Why Chinese biaxial geogrid manufacturers should invest in U.S. infrastructure and supply-chain.

How should they react? Chinese manufacturers finally paying for years of historical government subsidies.

The unanimous vote by the United States Federal Trade Commission (“FTC”) on February 7, 2017 to recognize material injury to American businesses from below fair value prices and Chinese government subsidies has resulted in anti-dumping and countervailing duty orders on imports of certain biaxial integral geogrid products imported from China [1]. The direct result of this on Bostd Geosynthetics Qingdao, Ltd. (“Bostd” or the “Company”) is a 372.81% dumping margin and countervailing duty rates of 15.61%, which equate to an effective increase of 396.42% [2]. Bostd’s response to this measure is critical to not only the survival of the Company, but also a reflection of how Chinese entities will react in the short-term to “protectionist” trade decisions. Furthermore, the medium and long-term actions of the Company could set the precedent for how Chinese entities react to enhanced “isolationist” policies and restrictions regarding spending of U.S. Department of Transportation (“DOT”), which has a federally allocated budget of $75.5 billion.

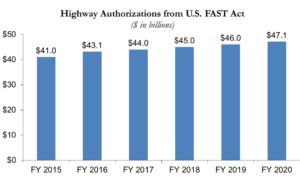

The market for these biaxial geogrid products has increased in recent years, particularly as it pertains to Chinese imports, which grew by 77.3% between 2013 and 2014 (the last full year of available data) [3]. The overall market for geogrids is expected to increase in the next several years, due to the new federal highway spending bill, Fixing America’s Surface Transportation Act (“FAST Act”), which was passed under the previous Presidential administration [4]. In addition, biaxial geogrid products have low penetration in the market, representing less than five percent of projects nationwide, providing substantial room for growth [5]. The overall market is comprised of two domestic producers, while there are an estimated four major international producers, including Bostd [6]. The Company’s actions in the coming years, as it pertains to expanding operations and the supply-chain in the United States, has the potential to position the Company as the leading international manufacturer of biaxial geogrid products, and a dominant player in a domestic oligopoly in a market with a committed and growing percentage of a federally allocated budget dollars. In order to best position themselves to succeed in the current environment, I believe the Company should invest in establishing and expanding their operational infrastructure within the United States in a two-fold strategy.

First, I believe the Company should take an asset-light approach to investing in American infrastructure in order to test the temperament of the underlying customer, the DOT, in these evolving global trade times. The proposed asset-light model includes a multi-faceted approach, which is dependent upon outsourcing critical components of the supply-chain, specifically manufacturing operations and distribution. The most important step in this process is to establish a relationship with a contractor in the US to manufacture biaxial geogrids. By doing so, Bostd can circumvent the dumping margin and countervailing duty rates that were recently imposed and position themselves on a relatively equitable cost-basis with the two established domestic producers. The second aspect of this is establishing a regionally-based distribution network capable of servicing the entire United States, specifically the Midwest, Northeast, and Atlantic regions. By doing so, Bostd can more effectively compete with domestic competitors, both of which have a manufacturing and distribution presence in these regions.

Following this short-term approach, the Company should evaluate whether the current trade environment in the United States is tenable and the cost-benefits of the recently established manufacturing and distribution supply-chain is economically viable. If the answer is in the affirmative, I would advocate that the Company invest in building their own manufacturing facility in the country, in order to capture the incremental margin that is extracted by outsourcing critical operations and better position themselves on a cost-effective basis with the incumbent, domestic competitors. In addition, by manufacturing domestically and creating jobs, the Company would have a competitive advantage over international competition and would be better positioned to avoid the detrimental impacts of future protectionist policies.

A potential fallout from the proposed investment by Bostd in establishing and expanding its US infrastructure is the potential supply-chain issues, specifically procurement of raw materials. By virtue of moving away from the largest region in the world for polyethylene (“PE”) and polypropylene (“PP”) [both are derived from crude oil], Asia-Pacific, which is responsible for approximately 51% of the world’s consumption, there is the potential that this could negatively impact the Company’s supply-chain [7]. As a result of this potential concern and the potential fallout from enhanced isolationist policies, I have two open questions. First, how should one account for the foreign exchange and commodity pricing fluctuations when evaluating the proposed strategy? Second, how will the Chinese government respond to “protectionist” policies of the U.S. government?

