Opensea: the first and largest marketplace for Non-Fungible Tokens (NFTs)

Opensea: the first and largest marketplace for Non-Fungible Tokens (NFTs)

Opensea launched in December 2017 as the first open marketplace for NFTs on the Ethereum blockchain, where participants can create, buy and sell NFTs. The two-sided marketplace attracts both creators and owners on one side and buyers and NFT browsers on the other. Opensea features over 80 million NFTs of all sorts (art, collectibles, games, music, photography, etc.) and over $20 billion has been traded through the platform. Opensea has improved the liquidity of this asset class and the platform’s profit formula is based on charging a 2.5% fee on all NFTs traded, which implies that the company has generated over $500 million in revenues.

As many successful two-sided platforms, Opensea benefits from strong cross-side network effects: more creators/sellers on the platform leads to a larger number of NFTs to browse and choose from for buyers, and the more buyers/browsers leads to more creators/sellers being motivated to display and list their NFTs. This strong network effects together with Opensea’s first-mover-advantage has led to consistent growth in active users, with the company achieving over 1 million active wallets this year.

Opensea has integrated features into its platform that create value for users and have enabled the company to retain its leading position in the NFT market.

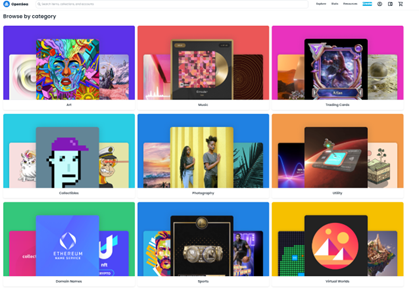

Feature 1: Breadth of NFTs on platform, pulling NFTs directly from blockchain

Opensea decided to build a wide-open marketplace including all types of NFTs. Since the blockchain is a public ledger, Opensea is able to pull all public NFTs into the platform. This allows the Opensea community to browse and follow all kinds of NFTs, even if they are not for sale. The breadth of NFTs displayed on the platform allows both creators and browsers to remain engaged, and track and follow different types of trending NFTs within a single site. Opensea user interface categorizes NFTs in an easy-to-browse way that enhances user experience.

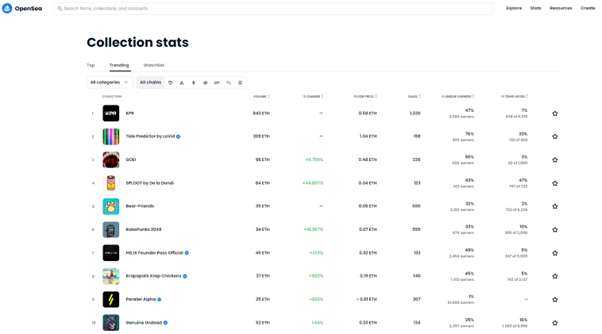

Feature 2: Data tracking and analytics

Opensea tracks and displays data on all NFTs that help analyze trading volume, pricing, rarety, holding ratio, previous transaction and historical ownership. These quantitative factors help buyers and sellers determine the value of the NFTs, facilitating more frequent trading and keeping the community engaged as anyone can track these statistics. This data is public and so not proprietary to the platform. However, Opensea organizes it in a user-friendly interface and saves users from having to extract and categorize these data from the blockchain, leading to high engagement.

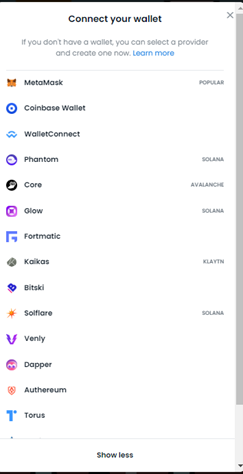

Feature 3: Compatibility with multiple wallets, blockchains and sale structures

Transactions are settled in cryptocurrencies and Opensea supports multiple wallets and blockchains to facilitate transactions. Moreover, the platform allows sellers to include price floors, sell through auctions, introduce royalty rates for future sales and fractionalize tokens. These features not only create value for sellers but also improve the future liquidity of NFTs, benefiting buyers and encouraging browsers to join the market.

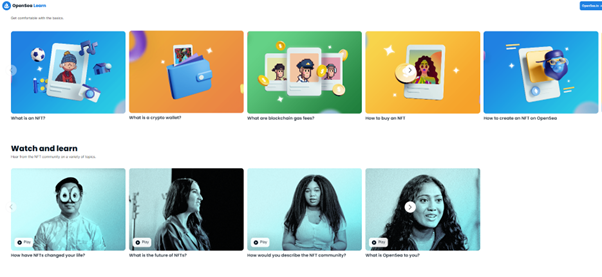

Feature 4: Educational videos, NFT creation tools and community engagement

Given the infancy of the NFT market, Opensea has introduced features to attract and educate people who are not necessarily currently trading NFTs. Its free educational videos on blockchain technology, free tools to create NFTs in minutes and active blogging community attracts over 30 million visitors to its site per month, most of which don’t trade NFTs. By doing so, Opensea hopes to grow the market for NFTs. This helps buyers and sellers on the platform, as community engagement and awareness are important drivers for NFT valuations.

