Box: Defending its Business through a Platform

Why Box's journey from product to platform is a matter of life or death.

Commoditization of the Cloud

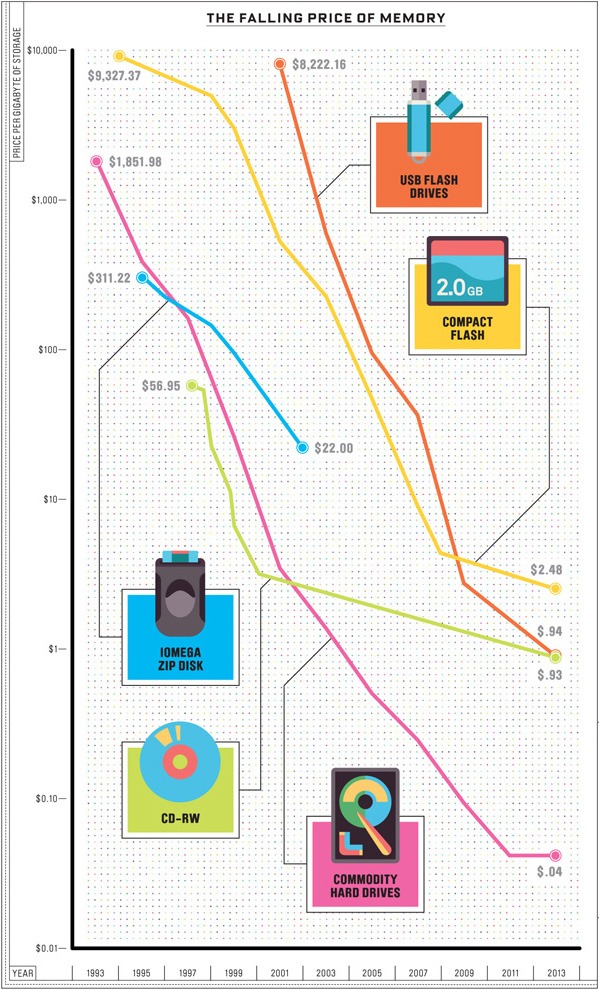

Box started out in 2005 with a simple storage product which enabled users to store files on the cloud and access them from anywhere. However, storage has been increasingly commoditized over the last 25 years as the cost of storage has declined significantly – the effects of this are apparent in the chart below. For example, the cost of storing 1 GB on a commodity hard drive has gone from $1850 in 1993 to $0.04 in 2013 (1).

Source: Wired.com (1)

Cloud storage is also facing incredible price competition as multiple large players including Amazon Web Services, Microsoft, and Google have entered a price war which is sure to drive storage costs to zero. Between 2008-2014, Amazon Web Services slashed its prices 45 times. Microsoft and Google have said they would match Amazon’s prices for cloud storage while offering value add services like cloud-based Office apps (2).

What does this mean for a file sync and share provider like Box? Many have speculated that its business would be defunct in a few years but Box CEO Aaron Levie says he has long seen this commoditization trend coming (3). “We see a future where storage is free and infinite” he told Business Insider thus challenging the notion that Box’s business will just be about cloud storage and content management (2).

Transitioning the Business

Box focused the first phase of its business in building a strong product suite in the cloud to attract paying customers. The company invested heavily in storage-related features that enterprise customers valued, including investments in security (e.g., encryption key management), governance, and regulatory compliance (e.g., HIPAA, FINRA). This has enabled them to acquire a large user base of 69,000 enterprise customers and 63% of Fortune 500 by the end of 2016 (4).

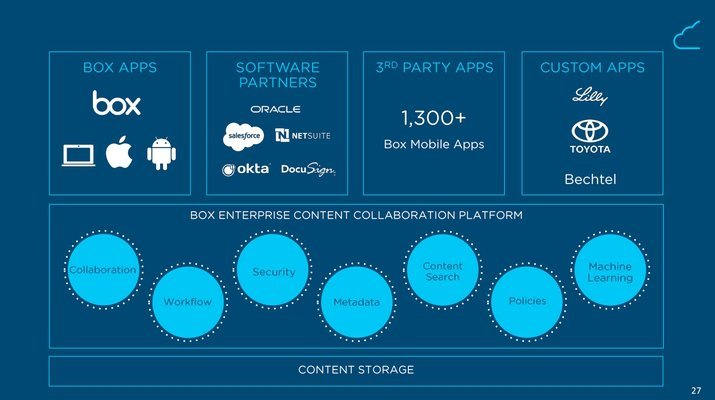

However, Box is now finding ways to unlock more value from its user base and so Box Platform was made widely available in 2015. Box Platform allows 3rd party developers to build applications that are customized for the needs of an enterprise by using Box’s API keys. This has enabled a suite of applications to sit on top of Box’s back-end storage systems, including Box’s own apps, apps custom-built for companies like Toyota, and 3rd party apps that can be deployed across multiple organizations. This also allows Box to integrate with other enterprise software like Salesforce and DocuSign, which creates a more seamless experience for all users.

