Digital Disruption in the Fast-Fashion Industry

Can apparel retailers including fast-fashion disrupters Zara and H&M save themselves from digital disruption? Zalando, Europe’s leading online fashion platform, Boohoo, ASOS, and other pure e-commerce player, are killing the fashion-industry status quo.

Since a decade ago that fast-fashion including H&M and Zara disrupted the fashion industry with lightning-fast production, trend-led products and a vast retail footprint. But today a new wave of digital disruption is coming from e-commerce players like Zalando, Boohoo, among others, leading retail’s growth.

What makes e-commerce players the winners?

Value creation

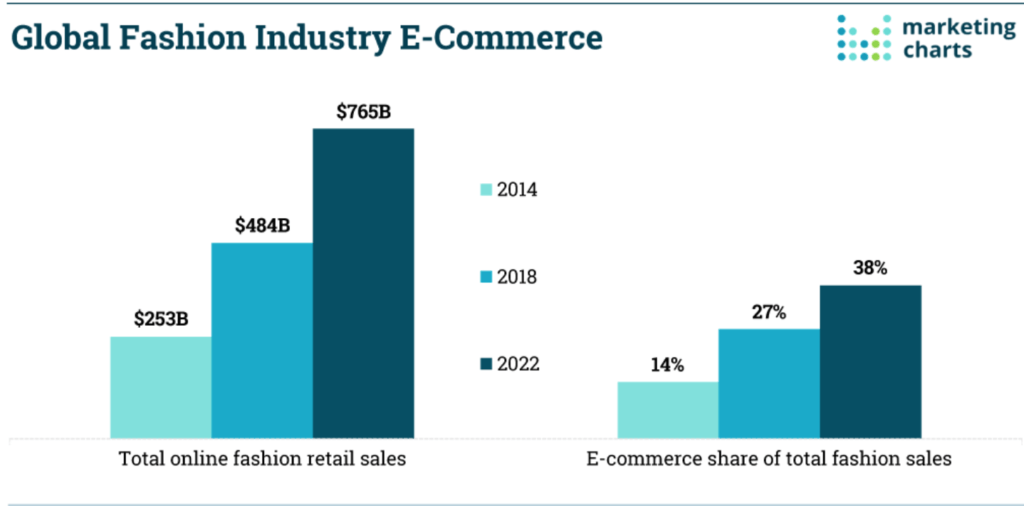

- “E-commerce outstanding grows in the Fashion Industry”

The global online fashion market is predicted to reach $765 billion by the year 2022, making 36% of total fashion retail sales vs 27% from last year and 14% from 2014 (1). Thus, consumer behavior is shifting from brick and mortar to online super-fast over time. Besides, BCG partner and a fashion industry expert said “Even today, online retailing at the surveyed companies is growing three times as fast as the brick-and-mortar business. This trend shows no sign of slowing down”(2). In fact, we can mention several department and specialized stores such as Sears, JC Penney, and GAP, Hollister, respectively that have closed several stores. Moreover, giant fast-fashion H&M is planning to close 160 stores in 2019 (3).

- “Fast pace is vital in turnaround fashion collections”

If we thought that fast-fashion companies including Zara and H&M were super-quick turning around collections vs “mall retailers” such as: GAP, Abercrombie & Fitch, etc. , some e-commerce players are even more agile and nimble. Furthermore, for speed, Boohoo.com, Asos, and Missguided can produce merchandise in two to four weeks. On the other hand, it takes Zara about 5 weeks to get a design from its origin to the store shelves and H&M between a few weeks to six months. Moreover, Fashion Nova, Southern California cheap & affordable fashion online, is lightyears ahead. “It can design, manufacture, and market its wares on its sites within one to two weeks”, according to its CEO Richard Saghian (4).

- “Cheaper, no cost for return and Faster Delivery Days”

Typically H&M charges $ 4.9 euros (Germany, biggest market) for delivery in 3-5 days and 3.95 euros at Zara, which offers free delivery for orders over 50 euros. However, “neither can trump Zalando, which lures shoppers by offering free delivery within 2 days and free returns within 100 days”. In addition, “People keep pushing free delivery, same-day delivery, incredible levels of customer service, but someone has to pay for that” said Bryan Roberts of consultants Kantar Retail (5). Thus, I strongly believe that Zalando is trying to imitate Amazon in the fashion industry trying to win against fast-fashion players with cheaper and faster delivery days as well as better customer service.

- “Better assortment and feedback from customers”

Boohoo, Fashion Nova, among other fashion e-commerce players sells online only at a time when more fashion is being bought via commerce vs. fast-fashion brands that need a large volume of goods to fill of brick-and-mortar stores. Moreover, according to the BBC, Boohoo can batch-produce items “in the low hundreds” to test out on its site, and an option not available to fast-fashion brands (6). Thus, e-commerce players can predict and “know” better their customers using data analytics to release better assortment over time vs. fast-fashion.

