Lending Club: A Marketplace for Loans

Lending Club is a platform that matches loan borrowers and lenders.

Lending Club is an online marketplace that connects loan borrowers and investors. The platform’s main products include personal, auto refinancing, patient finance, and small business loans. Its borrowers are consumers and companies. Lenders include retail investors, hedge funds, insurance companies, foundations, banks, pension plans, high net worth individuals, and university endowments. As of 2018, the company originated $10.8 billion in loans [1]. In the same year, it generated $695 million in revenue, but is not yet profitable.

Lending Club creates value by leveraging technology to:

- Facilitating borrower and investor matching

- Providing cost efficient products to lenders

- Servicing undeserved borrowers

Value through Matching

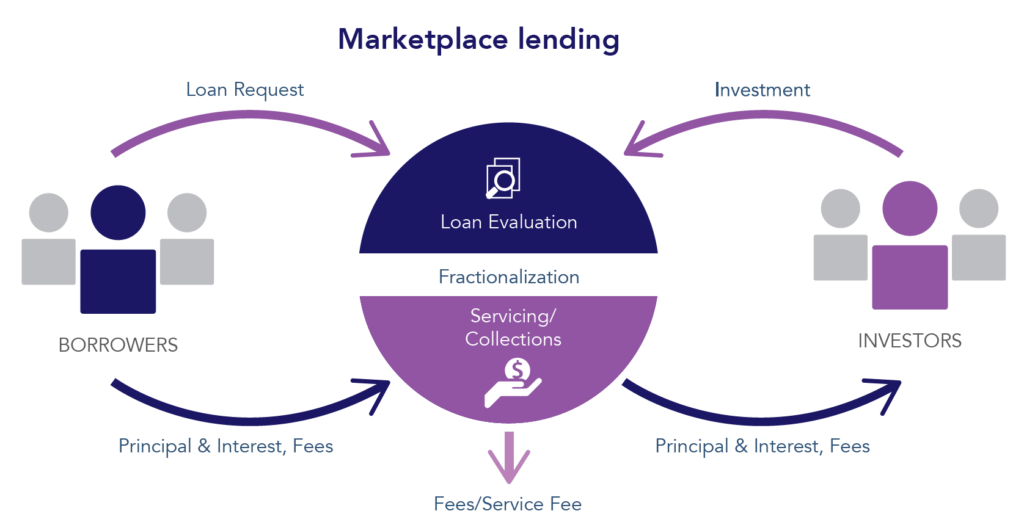

Lending Club uses technology and data to underwrite the borrower credit risk, determine loan amount, pricing, and terms. The technology also ensures regulatory compliance and prevents fraud. As result, by providing data, certifying its accuracy, and employing it to develop analytics, the company enables lenders to more easily find loans that serve their individual appetites for risk and return. In sum, the use of technology and data drives the matching between borrowers and lenders.

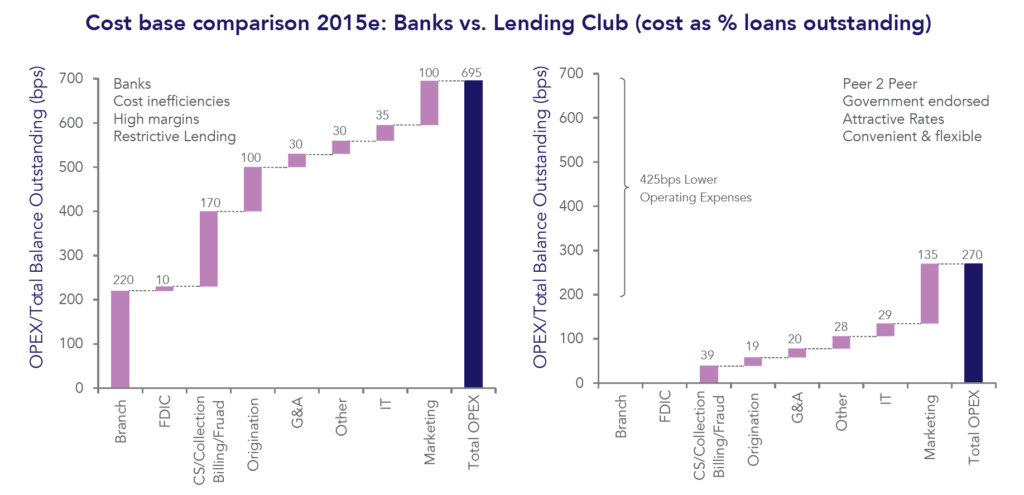

Lending Club has an asset and resource light model that enables cost competitiveness. Unlike banks, the company does not have retail locations, servicing borrowers and lenders online. Moreover, technology powers the entire lending process. In addition to employing technology to quantify the risk of loans and determine their terms, the borrower automates borrower applications and loan servicing. As a result, its operations are less resource intensive than banks.

Lending Club charges fees for originating and servicing loans. Its cost competitiveness allows it to offer competitive pricing to lenders [3].

Lower cost of operations also allows it to originate and service loans that would be unprofitable to banks. Scott Sanborn, CEO of Lending Club stated that their loans are “high-quality loans that community and regional banks would have if they had the technical and operational capacity to originate them” [3].

Lending Club’s platform benefits from network effects: a larger borrower base attracts a larger lender base which in turn attracts more borrowers.

However, finding borrowers and lenders to fuel the network effects has not been easy. Finding borrowers often entails paying fees to sites such as Credit Karma where consumers search for loans. The company moved from its original P2P model because not enough individuals wanted to finance the loans. Its lenders are now institutional players which can finance larger volumes of loans.

Now the company must prove that its data driven algorithms are as good or better than banks at predicting risk. The real test to its business model will be loan performance in the midst of the next economic downturn.

[1] GlobalData. 2019. “Lendingclub Corporation (LC) Financial And Strategic SWOT Analysis Review.”

[2] Cloud Lending. 2019. “How Banks Will Survive The Lending Revolution.”

[3] “Failed Promise Of Marketplace Lending Faces A New Test | Financial Times”. 2019. Ft.Com. https://www.ft.com/content/d1d7cc8e-dbb6-11e9-8f9b-77216ebe1f17.

[4] “An Introduction To Alternative Lending”. 2019. Morganstanley.Com. https://www.morganstanley.com/im/en-us/financial-advisor/insights/investment-insights/an-introduction-to-alternative-lending.html.

[5] “My Gartner”. 2019. Gartner.Com. https://www.gartner.com/document/3698918?ref=solrResearch&refval=-1&qid=null.