Honor of Kings: Not just a game platform

Honor of Kings, the most profitable game platform in the market, developed by one of largest technology companies, Tencent.

How can a game expand so much to form a community and even have its national tournaments?

Tencent, founded in 1998, is one of China’s largest technology companies. The corporation is based in Shenzhen with offices across Asia, including Tokyo and Seoul, Amsterdam, and Palo Alto, California. The company’s mission is to promote sustainability and innovation while helping shape the digital future of industries with the economy. In 1999, Tencent released its first product, an instant messaging service, OCIQ ( Latter “QQ”). The product became popular among young generations eager to communicate with each other and the world. The company remained unprofitable for the first three years of operation. In 2003, Tencent launched its QQ.com as a platform to offer a broader range of services and entertainment (new, fashion, sports, games, etc.), created and only licensed by Tencent. In 2010, Tencent had its first web-based multiple-player online game (MMOG) launched Qi Xiong Zheng Ba and officially entered the game industry.

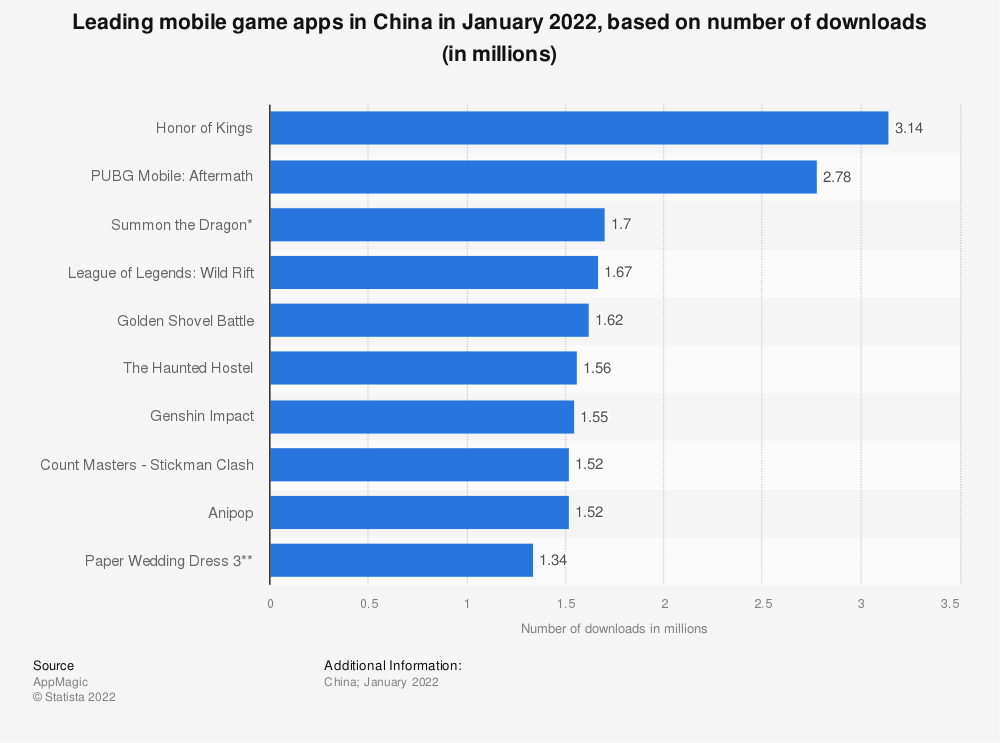

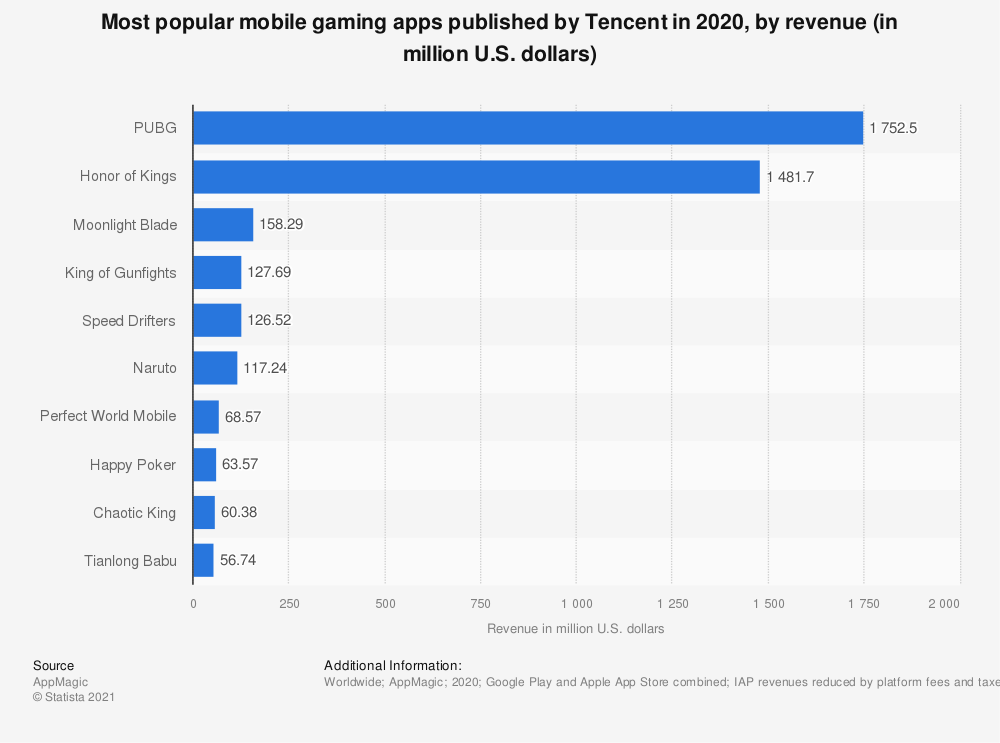

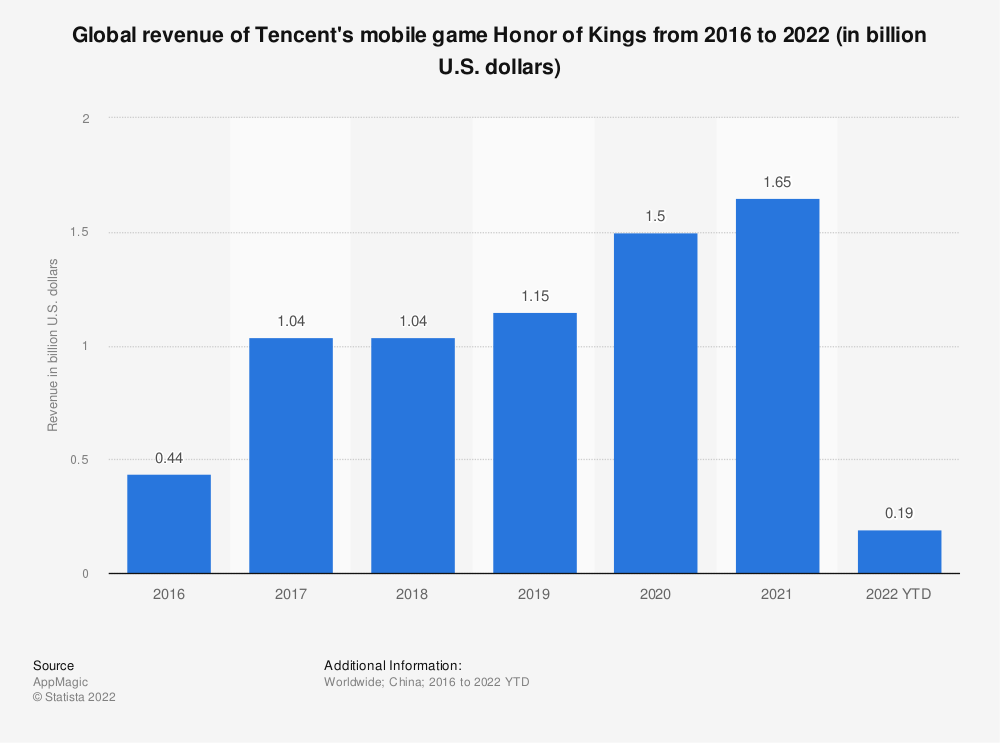

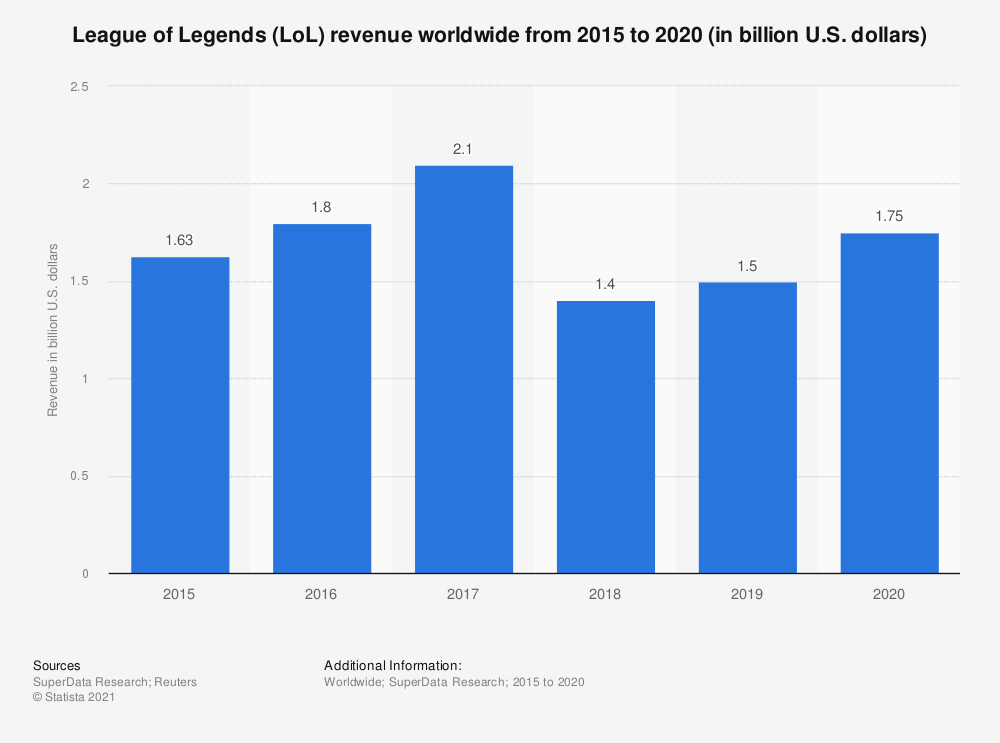

As of 2021, Tencent’s market has reached $880 billion and achieved a Compound Annual Growth Rate of 23.7% over the past six years in Gaming revenues, up from $5 billion in 2015 to $25 billion in 2021. This increment is due to the number of revenue contributions from its flag games, like Honor of Kings that Tencent has developed and League of Legends or Fortnite that Tencent has owned.

