Dynamic Yield: Scaling Personalized Shopping from McDonald’s to MasterCard

Dynamic Yield pioneered AI-powered personalization for brick-and-mortar outlets, and McDonald’s was lovin’ it! But their ideal home for value creation and capture maximization lay beyond QSRs – cue MasterCard.

THE BIG MACQUISITION

“McDonald’s is acquiring Dynamic Yield to create a more customized drive-thru”

– TECHCRUNCH (MARCH 25, 2019)

These headlines caused waves across the world in 2019 as many questioned why a fast-food giant was paying $327 million for an Israeli-based AI startup. The reasoning lay behind McDonald’s “Accelerating the Arches” growth and digital transformation strategy, which drove their acquisition of Dynamic Yield to improve customer experience, loyalty, and conversion to increase average order value.

ABOUT DYNAMIC YIELD

Dynamic Yield is a personalization and recommendation platform founded in 2011. Over the years leading up to their acquisition, the organization had focused on developing machine learning and AI technologies to enable enterprises across multiple geographies to deliver and optimize personalized and synchronized customer interactions. Under the complete ownership of McDonald’s, Dynamic Yield further expanded its customer base across verticals and doubled its sales revenue. To date, Dynamic Yield’s technology has been globally deployed to McDonald’s drive-thru and in-store ordering kiosks, powering 13-15 million transactions per day across 15,000 quick-service restaurants (QSR). Dynamic Yield currently offers a Software-as-a-Service (SaaS) platform with advanced technology offerings to personalize the customer experience and increase revenue for more than 400+ brands across the retail, financial services, travel, and restaurant industries, among others.

VALUE CREATION & CAPTURE – AI AS A SERVICE

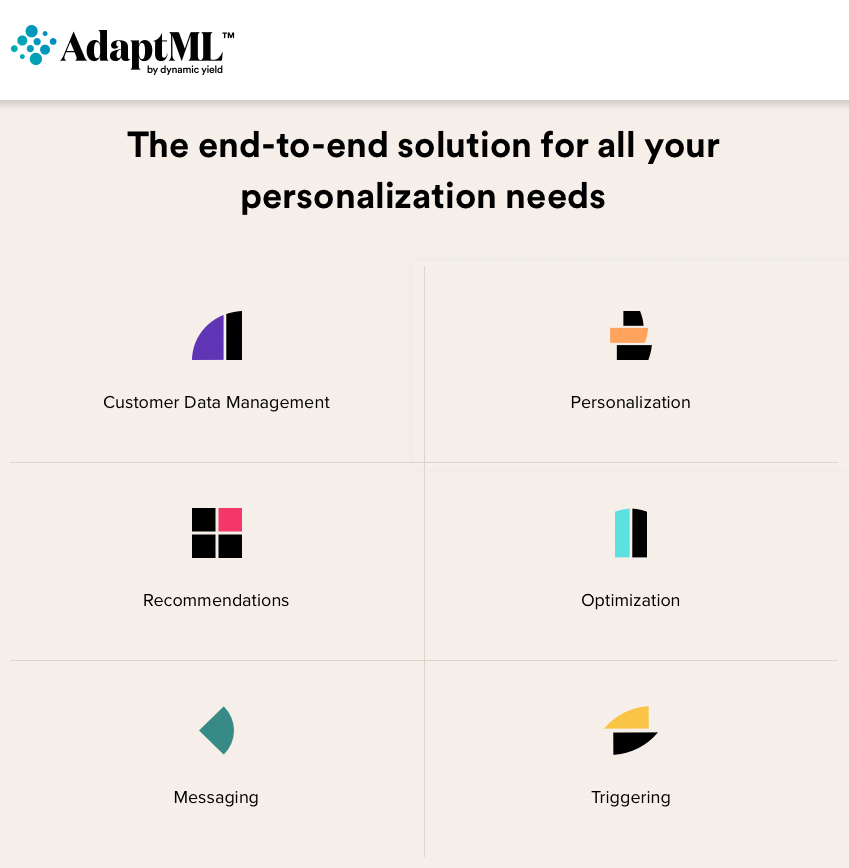

Dynamic Yield’s core offerings are built on top of a self-training deep learning system, Adapt ML™, that adapts and optimizes digital shopping experiences by extrapolating buying intent from customer data and predicting the most likely products a user is interested in.

The biggest advantages of using deep learning over traditional ML approaches are the ability to develop additional functionality automatically based on different and often unexplainable (i.e. black box) combinations from an initial set of given features, as well as to unravel non-trivial and non-linear relationships between user and product information (i.e. contextual, textual, visual, etc.) to generate quality recommendations. Deep learning requires more data than traditional ML to unlock its desired advantages – essential data that Dynamic Yield has continuously been acquiring over 10 years of working with clients in various markets and geographies.

