Domino’s Pizza: Delivering Innovation and Profit

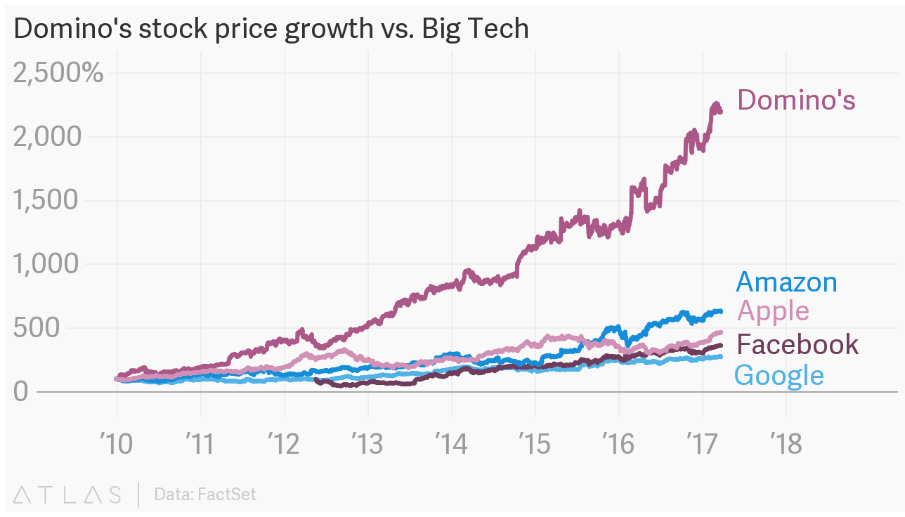

Pizza. It’s not the first thing that comes to mind when thinking of digital innovation or technology. Yet, when considering the winners and losers of the economy’s digital transformation, there can be no denying that pizza has a place at the table. More specifically, Domino’s Pizza. From 2010 to March 2017, Domino’s share price outperformed those of vaunted tech giants like Amazon, Apple, Facebook, and Google.[1] Similarly, since March 2014, Domino’s (+214%) has considerably outperformed its industry peers, including Pizza Hut’s parent company Yum! Brands (+79%), McDonalds (+90%), Restaurant Brands International (+76%), and Papa John’s (-15%).[2] While the entirety of this outperformance cannot solely be attributed to digital innovation, Domino’s commitment to technology is a clear differentiator from its industry peers.

After the company’s stock price bottomed out in 2008, Domino’s boldly pursued a multi-pronged strategy to initiate a turnaround.[3] In an effort to rehabilitate their brand, Domino’s announced a new menu and pizza recipe.[4] Simultaneously, Domino’s began to invest in digital capabilities that would enable it to deliver their product in innovative ways. However, in order to execute on these digital innovations, Domino’s first built out a more robust internal IT function, capable of internally developing these new digital innovations.[5] [6] As of 2016, approximately half of Domino’s 800 headquarter employees worked in software and analytics.[7] Perhaps most importantly, executive support for the company’s digital transformation ensured that the newly-empowered IT department and their marketing counterparts were able to collaborate in a quick, iterative processes.[8]

With this digital foundation in place, Domino’s emerged as a digital pioneer in the quick serve restaurant (QSR) industry. In 2008, Domino’s “Pizza Tracker” technology was launched, allowing customers to track the progress of their online orders via the Domino’s website.[9] Subsequently, in 2011, Domino’s launched its highly-rated iPhone application, further simplifying the consumer’s path to purchase. These innovations, when coupled with menu and ingredient changes, quickly took hold: approximately 25% of the company’s domestic sales were ordered online or through a handheld device in 2011.[10] As of 2017, this figure had reached 60%.[11] This early push into digital has not yet subsided. More recently, Domino’s became the first company to deliver pizza by drone, in addition to testing deliveries with autonomous vehicles.[12] [13] While some of these initiatives could potentially be considered to be “gimmicky” endeavors in innovation, Domino’s commitment to digital has undoubtedly increased value to consumers by simplifying the barriers to ordering and delivering their pizza.