This slide from the company’s 2015 roadshow illustrates how the Box ecosystem fits together, building platform solutions on top of its core storage product.

Source: Business Insider (3)

Value of the Platform

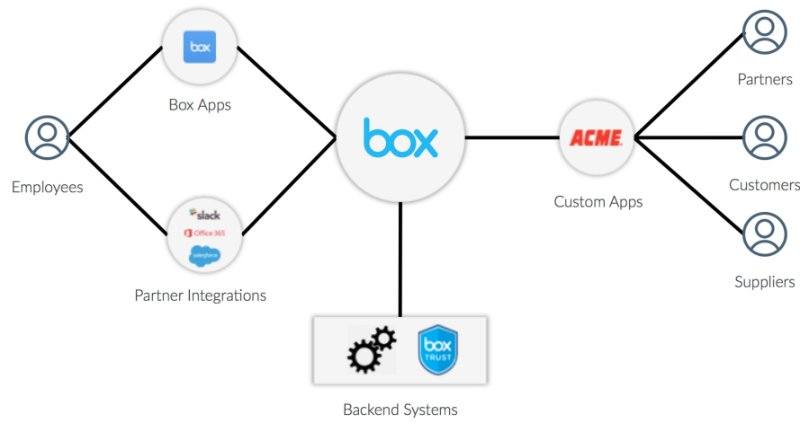

The Box Platform is value accretive all around – for software developers, enterprise users, and the company. Developers can access a revenue stream through Box’s revenue share agreement while leveraging a strong and secure content management system. Enterprise users are able to access customized apps tailored to their needs, and to those of their end customers. For example architecture firm Perkins+Will is a Box customer and used developers from Cognizant to build an app called Blueprint using Box Platform. Blueprint allows Perker+Wills’ designers and architects to collaborate with its clients by sharing real-time images of the project, receiving comments, ideas and feedback from the client, and providing project updates via the application (5). Therefore, Box creates value for its customers in two ways. First it serves their employees through collaboration and content management features, which are integrated with other enterprise software (e.g., Slack). Second, it enables its customers to serve their respective clients and partners better. The illustration below highlights how this works on both ends (6).

Source: LinkedIn Pulse (6)

The platform play benefits Box considerably as it makes Box customers extremely sticky once they invest in custom apps on top of the existing content management solution. Box therefore boasts a best-in-class retention rate of 115%*, which is invaluable for a SaaS player (4). Moreover, the platform strategy enables Box to serve a variety of enterprise customers across industries, without having to invest in customization for its largest clients (a trap many enterprise software companies fall in, which alienates the rest of their customer base). Box has therefore built a core product that is agnostic to industry, and lets the platform ensure that it can serve all its users effectively over time. By giving its customers access to value-add features and applications, Box has seen an 18% net expansion rate, which is the increase in contract value of existing customers over the last 12 months, and derived a new revenue stream from 3rd party developers (4)

* Retention is over 100% because it includes net increases in contract value from existing customers

Sustaining Success

Many believe that the competition in the cloud content management space makes this a challenging business to sustain over time. I believe Box’s platform play hedges this risk as it leverages 3rd parties to build highly customized solutions for their customers which can only run on Box. In the absence of multi-homing, it is therefore incredibly costly for enterprise customers to switch to lower cost content management providers in the short run. Moreover, this platform creates both direct and indirect network effects. As more users from a given industry sign up (e.g., healthcare), 3rd parties will be more likely develop solutions for healthcare (e.g., medical imaging apps, patient portals). Meanwhile, those developers will benefit from access to a larger customer base for their applications. All the while, Box is making money on a per user basis, as well as through developer access to its API keys. The availability of both kinds of network effects makes this an especially compelling model for all stakeholders involved, and will protect Box from the commoditization of the cloud.

Sources:

1 Wired.com: http://archive.wired.com/magazine/wired-20th-anniversary/

2 Business Insider: http://www.businessinsider.com/cloud-storage-race-to-zero-2014-11

3 Business Insider: http://www.businessinsider.com/box-doesnt-think-its-just-a-storage-company-2015-1#ixzz3PJjdmytU

4 Box Investor Relations Q3FY17 Presentation: http://www.boxinvestorrelations.com/home/default.aspx

5 Box Blog: https://blog.box.com/blog/how-architecture-and-design-firm-perkins-will-uses-box-platform/

6 LinkedIn Pulse: https://www.linkedin.com/pulse/using-box-content-apis-deliver-enterprise-grade-your-custom-mckegney