LinkedIn: Using data and analytics to chart connections between professionals, firms, and the economy

LinkedIn's success has relied on the desire of professionals to have online identities that are separate from their personal profiles, the quality of professionals and organizations on the platform, network effects that make the platform more valuable as it grows, and the high-quality, targeted insights and products the company delivers given its vast data and analytical capabilities.

LinkedIn’s has proclaimed that “There are approximately 3 billion people in the global workforce. LinkedIn’s vision is to create economic opportunity for every one of them.” With that mission, LinkedIn has developed an innovative online professional network which allows individual users from around the world to set up free profiles that showcase their professional identities, develop and engage with their professional networks, and discover professional opportunities (ranging from job postings to potential clients or customers). Launched in 2003, LinkedIn operates the world’s largest professional network with more than 467 million members in over 200 countries. (1)

LinkedIn creates value by attracting individual members and organizations to set up profiles on the site and encouraging them to engage on the platform with their professional networks. This creates tremendous amounts of data on users’ professional and academic history and their engagement with site content and other users / organizations. Analyzing the vast data from the platform, LinkedIn captures value by using those insights to deliver revenue-generating products and services (detailed below). Network effects are crucial for the value creation and capture: Member growth and engagement strengthen the network and data insights that benefit each individual LinkedIn member, while increasing the value of LinkedIn’s paid product lines to its customers.

LinkedIn monetizes engagement and data on the platform through three product lines: Talent Solutions, Marketing Solutions, and Premium Subscriptions. (2)

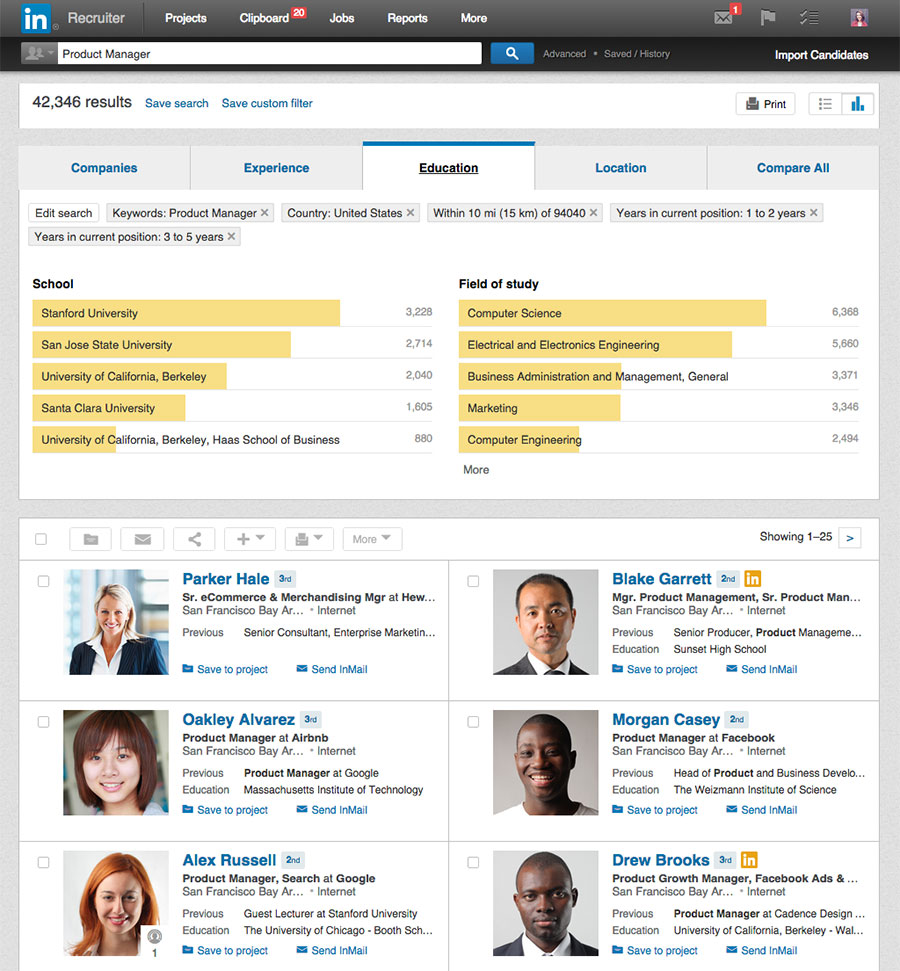

Talent Solutions (65% of revenue) allow firms to post jobs and source active and passive talent (people who are not actively searching for jobs), targeted according to member profiles and user alignment with specific job needs. For job seekers, LinkedIn also offers insights on average market compensation for a given position and information on current employee profiles, company hiring patterns, and the career trajectory of company alums. Recently, following its acquisition of Lynda.com, LinkedIn has focused more on ongoing learning and development. The company provides subscriptions to enterprises and individuals to online trainings ranging from people management and soft skills to technical competencies. LinkedIn can use the data from its L&D offerings to enhance user profiles and provide companies with information on the skills of their workforce.

