Will Cash Always Be King? What Does It Mean for ATMs?

The use of cash is being challenged by digital substitutes and there are directional trends towards a “cashless” economy. This digitization trend in the monetary value chain threatens the existence of ATMs, disrupting ATM hardware manufacturers like NCR.

Situation Overview

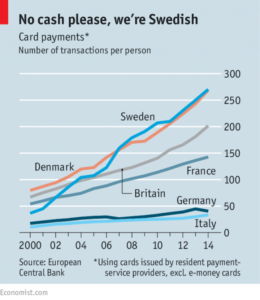

Cash has been the primary medium for exchanging financial value in the banking and monetary value chain for ages. However, the use and existence of cash is now being challenged by digital substitutes and there are directional trends towards a “cashless” economy. Sweden has led the charge against cash with only 5-7% of payments (by value) being made in cash in 2016 [1][2]. Kenneth Rogoff, a Harvard University Professor of Economics and Public Policy made a case for eventually getting rid of paper currency in his book titled “The Curse of Cash” [3].

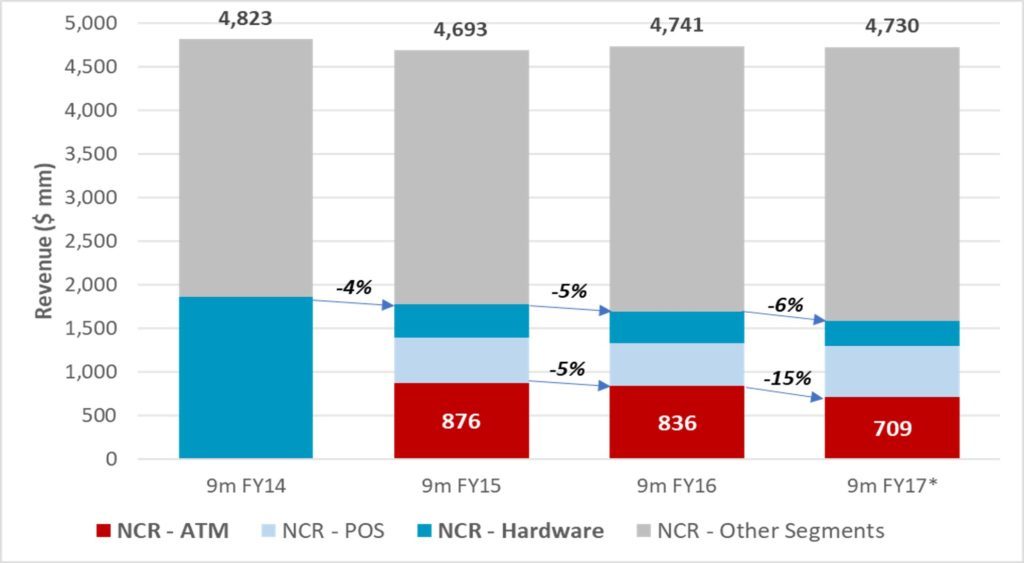

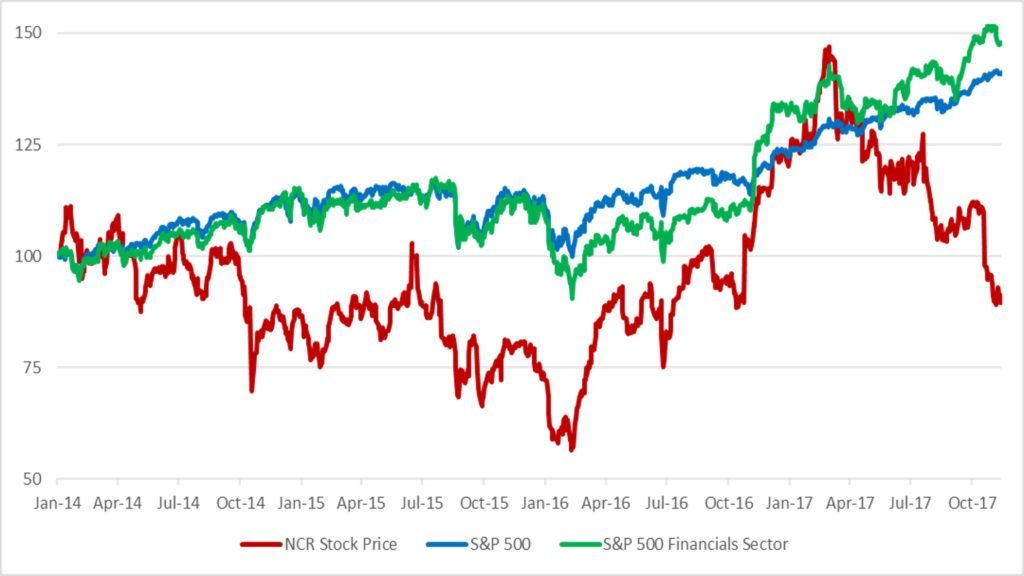

This trend implies a bleak future for the Automated Teller Machines (“ATMs”) industry in the long term. Over 2012-15 in the United States, while the number of non-cash payments grew at 5.3% CAGR, the number of ATM cash withdrawals declined at -0.3% CAGR [4]. Banks are critically revisiting their strategy for ATM networks. NCR (NYSE:NCR), one of the largest ATM hardware manufacturers, has borne the brunt of this trend. NCR’s revenue from the ATM hardware business has been shrinking over the last few years (Figure 2).

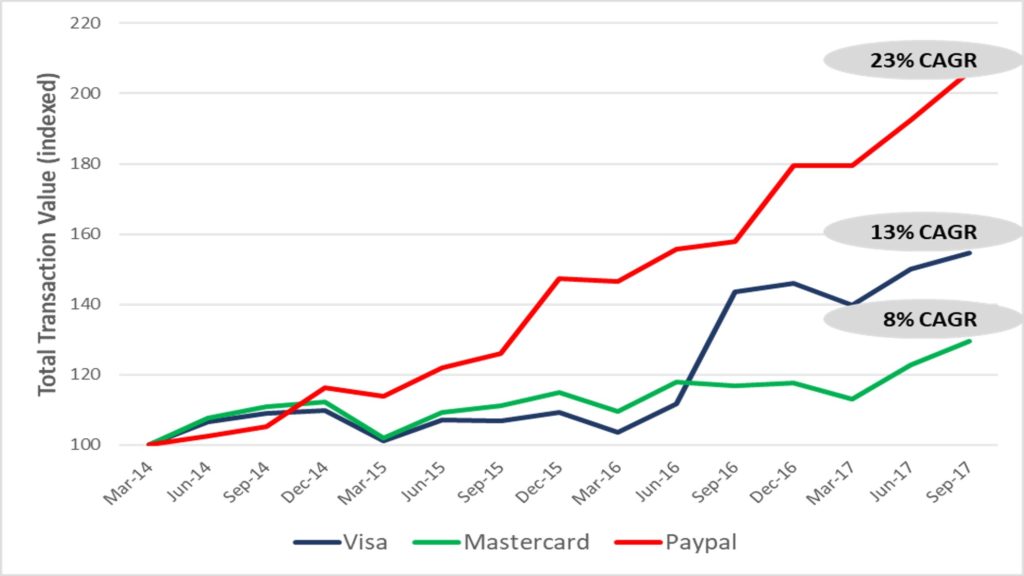

This is in the backdrop of transactions moving to digital channels. Figure 3 shows the rapid growth in total transaction value experienced by digital / cashless payment enablers like Paypal, Visa and Mastercard.

