MicroConnect – Connecting Global Capital with China’s Small Businesses

Recent development in China’s digital economy has substantially increased the interconnectedness and transparency of small businesses, finally opening up the possibility to invest in them at a scale and with a level of diversification that has not been achieved before.

The “Impossible Mission”

Small businesses are the cornerstone of the Chinese economy, accounting for over 97% of market entities, over 60% of China’s GDP, and over 70% of formal jobs. These small businesses span multiple industries, including retail, food and beverage, culture and sport, beauty, fitness, healthcare, repair services, among others. Yet many of these small firms struggle to secure enough financing to grow and scale, despite having great potentials. Armed with only a simple account book, even the smartest, most hardworking merchant with the best entrepreneurial idea has a hard time to prove its worth and potential. On the other hand, global investors are constantly looking for opportunities to earn quality returns and diversify their portfolios. The millions of stores in China’s consumer economy seem to be an untapped blue ocean, but there is no way to assess their quality – after all, it is much riskier to invest in these small businesses than to invest in bigger corporates certified by professional intermediaries. Because of these challenges, there has never been a formal channel for small businesses in China to systematically raise capital, and never a way for global investors to explore this vibrant, diverse market.

This impossible task of connecting global investors with China’s grassroot economy is now being tackled by MicroConnect, a Hong-Kong based FinTech startup and operator of a new market infrastructure. Why has the previously impossible task now become possible? The answer lies in the power of data and digital infrastructure. Thanks to the advanced level of digitization in the Chinese economy, many small businesses now adopt SaaS tools to monitor and track their performance. By partnering with SaaS companies and building its own digital infrastructure for investors, MicroConnect aims to create a transparent channel for global investors to invest in thousands of quality stores that could both bring high investment returns and create social value.

MicroStar Model

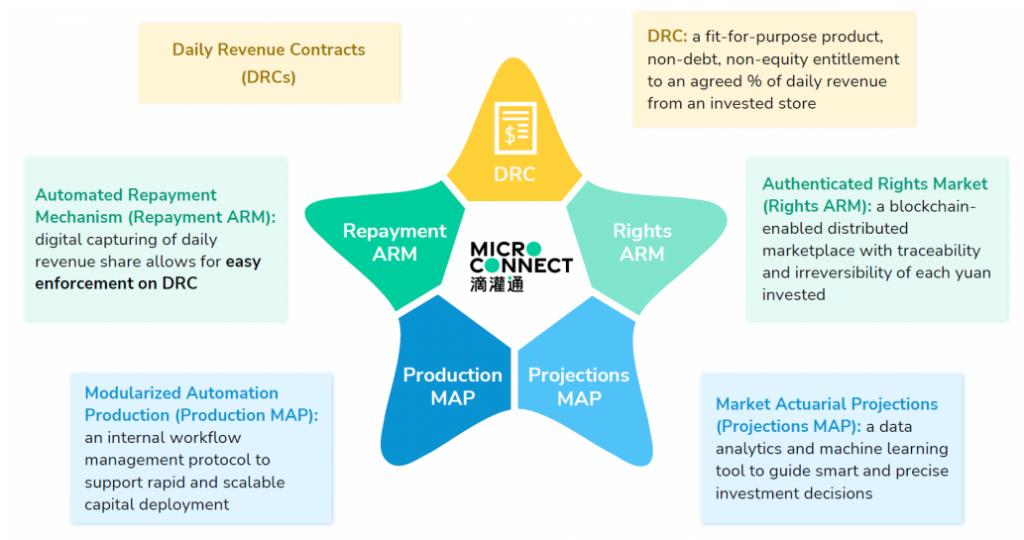

At the core of MicroConnect’s model is the Micro Star, a new market operating system. The system proactively identifies quality investment opportunities in the small business universe with efficiency, scale and sustainability. There are 5 key components to the model, most of which leverage digital capability.

- Daily Revenue Contracts (DRC): The main financial product at MicroConnect; a new asset class that promises investors a percentage of daily revenue share for an agreed time period from an invested store. DRCs are neither debt or equity. They are essentially contracts for revenue sharing.

- Automated Repayment Mechanism (Repayment ARM): An automated repayment system through which DRCs are enforced; a digital infrastructure that supports the automatic capturing of revenue data and splitting of cash flows from invested stores.

- Authenticated Rights Market (Rights ARM): A blockchain-enabled trading, clearing and settlement system designed to allow DRC portfolios to be traded with transparency, efficiency and low cost while fulfilling regulatory requirements.

- Modularized Automated Production (Production MAP): MicroConnect’s operational workflow organized into more than 100 modules with relevant tools to streamline and automate processes.

- Market Actuarial Projections (Projections MAP): Location-based data analytics and revenue forecasting system that guide the search for quality opportunities.

As described above, digital capability is leveraged everywhere in the MicroStar system, from ensuring the automatic capturing of revenue data to securitizing trading, to identifying quality opportunities and organizing workflow.

