IDI: Digitizing the way into disintermediation in Israel’s insurance market

In mid March 2016 it finally happened, a great birthday present for Moshe Schneidman: His majority-controlled company, IDI insurance, or “Bituach Yashir” in Hebrew, passed all other insurance companies in Israel with a valuation of ILS 2.8B.

How?

In mid March 2016 it finally happened, a great birthday present for Moshe Schneidman: His majority-controlled company, IDI insurance, or “Bituach Yashir” in Hebrew, passed all other insurance companies in Israel with a valuation of ILS 2.8B.

So what was the secret?

Schneidman started with a simple idea: He wanted to disintermediate the insurance agents; it was 1994, and the insurance market in Israel was entirely controlled by them. “Everyone laughed at him”, said an insurance professional, “they said that everything will collapse once the lawsuits start coming; how can you have an insurance policy without an agent? Who will take care of you?” Schneidman sought to sell insurance product directly over the phone, and later – over a platform he’d already sustained – directly online to consumers.

Most insurance companies joked on the idea, had little faith in Schneidman’s line of thought, and ignored the potential disruption. Some took the threat more seriously but instead of framing it as an opportunity, sought to increase the barrier to entry by litigation, a battle which they ultimately lost.

Several actions enabled the direct insurance method to rise to prominence. Below those actions will be examined under the lenses of value creation, value capture, and the underlying operating model.

By disintermediating the insurance agents, IDI solved more than just a margin problem; they tapped onto the inherent conflict of interest between the insurance company and the agent – the company wants to see good customers, insurance agents want to increase the number of customers, regardless of their quality. By focusing on technology, IDI established a significant database with dozens of parameters that allow better understanding of who the insured are. According to some sources, IDI’s algorithms were so precise, they could not only identify a strong correlation between a car’s color and probability of theft, but could also identify a driver’s parking habits based on their demographic data.

Until IDI’s arrival, differential prices were non-existent: a good driver paid the same as a bad one, even though the company made no money from the latter. A differentiated pricing scheme, based on their proprietary technology, allowed IDI to attract new good customers and avoid the bad ones.

From the customer perspective, as discussed, many hesitated. In the mindset of the average Israeli customer, insurance agents added value as the people who help us navigate through the maze during times of distress. IDI invested significant amounts in marketing and came up with a brilliant approach. Their controversial campaign introduced “Shuka”, a fake insurance agent who is portrayed as a lazy, good-for-nothing agent who enjoys making money off his customers’ back’s. In some ads, a client would run into Shuka while at an upscale restaurant in Paris, ordering the entire menu, and say “now I understand what it means to fund an agent”. The recurring theme in these ads was “save the agent, save money!”.

(See examples and screenshots at the end of the post)

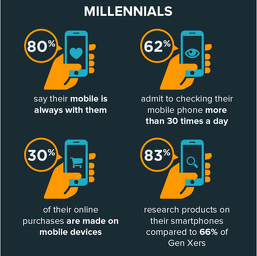

IDI not only used its digital superiority with big data on the backend with their pricing model, but also invested heavily in delighting the customer despite removing the agents. They were among the first to introduce a state-of-the-line digital app, thereby eliminating most human-related interactions. IDI swiftly became by far the most popular insurance company among millennials, even though their pricing model often charged them more; arguably, this proves that millennials see value in not talking to a human.

To conclude, IDI’s new business model of disintermediating insurance agents, first via phone and then online, enabled them to disrupt the existing market and be clear winners in Israel’s insurance landscape.

Costs that were saved on the disintermediation were invested heavily on a strong infrastructure, and state-of-the-line digital superiority (front end – via a mobile/web add, and back-end – with a differential pricing model. This created a new operating model that relied heavily on the value capture and value creation mechanisms. An aggressive ad campaign helped in the go-to-market strategy and ensured that public opinion drifts the right way.

Appendix – IDI Advertisements displaying “Shuka” the useless insurance agent:

https://www.youtube.com/watch?v=rwPYPC4m3eA

Sources:

http://www.globes.co.il/news/article.aspx?did=1000799434: Globes, Israel “economist” – millenial insurance costs

http://www.globes.co.il/news/docview.aspx?did=1001112088 Globes, “How Muki Schneidman turned IDI into an empire”

http://www.bloomberg.com/research/stocks/people/person.asp?personId=11500653&privcapId=5604059 Bloomberg, Moshe Schneidman

http://www.calcalist.co.il/local/articles/0,7340,L-3668405,00.html – IDI wins awar for “social employer”

This is a very interesting company. A number of insurance companies also sell their products online. I am just wondering whether IDI’s business model is easy to copy. How does IDI face copycats and competition from rivals?

Thanks, Bonnie!

Great question, here are my thoughts:

1. I think IDI’s first mover advantage is not negligible: their algorithms that optimize the differential pricing are well established and draw their power from the large amounts of data that they have.

2. Also on scalability, I think the unit economics in direct insurance only start making sense at a certain number of customers (because you have to maintain an app, call center, etc.). We have to remember that unlike the US, the Israeli market is rather small (~7m citizens), non-consumers are scarce, and there are very few industries in which there is room for more than one winner. Copycats may face a problem – unless they come up with another disruption mechanism.

3. Strong, very strong, brand: their ad campaign wins pretty much every year the award for best ad, funniest campaign, most remembered, etc. Think about Geiko-level ad spending, but with a very efficient viral campaign that everyone talks about.

Great article! I have heard the concept of replacing intermediate in the insurance market quite often, and it is interesting to see an insurance that truly achieve it. Just to clarify, before IDI, people only buy insurance through agents? I understand that IDI was able to optimize pricing through data analytics. However, where was the data to start with?

As the era of internet of things is coming, what is IDI’s next step?

Thanks, Jing!

Indeed, before IDI showed up people only used agents. In fact, it was (and still is) the law. What IDI did, from what I understand, is they used a “loophole” to create an umbrella of one ‘agent’ that everyone is under, when in fact that agent “delivers their service” through the app/call center representatives. That was the reason for the litigation discussed in the post, that ultimately prevailed.

The question on data ramp up is an interesting one. I would assume they took the RCTOM Team New Zealand America’s Cup approach – started with a general ‘best practice’ and used technology to refine the process. However you’re absolutely right that this must have been a huge challenge! The question is, like Bonnie asked above – is this enough to gain a first mover/scalability advantage over competitors? For now, the answer seems like it’s a “yes”…