Dynamic Yield’s advanced technology allows clients to leverage adaptive algorithms for different use cases and train bespoke models on an easy-to-use UI with streamlined workflows and pre-built templates, without requiring internal data scientists. Features such as age, location, weekday, etc. may be used to predict behavior, like purchasing intent.

Historically, Dynamic Yield’s value capture strategy involved licensing its solutions to enterprise clients who desired increased customer conversion. Dynamic Yield continued optimizing and expanding this strategy as it grew until its acquisition by McDonald’s, which forced it to predominantly focus on McDonald’s QSR business and verticals, which posed potential structural challenges and limitations to growth.

POTENTIAL CHALLENGES UNDER MCDONALD’S

Decreasing Competitive Edge in QSR Market

As many QSRs adopted personalization and recommendation technologies, what may have stood as a competitive advantage in 2019, became commonplace. For example, Burger partnered with Intel’s AI Technologies division to develop a deep learning-based recommender system. Considering that Burger King would be able to attain similar AI-powered capabilities without spending $327 million upfront, McDonald’s may have been coerced into realizing that it may make more sense to operate as a client of Dynamic Yield, instead of the owner.

Limitations to Growth under McDonald’s

Similar reasoning may be used for Dynamic Yield when considering the potential limitations of operating under a laser-focused QSR giant like McDonald’s, against the increasing external opportunities across horizontal markets. Perhaps spinning off independently or finding a new home with a more value and mission-aligned parent company could be more stimulating to growth. MasterCard approached as a potentially perfect new home for Dynamic Yield, enabling the full exploration of opportunities to maximize value capture across a variety of customer segments.

Potential Organizational Challenges under McDonald’s

Despite the positive results reported, the merger was short-lived as news emerged in December 2021 that McDonald’s was considering selling Dynamic Yield to payments giant, MasterCard. Nothing was shared publicly between 2019-2021 regarding the success of integrating Dynamic Yield into McDonald’s organizational structure, but disruptive innovation theory warns against “cramming” innovation into incumbent organizations and haphazardly integrating teams with different value propositions, processes, and cultures. The final deal terms may allow us to speculate on the potential challenges that may have existed internally, as one considers the fact that MasterCard acquired Dynamic Yield for merely $320 million – $7 million less than what McDonald’s paid for it 3 years prior.

OPPORTUNITIES FOR EXPANSION UNDER MASTERCARD

MasterCard acquires Dynamic Yield from McDonald’s for $320m

Under Mastercard, Dynamic Yield operates as a standalone SaaS business within the Data & Services division. The acquisition builds on MasterCard’s long-standing mission of providing data-driven loyalty, analytics, and marketing services, which aligns with Dynamic Yield’s core value proposition as a data-driven personalization and recommendation engine. Post-acquisition, McDonald’s continued to further integrate Dynamic Yield’s capabilities globally, while Dynamic Yield expanded into new opportunities and became the Global Leader in Stand-alone Personalization Engines, beating giants like Adobe, Salesforce, and SAP (as reported by Gartner in July 2022).

