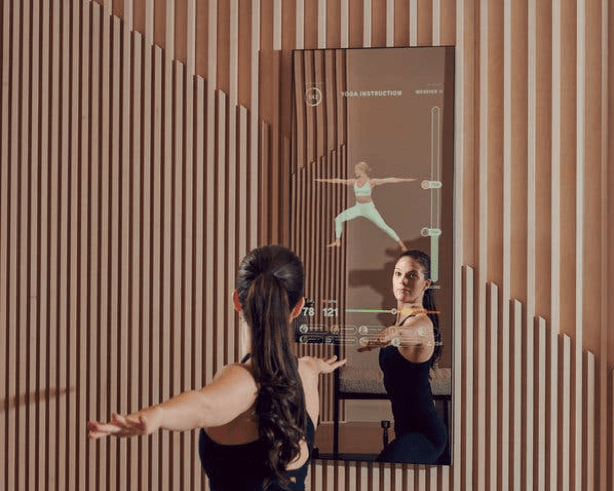

Mirror: The Future of Fitness?

Mirror is a recent example of a tech-enabled “home gym.” Digital products like Mirror are putting pressure on regular fitness clubs.

Digital disruption in the fitness industry.

Fitness is one industry that is experiencing meaningful disruption. Traditionally dominated by brick-and-mortar health clubs, the industry is witnessing a shift in how people want to pursue fitness. The change in fitness delivery is partially driven by new digital offerings, from wearable devices to virtual reality products. Millennials, in particular, have demonstrated an appetite for digitally enhanced workouts; as many as 36% report that they have paid for such an experience (1). Accordingly, digital fitness, as a relatively new sub-industry, is expected to balloon to a valuation of $27B by 2022 (2).

Introducing a winner: Mirror.

One interesting example of a “winner” in this space is Mirror. Mirror fits into the category of tech-enabled home exercise equipment. Mirror is an LCD screen (connected to the internet), which can be mounted on a wall of the user’s home and disguised as a full-length mirror when inactive. Once started, Mirror transforms into an elegant, interactive fitness platform. Users are served a selection of 70 fresh real-time fitness classes each week, as well as a library of on-demand classes ranging from yoga to boxing (3). Users stream these classes and conduct their workout in front of Mirror; they can watch their own movements on the screen, as well as those of a fitness instructor and fellow classmates.

Mirror has raised over $35M in funding from investors who have also bet on startups like Uber, Blue Apron and Warby Parker (4). The Mirror product officially launched in September of 2018 with a retail value of $1,495 for the physical device, plus a $39/month subscription fee (5). An average of 600 Mirrors have been sold each month since the product hit the market (6).

How is Mirror creating value for customers?

First, Mirror addresses common pain points of customers who would otherwise subscribe to a traditional health club. Used from the comfort of home, Mirror is ideal for people who feel uncomfortable attending an actual, in-person fitness class. Mirror also makes it easy for users to fit a workout into their busy schedule, and provides the flexibility to pursue any type of workout class on a whim (7).

Second, the Mirror experience is personalized. The system’s recommendation engine helps the user to select a workout. During the workout, if the user is wearing a Bluetooth enabled heart rate monitor, the system can also dynamically adjust the intensity of the exercises to help keep the user within their target heart rate zone.

Third, the Mirror platform can be made social, accommodating those who do not want to work out alone. During live classes, users work out in the company of others. Instructors offer tailored feedback and motivational comments to participants in real-time, which facilitates competition and helps recreate the exhilaration of a traditional group fitness class (8).

Is Mirror just a fad?