Value Capture

- “Not making money today, taking yours tomorrow “

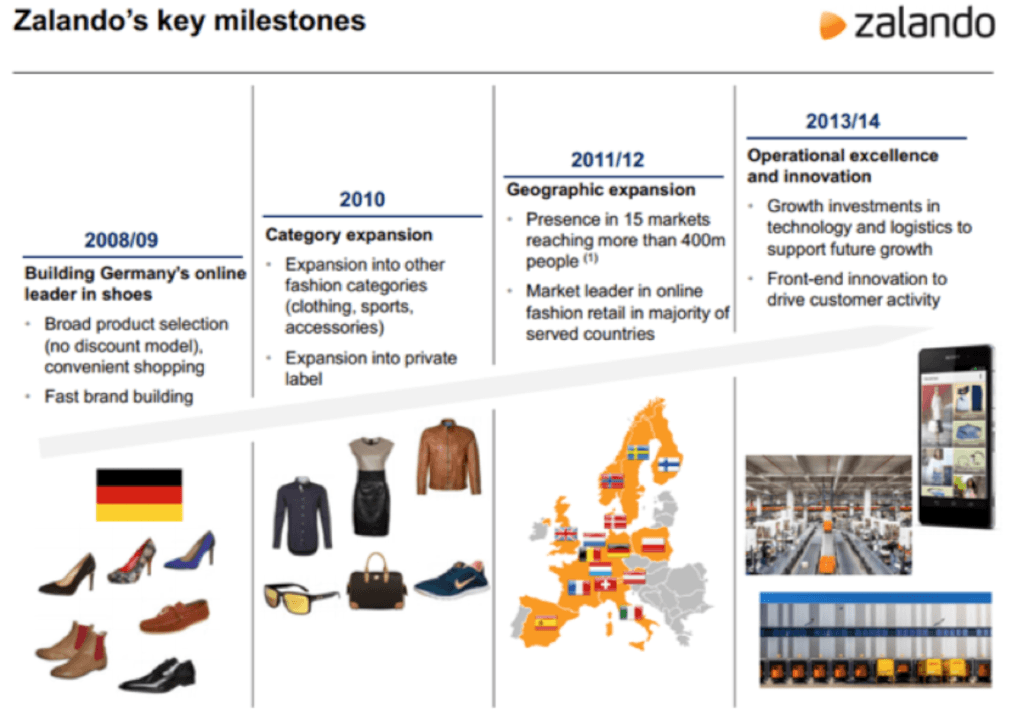

Zalando, like Amazon, focused on the growth of their market share instead of cashing in on quick – short term- earnings. Moreover, they started building Germany’s online leader in shoes, followed by expanded their assortment to other categories (apparel, accessories, etc.), followed by geographical expansion and finally improve its operations (7).

- “Zalando’s private label, zLabels, to chase fashion sales”

As we saw in class with X-Fire/Amazon case in which Amazon was developing its own products, Zalando is developing a quiet same strategy. Moreover, about 10-20 percent of Zolando’s sales come from its 17 own brands, compared with about 50 percent at ASOS’s private labels (8). However, the company expects super-fast grow in this channel as Jan Wilmking, CEO of zLabels, mentioned “We see great potential. We want to strengthen the brand outside of Zalando” (9).

- “Making profits after gained the market leadership”

