CB Insights – Making Private Companies Public

Fighting the private company data black hole

Data has been playing a HUGE role in the investment space for years, with financial analysts crunching numbers, and calculating M and F scores for breakfast, calculating WACC and running portfolio performance regressions for lunch, and validating operational ratios and checking multiples for dinners. The financial industry has become completely reliant on data.

So… what do you do if it’s not readily available…?

For years, companies (Bloomberg, CapIQ, etc.) have been making their fortunes (and donating new wings to B-School libraries) by aggregating publicly available data and providing research platforms to the financial sector. But these services have been limited to public companies that disclose their statements; venture capitalists, private equity funds, and the likes, looking to gain a better understanding of private companies were left out of the party. That is, firms and funds managing an accumulated $4.2tn[i] (TRILLION or $4,200,000,000,000 USD) were waiting for something new to come along.

In 2008, after spending 7 years with American Express, managing the $50 Million Chairman’s Innovation Fund[ii], Anand Sanwal and his co-founder, Jonathan Sherry, decided this white space must be addressed and set out to create CB Insight. The self-proclaimed “Bloomberg for Private Companies[iii]” has since bootstrapped its way to becoming a leading provider of private company data to the investment community.

CB Insights built a proprietary data set by developing a software platform that collects private company information, extracts data from press releases and news articles as well as other sources, and added another layer of dedicated industry analysts that make calls and push data collection further. While data by itself is great, CB Insights stands out by

creating an innovative analytics layer. This breakthrough dashboard allows subscribers, among other things, to view strength ratings of companies and VC firms, as well as map social relationships between different stakeholders in the industry[iv][v].

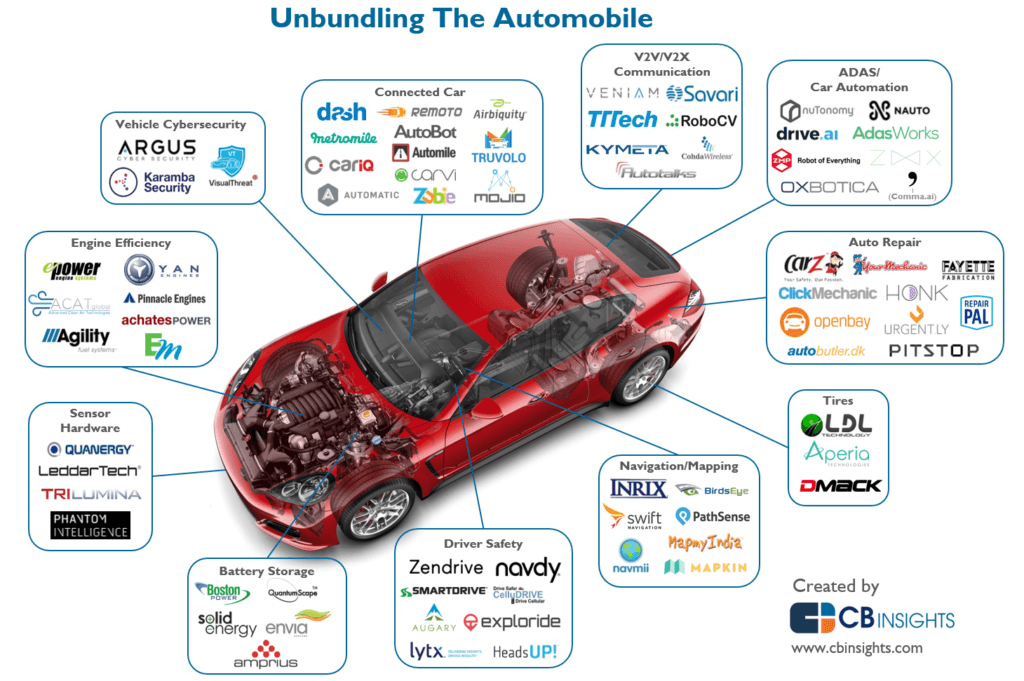

In order to increase their exposure and gain more traction, the CB Insights team started producing free industry reports and market maps, holding conferences, and, mostly, sending a daily newsletter that derives inputs from its unique data set. The newsletter has caught fire, currently being sent daily to over 250 thousand subscribers, providing them with puns, professional information and love (yes, love[vi]).

This endeavor made CB Insight a must use platform for large players, from Venture Capital firms to Corporate VCs, from media outlets to law firms, and from investment bankers to LPs. It has positioned itself as the data source of choice for private company information and has been cited in the press over 2200 times in 2016 alone[vii].

All in all, CB insight transformed the way private company information is accessed, provided new avenues for research and understanding of industries previously masked in the darkness of proprietary data, and did so with a smile. Can’t help but appreciate their process and where they are, even if they don’t necessarily appreciate our “diversity[viii]”.

I love you.

Gil

[i] https://www.preqin.com/docs/reports/2016-Preqin-Global-Private-Equity-and-Venture-Capital-Report-Sample_Pages.pdf

[ii] https://www.linkedin.com/in/anandsanwal/

[iii] https://www.youtube.com/watch?v=S0nnxzJrgf4

[iv] https://www.cbinsights.com/

[v] Bussgang, Jeffrey, and Annelena Lobb. “Mattermark.” Harvard Business School Case 816-073, February 2016. (Revised February 2017.)

[vi] https://www.fastcompany.com/3061344/how-emailing-i-love-you-translated-to-1-million-in-data-analysis-revenue

[vii] https://www.cbinsights.com/press

[viii] https://www.fastcompany.com/3058606/the-recommender/how-a-practical-joke-by-cbinsights-skewering-vc-culture-fooled-silicon-valle

Great article, Gil. I also read CB Insights’s newsletter on a daily basis and find it a lot more entertaining than the regular dry VC industry reports. Their focus on data and visual maps of industry landscapes like the one you showed is actually extremely helpful and gives you a quick and easy overview of what is happening in a particular field.

CB Insights is a newcomer though – what do you think about their datasets on the website? Whenever I have tried using them, it just seems a bit more cumbersome to find information than, let’s say, using the industry norm, which is Pitchbook. While CB are great at aggregating industry data, it seems that they have not yet been able to gather the copious amounts of data on people (incl. linkedin profiles!), investors, and valuations, and investing rounds the way Pitchbook has. Do you think they can still survive without it or they need to match up to the quantity and quality of data that Pitchbook has?

Regarding data gathering, do you think they have been doing this all manually or they have developed intelligent algorithms to scrape information off the web?