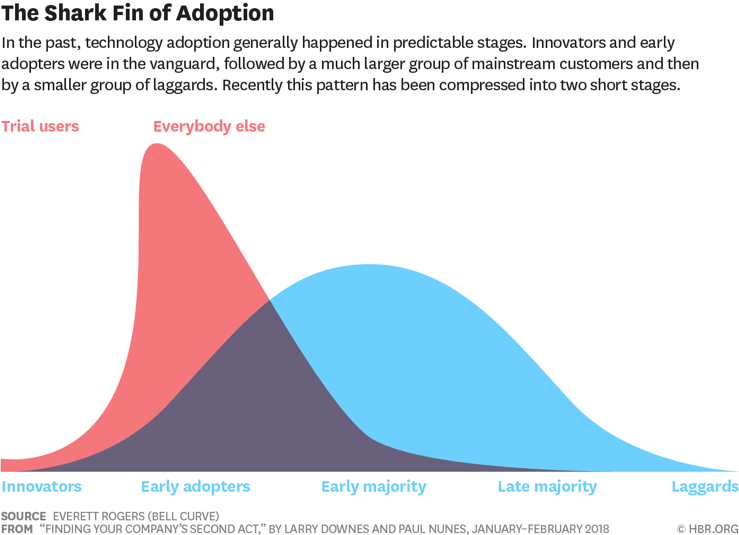

Many digital fitness products have previously splashed onto the scene, then lost traction in a competitive field (e.g. FitBit). This problematic trend has been described as the “Shark Fin” of adoption for disruptive digital products. Generally, the products that endure and achieve a steady flow of new customers are those that can create a nimble ecosystem, so that “as tastes change, the platform abides” (9). Following this logic, Mirror may be favorably positioned.

Mirror CEO Brynn Putnam explains that in a future state, this product need not even be limited to fitness applications. Mirror could also be used to provide interactive fashion and beauty media, for instance (10). Putnam says: “We’re looking to be the next screen in your life… you have your phone for communication, your computer for information, your TV for entertainment and now the Mirror for experiences” (11).

Who is the loser?

Traditional health clubs are feeling pressure to respond to the rise of digital fitness. While US gym membership peaked in 2018, the rate of growth has been slowing over the last several years (12). Mid-market fitness clubs (e.g. 24 Hour Fitness) are being hit hardest, as customers increasingly migrate to boutique fitness studios (e.g. SoulCycle), discount clubs (e.g. Planet Fitness), and novel “home gyms” like Mirror (13).

Historically, to stay competitive and keep up with fitness fads, these mid-market gyms would incur heavy upfront costs to purchase new physical equipment; the costs were then passed on to customers through significant membership fees. Now, these gyms are seeking new models to help them recover membership. Many are finally choosing to build mobile applications and invest in digital fitness solutions (14). Embracing digital could allow these gyms to deliver a better customer experience at a lower cost.

What do you think?

To what extent do you think digital fitness solutions will be able to cannibalize the demand for traditional health clubs and fitness studios?

Does Mirror, specifically, have staying power?

Sources:

- Evans, Alex and Geoff McQueen. “Three Myths of the Digital Fitness Boom.” May 21, 2019. https://www.lek.com/insights/ei/digital-fitness-boom-myths

- “Growth Opportunities in the Global Digital Fitness Market.” July 17, 2017. https://www.prnewswire.com/news-releases/growth-opportunities-in-the-global-digital-fitness-market-300489518.html

- “How it Works.” Accessed September 23, 2019. https://www.mirror.co/how-it-works.

- Rubin, Courtney. “The Most Narcissistic Exercise Equipment Ever.” February 8, 2019. https://www.nytimes.com/2019/02/08/style/mirror-fitness-method.html

- “Shop.” Accessed September 23, 2019. https://www.mirror.co/shop/mirror

- Rubin, Courtney. “The Most Narcissistic Exercise Equipment Ever.”

- Potkewitz, Hilary. “The Trendiest Fitness Class Now: Working Out Alone at Home.” https://www.wsj.com/articles/the-hottest-fitness-class-now-working-out-alone-at-home-11565712323

- “How it Works.”

- Downes, Larry and Paul Nunes. “Finding Your Company’s Second Act.” January, 2018. https://hbr.org/2018/01/finding-your-companys-second-act

- Griffith, Erin. “Silicon Valley Jumps Into the Fitness Business, and It Will Cost You.” September 6, 2018. https://www.nytimes.com/2018/09/06/technology/tech-workout-machines-price.html

- Brown, Dalvin. “Home Workout: Companies like Peloton, Mirror and FightCamp Push Remote Fitness Forward.” June 11, 2019. https://www.usatoday.com/story/tech/2019/06/11/how-5-g-wearables-and-ai-help-bring-smart-gyms-your-home/1331406001/

- Potkewitz, Hilary. “The Trendiest Fitness Class Now: Working Out Alone at Home.”

