Lyft-ing Communities, Delivering Hope, and Winning the Rideshare Race

Through the COVID-19 pandemic, even the disruptors have been disrupted. Lyft has a unique opportunity to help communities while building a platform for growth, advancing the company's mission to "reconnect people through transportation and bring communities together."

The ongoing COVID-19 pandemic has fundamentally transformed many parts of our world and ways of life – from healthcare and travel to school, work, and leisure activities. Even the disruptors have been disrupted, and, in this time of uncertainty, Lyft has the unique opportunity to not only play a key role in helping communities weather the storm, but the company can use its digital-enabled capabilities to support its long-term growth through partnership expansion, strengthen its employee network, and broaden its offerings to consumers.

Lyft-ing Safety and Support

The primary focus for Lyft throughout the pandemic should be safety. Safety for drivers, riders, staff, and partners. While some safety measures and digital solutions have become fairly standard practice such as virtual video conference-enabled meetings and digital communications, others require more strategic shifts – especially in industries as interaction-heavy as ride-sharing. In this regard, Lyft must strive to outpace and outperform its competitors.

Lyft’s website and app platform are the primary modes of communication with drivers and riders. For drivers, the company’s website and weekly email updates with specific, localized guidance for partners’ geographies – ranging from public health notices to lists of which auto repair shops are open through the company’s partnership with Openbay – have been instrumental in helping to ensure the driver community has adequate and up-to-date information to stay informed and operational while building trust with the corporate team and its guidance. A robust digital communications capability combined with agile response has served Lyft well in this regard, and continued utilization of these channels will be critical moving forward.

In addition to health, financial safety and security remains a major dimension Lyft and other digital players must address. One of the chief obstacles facing the gig economy through the COVID-19 crisis has been contractor status and complications obtaining support from government relief programs and sick pay offerings by their employers. Here, Lyft has demonstrated leadership with co-founders John Zimmer and Logan Green contributing 100% of their salaries through June 2020 to support the community in addition to a $6.5 million commitment to support virus response efforts. For all drivers, Lyft has extended their Lyft Rewards tier through July 2020 to enable continued access to cash back on gas and other engagement-based benefits, and, for drivers immediately impacted by the virus or quarantine orders, Lyft is offering additional direct financial assistance (based on previous activity in the Lyft platform). Additionally, Lyft’s website not only outlines best practices for preventing the spread of COVID-19, but also addresses the chief concerns and challenges facing drivers in adhering to these guidelines. By offering resources and assistance in obtaining CARES Act relief, state-specific unemployment assistance, and localized benefits for respective countries of operation, Lyft gives a helpful alternative to driving while infected which would otherwise further the spread of the virus.

While some of these processes have been effectively implemented using the company’s digital automation capabilities, execution obstacles persist. At other gig-heavy companies such as Uber, Amazon, FedEx, Target, Walmart, Postmates, and Instacart, employees have openly criticized their employers’ responses to COVID-19 – in some cases, even staging walkouts and going on strike. At Uber, drivers cited a “restrictive and inconsistent coronavirus sick pay program” and lack of promised cleaning supplies. Lawsuits against the company alleged that only 1,400 of 2 million drivers qualified for its sick pay program, and a judge “urged the company to… make it easier for drivers to qualify.” Dissatisfaction with Uber’s support may give Lyft an opportunity to lead the industry through this crisis, though the company faces similar implementation challenges delivering on its program promises.

Spikes in support request volumes have burdened manual processes, and, while Lyft has not experienced as much of a negative reaction as Uber and Instacart, the company has still seen significant delays in case-by-case sick pay processing. This goodwill is partly due to the company’s early commitments to sending free sanitizing products and face masks to drivers as available, prioritizing regions with specific government guidance on use of personal protective equipment. Lyft team members are also actively disinfecting bikes and scooters in the Lyft network when they dock for recharging. These efforts helped reduce transmission, keeping drivers and riders safe, but safety and financial security commitments must work in tandem with the company’s implementation of these promises. Lyft must leverage its digital-first strategy to execute on its promises to its community – both in delivery of promised benefits, and automated assistance in obtaining government relief packages to reduce wait times, lost sick pay requests, and burdens on service centers. If done effectively, the company’s digital capabilities may give the company a leg up on the competition regarding driver engagement and strengthen its network moving forward.

Milan, Italy February 28, 2020. REUTERS/Yara Nardi

Social Distancing by Getting Closer to Amazon

Part of the advantage of a digital-first business is its ability to pivot on a tighter timeline and scale operations accordingly. With a large network of drivers no longer receiving ride requests, and a spike in demand for delivery of online orders, Lyft launched a partnership with Amazon – keeping its contractors employed while simultaneously exploring a potential long-term partnership instead of a digital war over gig economy drivers.

Since the pandemic started, ride-share prices have fallen by 11% and total demand is down 20% — a direct hit to Lyft’s bottom line. At the same time, home deliveries are up with waves of new online shoppers emerging in the wake of brick and mortar store closures. Following the announcement of its partnership with Amazon, 100,000 Lyft drivers have signed up to work with the online retail giant. This current strategy poses a significant risk to Lyft if Amazon poaches drivers from its network, but offers a major opportunity if properly handled through digital integration, tech innovation, and careful coordination of offerings for mutual benefit.