NCR’s response so far

The NCR management team recognizes the long-term headwinds for the ATM industry, acknowledging the need to reduce the dependency of their business on ATMs [7]. The company is trying to overcome this hurdle in primarily two ways:

1. Diversifying into other businesses

NCR has diversified into other sectors outside of financial services. The company offers a portfolio of self-service and assisted-service solutions to serve customers in the retail, hospitality, travel, telecommunications and technology sectors. NCR offers point of sale (POS) hardware including terminals, handhelds, PC workstations, and self-service kiosks. NCR’s revenue from POS devices has seen significant growth over the last year and could potentially hedge the company’s performance. Further, NCR also provides software solutions and maintenance services for the hardware, which add to customer stickiness.

However, competition proves to be a barrier to the diversification effort. Technology companies including ToshibaTec, Fujitsu, Hewlett-Packard, Honeywell, Oracle, Datalogic, Embross, SITA, etc. compete in the retail, hospitality and travel industries. Consequently, NCR has struggled to gain significant traction in these businesses and the total revenue has seen a flat / mildly declining trend (Figure 2).

One concerning thing about NCR’s attitude towards the other businesses has been the change in the business segments reported in the financial statements. The company used to report financial results by sectors (Financial Services, Retail, Hospitality and Emerging Industries) until 2015. Since then, NCR has shifted to reporting results only by the type of offering (Hardware, Software and Services). It’s intriguing whether this decision was influenced by the individual industry segments not witnessing the desired growth and/or profitability.

2. Innovation in the ATM offerings

NCR has launched a new series of Interactive Teller Machines (ITMs). ITMs enable banks to offer their customers the benefits of self-service video banking, closing the intimacy gap between an ATM and a bank branch experience. It gives the customers a choice of self-service or connecting with a remote teller in a highly personalized, two-way audio/video interaction. In addition to the benefits of convenience and efficiency to the customers at all hours, this system could help banks reduce their operational costs and the ability to more efficiently deploy their teller resources [8][9].

The jury is still out on the adoption of this technology at a mass scale.

Looking ahead…

The ubiquitous trend of consumers moving away from the use of physical cash towards digital payments poses an existential threat to the ATM business. NCR needs to aggressively pursue its POS business. In order to compete effectively against competition in the near term, the company could potentially partner with a technology giant to leverage each other’s network and technical know-how.

In the financial services sector, the long-standing relationships with its customers are probably NCR’s most prized assets. The company should collaborate extensively with banks to identify alternative avenues in their operational value-chain where NCR can add sustainable long-term value.

Further, the management needs to re-orient their long-term vision for the company’s strategy. Instead of investing in ATM hardware innovation, NCR should focus its R&D efforts towards sunrise technologies related to POS hardware.

With the long history in the ATM industry, NCR’s thought partners and managers continue to advocate that ATMs are here to stay [10][11][12][13]. After over 50 years of dispensing cash to consumers, how long will it take before digitization renders ATMs obsolete? Will NCR survive this transformation?

(Word count: 796 words)

References:

[1] “Europe’s disappearing cash; Emptying the tills”, The Economist, August 11th, 2016. Link

[2] “In Sweden, a Cash-Free Future Nears”, The New York Times, December 26th, 2015. Link

[3] “Why some economists want to get rid of cash”, The Economist, August 17th, 2016. Link

[4] The Federal Reserve Payments Study 2016. Link

[5] NCR (NYSE:NCR) SEC filings and Quarterly Earnings Releases Link

[6] Visa (NYSE: V), Mastercard (NYSE: MA) and Paypal (NASDAQ: PYPL) SEC filings and Quarterly Earnings Releases

[7] NCR (NYSE:NCR) Earnings Call Transcripts

[8] “Interactive Teller”, NCR website Link

[9] “Interactive tellers can cut costs and drive revenues”, NCR Blog Link

[10] “Assessing the ATM of the future and its impact on US branch transformation”, NCR Blog Link

[11] “Cash — your truest flexible friend?”, NCR Blog Link

[12] “Why ATMs are not just about cash”, NCR Blog Link

[13] “What’s behind the war on cash – what is the reality?”, NCR Blog Link

[14] CapitalIQ

Very interesting, Pranay. Makes you wonder which other “kodaks” are struggling out there in different industries…

I must admit that NCR’s current strategy makes sense to me and, based on your analysis, I think that they have a sound reason to look forward with optimism.

