Will Climate Change Skunk the Beer Giant?

Climate change has undoubtedly affected AB InBev's operations, but will it also affect the prices consumers pay for their beer?

Climate change has the ability to affect the beer industry at large in a multitude of ways from raw materials to packaging to carbon footprint regulations. All of these elements directly impact the supremely dominant player in the industry, AB InBev. How will the company shield itself from the impact of climate change and, with limited options for consumers, will it even try?

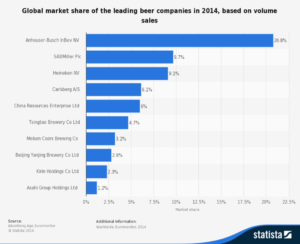

Global beer consumption in 2014 totaled 397 billion liters and completely dwarfed all other types of alcoholic beverages (15.5x wine and 17x spirits) [1]. Given the staggering sales of beer worldwide, it is truly amazing that just over 20% of it is from consumers who are “watching the game, having a bud” [2][3]. To keep up with this demand, AB Inbev produced 457 million hectoliters of beer in 2015 [4]. The sheer size of AB Inbev in the marketplace has resulted in the company consistently making headlines in its efforts to acquire SABMiller (AB Inbev’s largest competitor at only 10% market share [5]), which would dramatically drop purchasing options for consumers. However, the impact of climate change on AB InBev’s operations and its subsequent effect on pricing is equally newsworthy.

Although the production process of beer is fairly simple – grains, hops, and yeast are combined and fermented in water – and bottling and packaging are also straightforward, both of these steps are dramatically affected by the impacts of climate change. This vulnerability has the potential to result in variability in the price of raw materials and packaging.

First, let’s look at the raw materials element of the production process.

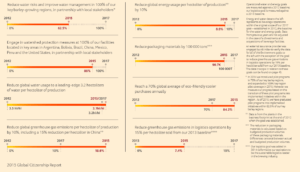

The primary ingredient in beer is water. With global drought continuing to expand across Europe, Asia, and North America, access to water has become scarce [6]. However, AB InBev has not been caught flat-footed in its response to water scarcity. There have been several company-wide goals enacted since 2012 aimed at reducing the company’s water usage and improving its sustainability. Examples of these initiatives include: the mission to “reduce global water usage to a leading-edge 3.2 hectoliters of water per hectoliter of production [by 2017]”, a weather station network called AgriMet that informs growers of relevant climate conditions, and irrigation improvement research in general [7].

Barley is the second most consumed resource during beer production. Interestingly enough, AB InBev discovered that more than 90% of its water use can be attributed to growing barley and other agricultural inputs [8]. Again, AB InBev has been one step ahead of the curve with the implementation of its SmartBarley program [9]. SmartBarley aligns AB InBev with its growers by allowing the company to provide quality seeds, insights into global growing data, anonymous benchmarking and sharing of best practices amongst growers, as well as recommended adjustments to standard growing practices [10].

Due to the impact production facilities have on the environment through carbon emissions, AB InBev is also under immense pressure to limit its carbon footprint. To meet carbon emissions goals, AB InBev has taken a multifaceted approach to reducing emissions. These efforts include everything from switching diesel tractors to vehicles that run on compressed natural gas or biodiesel to glass lightweighting in order to reduce the amount of material used in packaging [11].

Given all of the diverse steps that AB InBev has taken to hedge against the impact of climate change, there are not many additional steps that the company could take. One potential alternative would be to utilize ingredients other than barley and wheat. There are several examples of alternatives, such as rice, sorghum, and millet. Furthermore, AB InBev could also examine fuel alternatives. The company has already ventured into solar power [12], but perhaps they can begin to implement wind power to help fuel their operations like the Outerbanks Brewing Station [13].

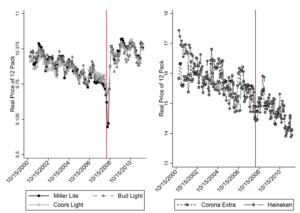

It only seems logical that these investments in sustainability would trickle down to consumers in the form of price increases and they have. However, researchers Nathan Miller and Andrew Weinberg claim that the price increases experienced after the 2008 merger of Molsen Coors and SABMiller “exceed the predictions of a standard economic model, accounting for changes in demand and cost conditions. This is consistent with tacit collusion between ABI and MillerCoors that emerges after the consummation of the MillerCoors joint venture…” [14][15].

This data does not bode well for the beer consumer given the imminent merger of AB InBev and SABMiller. Unfortunately, it appears that, despite AB InBev’s access to massive economies of scale and bargaining leverage to lock in long term contracts with suppliers, consumers should expect to continue to pay increased prices for beer. However, these high prices appear to be the result of other factors beyond the impact of climate change and AB InBev’s investment in capital expenditures to attempt to mitigate this impact.

(791 words)

[1] https://www-statista-com.ezp-prod1.hul.harvard.edu/statistics/437290/global-consumption-of-beer-wine-and-spirits/, accessed November 2016.

[2] https://www-statista-com.ezp-prod1.hul.harvard.edu/statistics/257677/global-market-share-of-the-leading-beer-companies-based-on-sales/, accessed November 2016.

