Introduction

Ddiscover the latest research insights from Harvard on digital disruption within the circular economy and discover game-changing “tough-tech” startups for potential long-term investments.

Insights

The Harvard USPTO Patent Dataset: A Large-Scale, Well-Structured, and Multi-Purpose Corpus of Patent Applications

By: Mirac Suzgun, Luke Melas-Kyriazi, Suproteem K. Sarkar, Scott Duke Kominers, and Stuart Shieber

Leverage HUPD for Investment Decisions

Given that the HUPD dataset includes comprehensive metadata and allows for the prediction of patent application acceptance with up to 64% accuracy, it could be a valuable tool for Google Ventures. It can help in identifying promising startups or technologies early on, based on their patent applications, thus providing a competitive edge in investment decisions.

Encourage Portfolio Companies to Utilize HUPD

Encourage your portfolio companies, especially those in the tech sector, to utilize the HUPD dataset. It can help them in predicting the acceptance of their patent applications, understanding patent trends, and refining their patent strategies. This could potentially increase their chances of success and, in turn, enhance the value of your investments.

Case: Ribbit Capital and the Gauntlet Investment Opportunity

By: Shai Bernstein and Allison M. Ciechanover

Consider Diversifying Investments

Ribbit Capital’s success in the crypto market, with notable exits like Coinbase and Robinhood, underscores the potential of fintech and crypto startups. As a General Partner at Google Ventures, you might want to consider diversifying your portfolio by investing more in these sectors. The crypto market cap has grown from $541 billion in 2018 to $2 trillion in 2022, and VC investment has surged from $90 million in 2012 to $33 billion in 2021, indicating a promising future for this space.

Explore DeFi Opportunities

Ribbit is considering investing in Gauntlet, a startup offering risk management and optimization tools for DeFi protocols. Given the rapid growth and potential of the DeFi market, it might be worth exploring similar investment opportunities. Gauntlet’s business model, which includes subscription fees and plans to launch its own DeFi protocol and token, could offer valuable insights for future investment strategies.

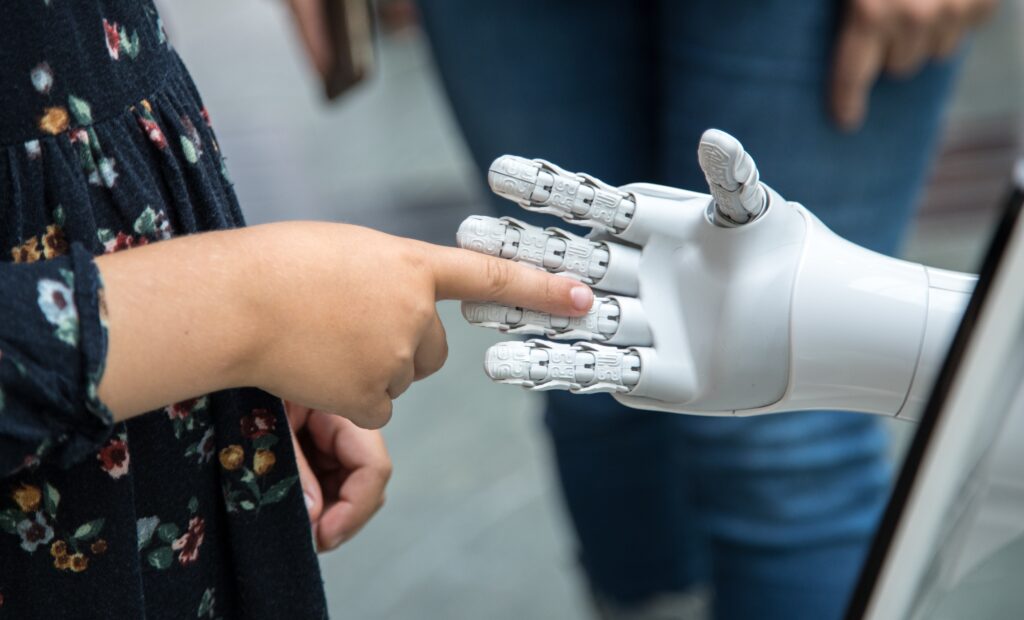

The Crowdless Future? How Generative AI is Shaping the Future of Human Crowdsourcing

By: Léonard Boussioux, Jacqueline N. Lane, Miaomiao Zhang, Vladimir Jacimovic, and Karim R. Lakhani

Invest in AI for Idea Generation

The study shows that AI can generate diverse, high-quality solutions quickly and at a low cost. Specifically, GPT-4 generated 730 solutions in under 2 hours at a cost of $0.037 per solution. This suggests that AI could be a cost-effective tool for generating innovative business solutions, particularly in the circular economy space.

Combine AI and Human Crowdsourcing

The research found that while AI solutions rated higher on value, human solutions were rated higher on novelty. This suggests that a combination of human and AI crowdsourcing could offer the best of both worlds. As a venture capital firm, Google Ventures could consider this approach when sourcing and evaluating new business ideas.

The Impact of AI on Developer Productivity: Evidence from GitHub Copilot

By: Sida Peng, Eirini Kalliamvakou, Peter Cihon, and Mert Demirer

Invest in AI-Powered Tools

The study found that developers using GitHub Copilot, an AI pair programmer, completed tasks 55.8% faster than those who didn’t. This significant increase in productivity could be beneficial for any tech company, including those in Google Ventures’ portfolio.

