K Health: Your new primary care doctor?

No more googling your health symptoms or waiting for an appointment with your doctor — K Health combines AI with easy access to live physicians for a 24 / 7 primary care solution.

Overview

K Health is a direct-to-consumer mobile application that uses artificial intelligence (AI) to deliver personalized primary care. It provides symptom checking through an AI-powered chat service that asks questions about the user’s symptoms, demographics, medical history, and provides diagnoses for the user based on how doctors diagnosed past patients. It also allows the user to chat with a doctor through the app to obtain a diagnosis, medical prescriptions, and to order lab tests. A smaller segment of the business is a mental health offering that provides patient assessments for anxiety and depression as well as mail delivery of psychiatric drugs.

In February 2020, K Health raised $48 million in a Series C round that included participation from Anthem, bringing total funding raised to $97 million. K Health has 3 million users and 200 employees, including clinicians across 47 U.S. states, its corporate headquarters in New York City, and its R&D center in Tel Aviv.

K Health’s AI engine of “health events” was initially trained with a data set provided by Maccabi, Israel’s second largest HMO and early investor in K Health. Maccabi has 2.5 million members representing 25% of the Israeli market. This initial data set included 400 million data points on patient diagnoses gleaned from historical clinical notes and charts.[1]

Value Creation & Capture

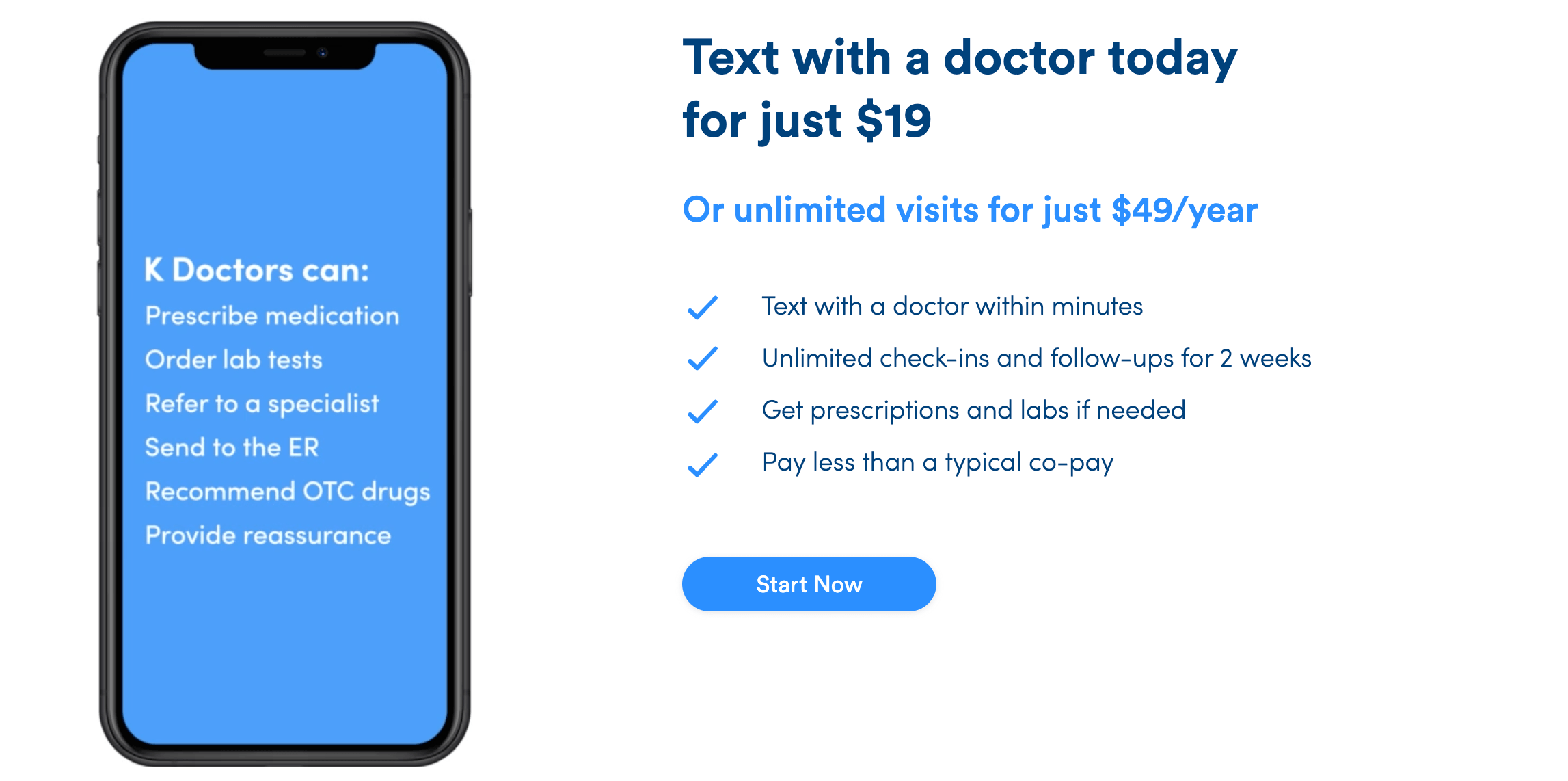

K Health creates value by reducing the barriers to accessing primary care that is (i) high quality, (ii) personalized to the patient and his or her symptoms, (iii) quick / on-demand, and (iv) affordable. The company has published peer-reviewed research in Medicine showing that K Health’s symptom checker outcomes achieve an 85% match with the ultimate physician diagnosis.[2] Its application interface tailors questions based on the user’s responses in order to hone in on the symptoms that are most relevant by comparing them to millions of anonymized medical records of historic doctors’ diagnoses. The symptom checker process takes on average less than 2 minutes to complete.[3] The results show outcomes of people in similar health situations as the patient, accompanied by percentages indicating likelihood of each diagnosis. Users can choose to directly access live doctors 12 hours per day, 7 days a week through a HIPAA-compliant messaging feature. Doctors review an AI-powered breakdown of the user’s symptoms and then diagnose, prescribe, or refer to a specialist.

The symptom checking is accessible to all users free of charge, while the feature to connect live with a doctor has a price of $19 per interaction (including follow-ups for 2 weeks), which is priced to be lower than the cost of a traditional co-pay. Unlimited messaging with a doctor is available for $49 / year. On average the cost of speaking with a doctor through K Health costs less than 90% of the cost of using a traditional primary care practice.[4] The app is direct-to-consumer and can be used without insurance.

K Health launched a partnership with Anthem in July 2019 to create a co-branded version of the K Health app called CareSpree that is available to the Anthem-insured population. CareSpree additionally allows for certain services (in-person visits, MRI scans, X-rays) to be scheduled and paid for directly through the app, and ties into patients’ health history and benefits structure.[5] Anthem is the largest for-profit managed health care company in the Blue Cross Blue Shield Association, and the 2nd largest health insurer in the U.S., with 40 million members across 14 markets. K Health receives exclusive access to de-identified data from this population. K Health’s solution creates value to Anthem and its members by increasing access to primary care while reining in healthcare costs.