First, as number of cash transactions shrinks, NCR’s total revenue has been almost stable, so it seems to me that the company had prepared itself for this threat for many years. In addition, you mentioned interesting examples for innovation that has already been executed by NCR such as ITMs that give the customer a choice of self-service. To my understanding, this might be a lucrative path as machine-based products for customer service are expected to gain ground in the upcoming years. Maybe NCR can look for customer-based products that are not only within the financial services industry to drive its growth further. Lastly, I totally agree with you that long-standing relationships with customers is a valuable asset and assume that the first mover advantage is highly critical in this instance. As its competitors are struggling with the same dilemma, NCR should take the risk and offer new products and solutions to make sure that the “next ATM” will not be stolen by others.

Pranay, this is great. I think the answer to whether cash will always be king is that it depends on where you are. ATMs will not be obsolete – at least not anytime soon – especially in rural and emerging parts of the world. In poor countries, most people do not have access to alternate forms of payment and cash will remain the only option. It seems that the highest card usages per your first chart are in highly developed and relatively homogenous European countries. Although almost extinct, you can still find gas stations in extremely rural U.S. that do not accept card payments (or they are so remote that their cards readers have been broken for weeks). Interestingly, NCR claims ATM usage in the UK has also been on the rise as you can see here: https://www.ncr.com/company/blogs/financial/atm-demand-grows-steadily-among-uk-consumers. I think NCR is smart to diversify in the ways that you mentioned. Going forward, they really need to have separate companies: what remains of the ATM business and everything else.

This is interesting. I totally agree ATMs are under huge threat by the fast growing of digital payment. What I think NCR could do include, 1) I agree with you that they should shift their focus to other business segments, e.g. POS business, to build partnership with a technology company and gain competitive advantage; 2) for ATMs, I believe they should bring more value to consumers to attract them using ATMs. Cash withdraw might be replaced by cashless digital payment, while what NCR can do is to make more services available and automatic on ATMs which currently are only offered at the counter in the bank. In this way, they can re-utilize the widespread ATMs and continue growing business by upgrading the systems for clients.

This is a really interesting read, Pranay. I think our generation will see a world in which cash isn’t king. That said, I’m in agreement with Kevin in that it there should always be places of sale where an ATM is required, whether it be convenience stores, gas stations or countries which have higher skepticism of cashless transacting (e.g. Germany, Italy). To Kevin’s point, the NCR’s last earnings call transcript shows that the company is focused on ATM hardware for convenience stores and gas stations [1]. Fundamentally though , I think NCR is has a falling knife on its hands with its hardware division and I agree with you that they should diversify and focus efforts elsewhere.

I’d like to push back on the potential of innovative ATM offerings as I don’t believe these represent a large end-market and represent innovation in a declining market. I feel diversifying into POS, software and services remains a much more interesting avenue. Q3 results show that NCR’s cloud business is growing healthily [2]. To me, a SaaS model with recurring revenue and growing ACV could be a growth vector that yields more some serious benefits, if the company can get it right. Software and services are a vital part of the digital world, are often recurring in nature and have higher gross margins (~25-50% gross margins) than NCR’s hardware business (~15% gross margins). As the encumbent in this industry, the Company has a right to play here and the institutional relationships, as you note, to push their products. So, I wonder if this existential threat actually has the potential (admittedly an uphill climb) to yield a business model that is inherently better than the hardware one that the Company may have to leave behind?