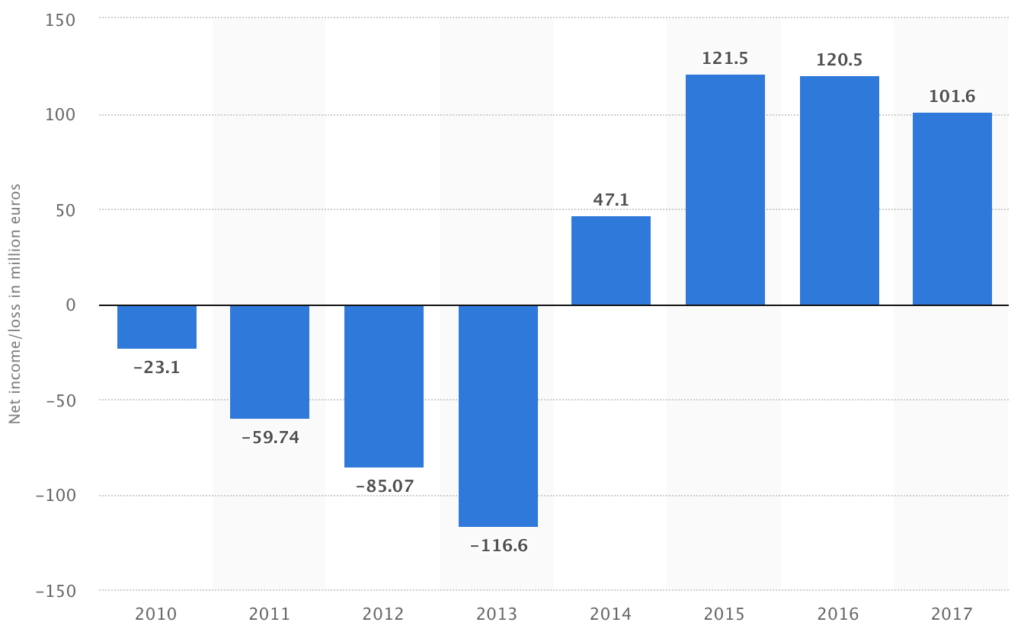

Since it was founded in 2008, Zalando has become Europe’s leading online fashion platform, generating over $ 5.2 billion in annual revenue (average growth over 20% in last years). In addition, the platform has grown to service more than 24 million active customers across its 17 geographies (10). Furthermore, since 2014 that the company is profitable with a net income of over $ 100 million euros in 2017.

Annual Net Income of Zalando from 2010 to 2017 (in million euros)

- “Other Fashion e-commerce players making profits”

Others fashion e-commerce competitors including Boohoo and ASOS reported in 2018, a sales growth of 50% and 20% vs. 2017 reaching £ 294.6 million and $ 134.5 million, respectively. In addition, Boohoo was profitable (pretty difficult to get considering few years of operation) in 2018 with a pre-tax profit of £ 30.9 million.

Losers

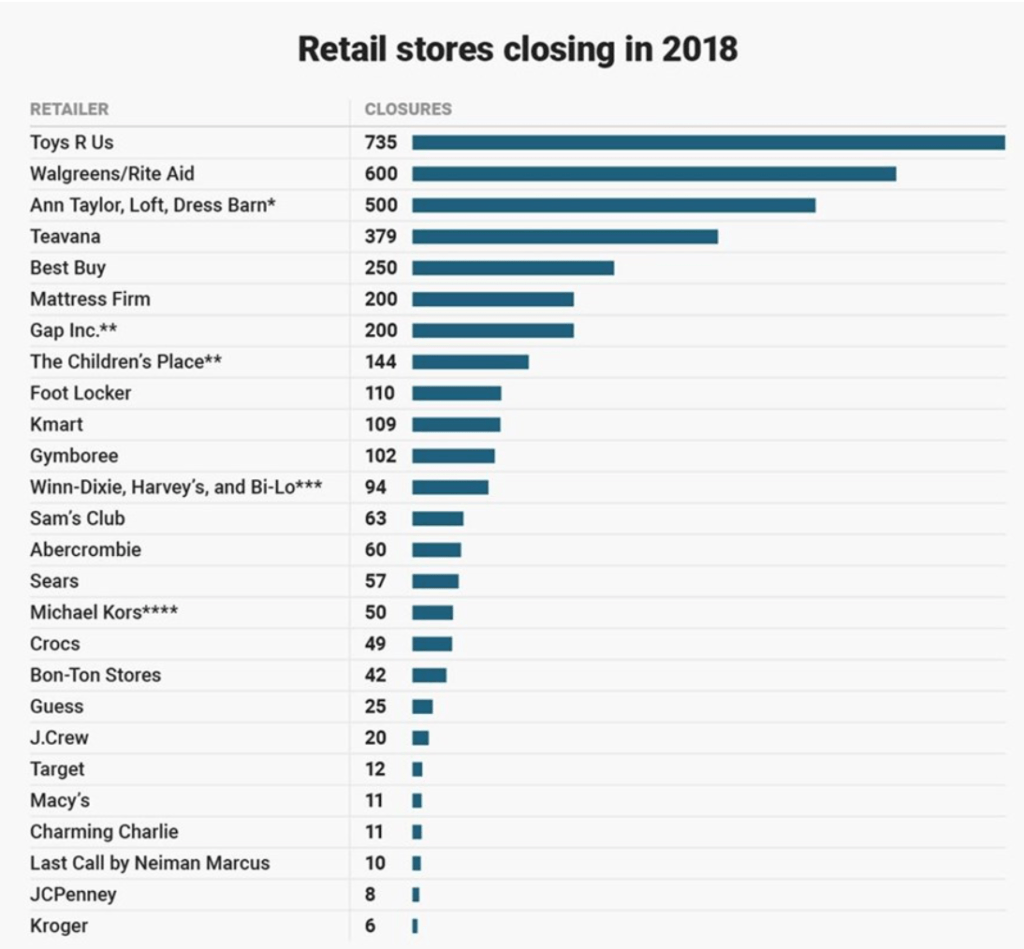

Not just “mall retailers” including department stores (Sears, JC Penney, etc.) and specialty stores (GAP, Abercrombie and Fitch, etc.) are losing the battle against digital disruptor fashion companies including Zalando, Boohoo and ASOS, but also Fast-Fashion companies such as H&M, Zara and Forever 21, among others.