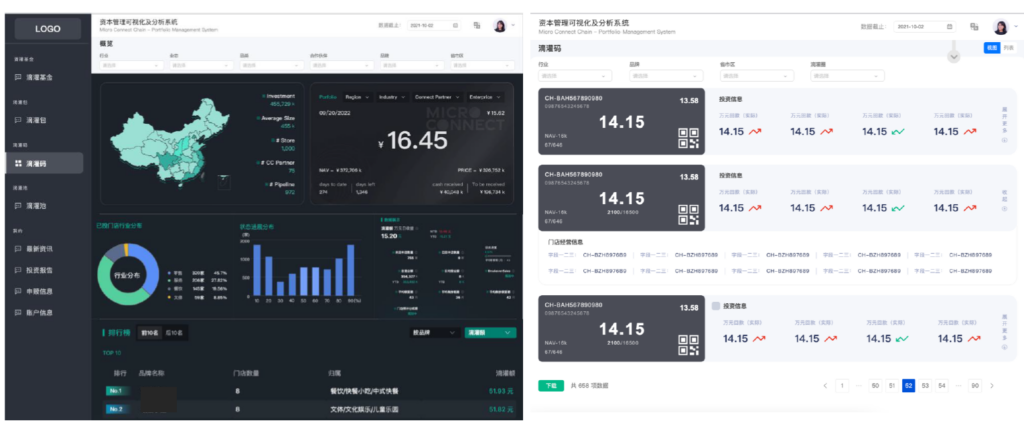

Creating value for Investors

MicroConnect allows investors to tap into China’s small businesses sector. These investments are small in size but large in numbers, allowing investors to diversify their portfolios in a cost-and-time-effective manner. MicroConnect’s digital infrastructure allows investors to access store-level data and track their portfolio performance at any time. The MicroConnect Dashboard, a proprietary tool, helps crystalize and visualize all valuable data for investors (see image below). The Dashboard shows the portfolio allocation, returns on each store, links to disclosure documents, historical performance, and revenue forecasts for the future. The forecasts are made using a combination of human and machine intelligence, and building upon the large amount of data SaaS companies already possess.

MicroConnect also built an algorithm that tracks the life cycle of the stores, which allows it to implement reiterative due diligence on its investments throughout the entire life cycle of stores. In addition to analyzing this time series data, MicroConnect conducts cross-sectional analyses to forecast future revenue performance for stores based on peer/competitor performance in similar industries and geographies.

Creating value for Entrepreneurs

MicroConnect empowers numerous small businesses by delivering growth capital tailored to their development needs. It serves as their long-term partner along their value creation process, sharing their growth and risks, rewarding them for their hard work and enhancing their cash flow certainty.

As of now, MicroConnect does not have a proprietary dashboard designed for the small businesses; it mainly gathers their performance data from SaaS companies, with whom it collaborates. But as the company grows, it aims to build infrastructures that would also allow small business owners to track their performance, implement revenue forecasting tools, explore pricing algorithms, and read industry analyses. The goal is to help merchants develop the business intelligence necessary to optimally design tools and acquire talent and resources. In addition to serving existing small businesses, MicroConnect also plans to leverage the data it collects to offer consulting advice and services for emerging entrepreneurs about to start new stores. For example, it can leverage its rich location data to perform analyses on where to best open a store.

Challenges ahead

MicroConnect was founded in 2021. In less than a year, the company has already secured two rounds of funding, successfully invested in 1090 stores with 103 brands, and delivered CNY 425 million (USD 60 million) of global capital channeled into the grassroot economy. The journey so far has been impressive. But grand missions always come with challenges.

One challenge going forward is the ability to continuously raise sufficient capital. It requires MicroConnect to further establish its credential and branch out to a wider range of global investors. MicroConnect needs to innovatively establish fundraising channels while also complying to the laws of different jurisdictions, which might not always be compatible.

There are also regulatory risks associated with digital transaction platforms. FinTech platforms are heavily regulated in China, partially due to the enormous risks brought by fraudulent peer-2-peer (P2P) transactions a few years ago. While MicroConnect operates on a different model that is a lot more transparent, the model is highly innovative and not known to the market. Therefore, approval processes might take longer than expected for any design change in the future.

Finally, there are a number of partners involved in MicroConnect’s model, including consumer retail brands and franchises, SaaS companies, industry associates and local government. A large amount of data is getting transferred between these parties on a daily basis. Contracts need to be carefully designed to ensure safety, fairness and accuracy in the use, control and sharing of data across the globe.

Sources:

[1] https://microconnect.com/about

[2] https://microconnect.com/MCIWP_EN.pdf

[3] https://www.oecd-ilibrary.org/sites/a3891ad8-en/index.html?itemId=/content/component/a3891ad8-en

[4] State Administration for Market Regulation: http://www.gov.cn/fuwu/bm/scjgzj.htm

Yifei, thank you for the post. I was not aware of a business concept like MicroConnect. If I am understanding this correctly, MicroConnect collects money from those receiving the company’s investment, taking a certain proportion of their daily income. This way, small businesses will not be under too much pressure, but if they are in danger, the risks are shared between them and MicroConnect. This seems like a quite complex systematic project. It sets up a network that can access many small and micro firms while building a network enabling investors’ participation. As you mentioned, I am also very curious how the government would react to future changes of MicroConnect

Thank you for reading through my post Jiwon! What MicroConnect is doing is indeed highly innovative and not simple. To clarify, MicroConnect directs money from investors to small businesses, with which the small businesses could grow. In return, the investors are promised a percentage of the small business’s future revenue as returns. If the small business grows successfully, the investor will be able to enjoy a greater amount of return as a result of that success. This is very different from traditional financing models where the small businesses borrow an amount of money from lending agencies and pay an interest rate on the debt. So in essence, the MicroConnect model is a financial innovation, but it is only possible to be implemented with proper digital infrastructure.

Indeed it is a very special financing model. The number of small businesses and their impact on the Chinese economy are the perfect ecosystem for MicroConnect I assume. Thank you for the clarification! 😀