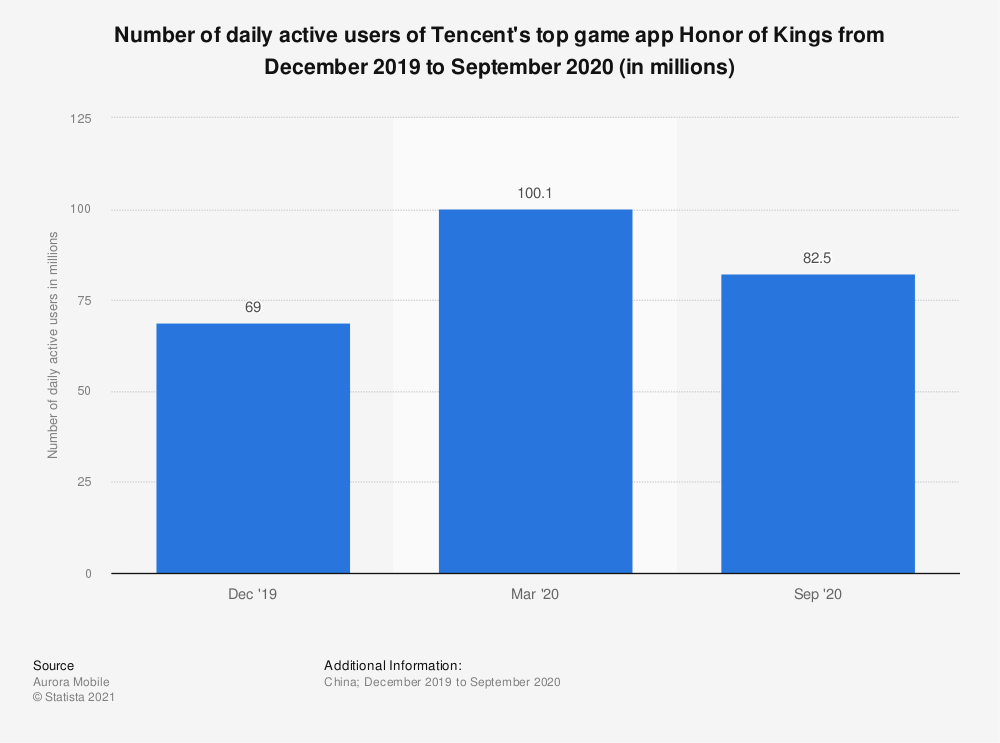

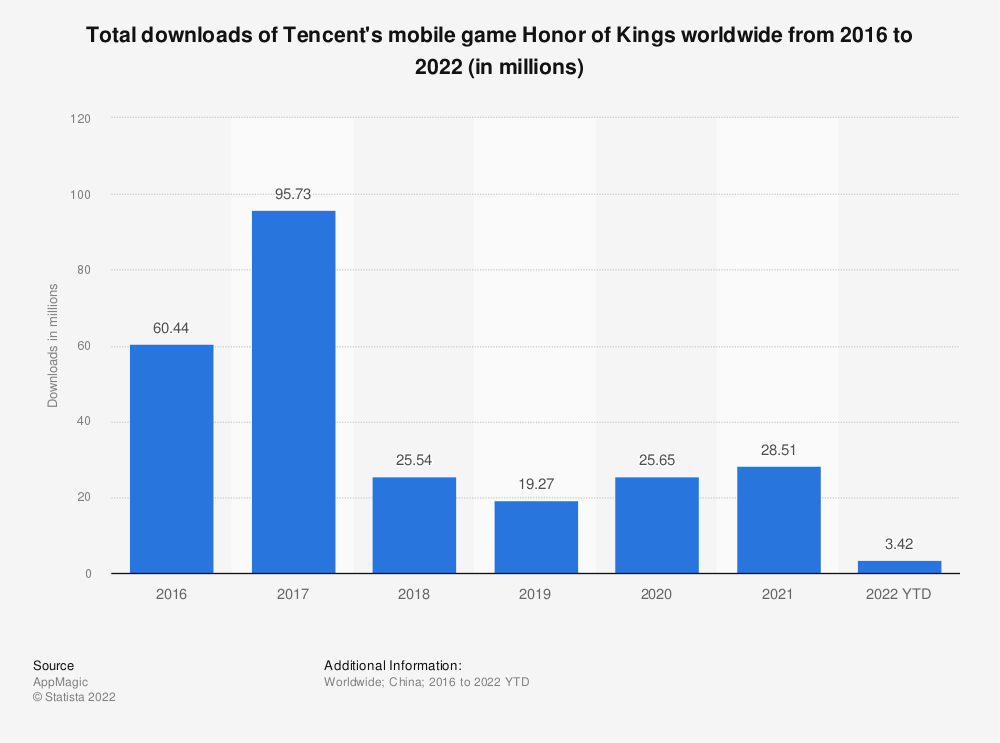

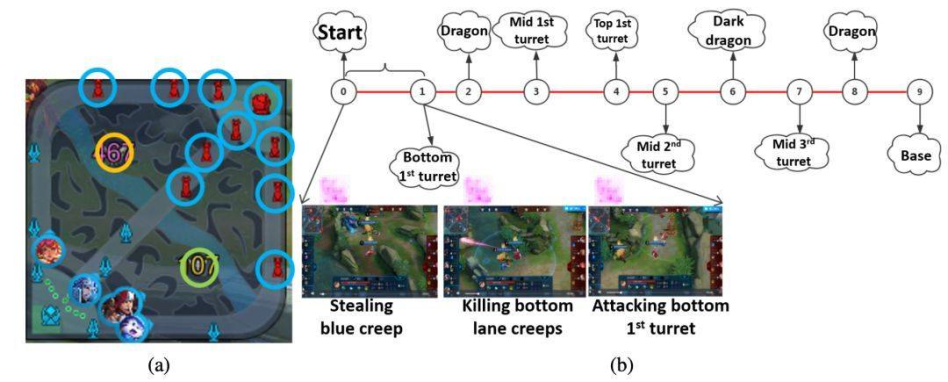

In 2015, Tencent released Honor of Kings, or Arena of Valor, in its international adaptation. The game made it easy for players to set up competitions with colleagues, adding to its appeal. It was free to play, but players had to pay for special weapons and superpowers. It is a multiplayer online battle arena (MOBA) mobile video game between two teams of five players who must take down their opponent’s central base to win. The game is not so different from other popular MOBA like Dota 2 and LOL but is much simpler to master, giving the user a lower barrier to entry. In November of 2020, Tencent claimed a record of 100 million daily active users on Honor of Kings and approached $10 billion in total player spending since its launch with almost $265 million in revenue.

The business model for Honor of Kings is simple; users purchase special weapons and powers to enhance their characters to compete with their opponents. And in special festivals, the game will release new quests and limited skin for certain characters. A cosmetic hero skin of Zhao Yun, one of the characters in the game, had sold for $22 million in just one day.

How does the Honor of Kings capture the value? The value comes from the customers. Why is the Honor of Kings so popular in China?

First, Tencent has two ubiquitous social networking apps that make it much easier for Honor of Kings to gain new users. WeChat and QQ, Tencent’s two major social networking apps, have 938 million and 861 million monthly active users, respectively. Both apps can easily access the game, creating accounts. Also, reportedly, players usually create different game accounts using multiple WeChat or QQ accounts to team up or raise their chance of getting limited weapons or skins.

Moreover, the game itself is a social game, making it a new way of entertainment for users and their friends. The Honor of Kings has a ranked matchmaking system, players can participate in a ranked competition, and they need to form or join a team. To form a team, users tend to invite their friends on WeChat or QQ to join them. Unlike many other video games that users play alone, Honor of Kings connects users with their friends in real life. But not just real life, players can real-time contact the other players in the same team or the opponent team and easily send out their WeChat or QQ invitation to play as a team or an adversary in the future. Its social function helps it gain more users and keep them sticky.

How to keep these players in this game?

The competition. The Honor of Kings players creates a friend community with their friends in WeChat or QQ. The players can send in-app invitations to their friends, and the players can show off their newly-purchased weapons or skins, or they can out-beat their friends with a higher rank. There is a ranking board where players can see their friends’ ladder ranking and theirs, and the players cannot prevent their friends from seeing the rank. This ranking system motivates players to play the game regularly and improve their performance, to reach a higher position. Some low-ranking players can find an in-game mentor of higher rank, and there will be considerable rewards for their co-playing.

