Kroger: Doubling down on data in the face of hungry competition

Kroger, the world’s third largest retail chain, has become one of the most data-centric organizations in the $600 billion grocery industry.

June 2017 was a challenging month for Kroger, the world’s third largest retail chain. The company reported decreased profitability for the quarter and, a day later, Amazon shook the industry with its announcement of its intention to acquire Whole Foods. The result: Kroger’s stock fell 22%. By early 2018, Kroger’s stock had rebounded, before falling once again, reflecting the continued uncertainty facing the company and industry at large. For years, Kroger has been an active investor in data analytics to differentiate itself in an increasingly competitive and margin compressed industry. Data is a key component of Kroger’s customer-focused strategy and has only become more pervasive after Amazon, one of the world’s most data-driven organizations, intensified its commitment to the grocery space.

Kroger wholly owns 84.51, a data analytics firm that helps the grocer and its biggest CPG suppliers understand the 60 million households that shop at Kroger and design solutions to better serve them. 84.51 operates as a stand-alone unit, with a highly entrepreneurial culture, and its own modern office space, enabling it to attract data scientists and analysts that may not otherwise be interested in working for the 135-year old grocer.

Examples of data-driven initiatives

Together, Kroger and 84.51 have launched a number of initiatives using data to create a better customer experience and improve the grocer’s operations.

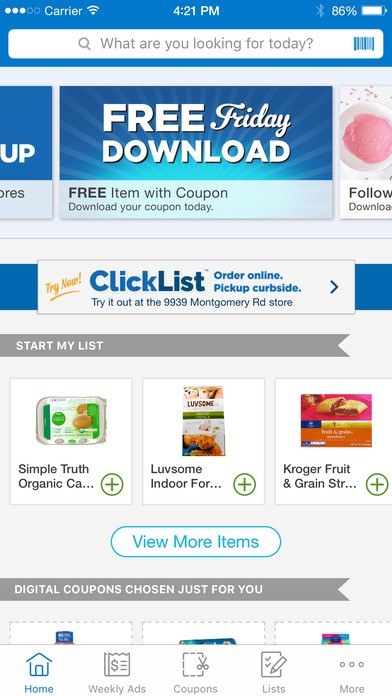

Personalized customer offers and tailored pricing. Kroger collects more food purchase data than any other organization in the U.S. Kroger leverages this data through its MyMagazine service to provide customers with personalized content (e.g., recipes) based on their past shopping behaviours and interests. The grocer also provides customer-specific pricing through e-coupons and mobile app offers (e.g., Best Customer Bonuses, Free Friday Downloads).

The value creation and capture implications are quite clear. Customers benefit from discounts on their favourite products while also discovering new products through highly customized recommendations. Kroger, on the other hand, benefits from increased purchases and deeper customer loyalty (some Kroger coupons have a redemption rate of 65% compared with a national average of 5%). Additionally, the more customers who use the mobile app and other offerings, the more data that is captured and the smarter the service ultimately becomes.

Exhibit 1: Personalized offers through the Kroger mobile application

Operations. Kroger is leveraging data in various ways to improve operating decisions. For example, data showed that Kroger’s private label pasta brands were significantly out-selling name-brand competitors, so the company revamped aisles to display its own pasta products more prominently. Assortment decisions like this are made at a store-level to ensure changes are tailored to particular markets. Kroger is also using data to optimize temperatures in refrigerators to eliminate spoilage. Several other data-driven solutions are under development, including a tool that will enable store managers to use augmented reality to see sales trends as they walk through aisles, and infrared sensors that monitor the number of customers in a store and automatically deploy staff to checkouts as necessary. These data-driven initiatives have enabled Kroger to reduce expenses by improving operating efficiencies while also providing a better experience for customers.

Exhibit 2: Kroger employee stocking shelves

Grocery is an extremely low-margin industry and building and maintaining a leading data analytics capability requires significant investment. As a result, Kroger’s profits have recently underperformed, which continues to weigh on its stock. The threats posed by traditional competitors (e.g., Wal-Mart, Aldi) and emerging competitors (e.g., Amazon) are formidable, but Kroger’s aggressive investments in data are a valiant effort to prepare for an increasingly uncertain future.

Sources

CGT Staff, “Kroger Using Data, Technology to ‘Restock’ for the Future,” Consumer Goods Technology, https://consumergoods.com/kroger-using-data-technology-restock-future, accessed April 2018.

Dan Orlando, “Kroger CIO: Data Collection is Our Present and Future,” Supermarket News, http://www.supermarketnews.com/retail-financial/kroger-cio-data-collection-our-present-and-future, accessed April 2018.

Heather Haddon, “The Future of Grocery Shopping is all About Data,” The Wall Street Journal, https://www.marketwatch.com/story/the-future-of-grocery-shopping-is-all-about-data-2017-10-24, accessed April 2018.

PYMNTS, “Kroger’s Secret Ingredient In 2018: Data,” PYMENTS, https://www.pymnts.com/restaurant-technology/2017/restock-kroger-invests-in-data-driven-grocery-retail/, accessed April 2018.

Sandy Skrovan, “Kroger’s Analytics and Personalized Pricing Keep it a Step Ahead of its Competitors,” FoodDive, https://www.fooddive.com/news/grocery–krogers-analytics-and-personalized-pricing-keep-it-a-step-ahead-of-its-comp/446685/, accessed April 2018.

Tim Denman, “Kroger’s Analytic Prowess Powers its Personalization Efforts”, https://risnews.com/krogers-analytic-prowess-powers-its-personalization-efforts, Retail Info Systems, accessed April 2018.

Thanks for the post, HU! Fascinating to see the stat about Kroger’s coupon redemption being 65% compared to the national average of 5%… they surely must be doing something right regarding utilizing data analytics and then targeting customers. Also, what a smart decision to keep 84.51 independent from Kroger in order to attract talent.

Regarding competition, I wonder if Kroger can utilize its wealth of data compete in the meal-kit market. The future of brick and mortar grocery stores is uncertain at best, especially with Amazon’s acquisition of Whole Foods making grocery delivery easier across the country, and the advent of meal-kits are also decreasing the number of people who go to the physical grocery store. With its mass of data, Kroger could potentially make meal kits specifically adapted to their customer base.