[1] – https://seekingalpha.com/article/4114895-ncr-corporation-2017-q3-results-earnings-call-slides

[2] – https://seekingalpha.com/article/4114933-ncrs-ncr-ceo-bill-nuti-q3-2017-results-earnings-call-transcript?page=3

Very interesting! I agree with you and with many of the other comments that the ATM industry is facing an existential threat and NCR needs to focus on growth in other segments to counteract the inevitable decline in the ATM business. It actually seems that NCR already has a very strong foothold in the POS market – they are apparently the market leader in retail and hospitality POS [1], and are the major provider of retail self-checkouts. As self-service kiosks and terminals become more ubiquitous, I would imagine that this represents a growth opportunity for them. However, it is worth mentioning that one of their primary POS customer segments is gas stations, which could well be another victim of disruptive technologies if and when electric vehicles become dominant.

Similar to others, I would recommend that NCR continue focus on its POS software and services segments. NCR should expand into other industry verticals that have been slower adopters of this technology, such as healthcare. I would also recommend that NCR take advantage of its existing customer relationships in the retail segment and jointly work towards payment innovation to stay ahead of future disruption. Because if Amazon realizes its vision of a grocery store without any cashiers, NCR may have much bigger problems ahead [2].

[1] http://www.nasdaq.com/article/ncr-leads-the-pos-market-according-to-research-firm-rbr-cm732729

[2] http://www.businessinsider.com/amazon-go-grocery-store-future-photos-video-2017-6

NCR is not mistaken to be looking for new business adjacencies to supplement its ATM business unit. Nonetheless I believe the death of the ATM won’t happen as quickly as we might believe. The usage of the different banking channels is highly influenced by the banks themselves and the way in which they position each channel. A bank will determine how much penetration the channel should have (i.e. number of branches/ATMs in a region. The bank will also determine the services available in each channel (i.e. types of transactions permitted). The most expensive channel for a bank is obviously its branch channel and banks world wide are implementing strategies to migrate low complexity transactions to cheaper channels. Human interactions are generally reserved for more complex problems: only 25 percent of agent phone calls are inquiries that could be serviced in other channels. Most intriguingly, digital channels have not replaced physical channels. [McKinsey] I believe full services ATMs will still be important in the near future as banks try to migrate more transactions to this channel. Some banks have even gone so far as to have ATM only branches. This year Bank of America has opened three mini-bank branches that have ATMs and videoconferencing but no people.[Washington Post] In the short term NCR should still focus on providing the most high end technological ATMs that can help banks migrate their services.

• McKinsey Retail Banking Insights. The Future of U.S. Retail Banking Distribution.

• https://www.washingtonpost.com/business/economy/bank-tellers-are-the-next-blacksmiths/2017/02/08/fdf78618-ee1c-11e6-9662-6eedf1627882_story.html?utm_term=.5b48a4debb14

A very interesting read. While I initially thought that an opportunity might exist for NCR to expand the functionality / capabilities of their current ATM machines, upon further consideration I question whether this will drive meaningful growth for them. I would assume that the bulk of NCR’s business in this segment comes from building new ATM machines, meaning that expanding functionality will not change the usefulness of existing machines, and thus will not impact core consumer trends to use ATM’s (unless NCR pays to upgrade them, which I would assume would be very expensive).

However, a bullish outcome of the situation could be if banks felt that the upgraded systems were so much better and central to some core initiative of a bank to drive more in-person traffic at their branches, then there could be an off-chance where banks actually find it economically logical to pay NCR to upgrade their existing ATM footprint, which would create an enormous opportunity. Thus, understanding the banks incentives in this matter seem like a key question that would need to be further investigated in order to determine what the net impact will be on NCR.