[3] Anheuser-Busch Companies, Inc., “Whassup?,” television advertisement (directed by Charles Stone III), 1999, https://www.youtube.com/watch?v=UDTZCgsZGeA, accessed November 2016.

[4] https://www-statista-com.ezp-prod1.hul.harvard.edu/statistics/269111/production-volume-of-anheuser-busch-inbev-worldwide/, accessed November 2016.

[5] https://www-statista-com.ezp-prod1.hul.harvard.edu/statistics/257677/global-market-share-of-the-leading-beer-companies-based-on-sales/, accessed November 2016.

[6] https://www.drought.gov/gdm/current-conditions, accessed November 2016.

[7] Anheuser-Busch Companies, Inc., 2015 Global Citizenship Report, p.13, http://www.ab-inbev.com/media/company/press-kit/ab-inbev-global-citizenship-report-2015.html, accessed November 2016.

[8] Anheuser-Busch Companies, Inc., 2015 Global Citizenship Report, p.13, http://www.ab-inbev.com/media/company/press-kit/ab-inbev-global-citizenship-report-2015.html, accessed November 2016.

[9] http://www.smartbarley.com/, accessed November 2016.

[10] Anheuser-Busch Companies, Inc., 2015 Global Citizenship Report, p.10, http://www.ab-inbev.com/media/company/press-kit/ab-inbev-global-citizenship-report-2015.html, accessed November 2016.

[11] Anheuser-Busch Companies, Inc., 2015 Global Citizenship Report, p.17, http://www.ab-inbev.com/media/company/press-kit/ab-inbev-global-citizenship-report-2015.html, accessed November 2016.

[12] Anheuser-Busch Companies, Inc., 2015 Global Citizenship Report, p.14, http://www.ab-inbev.com/media/company/press-kit/ab-inbev-global-citizenship-report-2015.html, accessed November 2016.

[13] https://www.obbrewing.com/wind-powered-brewery/.

[14] Max Ehrenfreund, “Why you might be paying too much for your beer,” The Washington Post, November 12, 2015, https://www.washingtonpost.com/news/wonk/wp/2015/11/12/why-you-might-be-paying-too-much-for-your-beer/.

[15] Nathan H Miller and Matthew Weinberg, “Mergers Facilitate Tacit Collusion: An Empirical Investigation of the Miller/Coors Joint Venture,” Georgetown and Drexel University, 2015, p. 32, https://site.stanford.edu/sites/default/files/miller-weinberg-15.01.14.pdf, accessed November 2016.

IMAGES (in order of appearance)

https://www-statista-com.ezp-prod1.hul.harvard.edu/statistics/257677/global-market-share-of-the-leading-beer-companies-based-on-sales/, accessed November 2016.

Anheuser-Busch Companies, Inc., 2015 Global Citizenship Report, p.13, http://www.ab-inbev.com/media/company/press-kit/ab-inbev-global-citizenship-report-2015.html, accessed November 2016.

Max Ehrenfreund, “Why you might be paying too much for your beer,” The Washington Post, November 12, 2015, https://www.washingtonpost.com/news/wonk/wp/2015/11/12/why-you-might-be-paying-too-much-for-your-beer/.

Thanks for the article, “John Smith”

It does appear like ABI does not have many others options available apart from working with barley growers on minimizing water usage, and reducing water usage in its manufacturing process. However, you’ll be pleased to know that American beers like Bud have a significant proportion of corn and rice – just don’t tell the Germans. Also, light beers use high fructose corn syrup (ferments very efficiently to produce alcohol while also not containing many calories or flavor).

In the interest of planet earth’s future, people should consume more beer and less wine! Beer requires 296 gallons of water per gallon of beer over its lifecycle while wine requires 872 gallons!

Dear John,

I think that Ad InBev’s managers should not have to spend sleepless nights worrying about the issue of the climate change on the price of the beer as competitors will also be impacted. Competitors here are not just other beer manufacturers, it includes other beverages that gets the same job of relaxation done, like wine and other plant derived refreshments such as juice. Ad InBev’s scale lets them be more cost efficient, reducing the impact on them as compared to competitors. Beermaking does not use ridiculous amounts of resources and does not contribute an excessive carbon footprint so at least Ad InBev doesn’t have to worry about facing pressure to be more environmental friendly, and therefore even more product cost.

John,

Great article. I wonder what steps AB InBev or its competitors have taken to support research into seeds for barley, etc. that require less water. Is that part of the SmartBarley program? For example, the work that Indigo Agriculture is doing to help fight food scarcity might be applicable here. I also find it disappointing that the merger did not yield any savings for consumers, even though the companies must have realized ignificant synergies. It would be interesting to learn how the relative price inelasticity of consumers affects AB InBev’s approach to capital investments and climate change issues.

John,

Great article. I wonder what steps AB InBev or its competitors have taken to support research into seeds for barley, etc. that require less water. Is that part of the SmartBarley program? For example, the work that Indigo Agriculture is doing to help fight food scarcity might be applicable here. I also find it disappointing that the merger did not yield any savings for consumers, even though the companies must have realized ignificant synergies. It would be interesting to learn how the relative price inelasticity of consumers affects AB InBev’s approach to capital investments and climate change issues.