COVID: A massive distraction or an opportunity to capture online market share for Target?

The retail industry has been going through tough times since the Great Recession and for many retailers, COVID-19 might be the final nail in the coffin. As the lists of winners and losers in retail are sorted out, a few companies have nearly secured their position at the top, and Target is one of them.

COVID’s Impact on Retail

While originally murky, the guidance for closure of non-essential retailers has allowed stores like Walmart, PetCo and Target to stay open, while TJMaxx, Zara and numerous others have closed. Obviously for any retailer forced to close their doors, COVID’s impact is massive, but for the sake of this piece, we’ll focus on COVID’s impact on retailers who have remained open.

The retailers who have stayed open have been forced to manage a number changes to their procedures to meet regulatory guidance and keep employees safe.

- Cleaning practices have been greatly enhanced.(1)

- Elements of the physical stores have needed change. Decals on the floor that help customers practice social distancing are the new normal. Plexiglass barriers that help eliminate contact between cashiers and customers are popping up at check outs near you.

- Management is enhancing messaging to consumers to keep panic buying at bay.

- Retailers are acutely focused on the health and safety of their employees. They are providing gloves and masks to all employees who are helping the in-store experience. And the media is enforcing this by reporting on COVID cases of store employees.

- Finally, changes in the supply change, shifting consumer demand and sales channel shifts are all impacting the retail industry.

Management teams across the world are making daily decisions to navigate all these changes.

Target’s Pre-COVID Digital Transformation

Target’s digital transformation, started in 2013, has set them up for success in the current crisis.(2) Over the past 5 years, they have modified parking lots to accommodate a Drive Up service, they created the Target Wallet app that allows for speedy check out and easier store navigation, they’ve enhanced their e-commerce site and in 2017 they acquired Shipt, a home delivery service provider, for $550M, and Grand Junction, to enhance th their delivery and supply chain analytics. Even with hindsight in my favor, I can’t begin to create a more perfect list of tools that enhance Target’s service abilities during this crisis. (3)(4)

For a much more detailed view on Target’s digital transformation pre-COVID, check out this blog post from one of our fellow DIGIT alums!

https://d3.harvard.edu/platform-digit/submission/target-transforms-for-the-digital-age/

Target’s Response to COVID

Target’s response to COVID-19 and their initial results have been received positively. Management acted swiftly yet with great caution, and they are constantly updating procedures to keep the stores open while keeping guests and team members safe.

Target Stock Price: Last 6 months

Source: Google Finance

In this Masters of Scale podcast(1), Brian Cornell, CEO of Target, discusses the changes they are making and says, “No one knows what will happen, but by putting my team first, I am putting the customer first – and serving the larger community.”

In case a 25 minute podcast isn’t in the cards today, Target’s website details the changes they have made to all stores:

Source: corporate.target.com(5)

Rolling out this many changes to nearly 1,900 stores and 350,000 team members in a matter of days if not hours, has been a tremendous undertaking, redirecting management time and resources away from other long-term strategic projects.(6) Management has reported the following changes to their original 2020 plans: reducing store remodels from 300 to 130, reducing store openings from 36 to 15-20, and enhancements to the Drive Up service are temporarily paused. (7)

And these are only the changes that impact customers. In addition, Target has been a leader in moves to enhance employee pay and benefits. In mid-March, Target announced a $2/hour pay increase for employees that has now been extended through the end of May in addition to a number of other enhancements to employees benefits, resulting in a $300M investment.(8)

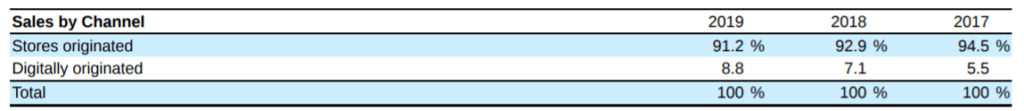

However, amidst mounting expenses and delayed plans, changing consumer preferences and habits may be a silver lining in all of this. In fiscal year 2019, Target’s strong online experience was generating just 9% of sales.(9) In Target’s April 23rd update, management reported more than 100% growth in digital channels! That’s more growth than they have seen since 2017.

