Drizly: A refreshing business model in the delivery app landscape

With food delivery becoming a commodity business, Drizly must continue to innovate to defend its direct-to-home alcohol delivery platform model

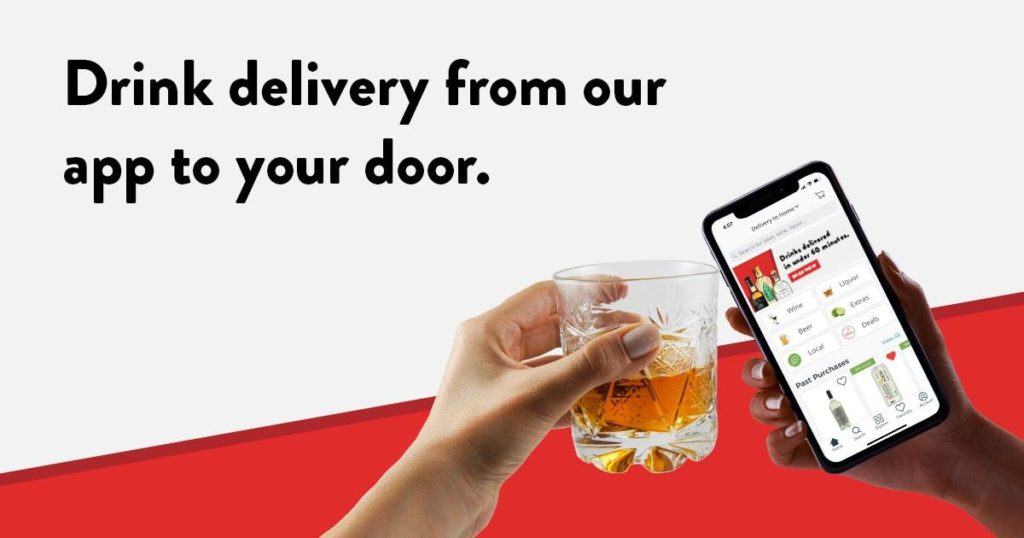

It’s 10pm. The dinner party in your apartment is going splendidly. Everyone is chatting after the meal, with no desire to leave your living room. Just as you’re about to pat yourself on the back for a job well done, you notice that your glass is empty… the conversation might be freely flowing, but the wine just ran out!

With no bottles in your fridge and no liquor store for miles, what’s a good host to do?

This is the kind of consumer problem that inspires the leaders at Drizly: an e-commerce platform in the US for alcohol direct-home delivery.

What is Drizly?

Drizly is a two-sided market that connects end users (drinkers) and retailers (local liquor stores that deliver) through a website/app.

There are obvious cross-side network effects; the more Drizly users there are, the more liquor stores want to be enrolled (and vice-versa). Drizly monetizes via a monthly membership fee to stores, rather than a cut of sales or a fee to consumers1. As of 2020, the company has raised $85M in venture funding and sells in 100 cities in North America.

How is Drizly combating disintermediation?

Consumers and liquor stores are located near each other, and a typical consumer living at one home address probably repeatedly gets Drizly deliveries from the same 1-2 stores. Since fulfillment of orders falls on the store to perform, it would be relatively easy for a store to encourage a customer to order off-app next time if they wanted to cut Drizly out.

However, Drizly has built in many value-add functionalities and an incentive structure that discourages disintermediation. For example, Drizly provides a proprietary app for ID age verification that member-stores can equip their drivers with. In addition, since Drizly only charges stores a flat monthly fee, there’s no marginal cost savings from switching individual consumers off Drizly. In other words, Drizly acts like an advertising platform for a liquor store, rather than a costly middleman.

Delivery is crowded. How does Drizly defend against bigger rivals?

Evidence suggests delivery has become a price-driven commodity business. Multi-homing is rampant: every Drizly drinker likely also has Amazon, UberEats, DoorDash, etc. installed on his/her phone. However, one thing that makes Drizly unique is its understanding of the idiosyncratic regulations that apply to alcohol.

Alcohol distribution in the US is heavily regulated and operates under a “three tier system”, requiring retailers or bars/restaurants to purchase from distributors rather than from manufacturers themselves. In most situations, end consumers are also not allowed to purchase from manufacturers, so DTC isn’t an option. Laws, taxation policies, and age verification requirements vary state-by-state, adding more challenge to the picture.

This might sound like a reason to be pessimistic about alcohol e-commerce, but Drizly sees this complexity an opportunity for competitive advantage. Most other delivery players (Uber, Amazon) have shied away from alcohol because compliance with liquor laws would compromise their core businesses. E.g., Amazon can’t leverage its warehouse network for alcohol in most jurisdictions, because state-level Liquor Control Bureaus doesn’t permit it to take possession of product and sell to consumers without a liquor license.