While these initiatives demonstrate a desire to digitally transform their business, Domino’s efforts prove particularly effective because they closely align with the company’s business model. Most notably, as a franchisor, Domino’s provides centralized services such as supply chain management and IT systems to their franchisees. Innovations like the Pizza Tracker allowed franchisees to simplify their operations (e.g., less employee emphasis on taking orders), monitor their delivery performance, and make incremental improvements. Similarly, Domino’s proprietary Pulse point-of-sale computer system facilitated franchisee’s efforts to take customer order and manage inventory.[14] Lastly, to further simplify the operations of franchisee stores, Domino’s announced the introduction of an artificial intelligence-enabled “virtual ordering assistant” to take telephone orders in stores.[15] Together, these digital innovations both help franchisees operate their franchises more effectively and increase the Domino’s corporate leverage over their franchisees, thereby justifying the royalties that they command.

Digital loser (for now…)

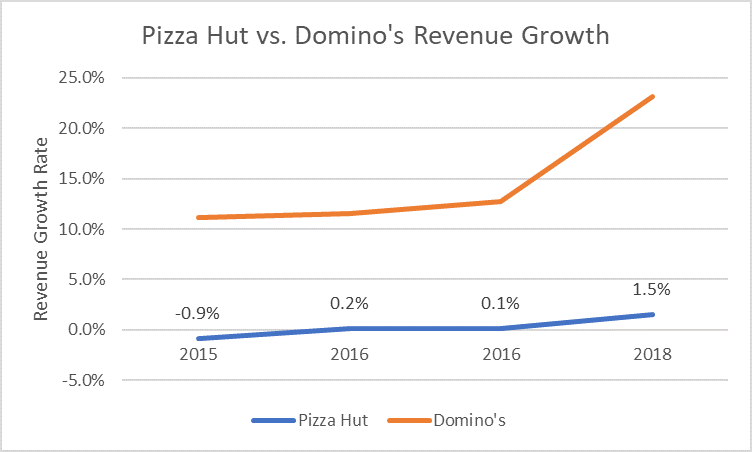

On the contrary, Pizza Hut is a direct competitor that has struggled to adapt to the digital environment in which Domino’s has excelled. Despite Yum! Brand’s strong stock performance, Pizza Hut remains a laggard in the company’s portfolio. Since 1995, Pizza Hut has seen a gradual decline in market share: from 25% to 14.5% in 2015.[16] As seen below, Pizza Hut’s revenue growth has been rapidly outpaced by Domino’s digitally-enabled strategy. The dismal performance stems, broadly, from the company’s self-assessed inability “to gain traction with our commitment to hot, fast, and reliable experiences.”[17] In the context of Domino’s success, these failings can largely be attributed to a poor customer experience (driven by lack of digital investment) and a business model that was not optimized for the continued rise of delivery orders. Regarding the company’s digital shortcomings, current Pizza Hut president remarked, “it wasn’t so long ago that people were talking about Pizza Hut and digital being a weakness.”[18] In a similar vein, the company’s business model was heavily geared towards dine-in customers. According to the company’s Analyst Day presentation, these “typical dine-in” assets were a “drag on brand perception and ability to execute.”[19] These two strategic decisions ultimately hampered Pizza Hut’s ability to deliver on their customer value proposition and, consequently, their performance suffered.

However, Pizza Hut has all but declared that they will be quickly following in Domino’s footsteps. In 2017, the CEO of Yum! Brands announced a $130M turnaround plan to invest in “assets and technology,” in order to “make this a more relevant brand.”[20] Since then, Pizza Hut has announced an investment in and a partnership with GrubHub, signed an international pizza delivery deal with Telepizza, and acquired online ordering software QuikOrder.[21] [22] [23] In addressing their typical dine-in assets, the company has now opened over 70 “Delco” units, which are designed for the specific purpose of delivery.[24] These initiatives reflect a company that is driven to join Domino’s as a winner in the new digitally-enabled QSR industry.

