GoPuff and COVID-19: The privilege and doom of exponential growth in the convenience goods online market.

Exponential growth during a global pandemic is always good news, but as competitive pressure increases so are the challenges to sustain this short-term advantage and avoid no-turning-back failures.

A transformation that started well before the pandemic

US’ fast-moving-consumer-goods (FMCG) online sales have been already growing at a 30% CAGR during pre-COVID-19 times[1] and convenience stores, with sales representing 3.1% of total U.S. GDP[2], have been ripe for disruption for a long time before this pandemic. With a myriad of segments to target, the space has seen the entrance of a diverse set of players and business models. Amazon and the big retailers with their online channels, deploying vertically integrated operations; platforms such as Instacart, Doordash or UberEats partnering with traditional chains (such as 7Now, 7-Eleven online store in partnership with Doordash or Walgreens partnership with Postmates); and relatively specialized players such as Drizly or Saucey that focus on spirits.

Amidst this fiercely competitive landscape, goPuff is an on-demand convenience store (no brick-and-mortar) with full ownership (control) of its distribution network (an a-la-Amazon model). The company, which started in 2013 to satisfy the impulsive purchases of snacks and spirits of college students, now sells more than 2500 products (from snacks to OTC medicines) in 170 markets.

From Millennials to Millennials: Order in seconds, Delivery in minutes

Customer’s joy of completing an unplanned purchase in a couple of minutes is what makes brick-and-mortar convenience stores so successful. goPuff creates value by offering that same convenience, but online, and improving it. When most of the online retailers put high-premium delivery fees for a 2 hours delivery, goPuff keeps its promise simple: all deliveries in less than 30 minutes, 24/7, and for a standard 1.95 USD delivery fee with no surge pricing. And that’s where the ownership of the distribution network plays a key role for the company’s value creation strategy, from feeding the demand forecasting algorithms to controlling the full customer experience.

In addition, goPuff’s app provides users with a fast and seamless ordering process that, combined with fast delivery, justify the slightly higher premium they charge compared to traditional convenience stores. Millennials and Gen-Z’s, who make up 51% of convenience store sales[3] and are the company’s main target segment, are happy with the service and the value capture strategy seems to pay-off: “goPuff is profitable in most markets, reaching a break-even point in an average of 5.5 months.”[4]

By having full digital access to Millennial and Gen-Z customers, goPuff provides FMCG manufacturers with an excellent channel to understand consumer patterns and how users interact with their brands. The company offers “action-oriented behavioral insights”[5], premium virtual shelf spaces, or individualized marketing campaigns, thus establishing a profitable way of collaborating with its CPG partners.

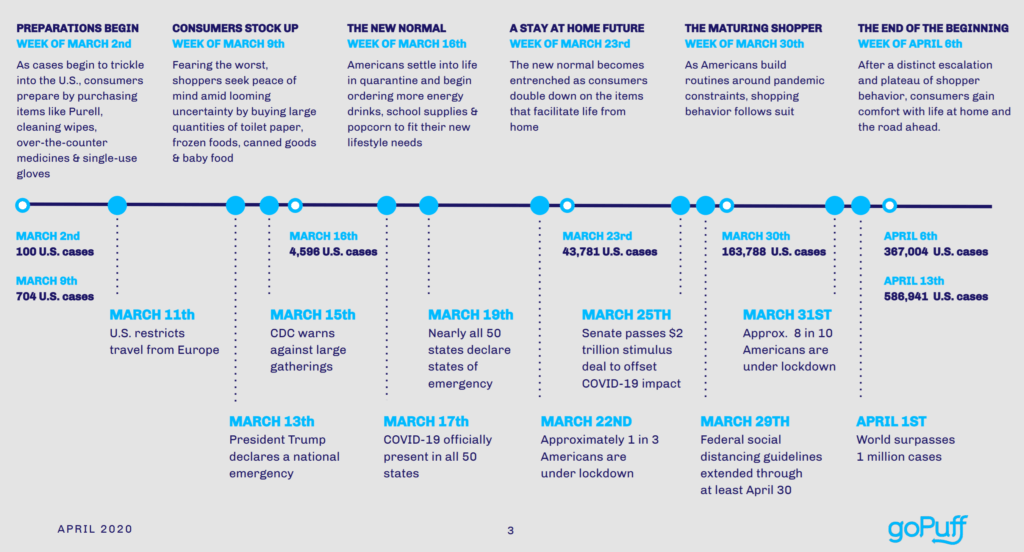

Exponential growth and untapped opportunities during COVID-19

It’s shouldn’t be surprising that during COVID-19 the e-commerce sector as a whole has experienced a +100% Y-o-Y growth[6], even after the first panic-buying wave disappeared. In fact, goPuff registered a “nearly 90% increase in customers ordering at least once per week (vs. March 2019), and a 55% increase in order value”[7].