Tencent then officially introduced an in-game community to engage new players and the existing community, in which new players and experienced players can communicate efficiently.

Mobility. Being a mobile game is one of the most critical features of Honor of Kings. There are only minimal limitations on the time and the play where people can play. While League of Legends requires a desktop or laptop to play, Honor of Kings can be easily played on a phone.

Being a mobile game also gives Honor of Kings relief from demanding requirements for configuration that have a powerful GPU or CPU.

The tournaments. There are local tournaments, consisting of King of City ( regular players competition), business matches, and national tournaments. Different tournaments offer a variety of prizes, from limited-edition skins to monetary rewards. Tencent made sure that these tournaments could engage more players by rewarding 90-112 of them instead of just one person, making the tournament too competitive. The competition has even become professional with various professional teams to anticipate the tournaments.

Tencent has worked with various computer graphic artists and game studios to produce character skins seasonally as a reward. And there are a total of 106 heroes (play characters) and increasing. Some characters are originated from the mythical story of people or history. The players are already familiar with these characters, and while playing with them, they have emotionally attached to certain characters. And the players are willing to purchase special items to armor the characters.

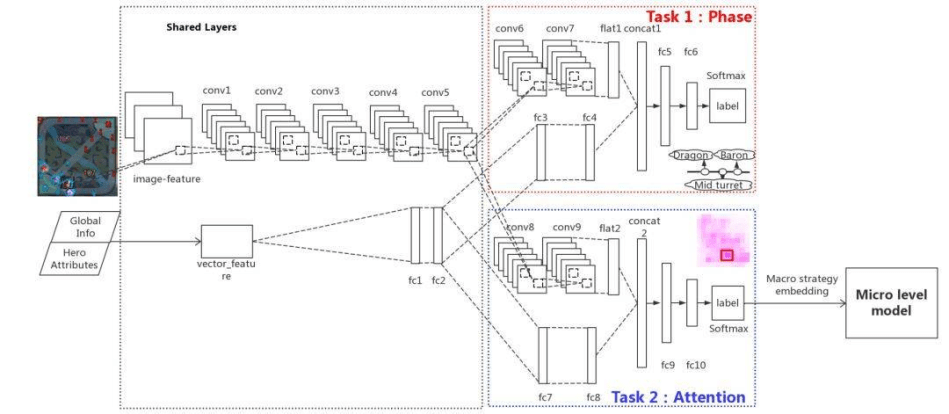

Beyond these general developments, Tencent is ramping up its research efforts in advanced gaming AI, a key step in its long-term pursuit of artificial general intelligence. The company has announced its homegrown AI system Wukong, exploring its capabilities in real-time strategy games, and eventually returning benefits to players’ game experience and across a wide range of fields, to healthcare, manufacturing, self-driving cars, agriculture, and smart city technologies.

Tencent makes the most of its social networking platforms to develop a close-relationship ecosystem. However, with the game restriction from the government, Tencent’s share fell 4%, wiping $12 billion off its market value. But Honor of Kings is not the only game Tencent possesses; it has owned League of Legends from Riot Games, Fortnite from Epic Games. The game empire Tencent envision building is still expanding.

Global cooperationReferences:

- Tencent’s immersive gaming experience, https://www.campaignasia.com/article/case-study-tencents-immersive-gaming-experience/444984, 03/03/2022.

- Tencent AI Trounces Pro Team in China’s #1 Mobile Game, https://medium.com/syncedreview/tencent-ai-trounces-pro-team-in-chinas-1-mobile-game-78ea79b7daa9, 03/03/2022.