Sample LinkedIn Recruiter Search Insights Page (https://business.linkedin.com/talent-solutions/blog/2015/08/new-linkedin-recruiter-search-insights-surface-valuable-talent-pool-data)

Marketing Solutions (18% of revenue) enable enterprises and individuals to advertise to LinkedIn members, targeted using data / insights from user activity on the platform

Premium Subscriptions (17% of revenue) enable professionals to manage their professional identities through enhanced profile features, grow their networks through enhanced search features, and connect with talent. Sales Navigator, LinkedIn’s premium social selling solution, enables sales professionals to efficiently prospect potential customers and find high-quality leads using the network.

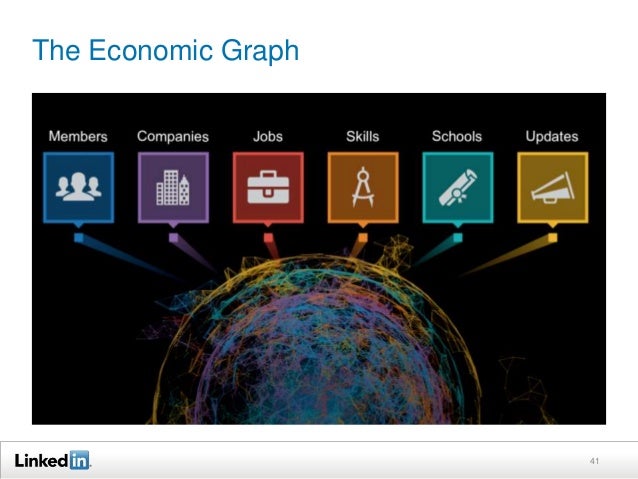

Economic Graph

LinkedIn’s data collection and analytics are part of its vision to digitally map the global economy through the Economic Graph. In LinkedIn’s words:

“We aim to have a profile for every one of the more than 3 billion members of the global workforce, a profile for every company in the world – and who you know at those companies up to three degrees – all the job opportunities those companies offer, every skill required to obtain those opportunities, and a presence for every higher education organization in the world offering a way to acquire those skills. It will overlay the professionally relevant knowledge of every one of those individuals, companies and universities to the extent that they want to publicly share it.” (3)

The power of the Economic Graph is not only in developing revenue-generating products for customers; LinkedIn is also helping policy makers, educators, and employers surface insights to create social benefit. For example, the company provided Economic Graph data to the City of New York to help develop the city’s tech talent. LinkedIn analyzed data from more than 3 million LinkedIn members in the New York City area and data from150,000 local businesses to provide the Tech Talent Pipeline Initiative with insights on the state of the city’s tech industry and opportunities to advance it. (4)

Microsoft Acquisition: The Future

In June 2016, Microsoft announced its acquisition of LinkedIn for $196 per share in an all-cash transaction valued at $26.2 billion. Although the companies have stated their goal for LinkedIn to retain its distinct brand and culture, future product integration was a primary driver of the acquisition. (5) The integration of LinkedIn data with Microsoft’s productivity software has the potential to enhance both companies’ existing products and spur innovation. For example, Microsoft’s calendar could automatically integrate relevant profile information before a meeting for all attendees, while LinkedIn’s news feed could deliver targeted content based on an individual’s outlook emails or calendar. (6)

(1) https://press.linkedin.com/about-linkedin

(2) https://press.linkedin.com/about-linkedin

(3) https://engineering.linkedin.com/data/economic-graph-research

(4) https://blog.linkedin.com/2015/02/12/linkedin-economic-graph-research-helping-new-yorkers-connect-with-the-jobs-of-tomorrow-infographic

(5) https://investors.linkedin.com/events-and-news/corporate-press-releases/press-release-details/2016/Microsoft-to-acquire-LinkedIn/default.aspx

(6) http://time.com/4367134/microsoft-linkedin-buy/

Thanks for the post Meredyth! Didn’t know about the Economic Graph–sounds really cool.

It seems to me that Talent Solutions is LinkedIn’s biggest differentiator and offers the biggest upside. For that (and the Economic Graph), the biggest challenge is to have people continue to sign up and fill out their profiles in as detailed a way as possible, because the higher quality and more granular profiles are, the more useful they are to recruiters/companies. I wonder if LinkedIn would be better off incentivizing users to improve their profiles by offering them free upgrades to Premium (e.g. if you add x skills and get them endorsed by y number of people, you get free Premium for 3 months), as opposed to charging for Premium, which could hurt the engagement of people unwilling to pay for the service.

Thanks for the great insights! One concern I’ve heard about LinkedIn’s business model is the firm’s inability to attract regular engagement from users—that people visit sporadically and only do so to perform particular tasks, while firms like Facebook have found ways to attract significantly more casual attention. Given that LinkedIn’s Talent Solutions offering—a product reliant more on occasional updates than casual visits—dwarfs the firm’s Marketing Solutions and Premium Subscription business lines, I wonder if LinkedIn is leaving money on the table by not leveraging its data to drive user engagement and enhance the latter offerings.