Kavak: leveraging data to become the most valuable startup in Latin America

Kavak

The company was founded in 2016 and serves consumers mainly in Mexico. Kavak makes easier the process of selling and buying used cars by facilitating the process and paperwork through their marketplace, providing at the same time personalized financing and guarantees system for each client. Kavak is now worth $8.7 billion, successfully becoming the most valuable startup in Latin America.

The company uses industry data and its own algorithms to make it easier for customers to sell their used cars, they provide an offer for your vehicle and eliminate the problem of frauds. Customers also feel more comfortable buying used cars as Kavak guarantees the mechanical repairs of the vehicles. Given the power of their internal data and understanding of the costumers’ profiles, they have been able to expand to other businesses, offering users access to credit finance through Kavak Capital. The company is helping formalize the Mexican market by providing financial solutions to users leveraging data algorithms and AI which helps estimating the payment capacity of customers.

Kavak has achieved an impressive growth in recent years and has been able to scale operations by optimizing its processes with the help of machine learning tools. Kavak’s VP of Data Science, Anders Christiansen, mentions that they apply machine learning in many parts of their business including recommendations, credit scoring analysis, price determination and process automation. When they receive a new car, their internal model and algorithms can analyze the car’s usage, mileage, brand, among other factors to estimate the probability that each auto part will need to be replaced, and this is taken into consideration to determine the offer for the end customer. Kavak’s algorithm has an advanced technology that retrieves public information from the automotive industry and adds to their own data generated with each transaction to predict market prices for used cars. The algorithm provides fair updated values for users interested in buying and selling a car. Because they can run a fast process analyzing vehicles without much need of human interaction, the company is able to reduce the length of inspecting a car by over 70%.

Becoming serverless

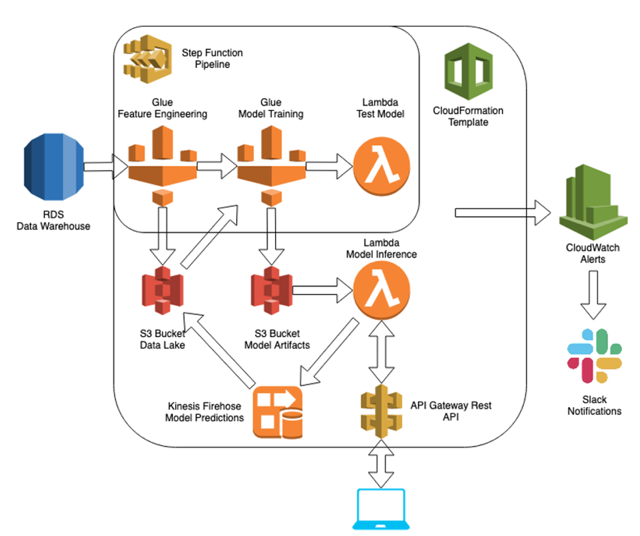

One of the key features which allowed the machine learning engineers to put their algorithm models in production faster, was leveraging the serverless services from AWS: AWS Glue and AWS Lambda. The serverless platform from AWS allows data scientists to easily build, monitor and modify their models in production.

Another helpful tool for the team has been the AWS CloudFormation template, as it allows engineers to use the Python code they wrote and turn it into a reliable service generating predictions. It is possible for engineers to code their infrastructure from available sample templates, letting users model and manage AWS and any third-party resources by treating infrastructure as code.

Diagram showing the ML process at Kavak

What comes next in the journey

Kavak has been able to innovate in multiple industries which has involved high complexity in their operations, using machine learning to solve car reviews, leveraging artificial intelligence to optimize vehicle routing, building algorithms for credit scoring for financial products, among other innovations that have brought added value for the end customer. The team now has the goal of expanding to the rest of Latin America where their model could be replicated to ensure transparent and secure transactions in an industry which nowadays presents many irregularities. Around 80% of people in emerging markets do not have access to a car, and Kavak’s CEO wants to go to big markets where customers are facing similar problems and change people’s lives by providing access to a vehicle.

In the future, the machine learning team from Kavak will be exploring how to make better use of computer vision applications to improve Kavak’s operations. The group of engineers expect to save even more time in analyzing the cars’ profiles by extracting more granular information about vehicles from photographs. Their ultimate ambition is to be a “super app experience” that bundles multiple services into a single package by also promoting a lean and more efficient operation.

Sources:

https://www.cbinsights.com/company/kavak

https://aws.amazon.com/blogs/startups/kavak-kicks-ml-into-gear-with-aws-serverless/

https://aws.amazon.com/lambda/

Thank you for the post Paulina, super interesting!

In this case, Kavak leverages data analytics to improve the customer value proposition to both sellers and buyers of used cars: the seller gets a quote and paid much faster (usually selling because of liquidity needs or to buy a new car) and the buyer gets a guaranteed purchase backed by Kavak’s technology.

The ability to underwrite credit and provide financing is also an interesting angle, particularly in emerging markets with large informal sectors where credit data and history is scarce for a large portion of the population. As these are asset-backed loans, they can be a good way for consumers to build a credit score/history with relatively low cost of debt (i.e. relative to credit cards) that can help them access other types of financing in the future.

Thank you for the cool post, Paulina!

I had the opportunity to meet Kavak’s founder, Carlos, at an HBS class just this week. One of the most impressive things that he mentioned is that a majority of the customers to whom they lend money to buy used cars have never been able to request a loan through traditional financial institutions. In that sense, Kavak is having a tremendous social impact because it allows this unbanked individuals to start building their wealth by giving them their first large-scale asset: a car. Moreover, Carlos mentioned that on average the income of the people who buy their first car through Kavak doubles a year after the purchase. This means that these customers are using the car to supplement their income streams (perhaps by reducing commuting time, or driving for a ride-hailing service). This is a very clear example of how the effective implementation of data analytics can have tremendous social implications and lead to economic progress at the base of the pyramid.