Toward the Future

K Health faces a number of challenges and decisions as it continues to grow. The main challenge as it grows its primary care offering is signing on further insurance partnerships. This space is becoming increasingly competitive as health insurers are launching their own virtual primary care digital models coupled with direct access to telehealth offerings. Humana announced a year ago the launch of On Hand, a plan providing members with access to a dedicated PCP and access to video visits with lower monthly premiums, in partnership with telehealth company Doctor on Demand.[5] Many other companies are now competing in the telemedicine space, projected to be a $29.6 billion market by 2022, including Doctor on Demand, HealthTap, PlushCare, Teladoc, and American Well.[1] Once partnerships are signed on, K Health faces the challenge of integration and implementation of its software and aligning product development roadmaps with the large technology teams of large insurance partners.

K Health has many promising opportunities for growth. The company is contemplating expanding into new areas of care, including pediatrics, orthopedics, and chronic disease management.[6] According to Allon Bloch, K Health CEO, “We plan to use the new capital to introduce K’s simple and affordable approach to primary care to more patient populations and medical categories. We will also be introducing K in more languages and will be expanding to strategically important countries by the end of 2020.”[4] One of these languages, Bloch has disclosed, is Spanish.[6]

K Health should work as quickly as possible to sign on health insurance plans in the U.S. in order to acquire customers as well as augment its data set and accuracy. Using early proof points from its partnership with Anthem and Maccabi, it should aim to demonstrate a meaningful reduction in costs without sacrificing quality, which is especially attractive in the U.S. environment that is moving toward value-based care. K Health should also work as quickly as possible to find health plans and sponsors in developed markets in Europe in order to access proprietary data and to start training its AI algorithms. Especially in markets that are under spending pressure, and where quality and ease of access to healthcare providers could be improved (e.g., U.K.), K Health should aim to quickly establish partnerships with healthcare payers and integrate its existing application.

The expansion into new areas of care should be evaluated carefully against K Health’s existing capabilities. Certain specialties, such as pediatrics, could be deployed quite easily in terms of a transition of K Health’s existing primary care algorithms and application. It would make sense to do so considering the market potential of pediatrics — it has high demand among consumers, who can drive growth and adoption under a pure direct-to-consumer model (and even without payor partnerships at first). Other specialities such as specific chronic disease management could become more complicated, and depending on the specific disease, there are a number of digital health players competing in this space. However, if particular payers were interested in reducing costs for certain disease populations, this would be a significant incentive for K Health to take their cue to move into that space if the economics of product development and value capture are favorable.