Whether these initiatives will be successful will likely be contingent upon two factors. First, it remains to be seen whether Pizza Hut will pursue a full-scale digital transformation as Domino’s did. In a 2018 interview, Pizza Hut’s Global Chief Customer Officer stated that a “wholesale overhaul” of Pizza Hut’s legacy systems was infeasible and, accordingly, new intelligent delivery algorithms would have to overlay over their old systems.[25] A patchwork attempt to create a digital transformation may not drive the operating leverage that Domino’s has achieved in recent years. Secondly, Pizza Hut must continue to evolve its business model to be more in line with the evolution that its digital assets aspire to deliver. Namely, they must continue to expand their Delco unit base, while selling off unproductive dine-in assets. Without a full-scale commitment to these initiatives it is possible that Domino’s will outcompete Pizza Hut in its superior execution of delivery pizza, while Pizza Hut tries to service both the dine-in and delivery markets.

Conclusion

As demonstrated in the cases of Domino’s and Pizza Hut, the success of a digital transformation is contingent upon both a dedicated investment to build digital capabilities and a close alignment with the company’s business model. As reflected in its immense success, Domino’s Pizza satisfies both conditions. However, with this triumph in the rearview, it remains to be seen whether this digitally-propelled success will be sustainable. Pizza Hut has articulated what can be seen as a copy-cat strategy, and new substitute products – enabled by third-party delivery services like UberEats – can offer wider variety and outsource their delivery processes. At the very least, regardless of who wins this battle in the long-term, we – as consumers – can rest easy, knowing that our appetites will not go unsatisfied.

[1] https://qz.com/938620/dominos-dpz-stock-has-outperformed-google-goog-facebook-fb-apple-aapl-and-amazon-amzn-this-decade/

[2] https://www.tradingview.com/chart/?symbol=NYSE%3ADPZ

[3] https://www.forbes.com/sites/kylewong/2018/01/26/how-dominos-transformed-into-an-ecommerce-powerhouse-whose-product-is-pizza/#55b5da6a7f76

[4] http://pizzaturnaround.com/2009/12/introducing-our-inspired-new-pizza/index.html

[5] https://www.cmo.com/features/articles/2018/4/9/dominos-cdo-right-internal-structure-to-be-digital-innovator.html#gs.AzJ2aPEO

[6] https://hbr.org/2015/11/dont-let-big-data-bury-your-brand

[7] https://hbr.org/2016/11/how-dominos-pizza-reinvented-itself

[8] https://hbr.org/2015/11/dont-let-big-data-bury-your-brand

[9] https://www.pizzamarketplace.com/news/dominos-intros-pizza-tracking-system/

[10] https://www.pizzamarketplace.com/news/dominos-launches-iphone-ordering-app/.

[11] https://www.latimes.com/business/la-fi-agenda-dominos-20170515-story.html

[12] https://www.cnbc.com/2016/11/16/dominos-has-delivered-the-worlds-first-ever-pizza-by-drone-to-a-new-zealand-couple.html

[13] https://www.cnbc.com/2018/02/27/ford-teams-with-dominos-to-test-deliveries-by-autonomous-vehicles.html

[14] HBS Case, “Domino’s Pizza,” Case Number 9-512-004

[15] https://www.qsrmagazine.com/ordering/dominos-begins-testing-artificial-intelligence-phone-orders

[16] https://www.cnbc.com/2017/02/09/yum-brands-posts-weak-sales-as-pizza-hut-continues-to-struggle.html

[17] https://www.qsrmagazine.com/pizza/checking-pizza-huts-130m-comeback-plan

[18] https://seekingalpha.com/article/4227124-yum-brands-inc-yum-ceo-greg-creed-hosts-2018-investor-analyst-day-conference-transcript?part=single

[19] http://investors.yum.com/Interactive/newlookandfeel/4025819/pdf/Final_Combined_Presentation_2018.pdf

[20] https://www.cnbc.com/2017/02/09/yum-brands-posts-weak-sales-as-pizza-hut-continues-to-struggle.html

[21] https://www.qsrmagazine.com/pizza/checking-pizza-huts-130m-comeback-plan

[22] https://www.qsrmagazine.com/news/pizza-hut-signs-landmark-international-deal-telepizza-group