- Tencent’s mobile game Honour of Kings is so successful that it faces unexpected challenges, https://medium.com/@actallchinatech/tencents-mobile-game-honour-of-kings-is-so-successful-that-it-faces-unexpected-challenges-d58f703f90de,

- This is why Honor of Kings has 100 million daily active players, 03/03/2022. https://medium.com/@wzy66618/this-is-why-honor-of-kings-has-100-million-daily-active-players-a5aaecd4b4e5, 03/03/2022.

What a fascinating platform company to dive into, Serrino.

As someone who does not have a Tencent account, I find it interesting that the company’s portfolio diversification into games is bolstering the juggernaut’s overarching market position. I was particularly intrigued by the network effect strategy implemented in 2015. With the product being offered for free, easy to set up, and easy to use undoubtedly helped onboard new users quickly, it is the innovative strategies and constant exploration to push novelty ensuring it doesn’t become “too easy” or “boring” for users that I believe continues to help drive interest and market share. I wonder if the company’s partnerships (with brands such as Burberry) and staggering advertisements (Chinese New Year, for example) could have been possible if this were a stand-alone company not connected to Tencent? Would the game’s popularity created enough “noise” for prospective partners?

Lastly, I am surprised that players can create multiple accounts. However, as a result, I wonder if Wukong’s AI capabilities combatting fraud or aberrant behaviors is a transferrable by-product to the other sectors mentioned?

This was a fun read, thanks for sharing!

Thank you so much for the comment, Heili!

You definitely spotted the point that what if there is no Tencent backing them up, can they get this successful? Honestly, the game itself is not innovative. But on the ground level, it is an all-access game that anyone, no matter how old you are, no matter who you are, can enjoy it. In fact, female players have occupied a larger portion of this game than males. And seniors are adapting it as well. However, I don’t believe it will achieve this big success without Tencent’s promotion and support. And for Wukong, I think what you said is for sure one of core purposes.

Great article Serrino. You mentioned that compared to other MOBA’s, HoK has significantly lower barriers to entry, potentially adding value and making it more popular. Do you know how they did that? Are there fewer characters/mechanics to master? And if so, does that lead to players becoming “bored” with it faster?

Thank you so much for the comment, Sutton! I think what they did is having a full tutorial to guide the new users and also the mentor system that can help new users to adapt. And the game provides different mode targeting users with various purpose of playing. At first, the user can choose a primary hero to play and with leveling up, the user can unlock more heroes. Thank you fo mentioning this question that I don’t have space to fill in!

Great post and very informative, Serrino! I like how this platform brings in the social aspect – physical and virtual – and has created a strong global following. Plus, the momentum (and monetary benefits) they’ve generated via tournaments is impressive. This vertical has certainly come a long way and I am eager to see how they continue to develop.

Thank you so much for the comment, Adela! The tournaments are definitely a sustainable way to continue the ecosystem.

Fascinating read, Serrino. Really interesting to see how they tapped into the massive networks of WeChat and GQ to gain users and then to keep those users they capitalized on emotionally compelling narratives within the game, competitive tournaments to keep users active. It seems that is also harnessed the introverted social culture that was amplified during Covid while also drawing in a large amount of female players – an underrepresented demographic in the gaming industry. With it’s massive popularity developing during a time when social and emotional health are becoming less taboo to discuss, I wonder how they plan to confront the growing challenge around addiction to video games – balancing profitability and the health of their user base.

Thank you so much for the comment, Stephen! Glad that you noticed the increment of female gamers! Actually the new heroes HoK developed are targeting these users. And Compared to male gamers, female users are more willing to invest in the game they like; taking Animal Crossing as an example, they exchange in-game coins and items online with real currency. Tencent has also developed many other games targeting the female market. In terms of regulation, It is definitely a challenge for not just Tencent but the whole industry. The silver lining for them is that regulation is only restrictive for children under 12 years old. But it is absolutely a ringing bell for them to expand the market to PC games, 3A games or newly metaverse games.