References

[1] https://venturebeat.com/2020/02/27/k-health-raises-45-million-to-apply-ai-to-telemedicine/

[2] https://www.businesswire.com/news/home/20191105005470/en/Medicine-Publishes-Peer-Reviewed-Study-Health

[3] https://www.khealth.ai/

[4] https://www.alleywatch.com/2020/03/k-health-digital-primary-care-health-telemedicine-allon-bloch-funding/

[5] https://www.fiercehealthcare.com/tech/anthem-launches-app-allows-its-40m-members-to-text-doctors

[6] https://medcitynews.com/2020/02/symptom-checker-k-health-raises-48m/

Thanks for a super interesting article! I had never heard about K Health and founding super cool and useful. I believe K Health is generating a lot of value for users in the sense that they provide a fast, reliable and cheap way to get diagnosed without having to go to a healthcare center to see a doctor (which usually takes a long time and is a hassle). Moreover, given the current COVID situation, this is especially valuable for people, it’s a very intelligent use of AI to make healthcare more convenient and accessible. I believe a good course of action moving forward would be entering countries where there is universal healthcare offered to citizens by the government. This would be a great way to gain access to a captive audience and avoid the whole competition side of things from private insurance companies launching similar offerings.

Super interesting post and company – thanks for sharing!

It’s interesting to think about this company relative to our case on Zebra Medicine. Whereas Zebra’s was really a B2B product for a very specific subset of doctors, K Health’s is a DTC product that is meant to cover a wide array of symptoms/conditions. Given this broad focus, I imagine they will face more data challenges than Zebra, in part because of the large number of symptoms/conditions involved in primary care diagnosis but also because they may have more significant issues with over-fitting models especially since their first data set was isolated to Israeli patients. I’ll be curious to see if they can maintain high levels of accuracy even as they expand the breadth of offerings and geographies.

This was a great read and I was interested to read about K Health’s capabilities. I was particularly intrigued to see that the AI engine was initially trained with data from Maccabi. Like the Zebra case, this is another AI product utilizing data from Israel’s large HMOs.

I like how K Health has undercut the $20 copay of visiting a traditional doctor (for those with insurance) by $1, however, it seems the $19 is to have a text conversation rather than a Telehealth video consultation. For those who are insured, does this truly create value? I would anticipate that the majority of patients who are insured would prefer to pay $20 to visit a doctor for a real consultation rather than pay $19 for a text chat with one. I see the value in those who are uninsured however, where $19 is considerably less than $300.

Thanks for the great article! I agree that they might have a tough time staying relevant if insurance providers have an equivalent product as K-Health would then presumably be only for uninsured patients. I wonder if there’s a possibility of them pivoting to a more B2B model where they can provide all of their features as a service for insurance companies looking to provide a virtual health service i.e. all insurance providers’ services will run on K-Health services.

The other part in the current model that makes me question the sustainability is the value proposition for doctors – I am unclear how doctors will be compensated for their time through K-Health and if it is lower than what a patient or insurance pays them, why provide their time here? Or if it is being subsidized by K-health, how long is that sustainable?

Thank you for sharing this information, it was very interesting! I read the study that was referenced that cited a 85% accuracy for their symptom tracker (https://journals.lww.com/md-journal/Fulltext/2019/10180/_A_patient_like_me____An_algorithm_based_program.57.aspx). There are many aspects of this study which I personally am skeptical about. On average, they report that patients only answered 3-4 questions total. Also, at the end of the dynamic questionnaire, they receive a list of possible diagnoses and if the self-reported diagnosis was included, this was counted as a successful diagnosis, not necessarily the top diagnosis. Ultimately, it seems like this symptom tracker appears to be a minimal part of their actual medical impact, and somewhat of a gimmick to attract users to their actual service of tele-health.

To make more of an impact, they should move their note-analysis software to be physician-facing to provide medical decision support for determining diagnoses, tests, and treatments.

Interesting offering! I love the idea of an interactive symptoms tracker paired with the ability to speak with a medical professional. It’s a nice mix of WebMD with telemedicine in an affordable offering.

The UI looks very intuitive and I imagine the price point will help acquire many customers easily. The only concern I have is whether insurance-covered persons will find value in yet another health app. They may be likely to use the symptom checker, but those are $0 revenue generating users. I wonder if the offering doesn’t have a clear customer base – those that are uninsured may need something with more functionality, while those that are insured may not see incremental value. Just one thought, though I love the idea overall!