Caesars Total Rewards: What Happens in Vegas Does Not Stay in Vegas

Caesars’ Total Rewards loyalty program pioneered Big Data-driven marketing and customer service in its industry, and grew to be one of the Company’s most valuable assets

Caesars Entertainment became a leader in the hospitality and gaming industries on the back of its iconic properties like Caesars Palace, the extravagant resort on the Las Vegas Strip. In 2008, Apollo Global Management and TPG purchased the business in a $31bn leveraged buyout. However, by 2015, Caesars filed for bankruptcy protection, encumbered by $24bn of debt and a slowing convention business stemming from the 2008 financial crisis.

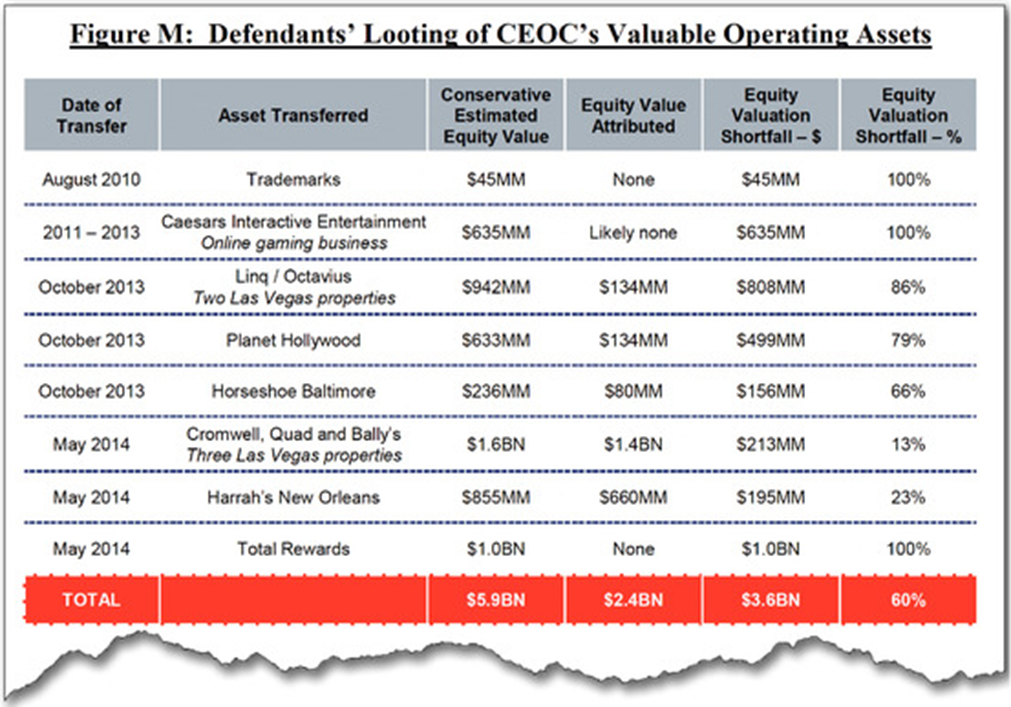

Litigation eventually ensued over previous asset transfers that the ownership group made prior to bankruptcy – effectively creating a “Good Caesars” of prime assets for the Apollo/TPG group, while leaving creditors with the weakest assets that could not satisfy debts (Source: FT).

Fascinatingly, the most valuable asset in dispute wasn’t the physical properties sold, but the data that the Company collected on customers through its Total Rewards loyalty program. The figure below shows an excerpt from a lawsuit filed Nov. 25, 2014 in Delaware court by senior creditors (Source: WSJ).

What is the Total Rewards Program?

Total Rewards was launched in 1998 by Gary Loveman, a former HBS grad and at the time the Company’s Chief Operating Officer (Source: WSJ). In a 2003 interview, Loveman (then CEO) said: “We use database marketing and decision-science-based analytical tools to widen the gap between us and casino operators who base their customer incentives more on intuition than evidence” (Source: HBR).

Loveman had formulated initial insights in the 1990s by collecting the gambling, dining, and lodging habits of customers, leading him to the eventual creation of the loyalty program. Eventually, Total Rewards grew to give Caesars a reputation for pioneering Big Data-driven marketing and customer service in the casino industry.

The program, which boasts 45 million members, ties every element of the Caesars offering together, including gaming, hospitality, and nightlife, for its customers across all its resorts. Total Rewards allows customers to earn and redeem Reward Credits (the program’s currency), as they spend money in gameplay and hospitality purchases (Source: Caesars).

Personalized enhancements are delivered to members through the program, including shortened wait-times, acknowledgements of special occasions, and access to special events and offers. For highest tiered members – known as Seven Star (who spend nearly $500,000 with the company in a year) – guests can receive four night’s complimentary stay at hotels and comped airfare (Source: Forbes).

Why is the Total Rewards data so valuable?

Alas, it turns out that what happens in Vegas does not stay in Vegas. Customer behaviors and purchases are tracked closely through the program, capturing data from the instant they book their stay to the moment they leave (Source: Forbes). This enables the Company to provide the most tailored customer service experience possible and encourage members to spend more.

The dataset is immense. Over 80% of all gaming play across its properties are tracked through this program, as well as 60% of all hospitality spend. Having these transactions aggregated in a single data pool allows the Company to deploy sophisticated customer valuation techniques and understand the nuanced drivers of customer spend. Caesars can then leverage these analyses to inform its marketing campaigns to keep customers playing within its network (Source: Caesars).

For example, it can identify customers engaging below their full potential and tailor personalized marketing to them. The Company has built predictive models for customer disengagement, allowing them to try to re-engage customers as play decreases (Source: Caesars). The program is a fascinating tool to maximize unit economics – increasing customer lifetime value (LTV) as much as possible, through the most effective customer acquisition cost (CAC) – all informed by detailed data.

Impressively, Caesars’ customer relationship management capabilities have enabled the company to drive a 22% premium in gaming revenue per unit over competition (Source: Caesars). For a Company that generated total revenue of $9.6bn in 2021 and $5.8bn in casino-related revenue, a 22% premium can equate to over $1bn in incremental revenue across its properties!

It is no wonder that this asset was of such importance in the bankruptcy process in 2015. As for the case, the group finally settled after years of contentious litigation. The entity controlled by Apollo and TPG agreed to put $6bn into the restructured company and handed back most of their ownership to the creditor group. In 2017, a new Caesars emerged from the process, valued at nearly $25bn (not too far from the sale price in 2008) (Source: FT).

Great article! Currently, gambling is heavily taxed and/or restricted due to it’s status as a “vice” industry. Is there any thinking about how companies that are restricted in such a way should be limited in the way they can use data? The FCC currently restricts many industries such as alcohol or cigarettes’ on the ways and formats they can advertize, and was wondering if people were starting to think the same about data collection and marketing

This was a very great choice of company to write about, Alex! I wonder if Caesars Entertainment every discussed about future limitations of the data from their rewards program, if there are any? And I wonder how their data collection fits into their wider business strategy, I imagine the insight that they get can lead them to introducing new quality services.

Loved the title of the blog too!