Support Less Experienced Developers

The research found that less experienced developers benefitted more from using AI tools like GitHub Copilot. This suggests that providing similar AI tools and training for less experienced developers at Moderna could enhance their productivity and accelerate their professional growth.

Towards Bridging the Gaps between the Right to Explanation and the Right to be Forgotten

By: Satyapriya Krishna, Jiaqi Ma, and Himabindu Lakkaraju

Consider Investing in ROCERF

The article presents a new algorithmic framework, ROCERF, which could be a game-changer in resolving the tension between the right to explanation and the right to be forgotten in AI systems. This could be a valuable addition to Google Ventures’ portfolio, especially considering the increasing importance of data privacy and transparency in AI decision-making.

Encourage Portfolio Companies to Adopt ROCERF

For your portfolio companies that utilize AI and machine learning, encourage them to consider implementing ROCERF. The algorithm has proven to generate more robust counterfactuals than previous methods, achieving high validity with low costs. This could help them better comply with data privacy regulations while maintaining transparency in their AI systems.

Using GPT for Market Research

By: James Brand, Ayelet Israeli, and Donald Ngwe

Invest in Large Language Models (LLMs)

The paper demonstrates that LLMs, specifically GPT-3, can be effectively used for market research. It provides realistic responses to typical survey questions and generates plausible willingness-to-pay estimates for products and product attributes. As a venture capitalist, consider investing in startups that are leveraging LLMs for market research, as this could be a game-changer in the industry.

Encourage Portfolio Companies to Explore LLMs

Given the promising results of using GPT-3 for market research, it would be beneficial for your portfolio companies to explore this technology. It could serve as a fast, low-cost alternative to traditional surveys and conjoint analysis for understanding consumer preferences. However, they should also be aware of the limitations and the need for prompt engineering to get useful responses.

Detecting Routines: Applications to Ridesharing CRM

By: Ryan Dew, Eva Ascarza, Oded Netzer, and Nachum Sicherman

Invest in Advanced Analytics

The Bayesian nonparametric model developed in the article provides a powerful tool for understanding customer behavior. By applying this model to Google Ventures’ portfolio companies, especially those in the consumer sector, you can gain valuable insights into customer routines, which can help improve customer retention and predict future usage.

Leverage Data for Customer Segmentation

The model’s ability to uncover different types of routines (like commuting and weekend routines) can be used for more precise customer segmentation. This can help portfolio companies develop more targeted marketing strategies, optimize pricing, and increase resilience to service failures.

Mapping Organizational-Level Networks Using Individual-Level Connections: Evidence from Online Professional Networks

By: Shelley Li, Frank Nagle, and Aner Zhou

Leverage Employee Networks

The study shows that a firm’s centrality in the employee network, especially connections of middle and lower level employees, positively predicts the firm’s value. A 1 standard deviation increase in centrality relates to a 3.7% increase in Tobin’s Q. As a venture capitalist, you should consider the strength and breadth of a company’s employee network when evaluating potential investments.

Encourage R&D Spending

The positive relationship between centrality and firm value is stronger when firms have higher R&D expenses. This indicates that centrality amplifies the benefits of R&D spending on firm value. Therefore, encourage portfolio companies to invest in R&D and build strong employee networks to maximize their value.

HBR: How AI Will Accelerate the Circular Economy

By: Shirley Lu and George Serafeim

Invest in AI and Digital Tools

The article emphasizes the role of AI and digital tools in accelerating the shift towards a circular economy. For instance, SXD Zero Waste uses AI to redesign garment mockups, resulting in zero waste in fabric and about 55% lower cost. As a partner at Google Ventures, you could consider investing in startups that leverage AI and digital tools to promote environmental sustainability and circular economy.

Support Tough-Tech Startups

The article mentions the potential of the “tough-tech” segment in reducing the material impact of existing supply chains. An example is GALY, which grows cotton from cells in a lab using 80% fewer resources compared to traditional agriculture. Given Google Ventures’ focus on innovative technology, supporting such startups could align with your investment strategy while promoting sustainability.

HBR: AI Won’t Replace Humans – But Humans With AI Will Replace Humans Without AI

By: Karim R. Lakhani

Embrace AI and Digital Transformation

The article emphasizes that most companies will not have a choice but to adopt AI and digital at their core functions. It’s crucial to develop a digital mindset, understanding how these technologies work and the deployment of them. The transition to AI is inevitable and the cost to make the transition keeps getting lower.

Invest in Continuous Learning and Change Management

The article suggests that learning and change management have become critical skills for any successful organization. Every executive and worker needs to understand digital technologies and machine learning, not because they’re going to become AI engineers, but because that is now a critical part of understanding how business works. The learning journey does not stop and companies need to invest in the learning for their own employees.

In Summary

The latest Harvard research emphasizes valuable opportunities in AI, digital tools, and tough-tech for promoting sustainability and revolutionizing supply chains. These insights could be valuable for investment strategies, given your interest in digital innovation, disruption, and fostering long-term growth via venture capitalism. Consider focusing more on investing in startups that utilize AI and/or lab-grown materials to support a more circular economy.