[23] https://www.qsrmagazine.com/pizza/pizza-hut-makes-one-its-biggest-acquisitions-ever

[24] https://seekingalpha.com/article/4227124-yum-brands-inc-yum-ceo-greg-creed-hosts-2018-investor-analyst-day-conference-transcript?part=single

[25] https://aibusiness.com/pizza-hut-digital-ai-overhaul/

Thank you for posting this interesting piece. I very much agree with you that in the face of digital innovations, traditional businesses should not forget that their core value creation is still valid, at least in most cases. The key question should be how to adapt to and embrace technologies to continue to deliver their core value. Domino clearly exemplifies this principle.

In the case of Pizza Hut, there could be two potential explanations for its failure: 1) it failed to deliver its core value – make and serve good pizza; 2) it simply failed to successful leverage technology to enhance its value creation. My guess is that it is a combination of both. Apart from failing to digitize, Pizza Hut may also have failed in operations, marketing, franchise management, etc.

In addition, there might have been a secular trend towards take-out from dine-in. Pizza Hut, which is more skewed towards dine-in, suffered as a result. This is not necessarily a fault on Pizza Hut’s part, but definitely raises a bigger strategic question as Pizza Hut considers future store distribution, store distribution and etc.

Thanks for this fascinating piece. I’d be curious to see how quickly Pizza Hut rebounds (if at all). If it rebounds quickly off the back of digital innovation, this would call into question the benefits/drawbacks of being a first mover vs. a thoughtful follower. In some ways Domino’s digital innovations appear to be great and accretive (i.e. the mobile app), but other ones seem to be odd moonshots in undeveloped spaces (i.e. Drones). I wonder how much more inefficient Domino’s tech-related R&D spend is vs. Pizza Hut, given all of this exploration.

Great post! It’s a very unique perspective to look at Domino’s success from the digital innovation side. Before reading, I have never checked their stock pricing and it came out to be very surprising to me. I’m sure the digital innovation has been an indispensable part of Domino’s success. They have done a good job combining the technology with supply chain management. However, I wonder if what really made them successful was more because of the great supply chain on reducing delivery time (and variance) or the tracking capability of the digital platform. If we view the delivery service as a core competency of Domino’s, I would envision the supply chain being the core competency of their core competency. Undeniably I would agree the digital innovation is a great facilitator of their great supply chain management but I guess there is a paradox that success don’t come from one single factor. Still, great post! I like the new perspective you shared with us.

That was quite a ‘yummy’ post 🙂 and on a less talked industry when it comes to digital transformation. Domino’s has clearly outpaced its competitors in delivering the core value – good quality pizza with a good consumer experience in terms of ordering and delivery. It will be interesting to see if Domino’s takes it to next level by further leveraging on the data collected to recommend users the pizza flavors (and sides) that they might like or introduce new pizza flavors backed by data analytics.

Interesting! Your post on technology in food business reminds me of Zume Pizza from California, a company that actually focuses n food-tech. It automates mobile pizza restaurant (restaurant in a car) that uses robots to take orders, add ingredients to the pizza based on the orders, and putting it into the oven. The robots also take account the time and location into each order’s cooking and delivery time so that when the pizza arrives at the customer’s door it will still be oven-hot. After being founded in 2018, it had shortly gone to stage B, raised $375 million in 2018 and is now valued over $2 billion.

Thanks for this interesting post! I couldn’t help but be most curious about what you mentioned in your conclusion — the development of third-party services like Uber Eats. From Domino’s perspective, it has already invested so much in its digital transformation that it might seem like duplicative / wasted effort to also make delivery available on those third-party services. It looks like Domino’s also doesn’t intend to partner with any of these services anytime soon because it wants to control the customer experience and brand quality (https://www.cnbc.com/2019/01/15/dominos-wont-be-switching-to-ubereats-anytime-soon.html) But given the rise of these other third-party delivery apps, is it a mistake for Domino’s not to partner with them? Does that limit it’s potential market of customers?