Coinbase Envisions an Open Financial System

Coinbase’s vision extends beyond simply trading digital currencies, with the stated goal of becoming the platform at the center of a revolutionary, "open financial system". Its core processes can be divided into five primary lines of business: Coinbase, Coinbase Pro (formerly GDAX), Custody, Wallet (formerly Toshi), and the Coinbase API. In the future, as the penetration of blockchain approaches critical mass and Coinbase’s vision becomes more of a reality, it will be interesting to see just how open the company can afford to be.

Founded in 2011 by former Airbnb engineer Brian Armstrong, at time of writing Coinbase offers buy/sell trading functionality for cryptocurrencies in 32 countries and a cryptocurrency wallet in 190 countries, but the company sees this as just the beginning. Coinbase’s vision extends beyond simply trading digital currencies, with the stated goal of becoming the platform at the center of a revolutionary, “open financial system”[1].

Coinbase aims to be the platform for all things blockchain (for a definition of blockchain technology see here), therefore the degree of its success depends largely on the pace of adoption of blockchain across the globe. To this end, Coinbase has created an ecosystem that promotes the adoption of blockchain, makes adoption easier, adds value through developing new apps and use-cases, and minimizes the risks associated with the new technology. This ecosystem encompasses not only buyers, sellers, traders and holders of digital currencies but also developers, businesses and consumers across an ever-growing number of industries and use-cases. Coinbase’s core processes can be divided into five primary lines of business: Coinbase, Coinbase Pro (formerly GDAX), Custody, Wallet (formerly Toshi), and the Coinbase API.

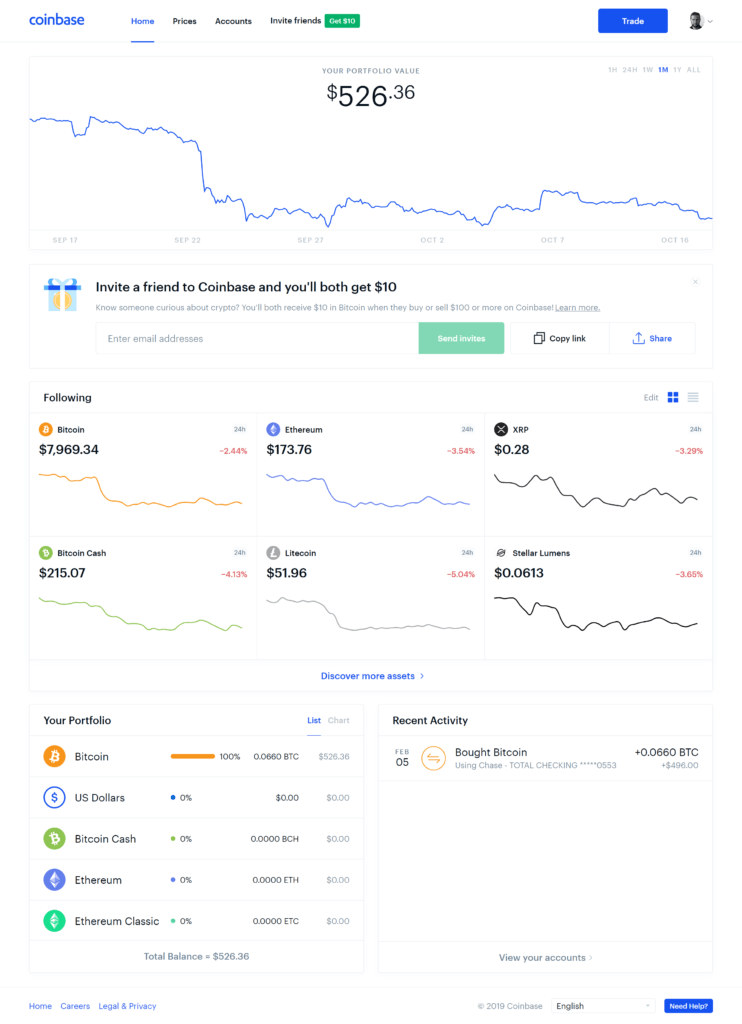

Typically, when people hear “Coinbase” they think of the company’s eponymous brokerage service where retail investors buy and sell cryptoassets, with Coinbase charging a fee for each transaction. Roughly speaking, fees range from 1.4% to 4.0% depending on transaction size, user location (local policies) and payment method. For example, due to increased risk, credit cards elicit higher fees than bank transfers[2].

Coinbase also operates an order book exchange, called Coinbase Pro (formerly the Global Digital Asset Exchange, or GDAX). This order book displays the “trading pair” (e.g. purchasing Bitcoin in USD); all the bids and asks at a given time (supply, demand); the aggregate amount of asks and bids at a given price, i.e. “market size”; and the “depth chart”, showing cumulative bid and ask orders over a range of prices, often used to gauge market liquidity. More advanced traders and organizations buy/sell cryptocurrencies using this service (with lower fees), which in turn determines the mid-market price for retail buyers on Coinbase, defined as the average of the current bid and ask prices[3].

Coinbase Custody, an independent, NYDFS-regulated entity, is a newer service aimed at Institutional investors such as hedge funds, asset managers, and pension funds. In their own words, “Launched in 2018, Coinbase Custody offers clients access to the secure, institutional-grade offline storage solution that has been used by Coinbase’s exchange business since 2012”[4]. This service costs $100,000 in initial setup fees, a management fee of 10 basis points monthly on assets under management, and a minimum balance of $10M[5].

