CarGurus: Building the world’s most trusted and transparent automotive marketplace

CarGurus, a leading online automotive marketplace, has grown significantly in the last years. Why the company has grown so fast? Is that growth sustainable? In this post it will be analyzed how the company creates value, how the company has been scaled and whether its growth is sustainable.

Business model and value creation

CarGurus is an online automotive marketplace that connects buyers and sellers of new and used cars [1]. The company provides the largest car listing marketplace in the United States and also operates in Canada, UK, Germany, Italy and Spain.

CarGurus creates value for both the buyers and sellers of cars. For the former, CarGurus offers a sophisticated search engine that shows how competitive car’s price is in comparison to similar vehicles. The platform calculates an Instant Market Value (IVM), which reflects the market value of a vehicle. The IVM is calculated through a data-driven approach that considers multiple dimensions such as make, model, mileage, and customers reviews [1]. This marketplace helps solve the lemon problem: the fact that owners of used vehicles have an information advantage over potential buyers in relation to the quality of the cars, making it difficult for buyers to select and buy great cars [2].

For dealers, the platform provides an efficient channel to sell their vehicles through the Basic Listing, Enhanced Listing, and Featured Listing products. The Basic Listing product allows dealers to publish and market their cars in the website without cost. The Enhanced Listing product provides dealers with a higher volume and quality of connections as well as the contact information of potential buyers. In addition to the benefits of the Enhanced Listing, the Featured Listing product ensures the dealer’s cars are promoted at the top of the search engine [3]. CarGurus captures value through the dealer’s subscription (89% of total revenues) and through car companies’ advertising on their website (11% of total revenues) [1].

Assessment of CarGurus’ scalability and sustainability, and next steps

Since the company does not charge a fee for car-buying customers and offers a free entry-level product for dealers, it has been easy to scale the company. Its main challenge it to sustain that growth over time in a profitable way.

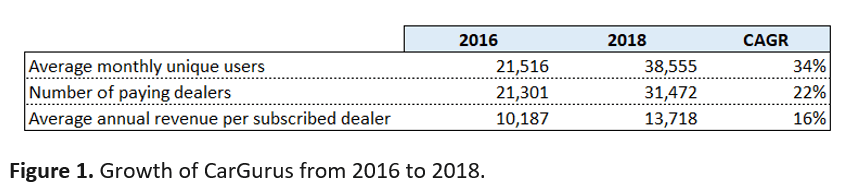

In its annual report, CarGurus highlights the cross-side network effects driven by scale. The more customers who use the platform, the more dealers subscribe to the marketplace and pay for premium products [3]. At the same time, having a large number of dealers attracts more customers who are interested in buying cars. Figure 1. shows that the company significantly scaled the platform between 2016 and 2018. To illustrate, in 2016-2018 the number of paying dealers increased by 22%, while the average annual revenue per subscribed dealer increased by 16% [1].

In relation to the sustainability of its business model, CarGurus participates in a very competitive market including other vehicle marketplaces (e.g Cars.com) and other automotive websites (e.g. Carfax.com) [1]. Although the company has no risk of disintermediation, since CarGurus only charge revenues for the subscription and no a percentage of the transaction, the company is at risk of dealers migrating from a paid service to the freemium version. To face this problem, CarGurus should strengthen the value proposition of Enhanced and Featured Listing products. The company should enhance its current tools (such as the Dealer Dashboard, which includes tools to price inventory by real-time market conditions) and create new tools to increase average revenue per dealer.

In addition, since car buyers search for cars in their areas, there is network clustering, which makes easy for other competitors to reach a critical mass in a local market and take off through a differentiated offer [4]. In a competitive market, both the car buyers and sellers can do multi-homing.

In the case of buyers, since in general automotive platforms does not have a cost for them, the cost of adopting an additional platform is low. For that reason, it is critical to strengthen the value proposition by improving its search tools and the customer experience. In relation to the sellers, the freemium users also do multihoming, while the premium users have a higher barrier to do multihoming. Currently, the subscription agreement of the dealers can be terminated with 30 days of notice. Deepening medium and long-term relationship with established dealers can increase the marketplace’s stickiness and improve the sustainability of the platform.