Footnotes

[1] [US Tariffs On Chinese Construction Goods Will Move Forward], via LexisNexis Academic, accessed [November/2017].

[2] Ibid.

[3] United States Federal Trade Commission, “Certain Biaxial Integral Geogrid Products from China,” Investigation Nos. 701-TA-554 and 731-TA-1309, March 7, 2016 (Boston, MA), [https://www.usitc.gov/publications/701_731/pub4596.pdf], accessed November 2017.

[4] Ibid.

[5] Ibid.

[6] Ibid.

[7] Fabrizio Galie et al., “Global Market Trends and Investments in Polyethylene and Polypropylene,” The White Paper (November 2016), ICIS. Research, Inc., http://www.forrester.com, accessed November 2017.

This is an interesting article because it is the first time that I have ever read a proposal for a Chinese company to off-shore its manufacturing to the United States. I wonder if the company could be successful here, given its lack of understanding of our regulatory framework, particularly since the company is charged with receiving state aid at home- I would expect the opposite of state aid upon arrival in the U.S.. Has the company faced sufficient pressures to make its processes leaner? Would the uptick in complexity of the supply chain erode any potential margin? Could you find a partner willing to do your manufacturing? If so, why would this company simply not manufacture the end product in its own name?

Moreover, I would be particularly concerned about regulatory framework insofar as it applies to public service projects, many of which already have odd policies underlying.

For the author, I think that there is interesting dialogue around whether or not the introduction of tariffs on these products constitutes protectionist behavior. As I look at the list of companies impacted by the decision, the company you chose appears to be the least targeted given a number of 152.5 applied to most of its Chinese competition. Is there denial that the state is subsidizing production?

I think these are all great points and address them individually:

– The tariff’s are in place to “even the playing” field to account for the Chinese government subsidies. The assumption is that the Company is losing money by selling products “below cost,” and is only an economically viable entity given these subsidies. If the Company were to move to the US, it could still produce at an economically viable price, but it’s costs would be similar to what the “effective” rate is after the tariff enforcement. As a result, the government subsidies would be non-existent and the Company would have successfully circumvented the tariffs.

– The Company operates very lean at the moment, and by outsourcing critical components of the supply-chain, it would definitely erode margin versus more fully, vertically integrated competitors. However, the market in the US is currently a duopoly, and as a result, pricing still leaves a legitimate margin, which would normally compress given another competitor entering the domestic manufacturing market.

– Outsourced manufacturing for this product, while difficult at first, would be relatively easy given the type of equipment is common throughout the “contract manufacturing” market and has multiple purposes. I recommend an outsourced strategy, at the initial stage, to test the market temperament in the US and trial an asset-light model to see if the margin is there to make it worthwhile to invest in a fully-owned, vertically integrated play.

– As it pertains to the regulatory framework, this actually benefits the Company. The largest state for highway miles and public funding is the state of Texas. Texas has a law in place that does not allow for patent protected products to be put up for bid or used on public projects. This actually hurts the largest player in the industry, which has by far the best-product, but is limited in it’s deployment in a number of key states. As a result, a lower quality substitute, biaxial geogrid, has far greater market adoption and usage.

– While I agree that the idea of protectionist behavior is a reasonable discussion, the tariff’s themselves “protect” domestic employers and manufacturers from competing on an “unfair-cost” basis with entities that are subsidized by foreign governments. Bostd ended up with a higher effective rate than several other competitors, but was lower than the broader market. The reason for doing so is because by testifying and providing a response to the petitioners, they were able to prove that they were losing less money than what was applied to the broader market, such as competitors that did not respond.

Regarding your comment on Luca’s first point, I wonder how effective these tariffs are in capturing the full extent of the underlying subsidy? I two questions First, how quickly is the government able to adjust the tariff to account for changing levels of subsidization? I can imagine that setting the tariff is a long bureaucratic process and changes in production processes or government support could mean that the tariff fails to correct the price differential. Second, I wonder if trade regulators evaluate government subsidization of parts of the Bostd supply chain. While this product does not sound like it would have that many inputs, tracing the impacts of subsidies though the supply chain would quickly get extremely complicated.

I could also imagine the development of a more severe “America First” procurement policy at the state level that artificially increases the competitiveness of American manufactured products. I wonder how companies like Bostd are evaluating this type of local isolationism risk.