However, and what is perhaps more surprising, is the fact that the pandemic brought a completely new set of users and significantly changed consumer behavior. goPuff has seen an abrupt change of mix of the products it commercializes, with cooking and beauty products growing at 112% rates to address the new DIY needs in American households. The new normal has become the normal, and goPuff has been able to quickly understand these trends, respond to the new needs better than its competitors, bring more customers (and transactions) on board and feed its machine learning models to improve company’s category management capabilities and speed-up the data flywheel.

At the same time, more mature and older users started to enter the app, engaging with the same frequency than tech-savvy millennials but with larger order sizes. In fact, “new customers order value surpassed that of existing goPuff customers in 5 of 7 days of the week”[7]. So, COVID-19 not only boosted the penetration among goPuff’s existing customer segment but also allowed the company to tap a new (and more profitable) customer profile that will require goPuff to rethink its product strategy.

Capturing short term opportunities to leverage long-term sustainable growth

As the above-mentioned figures prove, goPuff has been already able to capture the short-term benefits of the “new normal” dynamics. Looking into the future, goPuff should take the following actions to sustain its long-term growth.

Retaining the new customer segments: the pandemic has already boosted the awareness of the convenience of delivery services for essential goods and speeded up the transition to eCommerce. goPuff should strictly define the new customer segments that are accessing its service, use its predicting capabilities to adapt (through incremental innovations) its product offerings and delivery preferences to these groups, expand its penetration rate into these segments and feed the data flywheel. Even though the COVID-19 reduced the CAC for these new segments, any failed step or experience, particularly with bigger competitive pressure, could backlash and reduce the viral coefficient of these highly profitable groups.

Keeping goPuff as a “product”: even though a platform model could bring larger profits in the short-term, goPuff should keep its business as a vertically integrated product to sustain its differentiated offering in the long run. The end-to-end control of the customer journey will allow goPuff to deepen its relationships with FMCG’s manufacturers, improve the speed and quality of its product innovation processes (relevant when entering to new customer segments) and improving the efficiency of its unique logistics network (a competitive edge that most of the rivals have not solved yet).

Improving price transparency: since the pandemic will cause a severe recession, the “new normal” will be characterized by more price-conscious consumers, even in the convenience goods market. Thus, goPuff should anticipate this trend and improve its price transparency: alternatives could range from both implicit and explicit pricing algorithms that take into consideration its rivals’ pricing to customer spending tracking tools that allow users to better budget their expenses (or highlight savings vs. other competitors).

Enlarging CPG’s partnerships and services offerings: goPuff should double down on its partnerships with FMCG’s manufacturers, offer these players an alternative set of online retail data and services that both Amazon or other big retailers such as Walmart are reluctant to provide (or that provide at high cost) and thus increase these customers{ multi-homing costs, or at least their stickiness to goPuff’s channel. In addition to current offerings (behavioral insights and marketing campaigns), goPuff should add more sophisticated and differentiated tools, ranging from product development platforms (for example, that could help brands to launch a crowdsourced initiative or A/B tests for different customer groups) to brand’s extended loyalty programs.

Sources:

[1] Kantar World Panel, “Global online FMCG sales grew by 20% in 2018”, June 2019, https://www.kantarworldpanel.com/global/News/Global-online-FMCG-sales-grew-by-20-in-2018, accessed April 2020.

[2] National Association for Convenience Stores, “Convenience Retail Industry Pivots for Long-Term COVID-19 Impact”, April 14th, 2020, https://www.convenience.org/Media/Press-Releases/2020/Convenience-Retail-Industry-Pivots-for-Long-Term-C#.XqXtFshKhPY, accessed April 2020.

[3] Jackson Lewis, “5 Reasons GoPuff Is More Dangerous Than Amazon”, CSP Daily News, June 2017, https://www.cspdailynews.com/technologyservices/5-reasons-gopuff-more-dangerous-amazon#page=2, accessed April 2020.

[4] Dinah Wisenberg Brin, “Delivery start-up goPuff fills overnight needs — and whims”, CBNC.com, September 17th, 2017, https://www.cnbc.com/2016/09/17/delivery-start-up-has-a-late-night-plan-to-outdo-amazon.html, accessed April 2020.