If Lyft is able to using machine learning and artificial intelligence to properly optimize Amazon deliveries coordinated with ride-sharing services in real-time, it could develop a significant competitive advantage over Uber. Amazon’s business could offer varied delivery times (1-hour, 1-day, and 2-day delivery) and the Lyft AI/ML algorithm could prioritize profit margins of each route, directing drivers accordingly. Amazon currently lacks the autonomous delivery and ride-hailing revenue which offer Lyft a price advantage, and, therefore, this symbiotic partnership and machine learning-powered edge could strengthen over time, diversify Lyft’s revenue sources, and help the company hedge against exposure to concentrated ride-sharing service risk. Additionally, shifting towards more deliveries may reduce human-to-human contact with items deposited and removed from trunks without the need for additional handling by drivers, or passengers to remain in enclosed spaces with drivers as often, advancing social distancing to expedite the demise of COVID-19.

Feeding Growth: Grocery and Restaurants

While Lyft has already accomplished a lot in a short amount of time, the company must continue to look forward and consider the next steps in supporting its driver network and delivering value to users. In conjunction with offering resources for obtaining government assistance through the dip in traditional fares and income for drivers, expanded earning opportunities for its existing network will be critical to the company’s sustained growth. With Instacart’s struggles and Uber’s network challenges, Lyft has the chance to expand its portfolio to include grocery and restaurant delivery to advance these goals while boosting competitiveness.

Critical to this endeavor would be back-end integration directly with grocery store inventory and restaurant capacity. Digital coordination with real-time inventory updates via computer vision or IoT sensors as well as wait times linked to driver availability would leverage existing tech infrastructure to deliver value to both drivers and the platform’s user base. Uber already has a restaurant delivery offering, putting Lyft at a long-term disadvantage if the company fails to integrate this service into its own portfolio.

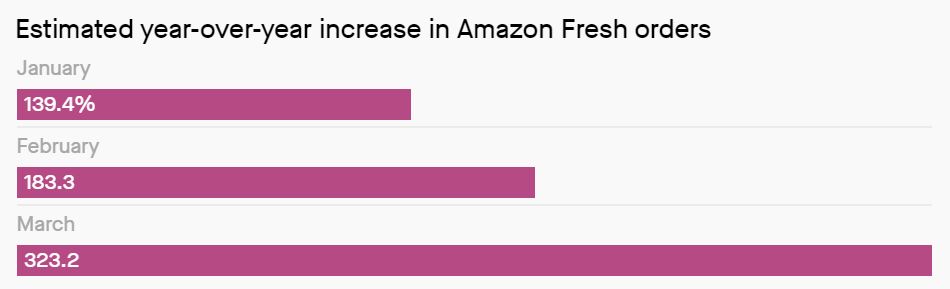

Additionally, these efforts would fit into the ongoing service diversification strategy Lyft has pushed since the start of the COVID-19 pandemic. Efforts to work with Amazon as well as initiatives aimed at supporting pharmacy deliveries and hospital trips for patients with critical conditions fit with this proposed next step and all serve to improve the company’s per-trip economics. Amazon has already had to stop taking new orders for grocery delivery through Amazon Fresh due to capacity constraints with massive year-over-year growth rates in demand. Not only would this be a much-needed service to buttress Instacart, DoorDash, and UberEats services, but these efforts would help drivers and provide a strong foundation for future expansion efforts. This would also be an ideal time to advertise the new services as digital marketing prices have dropped and email open rates have increases as much as 30% year-over-year. Offering grocery and restaurant delivery seems like the ideal next step for Lyft to diversify revenues, deliver value to users, and minimize the need for human interaction during the pandemic – advancing the company’s mission to “reconnect people through transportation and bring communities together.”

Overall, the COVID-19 crisis has been a challenge for many businesses – both big and small – and devastated many communities. Through digital innovation and transformation, Lyft has a chance to lead the way through the pandemic, build trust in the communities it serves, support its driver network, and turn the challenges faced into opportunities for a stronger and more robust digital future.

References:

https://www.lyft.com/safety/coronavirus/driver

https://www.fool.com/investing/2020/04/16/3-reasons-amazons-surging-demand-will-stick-around.aspx

https://www.lyft.com/blog/posts/lyft-commits-6-5-million-to-covid-19-relief

https://qz.com/1836912/amazon-stops-taking-new-grocery-customers-amid-covid-19-influx/

https://blog.hubspot.com/marketing/how-companies-are-pivoting-due-to-covid-19

I recently read an article (https://www.cnbc.com/2020/04/29/lyft-lays-off-17percent-of-workforce-furloughs-hundreds-more.html) mentioning that Lyft laid off 17% of its workforce and furloughed about 5% more. Do you think that these layoffs will have any impact on how well they’re going to be able to manage this transition to working with Amazon and transitioning more towards delivery of goods, rather than people?

Great article. With Lyft being a much smaller player than Amazon, I question their abilities to create an AI/ML platform quick enough. This might be a great opportunity for Lyft and Amazon to partner together with an AI/ML algorithm to optimize deliveries, utilizing Lyft for the last-mile fleet, and Amazon’s already well established ML capabilities.