Drizly is different, because it never takes possession of the product (delivery is executed by member-store employees) and because it doesn’t take a cut of sales (it charges a flat monthly fee). This operating model design is a strategic advantage that protects Drizly from the entrance of Amazon or other scaled delivery incumbents. Says CEO Cory Rellas: “The proposition [of Drizly] is so much more than delivery.”

Is Drizly’s platform sustainable?

Drizly has many of the characteristics of a successful platform business: strong network effects, regulatory barriers that dissuade players from entering, and mitigated disintermediation risk. However, I suspect that maintaining scale in all 100 of its cities is going to be a constant battle.

Alcohol delivery, in my opinion, is not a winner-takes-all market. Like Uber or Lyft, it’s a clustered network. Due to geographic constraints, Drizly’s business only works in highly dense urban markets where there are both a lot of drinkers and a lot of retailers nearby willing to deliver. A determined competitor in a single market (or even a large multi-unit liquor chain) could copy the Drizly business model and steal share without too much trouble.

In my view, the only sustainable line of defense for Drizly is to create best-in-industry user experience through data. While network effects are clustered, its nationwide scale gives Drizly a data advantage. Drizly can use its deep knowledge of drinker preferences to curate recommendations and orchestrate the most seamless, user-friendly in-app experience. All of that is difficult for an upstart to copy.

Notes

- Drizly also typically charges consumers a delivery fee, but it is passed on to the retailer to cover its costs for the driver time and not retained by Drizly.

Sources

“Amid Shift to Online Liquor Buys, Here’s Why Startup Drizly Sees Delivery as a ‘Commodity’.” Yahoo! Finance, Yahoo!, 21 Dec. 2019, finance.yahoo.com/news/americans-are-projected-to-buy-nearly-135-b-worth-of-alcohol-online-by-2024-heres-who-that-helps-130027878.html?guccounter=1&guce_referrer=aHR0cHM6Ly93d3cuZ29vZ2xlLmNvbS8&guce_referrer_sig=AQAAAKlwpiogBz4-J5U5EfeusgbaSoTm6t8eqxDV2fTsbQtI6JieuOEf69y0CXY81zWwLCsFaF9OJIYTbFvqC6eg45mquXwwMiHe2TwSCzi0ngEy50ZB0N-yKLzaDwmNDINAPVP6RS_Oc7HPM9_2T264ho0RaDS6-tm9ggtnDkxS5Hgz.

Newhart, Beth. “Alcohol’s Three-Tier System Slows Ecommerce and Dates the Industry.” Beveragedaily.com, William Reed Business Media Ltd., 17 Feb. 2020, www.beveragedaily.com/Article/2020/02/17/Alcohol-s-three-tier-system-slows-ecommerce-and-dates-the-industry.

Very interesting post! I wrote my post on Glovo, a Spanish on-demand service platform that purchases, picks-up and delivers products ordered through its mobile app. I think that the key to Glovo’s success and why it hasn’t been “eaten” by Amazon and the likes, is that it provides delivery services for literally anything that is available locally. I think that Drizly’s narrow product focus will put its business model at risk when Amazon moves into the alcohol business. My understanding is that Amazon started offering 1-hour wine delivery to customers in several states last year. I wonder how Drizly is reacting to this and if they’ve started to feel an impact on their revenues!

Thanks for the great post Megan. It’s interesting to see how Drizly found a white space in the spaced entered this space as a niche player. I think through its narrow focus on alcohol, it can escape the radar of other large players who are often constrained by selling alcohol. In addition to offering alcohol, I wonder if Drizly can expand into adjacent products such as tobacco (also heavily regulated category) or complementary products such as cheese and flowers. This way, it an increase its target customers to not only those who are serious alcohol drinkers but also people who wouldn’t mind a glass or two of wine + other products.

Thanks for the interesting blogpost Megan! I’m a regular Drizly user and I love the company. As PZ mentioned, their narrow focus on alcohol might allow them to escape the radar of other large players (i.e. Amazon), but I do believe that this is a temporary thing. Should Drizly become large or profitable enough, rest assured that large players will start looking into that market. On the flipside, given that alcohol is a highly localized line of business in terms of retail, I believe the true risk for Drizly is in local apps in attractive markets that will be able to avoid the high fixed costs of running a nationwide operation and inherent complexity. Evidence of this is the wide range of smaller competitor apps that Drizly is already facing. Protecting against this via incentives may prove to work, but multi-homing will always be a constant threat.

Great post Megan, thank you very much for sharing! Following up on your last reflections about the ways Drizly could make its business more sustainable, I was wondering if in addition to offering value-added features for users they can find ways to develop their relationship with local retailers, providing them with more user data, management best practices or even apps to improve their business performance. I think that reducing multi-homing is the only way they have to raise barriers for new entrants, whether small competitors or big players (who will enter sooner or later).