Feature 5: NFT authentication

The exponential growth of the NFT market has seen an increased risk of scams and fraud. Opensea has had cases of counterfeit NFTs displayed in their platform and insiders front-running other buyers. The company is working on algorithms that can spot fakes automatically and it also employs full-time moderators who investigate suspicious listings. Overall, Opensea is recognized as a trustworthy platform by the crypto community and its future success hinges on its ability to continue to authenticate NFTs and create trust for its users.

Opensea has been successful at building several features that create value for participants on both sides of the platform, enabling the company to continue to be the largest marketplace for NFTs in what could be a winner-take-all market. The NFT market continues to be in its infancy, with less than 2% of Americans having ever traded NFTs, and so Opensea must continue to deliver value to its users to maintain an engaged community and protect its platform from the risks of competition and online fraud.

Sources:

NFTs: The Next Killer Financial Asset; Julia Maltby; https://jvmaltby.medium.com/nfts-the-next-killer-financial-asset-7be9be581b6e

NFT Investing: Deconstructing the Rabbit Hole; Julia Maltby; https://jvmaltby.medium.com/nft-investing-deconstructing-the-rabbit-hole-2bf945f6f099

What Every Crypto Buyer Should Know About OpenSea, The King Of The NFT Market; Forbes; https://www.forbes.com/sites/jeffkauflin/2021/11/23/what-every-crypto-buyer-should-know-about-opensea-the-king-of-the-nft-market/?sh=415fda362f89

First-ever NFT ‘Quantum’ sold for $1.47M; Fox Business; https://video.foxbusiness.com/v/6258820256001#sp=show-clips

Global Non-Fungible Token (NFT) Market Size to Reach USD 20 billion by 2028 | BlueWeave Consulting; https://www.globenewswire.com/news-release/2022/09/12/2514295/0/en/Global-Non-Fungible-Token-NFT-Market-Size-to-Reach-USD-20-billion-by-2028-BlueWeave-Consulting.html#:~:text=BlueWeave%20Consulting%2C%20a%20leading%20strategic,USD%204.36%20billion%20in%202021.

Only 20% of Americans familiar with NFTs, 4 million have used: Survey; Yahoo News; https://news.yahoo.com/only-20-of-americans-familiar-with-nf-ts-4-million-have-used-survey-165016231.html?guccounter=1&guce_referrer=aHR0cHM6Ly9qdm1hbHRieS5tZWRpdW0uY29tL25mdC1pbnZlc3RpbmctZGVjb25zdHJ1Y3RpbmctdGhlLXJhYmJpdC1ob2xlLTJiZjk0NWY2ZjA5OQ&guce_referrer_sig=AQAAANV-j5qRZ4bQgASV4ZUtSQRi_8vrCDV0k2TiehcXZ2z10vBbnq_6WWjuBwz7rV3BaqalFxa6m46nVljbd45C7n4J_yn32oAIzPjqhgmzNBLzCCIVhQPjGN-avjq3IRXkXmDgZAX0eg6mokhwaOJejlRjRhzP7uCJbTEou3_OQAN7#:~:text=Roughly%204.1%20million%20Americans%20have,other%20collectibles%20in%20the%20future.%E2%80%9D

HOW MANY PEOPLE USE OPENSEA IN 2022? (LATEST DATA); Earthweb; https://earthweb.com/how-many-people-use-opensea/

Similarweb; https://www.similarweb.com/website/opensea.io/#traffic

Opensea website; https://opensea.io/

Hey Carlos! Thank you for posting about OpenSea. I actually wanted to write on OpenSea for this assignment, but ended up deciding against it because I didn’t understand enough about NFTs and the unique value that OpenSea brings to the ecosystem beyond being one of the first to facilitate transactions. I’ve heard much criticism about how OpenSea is not authentic “Web3” because it’s so heavily VC funded and not decentralized – with Jack Dorsey being one of the big name critics who spoke out about this in 2021. What do you think? Are the features enough to differentiate OpenSea and make it defensible against fierce Web3-based competitors in the best future?

Another concern for me, was the valuation. While doing my research on PitchBook, I read that OpenSea’s valuation was sitting at over $13 billion, with less than $500 million revenue reported in the same period. Do think this valuation is inflated? Considering the hype around Web3 and NFTs last year, and how that had died down in 2022, it would be interesting to see how this valuation is adjusted to reflect the current marker speculation around the Web3 space, and NFTs as a valuable asset class.

Thanks for the fascinating post, Carlos!

Similar to Nthato, I think about OpenSea’s valuation, and it reminds me of how linked demand for platforms are with the “intrinsic” demand for transactions that platforms facilitate. I think it is unquestionable that OpenSea significantly enhanced the market for NFTs by facilitating an open marketplace for transactions, and that the many features they offered significantly enhanced both the purchasing and selling experience for NFTs. And yet, it feels like the rapid decline in transactions on OpenSea points to how, as powerful a complement that OpenSea has proved to be in the marketplace for NFTs, at the end of the day the value that a marketplace platform can create is ultimately most contingent on the amount of demand for the assets being transacted upon…