mPharma – is a platform model always successful?

When it first started, mPharma focused on connecting patients, doctors and pharmacies through an electronic prescription network (EPN). But a myriad of the platform’s “cold start” problems rooted in the Ghanaian context hampered the EPN platform strategy, forcing the company to pursue another model.

mPharma’s EPN

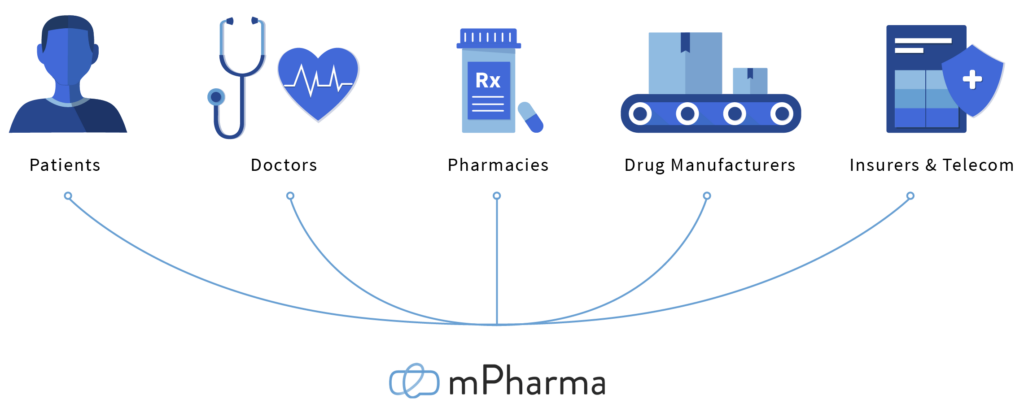

Founded in 2013, mPharma is a drug-monitoring platform that connects patients, hospitals and pharmacies. The company’s mission is to make prescription drugs more affordable to underserved populations and emerging markets in Africa. Currently, mPharma serves 9 countries, including Ghana, Nigeria, Kenya, Zambia, Malawi, Rwanda, Ethiopia, Uganda and Gabon.

When the company first started, the core product it offered is an electronic prescription network (EPN), a cloud-based data platform that allows doctors, patients and pharmacies to send, share and track digital prescriptions. While the EPN isn’t precisely a platform, it has the core features of a platform, as “network effect” is present – the product’s value increases as more users engage with it, and mPharma is able to grow and scale more quickly as it collects more data.

Value Creation

The EPN, if operated successfully, creates value for several parties:

- Doctors can write digital prescriptions (rather than paper prescriptions, which often get lost) and direct patients to the most suitable pharmacies. They will also be able to know the exact location and availability of medicines in real-time.

- Patients can make more informed buying decisions with greater knowledge of the drug availabilities.

- Both retail and hospital-based pharmacies can take orders online (most of them did not have the technology to do so back then!)

Value Capture

As more patients, doctors and pharmacies sign up for the EPN, mPharma is able to collect a larger amount of data, and generate disease profiles of cities, demographic information, and data on supply and demand for medicines. The company monetizes the data by selling analytics to drug manufactures, who are able to better anticipate demand by patient sectors and ensure supply.

Why didn’t the EPN work?

In 2016, mPharma lost its major customer Pfizer and a few other funders. The core issue was that the data collected was asymmetric: mPharma was capturing a large amount of drug prescription data from doctors, but little data on drug dispensation from pharmacies, such as drug prices and quantity sold (which the pharmacies were under no obligation to report). As a result, the data collected speak little to drug sales patterns and retail trends, key information sought by its customers (e.g. Pfizer). Moreover, since the pharmacies charged high prices, the patients were often reluctant to buy the drugs prescribed by their doctors. In this light, the EPN created little value for the patients – the very population that mPharma intended to serve in the first place.

