HotelTonight: A Trendsetter Tries to Keep Up

With fierce competition from major OTAs and high levels of multi-homing, can HotelTonight, the pioneer of last-minute mobile hotel bookings, stay in the game?

It’s Friday morning, and you decide to plan a last-minute trip to NYC for the weekend. As you rush to the office, you pull up the HotelTonight app on your iPhone – and within two minutes, you score a discounted rate on the SoHo Grand.

Prior to HotelTonight’s launch in 2010, the idea of same-day bookings was a foreign concept. Now, millions of users and thousands of hotels are on the platform that allows users to book the same day or up to a week in advance. For spontaneous travelers, procrastinators, or those with unexpected itinerary changes, HotelTonight’s app offers convenience and lower prices for a curated selection of hotels. While some of the platform’s inventory is simply the best available online rate, many rooms are priced a healthy discount – on average, 17%[1]. The app’s interface is cleanly designed and easy to use, a stark contrast to often-confusing and cluttered OTA websites.

For hotels, HotelTonight offers a way to sell unused inventory at a discounted rate. HotelTonight charges a commission rate of approximately 20% on each transaction.[2] Mitigating the risk of brand dilution, the app rotates the hotel selection frequently and positions itself as a highly-curated, upscale selection of hotels.

Scaling Up

Since the company benefited from indirect network effects, it was crucial to build traction quickly on both sides of the platform; the more consumers using the app, the greater benefit to hotels, and visa versa. So how did HotelTonight build up both supply and demand quickly? On the consumer side, same-day hotel booking offered a novel value proposition and a great user experience. Through referral programs, social media marketing, great customer support, and a lot of organic PR that led to app store boosts, HotelTonight was able to gain brand awareness quickly.[3] And on the hotel side, the platform offered high levels of flexibility and a new way to offload last-minute unsold inventory. Plus, the platform charged a 20% commission rate – at least 5% lower than many of the OTAs.[4]

Challenges…Tonight, and Tomorrow

Within a short time frame, however, competition became fierce.

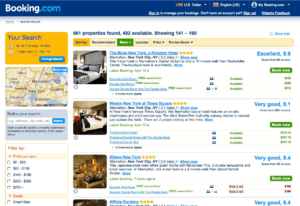

Soon after HotelTonight’s launch, OTAs like Priceline and Expedia added same-day booking functionality and mobile-only apps. Booking Now, from Priceline’s Booking.com, launched in 2015 with its network of 585,000 hotels globally. Likely taking a cue from HotelTonight, the app is simple and – importantly – includes its massive review database.[5]

The hotel groups, in turn, saw a window of opportunity. Often, in an effort to discourage users from booking through third-party platforms, hotel groups do not allow users to earn loyalty points through HotelTonight. The Standard International hotel group launched their own app for $99 last-minute bookings at their own properties. The app was so successful that the group is now launching a new app that will include non-Standard properties.[6]

And finally, new copycat apps such as JustBook and Blink (acquired by Groupon) entered the market.

Likely in response to increased competition, HotelTonight has made a number of platform changes. First, on the consumer side, it edged into OTA territory by offering bookings up to 7 days in advance.[7] Second, to enhance its value proposition, it launched a number of new features for users, including the ability to book seven days in advance, geo-targeted discounts, loyalty programs, and a chat-based concierge service.[8] For hotels, at times HotelTonight will actually pre-buy rooms; a nice feature for hotels, but costly for the platform if the inventory goes unsold.[9]

Multi-homing is at play on both sides of the platform – which is problematic. It’s easy for hotels to post their rooms on the app, and to put the same inventory at similar or higher prices on other booking sites. One NYC hotel manager told Bloomberg that she simply pulls inventory off HotelTonight when it books for a higher price elsewhere.[10] And consumers have no loyalty to the platform that would prevent them from booking elsewhere; they simply want the best price they can get for the best hotel.

Despite claims of massive revenue growth and near-profitability, the company laid off 20% of its workforce in 2015, with the founder sharing that the company was overly focused on growth instead of profitability. In the spring of 2016, the company was attempting to re-negotiate margins with hotel suppliers.[11] This suggests that customer acquisition costs were getting too high as the company tried to prop up the demand side of the platform – in turn, keeping and attracting new suppliers.

Is HotelTonight’s value proposition strong enough to hold its own against OTAs and other players in the increasingly crowded travel booking space? Time – or a swift exit – will tell.

[1] https://skift.com/2016/03/09/kayak-and-hoteltonight-settled-trademark-lawsuit-over-hotel-for-tonight/

[2] https://www.bloomberg.com/news/articles/2011-11-17/hotel-tonight-a-last-minute-travel-app

[3] https://www.marketingsherpa.com/article/case-study/how-hoteltonights-mobile-app-became

[4] https://www.bloomberg.com/news/articles/2011-11-17/hotel-tonight-a-last-minute-travel-app

[5] https://www.wired.com/2015/01/booking-now/

[6] https://skift.com/2015/08/24/is-it-crisis-time-for-hoteltonight-or-all-systems-go/

[7] https://techcrunch.com/2014/09/24/hoteltonight-pivots-beyond-same-day-booking-as-competition-heats-up/

[8] https://techcrunch.com/2016/04/21/hoteltonight-expands-its-in-app-concierge-service-aces-to-30-cities/

[9] https://skift.com/2015/08/24/is-it-crisis-time-for-hoteltonight-or-all-systems-go/

[10] https://www.bloomberg.com/news/articles/2011-11-17/hotel-tonight-a-last-minute-travel-app

[11] https://skift.com/2016/03/01/hoteltonight-is-having-difficult-discussions-with-hotels-about-margins/

Interesting post! I think HotelTonight is such an interesting company and will certainly be interesting to see how it’s able to evolve to out-compete established OTAs. When competing against other platforms, it feels like HT is at a disadvantage for both price-sensitive and price-insensitive customers: for the platform-loyal, price-insensitive segment, consumers have a “go to” platform that they use for booking hotels (for me, I generally go to Booking.com first), and if those OTAs are able to provide the same “booking now” services, HT has to overcome friction costs of the consumer mentality of clicking on their “go to” platform first across all use cases (i.e., I would go to Booking.com first regardless of timeline – whether I need a hotel 3 months out or tonight). That friction cost is hard to overcome when most consumers presumably book more often in advance than night of, so they’re trained to go to their primary platform first even if they’re booking night of. For the price-sensitive segment, they’re willing to go the extra mile to check several platforms, in which case HT is in a race to the bottom to have the best inventory and cheapest prices at all times – a difficult feat for a startup.

Great post, Julia! HotelTonight solves such an important pain point for hotels of having unsold inventory. It is all upside for them to fill up their rooms at any price. And on top of that, it is interesting that HotelTonight charged 5% less than OTAs to gain a foothold in the market. However, I wonder if hotels are worries about priming customers to wait to book until the last minute in order to get a good deal. If it is not a holiday weekend or some big event happening in a city, what would stop cost-conscious consumers from changing their behavior to book last minute hotel rooms in order to get a better room rate? Do you think this is a big concern for hotels?