Next Big Sound – BandPage on Steroids?!

“I stream, you stream, we all stream some Trap Queen.”

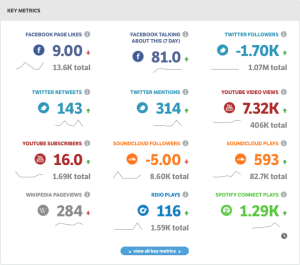

Next Big Sound brings analytics to artists and brands using streaming music and social media data.

At this point, we should all be convinced of the value of data and analytics in the music industry. If the proliferation of various streaming services and accompanying press over artist backlash (…looking at you, Taylor) hadn’t done it for you, then surely the BandPage case would’ve. That in mind, I’d like to introduce another company in the industry with particularly interesting value creation and capture models – Next Big Sound.

Value Creation

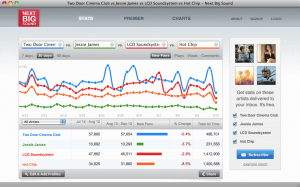

Like BandPage, NBS focuses on a holistic view of an artist’s digital presence – everything from streams to iTunes sales to Facebook likes, Twitter mentions, and Wikipedia page views. However, rather than consolidating information on behalf of the artist and consistently publishing to various platforms, NBS tries to use platform data to accurately predict an artist’s trajectory. Think about it as de-mystifying an artist’s meteoric rise from playing in their garage to headlining nationwide tours with a data-driven approach. To artists and labels, imagine the possibilities of knowing which bands are about to break and why – playing which late-night shows, which venues, which cities, which social media platforms really impact an artist’s trajectory. In fact, NBS has already predicted the rise of acts like Iggy Azalea, A$AP Rocky, and Macklemore & Ryan Lewis. Billboard now publishes two charts based exclusively on NBS’ data. They produce insights that tell us things like while T Swift dominates Twitter and Instagram (obviously), she doesn’t even crack the top 10 in interactions on Facebook, where Latin artists engage users the most. Likewise, while any indie music fan might be able to tell you that Halsey was/is about to blow up into the mainstream, NBS can supports that claim with data and democratize the information.

Value Capture

NBS also differentiates on the Value Capture model. Clearly there is value to be had for all artists trying to make it big, and for those who are already big, how to stay on top. This has enabled NBS to ink deal with the biggest names in music, answering questions like – who is my target audience and most loyal fans, when should I release my next single, where should I play a show next, and are my tweets working? Providing that information is one revenue stream.

Equally important though, is the $1B+ spent each year by various brands on music-related marketing and sponsorships (think Pepsi). NBS is using their analytics to point brands toward the right artists to sign deals with. They know precisely what demographics are strongest with each artist, and can leverage that to target market with brands. Similarly, they can steer brands away from signing on with last year’s pricey superstar, and instead get them a deal with next summer’s smash hit.

Operating Model

Clearly data mining must be a critical competency for NBS. In the first 6 months of 2015 alone, NBS tracked over one trillion plays on various platforms including Pandora, Spotify, Rdio, SoundCloud, Vevo, Vimeo, & YouTube. They track engagement on Facebook, Instagram, Twitter, and Wikipedia as well. Designing and refining the predictive algorithms that make the data meaningful, and the visualizations that allow artists, labels, and brands to digest and use the output are other critical components of a well-functioning NBS ecosystem. Getting the right partnerships and access to data early on has been critical (access to Spotify data came a few years ago) as well, and they’ll have to continue to expand the data pipeline to add value for its customers.

Challenges

There has been a lot of change for NBS recently. They were acquired by Pandora in May, and launched Next Big Book for the book publishing industry recently as well. While NBS may bring analytics to music better than anyone currently – barriers to this market aren’t especially high, and their alignment with Pandora may deter other streaming services from sending them data. On the flip side, people are now starting to question whether NBS is predicting hits, or actually creating them. If Billboard uses NBS data to publish a list of up and coming artists – does that predict those artists’ success, or does it actually make them successful?

Cool post! Your last question was great and made me think about causation versus correlation. Clearly the correlation is there – NBS’s predictions move positively with a band’s success and vice versa. However, which caused which? NBS can do a few things to evaluate this question. The first strategy that comes to mind is doing a controlled matching experiment using historical data. To do this, they would make two groups of past bands, one for NBS promoted bands and one for non-NBS promoted bands. Each band in the NBS group should have a partner in the non-NBS group that has similar demographics like launch year, starting fan base, genre, social media outreach, etc. Using a success rate metric, like number of fans after a certain time period, as the dependent variable, they can then run a one sided t-test to see if the NBS group had a statistically significant higher rate of being successful. Each group had comparable bands within it, so the null hypothesis is that the NBS group success should equal the non-NBS group success. If the t-test comes up with a low p-value, then they would reject the null hypothesis and the alternative would be true that the NBS bands are more successful than the non-NBS bands. Thus, telling us that NBS’s promotion actually caused the success. NBS can then choose to use this information to re-position their marketing message to bands and sponsors or not.

I used to work on music partnerships at YouTube and not only would we provided them with artist data, but we would also utilize their services to spot home-grown YouTube talent on the upswing which we could then put some support behind. Definitely plays into your last question in the post about predicting vs. creating hits.