Zara: disrupting the traditional cycle of fashion

How running a fashion company made Zara’s founder richer than Warren Buffet

Zara has been a pioneer in fast fashion, a business model which minimizes the distance between when a fashion trend emerges and when it is made available to consumers at the store. The company has been successful because it has developed a revolutionary operating model which delivers on this value proposition.

Zara’s business strategy is built around three main pillars: product development and manufacturing informed by customer insights and latest fashion trends; frequently and quickly updated collections with around 300,000 new different SKUs produced on average every year; affordable pricing with profits sustained by high turnover and margins. The distinctive features of Zara’s operating model are aligned with these three pillars.

The communication loop

While traditional fashion retailers forecast trends 12 months in advance to develop their production schedules, Zara meets customer demand focusing on fashion trends as soon as they appear. Store managers collect hard data, such as orders and sales trends, and soft data, such as customer reactions and “buzz” around a new style. They transfer this information to headquarters, where designers, market specialists and procurement and production planners are sit together and constantly develop new products to meet fashion trends. Working in cross-functional teams increases both the speed and the quality of the design process. Though it is more expensive, Zara has three separate staffs dedicated to each of its clothing lines: women, men and children. This choice ensures that information flows fast, direct and unencumbered by problems in other channels. To close the communication loop from shoppers to designers and production staff, Zara controls the entire supply chain: it keeps around half of its production in-house; it manages design, warehousing, distribution and logistics functions itself; it runs nearly all of its retail shops instead of relying on franchises. This enables Zara to get direct access to the critical last step of the supply chain – customers. Constant flow of updated data throughout the vertically integrated supply chain mitigates the bullwhip effect. The latter would otherwise be especially severe as demand in fashion industry is extremely volatile and, while traditional retailers change a maximum of 20% of their orders once the season has started, Zara adjusts 40% to 50% of them.

Flexibility in operations

Once a new trend is identified, Zara can ramp up or down production of specific garments quickly and conveniently. Its highly automated factories normally operate only one shift and can easily run extra hours to meet seasonal or unforeseen demand. Zara tolerates lower capacity utilization in its factories and distribution centers, in order to react to unexpected demands faster than its rivals. The company indeed realized that waiting time increases exponentially when capacity is tight and demand is highly variable. Zara’s factories constantly create unfinished “greige goods”. Adopting a “just-in-time” approach, Zara sends “greige goods” to its network of finishing shops and turns them into products, as soon as a new design is developed. Complex and trendiest items are made in Zara’s own factories or within proximity to the company’s headquarters, so that production process, from start to finish, takes only two to three weeks. All finished goods pass through the distribution center in La Coruña, where operating hours are flexible to accommodate fluctuation in the orders. In a normal week, the facility operates around the clock four days and only one or two shifts on the remaining three days.

Low prices with high margins

Responsiveness to customer demand allows to keep high turnover and enables Zara to charge relatively low price without affecting its margins. The company typically sells its products just few days after they are made, operating with negative working capital. Zara manufactures and distributes products in small batches. Customers can always find new products but in limited supply. They are incentivized to buy immediately because products sell out very quickly and pricing is relatively cheap. Unsold items account for less than 10% of stock compared with an industry average of 17% to 20%. Short window of opportunity for purchasing items also motivates consumers to visit the stores more frequently – typical customers visit Zara’s shops an average of 17 times a year vs. an average of 4 visits a year to any other retailer. Zara’s strategy also allows to minimize the recourse to markdowns with positive impact on margins.