[5]Dave Know, “How Brands Can Adapt To Changing Consumer Behavior Amid COVID-19”, Forbes, April 17th, 2020, https://www.forbes.com/sites/daveknox/2020/04/17/how-brands-can-adapt-to-changing-consumer-behavior-amid-covid-19/#887ff725947b, accessed April 2020.

[6] Emarsys in cooperation with GoodData, “COVID-19 Commerce Insights”, https://ccinsight.org/, accessed April 2020.

[7] goPuff, “Consumer Behavior amidst COVID-19: White Paper”, April 2020,https://cms.gopuff.com/wp-content/uploads/2020/04/COVID-19-Whitepaper.pdf, accessed April 2020.

[8] Jeff Fromm, “Marketing Convenience To The Modern Consumer”, Forbes, January 2019, https://www.forbes.com/sites/jefffromm/2019/01/04/marketing-convenience-to-the-modern-consumer/#590d4112127f, accessed April 2020.

[9] Lauren Debter, “A Low-Profile Delivery Unicorn Eyes A New Customer: Busy Healthcare Workers”, Forbes, March 27th, 2020, https://www.forbes.com/sites/laurendebter/2020/03/27/gopuff-delivery-service-healthcare-workers-coronavirus/#3b47bef43f9f, accessed April 2020.

[10] Claire Sasko, “Beyond Condoms, Cheese Puffs and Beer: How GoPuff Became Essential”, Philly Magazine, April 1st, 2020, https://www.phillymag.com/news/2020/04/01/gopuff-coronavirus-essentials/, accessed April 2020.

I had never heard of it but I know now where to get snacks. I agree with all the suggestions on how to proceed going forward. What I want to add is that this new customer segment that they acquired during the pandemics are a whole new use-case not very compatible with the ild customer segment. I would stress that GoPuff needs to shape their operations (Hire more people or change the hierarchy of the products) taking into consideration the predictions of what part of their revenue is going to come from these new customers. In a post-pandemic era companies would be inclined to not hire and to do everything with the same people in the same way, that would be not the right way to retain the new customers.

I was a member of this for a while but never used it and then cancelled it (pre-COVID). The delivery price was too high for the small snack I wanted, and the selection of products was too limited. This model is trying to replace vending machines, but it is inherently an inefficient model to do last-mile delivery for very small ticket-price, non-bulk orders (until it reaches scale — but even then, would it be worth it?). I’d be interested to see how they make the economics work during normal times!

This is so interesting, Leo! I always thought of GoPuff as a convenience store for tech-savvy teens, but it’s fascinating that now older shoppers are turning to the app to have their essentials delivered during COVID-19.

One thought I had is whether GoPuff can successfully serve these two different types of customers over the long term. Like Lemonade with their HENRY target market, having a specific focus on one user segment can allow a product to more successfully and sustainably meet that user’s needs in an excellent way. I would expect that the assortment, price-pack architecture, delivery time, and service requirements vary dramatically across generations… Is GoPuff really well positioned to serve both? And if it tries to, how does it stand up to Amazon?

Gives me lots of “food for thought”!! 🙂

This is a really interesting business! However, I wonder, with the low margins that most of their products already possess, on top of the price pressure that will come in the future from a potential recession, how much they’re gonna struggle. To sustain the fixed costs associated with their own delivery structure, which are likely to be high, they are going to need a significant volume, which usually involved an investment in marketing and advertisement. I wonder how liquid markets will be to provide the injection of capital the company will need to scale.

A very nice example of a digitally-native company that is shining throughout the current pandemic. As the business was already digitized before the pandemic, they could experience significant growth in the last couple of months. At the same time, going forward, it would be interesting to understand how costs should be managed, in order to sustain growth, in a profitable way. I think the big uncertainty right now is if the pandemic will also change consumer habits and so how many consumers will keep ordering their grocery online. In case there will be significant drops or even just fluctuations in volumes, GoPuff will need to build a variable cost structure, that can be scaled up and down with agility. Logistic is a good example, where they should invest in 3PL relationship vs. internal capacity (fixed cost).

Thanks for the interesting article. Do you have any information on the profitability of GoPuff outside of the break-even point? I wonder how sustainable it is to charge 1.95USD for smaller purchases (even with the margin included in convenience store products). Do you think this is a solution that will predominantly grow the convenience market or steal share from physical convenience stores? If it steal share from convenience stores how will GoPuff deal with the problems associated with building out a last mile delivery network (especially when they start expanding out of high density areas).