- “Mall Retailers”

From the list above we can include Gap Inc, Foot Locker, Abercrombie, among others, brick-mortar retailers that have closed many stores last year (11). Moreover, we can mention Big Department Stores including Sears, the one-time titan of American retail, filed for bankruptcy last year as well as Payless, American Apparel, among others.

- “Fast Fashion”

Fast-Fashion retailers have largely been immune to the challenges crippling department and specialty storess—until, possibly, now, as recent financial reports suggest no spot is safe within the turbulent space (12). Indeed, for fast-fashion brands, especially Zara, H&M and Forever 21, its lower prices make it harder to offset delivery costs in comparison with Zaldano, Boohoo, among other pure online competitors. Furthermore, H&M’s sales just grew 3% annually in 2018 and net incomes dropped 25% from $20,809 SEK to $15,639 SEK (13). Also, Zara just grew 7% in local currencies in the first 9M18 (Zara has not released 4Q18 yet) posting $18,437 million euros and Net Income grew just 4% to $ 2,438 million euros (14).

(1) “E-Commerce Grows in the Fashion Industry,” Marketing Charts, November 29, 2018. https://www.marketingcharts.com/industries/retail-and-e-commerce-106623

(2) “Fashion Industry Outlook: 25% of sales Through E-Commerce by 2020”, Zalando Press Release, June 12, 2018. https://corporate.zalando.com/en/newsroom/en/press-releases/fashion-industry-outlook-25-sales-through-e-commerce-2020

(3) Holly Shively, “Clothing giant H&M planning to close 160 stores in 2019”, Dayton Dayle News, February 4, 2019. https://www.ajc.com/news/national/clothing-giant-planning-close-160-stores-2019/fQcB6nnT7dGjLnmtp1iMYP/

(4) TFL, “A Slew of New Retailers are Killing the Fast Fashion Status Quo”, The Fashion Law, March 27, 2019. http://www.thefashionlaw.com/home/is-fast-fashion-dying-or-is-it-just-hm

(5) Elisabeth O’Leary, “Zara-owner Inditex has the edge in online battle with H&M”, Reuters, March 16, 2015. https://www.reuters.com/article/us-inditex-hennes-mauritz-internet-insig/zara-owner-inditex-has-the-edge-in-online-battle-with-hm-idUSKBN0MC1VI20150316

(6) Marc Bain, “Boohoo’s soaring profit shows how fast fashion looks unencumbered by brick-and-mortar stores”, Quartz, April 26, 2017. https://qz.com/969319/boohoos-soaring-profit-shows-the-advantages-of-fast-fashion-sold-only-online/

(7) “Working at Zalando, Europe’s Fastest Growing Fashion E-Commerce Player”, Business Off Fashion, September 17, 2018. https://www.businessoffashion.com/articles/sponsored-feature/working-at-zalando-europes-fastest-growing-fashion-e-commerce-player

(8) Emma Thomasson, “Zalando to chase fashion sales with bigger own-label push”, Reuters, September 8, 2016. https://uk.reuters.com/article/uk-zalando-zlabels-idUKKCN11E1M9

(9) “Private Labels gone Public”, PYMNTS, January 18, 2018. https://www.pymnts.com/news/retail/2018/zalando-ecommerce-fashion-private-labels/

(10) “How digital players are destroying your market without making profit”, Digital Transformation Book, September 24, 2014. https://www.digitaltransformationbook.com/how-digital-players-are-destroying-your-market-without-making-profit/

(11) Hayley Peterson, “More than 1,500 stores are expected to close this year – here’s the full list”, Business Insider Nordic, February 15, 2019. https://nordic.businessinsider.com/stores-closing-this-year-2019-2/

(12) Lindsay Rittenhouse, “H&M proves the once-invincible fast-fashion industry is now crumbling just like every other retailer”, The Street, March 15, 2017. https://www.thestreet.com/story/14045374/1/the-once-invincible-fast-fashion-industry-is-now-crumbling-just-like-every-other-retailer.html

(13) H&M Full Year Report, 2018 https://about.hm.com/content/dam/hmgroup/groupsite/documents/masterlanguage/cision/2019/01/2371044.pdf

(14) Inditex 9M2018 Financial Report”. https://www.inditex.com/documents/10279/588551/Interim+Nine+Months+2018+RESULTS.pdf/c3b69a62-fdd2-3ce4-4559-d443c33049fc