As you indicate, I believe that NCR will not find growth in the ATM business. You present compelling data to show the decline in cash purchases across many geographies, and even though the need for cash and ATMs may persist in certain areas, I don’t see a reason to think the need will actually grow. I do not think, though, that this is a cause for concern for NCR as a company. As Kathryn points out, NCR is now the world’s number one POS software provider for the retail and hospitality industries. [1] This is a telling sign, that NCR is evolving with the times and looking to create a new value proposition that aligns with a growth market. Moving POS capabilities from human-enabled, to truly automatic, is a trend that is expected to continue. Consider the kiosks and machinery that have sprouted up in grocery stores, other retail aisles, and in airport check-in lines. I expect that same automation will be enhanced further and brought to the hotel check-in experience, cafeterias and fast-food restaurants around the world. NCR is latching on to an industry expected to grow, and this is reflected in the company’s stock price. As of January 2017, the stock price had increased 112% over the past year, which is well above the 38.5% growth in the computer-integrated systems market as a whole. [1] This suggests that the company is pursuing the right growth objectives and that they’ve convincingly proven their ability to do so effectively. An ATM hardware company would have reason to worry, but NCR has become much more than that and appears poised for sustainable growth.

[1] http://www.nasdaq.com/article/ncr-leads-the-pos-market-according-to-research-firm-rbr-cm732729

Pranay, great post and a very interesting read. As I think about NCR and what they are facing, I agree with your sentiments and the sentiments of several commentators that they will have to move beyond the traditional ATM machines. As you mentioned in your post, NCR has key relationships with banks. I fear, however, that their continued innovation might be at odds with the very industry (retail banking) that they are tied to. While NCR might innovate in the interest of the customer’s convenience, they might to too far for comfort with regard to the retail banking industry. These banks will likely see NCR as a threat that can take jobs away. NCR might want to re-focus on a direct to consumer approach in which they are not co-branded with retail banks that might want to hinder their success.

Thank you for raising this topic, very interesting. In my view, there is no reason for the world to not be completely cashless – it is a waste of resources – paper and metal. Everything should be digital, so anyone that is betting on cash existing in the 10+ year horizon in the developed world will lose out.

A NY Times article from earlier this months shows the % of people that have made or received a cashless payment, and the numbers are staggering (92% in U.S., 97% in Canada, 97% in Britain, 99% in Sweden, etc.). The countries where the numbers are not so high will eventually get there but NCR may not be playing in those countries (e.g., India with 22%). So in the short-term, NCR should start diversifying their business model, take out their investments in the U.S., and invest in the developing world [1].

In the end, we will all be trading money digitally. Not only am I worried about ATMs, I am also worried about currencies – is the dollar also at threat with the rise of digital currencies? That one I have less of a view on, but definitely think about!

[1] https://www.nytimes.com/interactive/2017/11/14/business/dealbook/cashless-economy.html

Really interesting article, Pranay! I agree with your concerns about the long-term viability of ATMs as cash is increasingly displaced by alternative methods of payments but I am perhaps less bearish than you are on NCR’s prospects. In addition to the options you laid out, which, as of other posters have noted have seemed to stave off potential revenue declines in the core ATM business, NCR should also pursue growth opportunities in the international arena. While cash usage has declined considerably in the US, it remains the predominant form of payment in many parts of the developing and even the developed world. As those countries’ economies continue to grow and more people ascend into the middle class, consumption on discretionary cash purchases should increase as well. NCR should seize on the opportunity to expand its ATM network in international and developing markets to counter the declines in cash transactions currently happening here in the US.

I loved your topic, Pranay. I have been really surprised to see how quickly many developed and western countries are switching to a cashless system. The majority of the times that I have pulled out cash from an ATM have been as a traveler to foreign countries or when paying for goods at small mom and pop shops (US included) or in a rare taxi cab. I think that the demand and need for ATM’s in developing nations will continue, as transactions in many parts of the world are still based on cash. Additionally, international travelers may not be able to complete some transactions with cards because of the lack integration in types of banking and POS equipment, rendering cash necessary to complete the sale. I agree with many comments above and your thoughts on investing in technology since NCR needs to think about how to innovate and remain a player in the business world as developing nations become more sophisticated and digital.