopian, founded in 2011, has utilized the power of the crowd in its efforts to “Level Wall Street’s Playing Field.” Currently, the community consists of over 100,000 members, many of whom are accomplished PhDs, algorithmic traders or mathematicians who have found algorithms that generate outsized returns for investors. Quantopian itself offers capital, along with data and programming tools to allow its members to test their algorithms and earn income based on the quality of their programming.

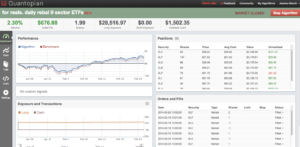

In order to entice participation in the platform, Quantopian offers access to its hosted IPython environment which allows for access to not only coding programs but also data sets, including corporate fundamentals, historical stock price information and other relevant data. Additionally, Quantopian allows users to run their newly designed algorithms through back-testing systems to determine the quality of their strategy and refine as needed.

In addition to providing coding tools and data sources, Quantopian offers an attractive compensation structure which allows for top algorithms to earn a share of the net profits from their code. Other monetary prizes and incentives are also offered to further increase usage of the platform. Quantopian also utilizes the power of community to reinforce its platform. The company hosts online forums to discuss specific algorithm or programming challenges that allow for any members to contribute ideas to one another. Additionally, Quantopian hosts numerous in-person workshops to introduce members to new concepts and allow for greater sharing of information.

Overall, Quantopian allows greater access to implement trading strategies for accomplished academics, financiers and market participants without the large capital requirements generally needed to achieve sufficient scale in the asset management industry. Additionally, the platform allows Quantopian to spread the fixed costs of creating software tools, accessing data and implementing back-testing software across a broader set of actors (as compared to other asset managers).

While I believe the platform is an intriguing use case for crowd sourcing, I do have several concerns regarding the sustainability of the model. One major challenge is the ability of the platform to compete for talent with asset managers who have far greater incentive to produce returns. Many programmers may find that after months of showing positive results, they can send their track record to a quantitative hedge fund who would quickly either hire or buy the code in order to have sole ownership of the alpha-generating capability. As has been seen many times with other stock market fads, once ideas are well-known and widely disseminated, the ability to use these strategies tends to reduce to near zero relatively quickly. Additionally, the current fee structure only pays programmers 10% of net profits as compared to higher fee allocations (20%+) at other firms.

In addition to the risks related to poaching and the ability of the crowd to continue to provide outsized returns, the combination of limited capital at risk and the ability to back-test easily, could lead to the creation of “bad” algorithms that were designed to fit well to past information, but are unlikely to produce outsized returns in the future.

I believe the sustainability of Quantopian’s business model will be dependent on their ability to continue to aggregate sufficient programming and financial talent to produce algorithms that offer compelling returns to investors, despite the headwind past success will continue to present. Additionally, Quantopian will need to find ways to attract sufficient capital to provide rewards for its programmers, without leading to poaching talent at a rate that diminishes the platform significantly.

This is definitely an interesting business. It reminds me of Covestor which allows you to invest alongside other professional investors, such as fund managers, and they take a percent of your profits. A couple things concern me about companies like Quantopian and Covestor. The first is that there is limited downside risk for them and other non-professional investors could really get burned if they aren’t doing their own diligence. In a world of new complicated financial products, the limited regulatory oversight seems concerning for their business model. Someone could lose a lot of money and sue them for not disclosing the risk properly. Second, as investors all pile into a strategy, the returns diminish – as you mentioned. If someone truly had a monumental strategy/algorithm, wouldn’t they keep it for themselves or sell it to someone else who has capital for a big return? Sharing it would get them their 10% profit share, but that seems small compared to what someone else who stands to make more would be willing to pay. It makes me think that the best ideas may not make it onto the platform and that only the mediocre ones do.

Thanks for the post Dan! As you mentioned that winning strategies expire quickly, isn’t it more the reason that Quantopian exists to continue supplying the market with new strategies? I disagree slightly with NP’s assessment of the adverse selection. There are other reasons, mostly of convenience or access, preventing a quant to submit their trading strategies directly to an asset manager. That includes lack of awareness how good their strategies are, and the lack of data and back testing mechanism. If Quantopian is able to build good relationships and create good experience with the quants, for the hobbist quants, i see it is a very viable “playground”