Great post, thanks! I think the point you made about how Drizly achieved competitive differentiation in part due to its approach to idiosyncratic alcohol regulations is really interesting. I agree that in its early days this provided them with a competitive advantage and helped them develop a creative and unique business model that threads the needle of following the law while providing a valuable user experience. However, I fear that this advantage is not sustainable, since now that Drizly has demonstrated the model a competitor –whether it be a new upstart or an adjacent incumbent like Amazon — can simply replicate the regulatory strategy while slightly improving upon the user experience in some manner.

Thanks for introduction! Very interesting business, I think I will try the platform when I am back to U.S. I am thinking what’s the competitive advantage for Drizly. Besides good service as you mentioned, can I provide something unique for consumers, or can it optimize its supply chain to have the best operation process?

Thanks Megan! It was fascinating to read this post. It is very interesting to see how you compared a typical price-driven commodity business with Drizly, which operates in a very regulated market.

Despite that differences, I still believe that in every marketplace the main driver for being successful is the customer experience. I agree that Drizly can use data to improve customer experience. Based on my personal experience, I believe that Drizly should do a better work on training the stores. I have experienced different quality on the service depending on the stores. Although the company has implemented a rating tool, it is not easy to access the reviews and the number of reviews is very low. To reduce the impact of local competition the company should focus on improving the customer experience in each one of the 100 cities in which it has operations as well as increasing its brand awareness.

I really enjoyed reading this post and learning more about Drizly. I can imagine its use will probably skyrocket in the next few weeks as we are confined to our homes due to social distancing.

It is also interesting that Drizly’s success may be due to the fact that some usual suspects such as Amazon, Uber Eats etc. don’t provide alcohol delivery. At least not in the US. In the UK, Amazon Uber and Deliveroo all deliver alcohol, and I wonder if Drizly could create an impact internationally where there would be stiff competition.

Great article! Alcohol is a tricky subject, because regulations forbid shipping of alcohol across state borders for DTC. If Amazon or another large player were to enter and gain market share from Drizly, they would need to do so in the same clustered network style that Drizly has set up.

Great article on a useful consumer platform! It is interesting to see how they are able to develop a marketplace as an intermediary in this space which is in line with the 3-tier distribution model and legal purchasing requirements. In terms of sustainability, I would not be surprised to see Uber Eats or Door Dash make a move to purchase this platform and integrate it into their existing business models given the value of scale in products delivered and larger cart sizes. I do however believe the user experience and use case here for the current offering is unique and requires a high level of trust and end consumer verification, which competitors may not want to deal with.

I am curious about the scalability of Drizly’s profits. Specifically, if Drizly only charges a flat fee to its suppliers (the liquor stores) and doesn’t take a cut of the revenues or the per order delivery fee, then with a greater number of transactions on the platform, Drizly ISNT necessarily seeing an increase in revenue and therefore profits. I would love to understand their economics a little more but I’m worried that without tiered pricing on the supplier side (I.e. after you get 50 transactions that month, then you get charged $X more), that Drizly will eventually max out on the number of liquor stores and have called their revenue

Very interesting read Megan. Sounds like Drizly faces a lot of challenges. On one hand competition from companies like Instacart that offer a one-stop solution (liquor, groceries, etc.) and the potential entrance of larger players like Amazon. On the other hand, it seems that they will face issues scaling the business, the revenue model is caped by the flat-fee. I wonder how this will impact their ability to raise future funding rounds. I am Drizzly user so I hope they make it. Thank you for a great article.

Great post! I think it’s interesting that Drizly only charges the liquor store side of the platform, making it a de facto ‘advertising’ cost, as you say. I do wonder if consumers see it that way, however, with your footnote about consumers being charged a delivery fee (although it goes to the liquor store).

I hadn’t heard of this company and had only used Minibar delivery before. They sound similar, with local liquor stores selling their products through the platform. Minibar also includes complements like fruit (e.g., limes), cheese, etc. Prices seem to be marked up on Minibar, so I am eager to try out Drizly now!

Thanks for a great post!

“Drizly can use its deep knowledge of drinker preferences to curate recommendations and orchestrate the most seamless, user-friendly in-app experience. All of that is difficult for an upstart to copy.” This is a great point and beer-advocate has a similar play for tracking taste and also possible recommendations. I’m wondering if an aspect to expand beyond delivery (and possible competitors like amazon etc) is to partner with restaurants/places with exclusive access to leverage suggestions that are outside of their delivery model.

Interesting post! I’m impressed by the pricing model that Drizly chose to implement. So many platforms struggle with disintermedition, but I liked your point that the flat fee almost makes Drizly a marketing channel for liquor stores, since the marginal cost of an additional buyer doesn’t diminish their margin. While Drizly is ahead currently, I’m curious how long (if ever) it will take Amazon to enter the alcohol business. Given the high margin on these items, I imagine it’s a very valuable business for a player like Amazon that controls the supply chain. In the meantime, I’ll continue to enjoy Drizly!