As explained above, going forward the company should focus on strengthening the value proposition for both dealers and buyers [5]. In the year 2020, the company has implemented new initiatives to improve customer experience. For example, CarGurus decided to improve the customer experience by reducing the advertising load [6]. Continue implementing initiatives that improve customer experience and establish long-term relationships with dealers is the only way to thrive in this competitive market.

# Words: 749

References

There’s no doubt that CarGurus has created immense value for both sides on the platform and I’m sure they’ll sustain in the short term and I wonder if they can expand their offerings by offering a peer-to-peer model as well for individual sellers and buyers rather than dealers or go the other way where individuals looking to sell their car can seek out multiple used car dealers who might be interested? On the longer-term horizon, with car ownership trends showing a decline because of car-sharing and ride-sharing I am curious about what the future, one where fewer people are looking to buy cars, looks like for them.

I believe that CarGurus already has a P2P sales option (https://www.cargurus.com/Cars/sell-car/) – this is typically just a small part of online marketplace’s business because its a one time fee (maybe a few times if they need to renew) versus ongoing and larger subscription fees for dealers (who value higher because they are selling many cars) + buy upsells (enhanced listings, or in the case of competitors like AutoTrader – vAuto, websites, etc.).

Andres – what’s your opinion on whether or not CarGurus can continue to differentiate itself on its IMV? A lot of companies have moved in similar directions of giving more transparency to buyers, so do you think this slows down CarGurus’ growth? And dealers typically do not like too much transparency (TrueCar is a perfect example – they lost a significant number of dealers in a single quarter because they were showing too much information) – how does CarGurus continue to differentiate without pissing off paying customers (e.g. dealers)? I totally agree with you that they have really done a great job growing and adding value, and think it’s sustainable, but definitely a competitive market and wondering how you see them innovating more in the future!

Andres, I agree with you that there is “network-clustering” for this platform, but I wonder how large are these networks. The advantage of an online platform vs. traditional offline car dealers is the broader reach. Cars need not be physically transported to be shown to a potential customer on this platform. Therefore, all the cars, irrespective of their location, should have the same weight for a person browsing to buy. Someone from Texas can more easily purchase a car from California via Carguru vs. visiting physical dealer-store where he/she is tempted to buy something immediately available. What do you think?

Sneha, thanks for your comment. I agree that the network-clustering is not as big as in the case of Uber or Lyft. However, since there is an additional cost of buying a car from other state (e.g. transportation cost), not all cars have the same weight for a person browsing to buy. For that reason people would prefer to buy cars within the same region.

Great read Andrea. I agree with your analysis about the platform. Given the amount of data and users they have, I wonder if there are opportunities to expand their businessmen to a seller to seller model. By doing this they could potentially offer other products like car insurance, car guarantees or similar. There are some companies in LatAm like KAVAK that have a financial business on top of their auto marketplace. They assess and buy cars from sellers instantly at a discount and then resell them at market value on the platform. Do you think something like that could work? Anyway, it was a very nice article, buena joe wn.

Very interesting article and compelling platform – second-hand car transactions are exposed to information asymmetry that leads to overall opacity in the system, so this platform can bring a lot of value. With strong network effects but also low entry barriers and multihoming cost, competition is very high. It would be interesting to explore more the actions CarGurus can take to influence multihoming costs, in order to improve loyalty of users (car buyers). As an example, a strong offering on complementary services (e.g. maintenance, insurance, etc.) may be helpful. Lastly, another area that could be explored is the advertising stream – advertising revenues were mentioned and represent 11% of total revenues; it could also be powerful to explore how advertising investments (from CarGurus) could help increase traffic and so boost both transactions as well as advertising revenues.

Thanks for the breakdown, Andres! This is a really interesting company to read about. The question of multi-homing is such an interesting question for the new and used car market. Particularly with car purchasing being so infrequent, expensive, and high friction, I assume that buyers feel as though they have to multi-home; it’s essentially a part of the expected process. I’m curious to see how CarGurus can create a buyer experience so unique to the platform that it negates this.