Finally, Coinbase Wallet (formerly Toshi), aims to be the easiest and most secure crypto wallet and browser. When users purchase cryptocurrency on Coinbase, their assets are stored remotely, on Coinbase’s servers; however, a crypto wallet allows users to securely store their currency solely on their own device and transact with other users directly, without fees. Part of Coinbase’s vision is a belief that “the applications of the future will be built on a decentralized internet (the blockchain). Everyone will own a crypto wallet that allows them to access decentralized applications (dapps) and that wallet will be their gateway to the open financial system”[6]. When Wallet (at the time still Toshi) was developed, it was the world’s first mobile “dapp” browser. Later, it became the first wallet to launch crypto collectibles, i.e. the “beanie babies of blockchain”. In 2017, the debut year, one company sold over $12 million of these unique, virtual collectibles, with some items selling for over $100,000[7].

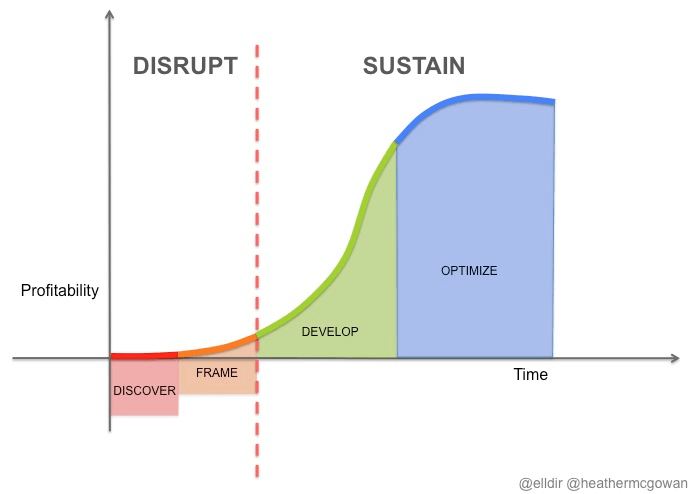

Finally, the Coinbase API promotes the adoption of blockchain by enabling the development of applications that extend the technology to new use-cases and/or improve existing solutions, adding functionality, making them better and easier to use. Any app that makes the adoption of blockchain technology easier plays a part in furthering Coinbase’s vision. For this reason, multi-homing is not a particularly big threat to Coinbase since they see their success as the success of blockchain at large. They are such a big player, offering so much value across such a diverse array of services that they simply want blockchain to reach critical mass as quickly as possible. This is a familiar platform strategy, open-sourcing your technology to the public, at least enough for developers across the world to build complimentary apps (for free!) that add value to the ecosystem, generating cross-side network effects. Often this takes the form of an API, allowing the public to leverage the platform’s power without getting access to anything too sensitive.

In the future, as the penetration of blockchain approaches critical mass and Coinbase’s vision of an “open financial system” becomes more of a reality it will be interesting to see just how open the company can afford to be.

[1] Armstrong, Brian. 2016. “The Vision, Mission, And Strategy For Coinbase”. Medium. https://blog.coinbase.com/the-vision-mission-and-strategy-for-coinbase-944b79a64a7c.

[2] “Coinbase Pricing & Fees Disclosures”. 2019. Coinbase. https://support.coinbase.com/customer/en/portal/articles/2109597-coinbase-pricing-fees-disclosures.

[3] “Coinbase Strategy Teardown: How Coinbase Grew Into The King Midas Of Crypto Doing $1B In Revenue”. 2017. CB Insights Research. https://www.cbinsights.com/research/report/coinbase-strategy-teardown/.

[4] “Coinbase Custody”. 2019. Custody.Coinbase.Com. https://custody.coinbase.com/.

[5] “Coinbase Strategy Teardown.

[6] Coelho-Prabhu, Siddharth. 2018. “Goodbye Toshi, Hello Coinbase Wallet — The Easiest And Most Secure Crypto Wallet And Browser”. Medium. https://blog.coinbase.com/goodbye-toshi-hello-coinbase-wallet-the-easiest-and-most-secure-crypto-wallet-and-browser-4ba6e52e4913.

[7] Young, Joseph. 2017. “Cryptokitties Sales Hit $12 Million, Could Be Ethereum’S Killer App After All”. Cointelegraph. https://cointelegraph.com/news/cryptokitties-sales-hit-12-million-could-be-ethereums-killer-app-after-all.

As a user of this platform, I believe in the mission as well to make cryptocurrencies a liquid and viable market for the world! What I am most excited about is the idea of giving these currencies a platform to improve industries like real estate, art, remitance payments, and energy. It’s an exciting time for financial innovation; let’s hope that this benefits industries ripe for disruption!

Great post!

It is very exciting to see Coinbase at the helm of the cryptocurrency revolution, and as you describe in your post, they seem to be using several platforms to do so. In particular, it is interesting to see how they are betting on only a handful of cryptocurrencies, as opposed to competitors like Binance and Kraken.

I find your analysis of the multihoming threat to Coinbase very interesting! While I agree with your suggestion that Coinbase is invested in the growth of the overall cryptocurrency market, I do think multihoming can still be a credible threat. The number of APIs and platforms in the cryptocurrency space is rapidly proliferating (https://blog.nomics.com/essays/cryptocurrency-market-data-apis/), and unless the system can agree on a single standardized API, interconnectivity and interoperability may be stunted, and that does not bode well for the crypto space. In my opinion, as one of the market leaders (depending on how we look at it), Coinbase should actively reduce multihoming by collaborating with its competitors (through consortia, for instance) or by leveraging its network effects to shove them out of the market.

Also, it is interesting to see how same-side network effects are just as important as cross-side network effects in several of the Coinbase platforms. By enabling peer-to-peer transactions, Coinbase seems to have mastered the mantra for rapid scaling through network effects.