Source: Target 2019 10-K

Unfortunately, financial results won’t come with rainbows and chocolates for Target this quarter due to COVID-related expenses and margin compression as spending shifts to lower margin goods (food and essentials) and away from higher margin apparel and accessories. However, meaningfully shifting consumers to Target’s digital channels may set them up to better compete with Amazon (we know how hard that is!) and emerge from this crisis in a stronger position to tackle the long-term trend retail has been struggling with for a decade. Unfortunately for Target, this likely means accepting they will be managing customers who are multihoming, but Target needs to take the opportunity to make multihoming worthwhile! This is the biggest bright spot in my mind.

Unknowns and Further Changes Needed

As in any crisis, the evolving situation must be managed with care, and Target shouldn’t start counting their chickens just yet. In the near term, COVID cases among Target store team members continue to emerge. Threats of strikes at Walmart and Amazon must have Target management on their toes. And the next wave of supply chain disruption is top of mind in the past few days. Each of these elements not only require management’s full attention, but also Target’s responses impact how consumers view them on a go forward basis.

Continuing to manage the myriad of challenges may take management focus away from that one bright spot: helping the transition to online stick in the long term. And I believe there should be a huge effort over the next few months to ensure that every digital adapter is having an experience they are excited by and want to come back to, virus or no virus. Setting up a culture of rapid experimentation to learn from first time and dedicated users of Target’s digital channels may seem like a far-fetched idea given everything we’ve discussed, but if they don’t seize this opportunity, they may not get another chance.

Sources

(1) Special: Target’s Brian Cornell: “I want to see retail survive this”https://podcasts.google.com/?feed=aHR0cHM6Ly9yc3MuYXJ0MTkuY29tL21hc3RlcnMtb2Ytc2NhbGU&episode=Z2lkOi8vYXJ0MTktZXBpc29kZS1sb2NhdG9yL1YwL25WdGRxUFNobUxXMEdPSjRrRlBfcDJhLVM2bTAtSUlJVV9JeUdsa0ZDWXc&hl=en&ved=2ahUKEwi76K-arYzpAhWiHTQIHZGcD3UQjrkEegQICBAE&ep=6, accessed 4/28/20

(2) Target to pay $18.5M for 2013 data breach that affected 41 million consumers, https://www.usatoday.com/story/money/2017/05/23/target-pay-185m-2013-data-breach-affected-consumers/102063932/, accessed 4/28/20

(3) Target Transforms for the Digital Age, https://d3.harvard.edu/platform-digit/submission/target-transforms-for-the-digital-age/, accessed 4/28/20

(4) Target’s standout performance during COVID-19 aided by digital decisions made in 2017, https://www.zdnet.com/article/targets-standout-performance-during-covid-19-aided-by-digital-decisions-made-in-2017/, accessed 4/27/20

(5) Target’s Coronavirus Response, https://corporate.target.com/about/purpose-history/our-commitments/target-coronavirus-hub, accessed 4/27/20

(6) all about Target, https://corporate.target.com/about, accessed 4/28/20

(7) Target Provides Business Update Related to COVID-19,

https://corporate.target.com/press/releases/2020/03/target-business-update, accessed 4/27/20

(8) Target Extends Enhancements to Pay and Benefits and Provides COVID-19 Business Update, https://corporate.target.com/press/releases/2020/04/Target-Extends-Enhancements-to-Pay-and-Benefits-an, accessed 4/27/20

(9) Form 10-K https://investors.target.com/static-files/f3ac06a7-c251-42ad-8888-4977acd43a0c, accessed 4/27/20

Thank you for the thoughtful post! We are perhaps overly broad with the way we think of retailers in the early innings of the pandemic and it is rightly worth understanding how specific players like Target can better weather the storm and recover on the other side. The pandemic has accelerated the war between traditional retail and Amazon, which is likely to be Target’s biggest rival even more so now and in the future. At the same time, the pandemic reveals the value of having robust and diversified supply chains, and so competition to Amazon is not only desirable but necessary. Target seems to be making the right investments in the near-term and I hope its creativity and speed can help it pull ahead.

Thanks for the great post. It’s so impressive to see how Target was able to capitalize on its recent successes in going digital to weather the Covid-19 storm today. I agree with Lumos that this pandemic accelerates the war between Amazon and traditional retailers. Speaking from personal experience, it’s as convenient (if not more) to order from Target/Walmart online and pick them up as shopping on Amazon now, given mailing as a distribution channel has dramatically slowed due to increased demand for courier service. I also noticed that the prices on Amazon are often more expensive than those in traditional retails. This highlights the importance of having multi-channel distribution for retailers, as well as the benefits of healthy competition in the retail industry from consumers’ perspective.