ClassPass: doomed to be the next Blockbuster?

When the disruptor becomes the disruptee: with the rapid rise of at-home streaming services like Peloton, will ClassPass be able to pivot and survive or will it go the route of Blockbuster post-Netflix?

It may not seem like there’s much to innovate on running and lifting weights, but between trends like wearables, “wellness,” and streaming, fitness has become a hot space for technology investment. One key change in fitness over recent years was the rise of boutique fitness studios (vs. traditional big box gyms). Niche studios, such as Soul Cycle and Pure Barre, have experienced rapid growth.

One driver of this growth was the creation of ClassPass, the original disruptor in the boutique fitness studio market. ClassPass is a platform through which users can sign up for boutique studio classes. For a monthly subscription fee, users can book classes at a variety of fitness studios, often at a discount to the price of booking directly with the studio. Today, ClassPass boasts more than 8,500 partner studios and 45 million reservations have been made to date on the platform[i].

As a two-sided marketplace with low incentive for multi-homing, ClassPass’ current platform model operates in a winner take all market, and in fact, ClassPass is the only major player offering its service model. ClassPass’ main value proposition to the consumer side of its marketplace is that it offers a variety of classes all in one place for a reasonable fee. Its value proposition to studios is that it gives studios access to a larger base of customers (particularly key for new studios or to fill classes at unpopular times). It also leverages its large customer base to provide studios with valuable data analytics, such as where to open a new studio or what the best times are to offer classes. To meet both of these value propositions, it is key that ClassPass have as large a base as possible of both users and studios, and therefore there is not room for many competitors. As evidence, though many other startups have attempted to copy the ClassPass formula, they have since either been acquired by ClassPass or proved unsuccessful.

However, ClassPass’ dominant market position is being threatened by a new technology trend in fitness – streaming. The trend of taking boutique fitness studios home was started by Peloton, a live streaming bike app. Peloton, founded in 2012, brought the spin studio into consumers’ homes. Peloton sells a $2,000 bike as well as a subscription app through which users can access both live streaming and on demand spin classes. Peloton recently announced that it will be releasing a treadmill next. Since the entry of Peloton, there have been a wave of new apps trying to disrupt boutique studios and bring curated workouts directly to users through streaming technology, such as Aaptive and Gixo.

This streaming model has proven incredibly successful for Peloton, which has seen rapid growth in the past few years. And investors seem to believe that Peloton’s business is better poised for success than ClassPass’. In May 2017, Peloton raised $325 million from investors at a $1.2 billion valuation[ii]. In contrast, in June 2017, ClassPass raised $70 million at a $470 million valuation (and estimated to be at a lower share price than the previous round, considered a “down round”)[iii]. Peloton, and other streaming services, present a threat to ClassPass in that their offers of convenience may take customers away from ClassPass and its boutique studios. And if ClassPass’ user base drops too low, not only will it lose revenues, but it will reduce its competitive advantage as a large source of data.