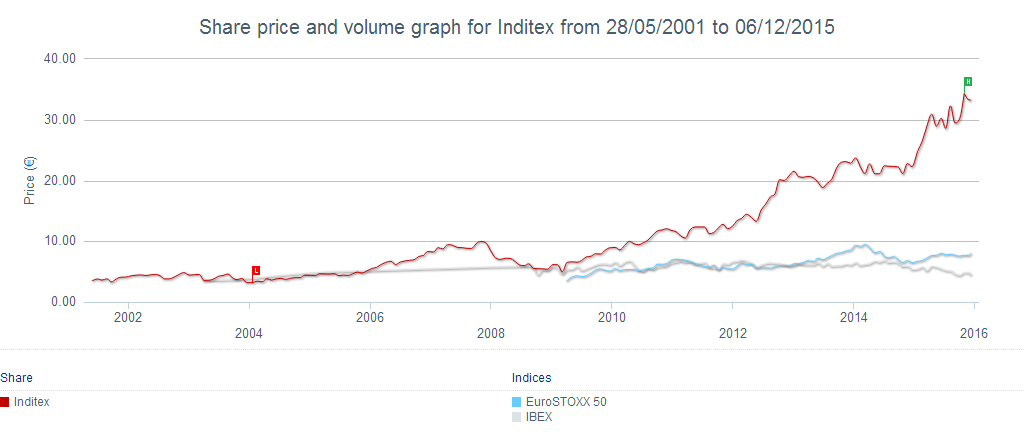

Performance

Alignment between business model and operating choices has translated into successful financial performance. Higher margins, turnover and reduced inventory risk makes Zara four times more profitable than the average retailer. Inditex, Zara’s holding company, posted a 26% jump in net earnings to €1.16bn in the first six months of 2015. Sales rose 17% to €9.42bn and 7% on a like-for-like basis. Gross margin has increased slightly from 57.6% to 58.1%. Iniditex’s share price has constantly outperformed the European market over the last 5 years. Zara’s founder, Amancio Ortega, is now the second-richest man in the world, surpassing even Warren Buffet.

As other fast fashion retailers, Zara has not been immune from critics for outsourcing half of its production to countries with cheap labor force (see link to Last Week Tonight with John Oliver episode on fast fashion).

However, I would argue that the source of Zara’s competitive advantage is not cheap labor but the execution of its business strategy: offering the latest customer trends by leveraging on agile operations.

Sources

[1] Fast Fashion Has Completely Disrupted Apparel Retail, Forbes, 05-21-2015

[2] Fast fashionista Inditex earnings accelerate 26% to €1.16bn, Financial Times, 09-16-2015

[3] How Instagram is helping Zara take over the fashion world, Business Insider, 09-17-2015

[4] How Zara became the world’s biggest fashion retailer, Telegraph, 10-20-2014

[5] How Zara Grew Into the World’s Largest Fashion Retailer, The New York Times, 11-09-2012

[6] Rapid-Fire Fulfillment, Harvard Business Review, 11-2004

[7] The Future Of Fashion Retailing, Revisited: Part 2 Zara, Forbes, 07-23-2015

[8] This clothing company whose CEO is richer than Warren Buffett is blowing the competition out of the water, Business Insider, 07-13-2015

[9] Last Week Tonight with John Oliver: Fashion, 07-26-2015

Being able to quickly meet customer demand is a key success factor in apparel retail, as is avoiding stale merchandise and discounting. My question is whether competitors have tried to copy this model, and whether there’s any evidence of success in doing so? This model just seems like such an upgrade over what most fashion apparel companies do today that I can’t see why they wouldn’t try, other than that it’s hard to do well and requires a lot of capital + expertise they don’t necessarily have today. Also, any sense for how they’ve aggregated data from stores? Are they asking managers to fill out standardized, quantitative surveys, or is it more qualitative and free-form? I can imagine the latter being time-consuming to sort through.

Certainly Zara has some rivals adopting a similar “fast fashion” business model, namely H&M and Forever 21, and also more traditional retailers, such as Gap for instance, are currently testing more flexible manufacturing processes to keep pace. In my view, Zara still differentiates itself from copy-cutters in two aspects. First, the company’s tight control on its supply chain is pretty unique and allows Zara to set the pace of its product and information flow. Even Benetton, which has been widely recognized as a pioneer in tight supply chain management, does not keep control on its stores, relying heavily on franchises. Second, in order to maximize its responsiveness, Zara engages in very expensive practices, which may seem definitely questionable, but eventually pay off. Just to give you an example, Zara ships most of its items hung up on racks instead of packing them into boxes, so that store managers can put products on display as soon as they’re delivered, without having to iron them. Looking at financial performance, H&M reported 8% decline in like-for-like sales in August, while like-for-like sales at Inditex were up 9% over the same period.

Collection of customer insights is extremely time-consuming! Sales staff is trained to draw insights from customer comments. Every day, store managers gather these insights in a qualitative fashion and transmit them over the phone to market specialists sitting in cross-functional teams at the headquarters. Moreover, store managers have three parallel conversations with teams dedicated to each of the three clothing lines (men, women and children). Again this practice may sound crazy at first, but it enables Zara to meet exactly its customers’ demand.

Very nice article Daly! Really an excellent read… Looks like Nic+Zoe can learn from Zara’s fast-fashion business model in trying to optimize their design-produce-sell cycle (maybe you should go in to help)! Also its good to know that sales staff draw insights from comments we make during fittings. Better watch out what I say next time or we will all be dressed like James Bond! 😛

Hi Daly -great job, I think your analysis is spot on especially because their operational model of quick turnover of new fashions over quantity really aligns with their business model. The lack of sales is also completely aligned, I never thought about that – this directly contributes to why they only have a handful of sales each year and why customers are willing to pay full price because they know the styles will sell out.