FUTURE – CONVERGENCE OF CAPABILITIES TOWARDS MAXIMISING VALUE CREATION AND VALUE CAPTURE

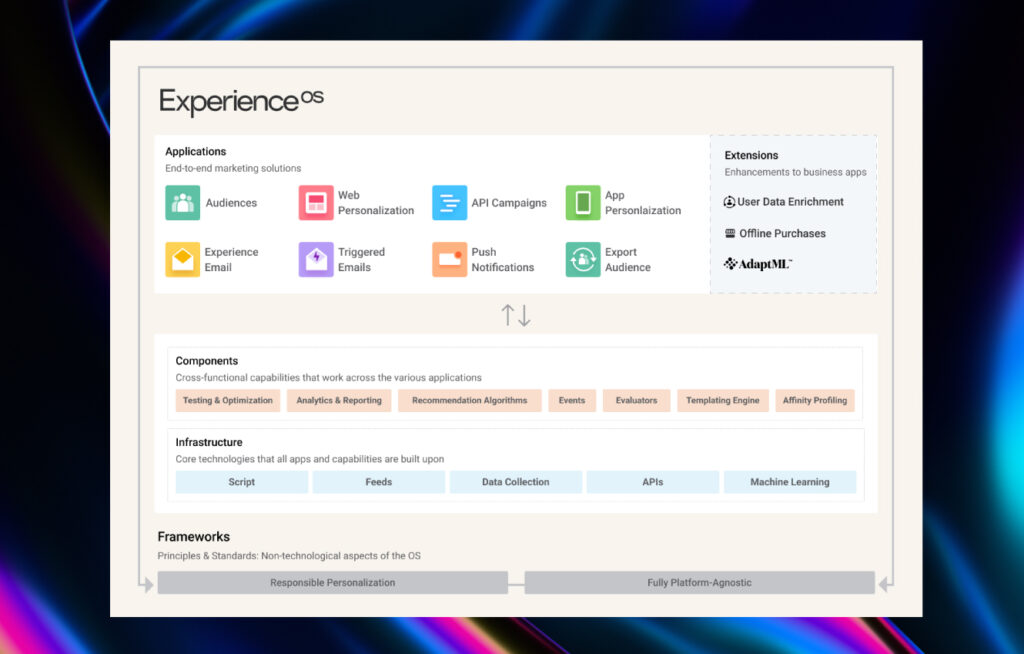

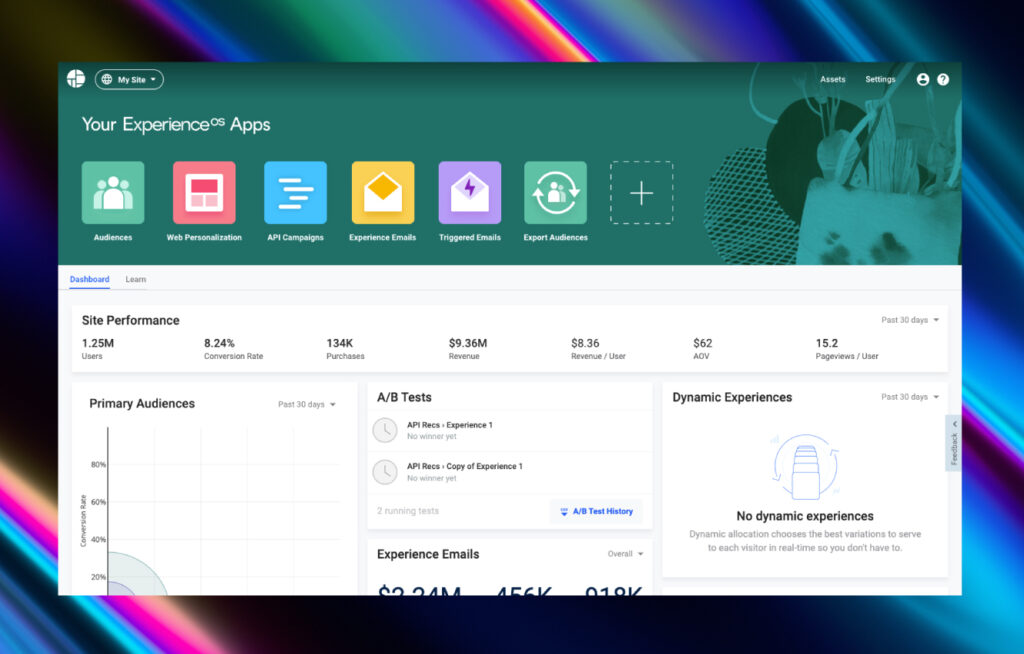

Introducing the Experience OS

In September 2022, Dynamic Yield launched its redesigned product framework – “Experience OS” as it ventures towards becoming the operating system for customer experience. Experience OS represents a convergence of Dynamic Yield’s various service offerings into a singular open, modular, and customizable system which lets retailers flexibly build and manage their own mix of personalization capabilities. As Dynamic Yield expands its offerings to divergent customers, building flexible and scalable tools that enable them to address their own unique needs and KPIs will become critical to maximizing value creation and value capture.

Experience OS is already purpose-built to be adaptable and agnostic with the ability to interface with legacy systems and offline data, but Dynamic Yield plans on pushing value creation further by incorporating historically inaccessible data and applications from MasterCard’s suite of retail, loyalty program, and performance analytics services to enhance its machine learning data sets and deep learning algorithms to unlock breakthrough levels of hyper-personalization. With this strategic integration in the pipeline, the future looks promising, and growth seems imminent for Dynamic Yield in their new home.

REFERENCES

https://techcrunch.com/2019/03/25/mcdonalds-acquires-dynamic-yield/

https://www.mirrorreview.com/mcdonalds-acquires-dynamic-yield/

https://www.dynamicyield.com/case-studies/mcdonalds/

https://www.dynamicyield.com/adaptml/

https://www.dynamicyield.com/lesson/deep-learning-recommendations/

https://www.dynamicyield.com/case-studies/

https://my.pitchbook.com/profile/56717-83/company/profile#insights

https://www.crunchbase.com/organization/dynamic-yield

https://www.dynamicyield.com/blog/2022-gartner-leader-in-personalization-engines/

https://www.dynamicyield.com/about-us/