- Club Intel. “the Rollercoaster Ahead: 11 Prognostications for the Fitness Industry in 2018.” https://www.club-intel.com/wp-content/uploads/Eleven-Prognostications-for-2018.pdf

- Ibid.

Amazing idea! These things are surprisingly easy to build – all you need is an arduino, LCD/LED screen and a one-way mirror. That being said, I think the application of these mirrors in the fitness space is genius. It serves as a personalized content delivery system and regular mirror for people to check their form during workouts. However, I do not see a tension between Mirror’s and fitness clubs’ business models. I see the fitness clubs as potential customers for Mirror. For instance, 24/7 clubs would love to be able to offer personal-training on demand round-the-clock, without having to staff personal trainers at all hours.

Very interesting article.

While Mirror could disrupt the traditional Gym Industry, the retail value of $1,495 for the physical device, plus a $39/month subscription fee seems extremely high compared to the average Gym Membership fees at $58 per month – or $696 per year-. (https://www.healthline.com/health-news/gym-memberships-can-be-a-trap). My concern is that Mirror addresses a high-end small market which could hinder the company’s growth. Do you know if the company plans to extend its line of products and offerings?

How does the company protect itself from privacy concerns and security overall? Aren’t users concerned about adding a camera connected to the web inside their home?

Thanks for sharing this innovative idea of working out, KO! I actually am very tempted to purchase one for my apartment, and just visited their website to look at the equipment options available. I very much agree that Mirror will particularly appeal to those who don’t feel comfortable working with a group of people in a public fitness center, and those who have a generally busy schedule and hence unable to attend fitness training sessions and classes at gym on a regular basis. At the same time, though, I also agree with Matthieu’s point that the current pricing could be adjust downward a little bit to make the product more affordable to a larger group of customers.

I believe Mirror will be able to do that as it continues to optimize the manufacturing process and ultimately achieve economies of scale. I am also very curious about the company’s plans to expand overseas. The addressable fitness market in the U.S. is surely big already, but it is the rest of the world -especially emerging markets with huge populations such as China and India – that can provide Mirror with immense opportunities to grow and scale.

You asked to what extent digital fitness solutions will be able to cannibalize the demand for traditional health clubs and fitness studios. I am wondering if the digital solutions, for which you give one example, and conventional gyms actually compete for the same customers? For example, the people who go to the gym to lift weights seem unlikely to entirely switch to digital devices. Those who like the social or wellness aspects of gyms and health clubs will also be hesitant to cancel their gym membership and switch to a home workout. Most of the remaining gym-goers will only complement their work-out with digital devices without canceling their membership. Therefore, I believe an increasing market penetration of digital devices will have two effects―those who did not have enough time or motivation to go to a gym will start doing workout at home, and those who have a gym membership will go less often to the gym and use their device instead. If gym-goers go less often to the gym without canceling their membership, operating profits of the gym will actually increase. Thus, gyms might even profit from an increasing use of digital tools. What do you think?

Thank you for this thoughtful post! This reminded me of a somewhat similar product I tried out this past weekend at a new concept store called B8ta. The product is called FightCamp Gym and it’s a full-on in-home boxing gym including a free-standing punching bag, gloves and wraps. Similar to Mirror, it offers on-demand workout classes, but specifically for boxing, and unlike Mirror, connects over WiFi on a regular TV. The unique aspect of it was that the boxing wraps and gloves incorporate punch-tracking sensors that measure the workout via the service’s app. It very much seemed like an evolution of Peloton at home. What I appreciate about Mirror is its potential to go beyond not only one specific type of workout, but the potential to be a retail or virtual experience. I actually think it would be super interesting to see these new smart home fitness technologies converge – combine Mirror with sensor-connected equipment, be it boxing gloves or a bike, so you benefit from both the more granular tracking metrics as well as the social aspects that Mirror provides. While the upfront cost of Mirror and the monthly subscription service may feel hefty, it appears to be in line with alternative smart home digital fitness offerings including FightCamp.