We all know that a platform connecting two sides needs substantial numbers of users on both sides in order to generate revenue and scale successfully. If one side fails to attract enough users, we call it a “cold start” problem. mPharma was facing a four-side cold start problem: the doctors, patients, pharmacies and drug manufacturers all had reasons to not engage, due to contextual concerns. For example, if a prescription is sent to a pharmacy, which doesn’t have the drug in stock because the manufacturer isn’t on the platform, then the pharmacy and the EPN provide little value to the patient. Similarly, if not enough doctors or pharmacies join the platform because of barriers to adoption (e.g. many doctors in Africa do not have a computer that is compatible with mPharma’s EPN), then there would be insufficient incentives for patients and drug manufactures to join, as well. These reasons explain why similar EPN systems thrive in the US (where electronic record systems abound and overall trust levels are higher), but failed in mPharma’s case in Africa.

Pivoting to Supply Management

Greg Rockson, the CEO of mPharma, is well aware of all the issues previously mentioned. “One mistake was thinking the issues were with the doctors”, he said, “but it looks like the pharmacies were the problems all along. Those are the people we need to be working with”. Rockson believes that the real reason for the high drug prices was the fragmented nature of the industry: drug manufacturers do not supply directly to the pharmacies; instead, a complex web of intermediaries such as distributors and wholesalers procure drugs from the manufactures and sell to the pharmacies with a high markup. A promising task of mPharma, then, is to eliminate these intermediaries and reduce costs of procuring drugs for the pharmacies.

By early 2017, mPharma had decided to pivot to a supply management company, adopting a vendor managed inventory (VMI) model. It now collects detailed information on patients, pharmacy sales and inventory level, movement of drugs from warehouses to the pharmacies, clinical data, delivery information, etc. Through analyses of driver route optimization, procurement, fulfillment rates, and the industry network, mPharma has been able to leverage its technology to help pharmacies source drugs at cheaper rates and improve inventory management, ultimately lowering prices for the patients and increasing revenue for the company itself.

Hi Yifei,

Thank you so much for this blogpost! I found it really interesting to read about mPharma. One of the points that stood out to me were the problems they had with the cold start. I wonder if they could have solved this problem by focusing on one customer group first, for example finding pharmacies that are able to give discounts in exchange for geographic and demographic knowledge. Or maybe loose money at the beginning by substituting the drug costs and prescription costs to spark network effects. Or maybe bulk orders could have been a solution if one town would need many of the same antibiotics for example. Another solution could have been to sell to local pharmacies in these regions instead of the customers directly maybe. I think it is interesting how the company pivoted to a data focus, which in my opinion has little to do with their original mission. I think what I am learning from reading this blogpost is how important the right kind of data has become in our society.

This was fascinating, Yifei! Your account of why mPharma eventually failed highlights the importance of understanding the ecosystem when you are trying to build a platform business. As you noted, it seems like mPharma spent time focusing on one side of the ecosystem (doctors), when it also needed to pay attention to others. The network that mPharma was trying to build seems exceptionally complicated because many of the successful platforms we have studied are simply two-sided. Here, mPharma had at least 4 separate parties whose buy-in was necessary for the platform to be valuable to the others. A related lesson is that platform businesses sometimes have to build the infrastructure that they need to succeed. The fragmented nature of the drug supply chain seems like a permanent bar to onboarding patients on the platform, so it makes sense that mPharma has pivoted to trying to solve this problem first.

Thank you for an interesting blogpost, one thing that I really find super interesting that mpharma realized the root cause and pivoted to their business to VMI. It is definitely a great solution for the end to end value chain in the medical ecosystem. In my opinion it will be very beneficial for all the parties in the value chain, for patients – they can improved affordability and availability, for Pharmacy and manufacturers they can better predictability of demand and can optimize the supply of drugs in a particular geographical location and can prevent overstocking. Moreover, I think mpharma can also monetize on sharing this data with the drug manufactures as this is super beneficial for the drug manufacturer to build their market entry strategy if they know the demand of a drug in a country.