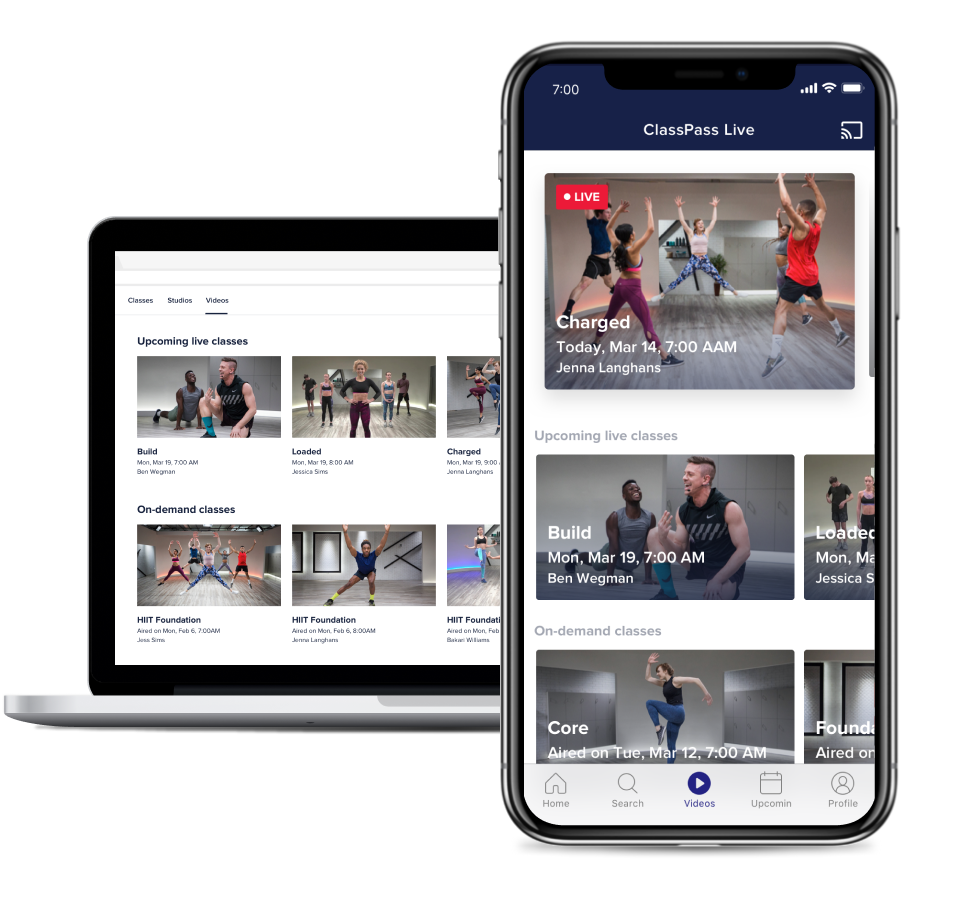

ClassPass’s response to Peloton so has been to try and replicate its success with the release of ClassPass Live, its own live streaming service. For $15 a month, users can stream equipment free HIIT classes from ClassPass’ studio in Brooklyn. Users have the option to purchase a starter kit up front that comes with a Chromecast and a heart rate monitor which can sync its output with the video[iv].

I don’t believe that this approach is the right one for ClassPass. ClassPass seems to have fallen into a typical trap of dealing with digital disruption. They attempted to replicate their disruptor, rather than identifying and strengthening their own competitive advantage in response. ClassPass is unlikely to succeed by offering its own streaming option. Peloton offers users a differentiated workout experience through its superior instructors (many have been poached from other top studios like Flywheel), strong brand, sense of community and loyalty, as well as an expensive to build and technologically advanced hardware product that provides them a barrier to entry and creates high switching costs for customers.

ClassPass is not prepared to compete on any of these factors. As a platform, it has no pre-existing brand as a workout provider, nor does it appear to provide a differentiated experience through its videos. Its equipment free classes make it easy for users to churn if they aren’t interested in the product. And most concerning, by providing workout classes, ClassPass is now competing with the suppliers it relies on to run its marketplace.

Though ClassPass Live is not the right approach to address the threat of streaming, ClassPass can compete by leveraging and strengthening its current competitive advantage of data and variety. Though in many ways Peloton and similar companies are a threat to ClassPass, they also present an opportunity. For much of its history, ClassPass has been in a “love/hate” relationship with the studios on its platform. Though studios are on ClassPass for its access to consumers and data, many feel that ClassPass pays them far too low of fees per user compared to what they would normally charge for a class. Some also worry that the ClassPass association will harm their brand. And though large studios like Flywheel have strong bargaining power, since ClassPass is the only platform on the market, smaller studio chains have few options and little power.

However, the introduction of streaming competitors now better aligns incentives between ClassPass and its studio suppliers, as both are threatened by these new entrants. Even studios which have typically been resistant to ClassPass, such as Soul Cycle, may soon start to feel a threat to their business model. Therefore, ClassPass’ best plan of attack may be to offer more services to studios that help protect their customer bases.

There are two key services ClassPass should consider offering to studios. Both of these options leverage ClassPass’ existing moat and competitive advantage of its large user base and large and exclusive data set.

- ClassPass should create a large video marketplace through which its studios can offer their own streaming video workouts. Though ClassPass currently has some videos on its app, they are limited. Rather than offering a competing workout video, ClassPass should provide assistance to studios in creating their own workout videos. ClassPass could charge for these services by taking a cut of video revenues as well as by renting out the studio they had built for ClassPass live. Offering a variety of workout class videos in one place will create an advantage over streaming competitors like Peloton who will not be able to replicate the variety ClassPass offers.

- ClassPass should create a standalone data analytics service for studios, separate from its marketplace. At 45 million reservations and counting, ClassPass has a better insight than anyone else into the world of fitness. Further, this data cannot be replicated by any one studio unless they are willing to collaborate with all 8,500 studios on the platform, therefore offering ClassPass a huge value source. By offering a standalone data product that helps studios with factors such as where to open a location, what types of classes to offer and at what times, ClassPass can expand and diversify its revenue stream. It also may be able to gain revenues from studios such as Soul Cycle, which do not want to be dilute their brand with the ClassPass marketplace but would could still gain value from ClassPass’ data insights.

ClassPass is in the unique position of the disruptor now becoming the disruptee. If it adopts a strategy of replication it is likely doomed to failure. However, if it is able to leverage its unique data assets, it may be able to pivot and survive the new competitive pressures in the fitness landscape.

Sources:

[i] https://techcrunch.com/2018/03/01/classpass-introduces-credits/

[ii] http://fortune.com/2017/05/24/peloton-funding/

[iii] https://www.wsj.com/articles/classpass-taps-70-million-in-down-round-1497639263?ns=prod/accounts-wsj

[iv] https://www.womenshealthmag.com/fitness/a19434038/classpass-live-review/

Thanks for this post Rachel. While I agree that the video marketplace would allow ClassPass to continue to offer the same value proposition, just online, I wonder whether the boutique studios would buy into it. In particular, do Peleton and SoulCycle attract the same customer? The motivation offered by instructors, who tend to walk around the room rather than just lead from the front, as well as the energy of fellow riders is what makes that experience so unique. I am not sure that they would want to proactively encourage their customers to trade that in for an at-home experience. For SoulCycle then, video streaming could just serve as an add-on feature, e.g. for customers to stay engaged while they are travelling to areas where there aren’t any SoulCycle studios. In that case, I think they would want to record sessions in their own studios to give customers a sense of being physically present. I would therefore approach the video marketplace with caution and focus more on emphasising the sense of community in physical studios as well as the data services.