C&S Wholesale Grocers: Autonomous Vehicles… For Your Apples?

The grocery conglomerate CnS Wholesale Grocers may have earned the HBS case spotlight with its human capital management strategies, but its latest innovation does not involve humans at all. In fact, it features 28-inch-wide autonomous robots.

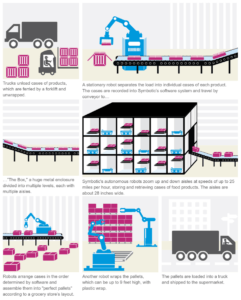

The grocery distribution empire owned by the reclusive New England billionaire Rick Cohen has built an in-house warehouse autonomation technology company called Symbotic (acquired the underlying technology in 2009), which has outfitted its network of distribution centers with automation systems consisting of autonomous robots. These robots work in conjunction with other familiar faces of a warehouse (e.g. stationary robots, conveyer belts, cases and pallets of goods) in rather elegantly simple ways. As the below diagram demonstrates, once cases of grocery goods are separated into individual cases by stationary robots and travel down the conveyer belt into multiple aisles, these autonomous robots race up and down the aisles (at speeds up to 25 miles per hour) to stack, store and retrieve cases. Unlike other warehouse automation systems where robots tend to be bolted down or limited to fixed routes and tracks (thus less flexibility in the types of activities they can do), Symbotic robots can travel untethered among storage racks. The embedded software instructs the robots to arrange cases in a specific order to assemble the “perfect pallets” mirroring the specific destination grocery store’s layout (as requested by the customer, e.g. canned corn next to soup). These are then wrapped, loaded onto trucks and shipped out.

To be clear, these robots may be small, but they did not come cheap for C&S. In fact, one of the biggest impediments to market adoption broadly has been the upfront cost. Equipment alone (excluding the requisite warehouse re-fitting, workforce and management training and subsequent maintenance costs) costs between $40 and $80 million. This is a meaningful chunk of change for food wholesalers and grocery chains that run on razor-thin 1-2% profit margins.

However, Cohen had a far greater vision and “kill-or-be-killed” sense of urgency that triggered the adoption of such far-reaching automation technology. He noted that if he did not invest in this type of automation, a competitor would, and within five years, be ahead. What resulted were significant cost savings in the three biggest expenses buckets in conventional human-staffed distribution: labor, time and real estate.

- Labor: C&S cut labor costs by 80%. The most important human job at a Symbotic-enabled warehouse is that of the system operator, who sits behind a bank of screens all day and makes sure everything is working right. Under current technology, human workers do not handle any of the shipments. Instead, each shift is staffed by 8-9 associates on the floor – a fraction of what a traditional warehouse requires – who monitor the system and resolve any issues that may come up. C&S needs only 30% of the jobs as before (to be sure, it raises the delicate question of employment and human worker displacement). This also reduces room for human error when putting together the pallets.

- On a related note, these robots come with impressive predictive maintenance capabilities to slash downtime and error. When a Symbotic robot is “sick” or malfunctioning, its software is trained to take itself out of the storage system and alert technicians to conduct repairs or maintenance.

- Time: Unlike human-staffed warehouses that run on shifts and must consider factors such as worker overtime pay, these robots can run 20+ hours a day, 7 days a week. Additionally, these robots can drop off and retrieve one case of product every minute, which represents 5x the speed of humans on foot, generating huge efficiencies.

- Real Estate: C&S claims the autonomous robots can reduce warehouse size by 25-40%. At just 28-inches-wide, they can travel up and down aisles that are only slightly wider, compared to conventional warehouse aisles that take up 10-12 feet of space. In addition, unlike conventional warehouses where cases of a given product are stored in the same section (as to make it easier for human workers to find them), Symbotic robots can put any product in any spot on the racks. This is because the embedded software remembers where each product is stored, and instructs the robots to find them in a specific sequence to construct the resulting pallets. This enables more efficient storage capacity: by storing more goods per square foot, C&S can store more in the same building, or store the same amount in a smaller building while fulfilling the same customer demand (with Symbotic technology, C&S was able to replace traditional pick-slot scenarios where maximum 55-60,000 units could be stored, with 1.2-1.4 million units of goods). An interesting side effect has been that C&S can store more products in a smaller space, or thereby operate more compact warehouses closer to retail outlets, which in turn requires less trucking and lowers fuel and driver costs. Finally, robots do not need light to operate, which on average lowers warehouse energy consumption by 35%.

All in all, the company estimates the payback period on the equipment investment to be 4.5 years.

The allure of this cost saving math has put C&S and its Symbotic technology at an interesting inflection point. As grocers and food and beverage manufacturers face ever-increasing labor costs and competition from e-commerce players (read: Amazon), C&S has adopted a two-pronged strategy: (1) continue installing robots in C&S warehouses; (2) while selling autonomous robot technology to external customers, such as Coca-Cola (already operates two Symbotic-fitted distribution centers), Walmart (several) and Target (one), as well as executing on current pipeline of nearly a dozen food warehouses held by grocery chains. Coca-Cola’s arch nemesis Pepsi is now in line to try the system, with Symbotic CEO noting that, “if someone can start a warehouse with automation and sell for less, everyone else has to follow. Consumers buy on price, so the cost on the supply chain matters. Walmart, it made a very efficient supply chain and that’s why it was able to offer the lowest prices in its stores, so everyone else has to compete. And now you’re seeing that happen with automation.”

It remains to be seen whether C&S will continue to differentiate itself with cutting-edge warehouse automation and the associated lower cost structure to defend its position in the market, or whether it will be compelled to further monetize this technology in the groceries ecosystem. What is clear is that C&S stands well ahead of its time – with robots assembling everything you need for tonight’s dinner.

https://www.newyorker.com/magazine/2017/10/23/welcoming-our-new-robot-overlords

https://logistics.cioreview.com/vendor/2016/symbotic

http://archive.boston.com/business/technology/innoeco/2012/01/symbotic_formerly_known_as_cas.html

Thanks for the post Shiv. After seeing the JD.com warehouse video in class, I really enjoyed picturing C&S’s version… till the point where you mentioned it doesn’t need light and all I saw was darkness 🙂 The increased efficiencies and cost savings you’ve described are really compelling and while I wonder how the questions you’ve posed will play out, I also wonder what the political response will be to technology that cuts 70% of jobs! We’ve recently seen tariffs on steel imports get hiked to protect jobs locally and the President has repeatedly boasted about low unemployment rates. Could C&S be setting themselves up for political backlash and is there a way for them to proactively address this? I wonder for example, to what extent they are assisting retrenched employees with finding new jobs so that there is a win-win for C&S and their workers.