Blockchain to Transform Energy Commodity Trading Industry?

Energy commodity trading companies have been inefficient in their business operations and logistics. Will the advent of "Smart contracts" powered by the Blockchain be the game changer to allow them to achieve transparency, higher speed, and lower cost?

Can energy and commodity trade companies capitalize on the new technology “Smart Contract” powered by Blockchain to help them streamline their business operations and achieve cost saving?

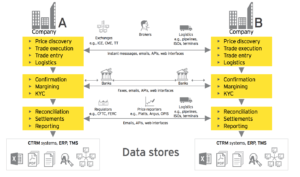

The commodity trading industry has been behind other industries to adopt and capitalize on technologies to improve its productivity and efficiency [2]. With prior experience working in energy commodity trading industry, I witnessed first-hand the inefficiency in handling trading transactions, including the number of counterparties, the number of documents, and the lead time, and observed many rooms for improvement. The Figure A below showed the dynamic and complexity of the current energy and commodity transaction.

Figure A – Energy and commodity transaction life cycle.

Source: EY, “Overview of Blockchain for Energy and Commodity Trading”

However, with the megatrend of “Digitalization” of supply chain and the advent of new technology called the “Smart contract”, is this really a game-changing technology or just another buzz word to keep the industry excited?

What is Smart Contract?

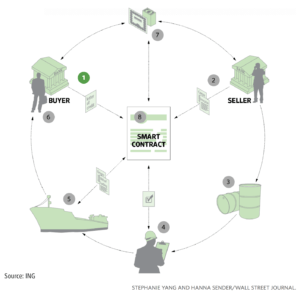

Smart contracts are one application of Blockchain technology. It allows the possibility of automatically executing pre-defined code once a set of pre-specified conditions are met [5]. For example, smart contracts will enable the ability to automatically execute the terms in the commodity trade contracts once the conditions, such as the successful delivery of goods, are satisfied. The key features of smart contracts include transparency, trust, efficiency, and control and security [1].

The Degree of Disruption

To what extent does the level of disruption a smart contract bring to the industry? Let us look at the issuing of letter of credit (L/C) which traditionally can take up to a month to complete. In 2015, there were more than 4.5 million letters of credit issued globally, accounting for over $2 trillion dollars [2]. With the use of smart contract, energy and commodity companies will be able to not only save cost by simplifying processes or reducing paperwork but also improve transparency, control, and security throughout the supply chain.

One of the largest commodity trading firm, Mercuria, has estimated it could reduce its cost by 30 percent by using the technology. With such a huge volume of trade, a slight reduction in cost could mean billions of dollars saved for every party across the supply chain [2].

Industry Short- to Medium-term Responses

Right now, the smart contracts have not been fully integrated into the industry business process yet. There are certain conditions that must be tested for a blockchain-based application to provide the most value, including the number of parties in the ecosystem, the extent of trust issues, and the extent of transparency issues.

However, there has been a number of promising pilot projects of smart contract that have been carried out by several parties within the energy and commodity trading industries. For example, a global commodity trader joined with a bank and a technology partner to developer a commodity trade finance platform (utilizing smart contract feature) to facilitate US crude oil transactions. Many more of this partnership are happening around the globe [3].

In late March 2017, Natixis (financial service), IBM, and Trafigura (leading commodity trading firm) have worked together to introduce the blockchain solution in commodity trade finance for US crude oil transaction. This initiative is referred as the effort to modernize trading in the global crude oil trading industry, which is previously dominated by manual and paper processes. A more medium-term is their expansion plan to allow all parties in the supply chain to participate and enter data directly into the blockchain application [4].

What more can be done?

It seems so that the many companies in the commodity trading space are in the phase of piloting the projects so see the practicality of the smart contract application. To some extent, I agree with this short-term oriented approach. However, I would add the following actions to plan further into the future.

- Local regulation can play a key role in supporting this digitalization of commodity trading companies so partnership opportunities with the government should not be overlooked.

- Look at the opportunity to restructure the organization so as to align with the use of new technology. Since smart contracts will eliminate all the paper and reconciliation work, less labor is needed. This means the company has to either prepare the workforce to be readily equipped with new skills needed by the organization when it starts to fully adopt the smart contract application

Open questions

- Since the number of participants is crucial in smart contract application, would the industry be able to come together, coordinate, and work with several parties involved in a complicated supply chain?

- Since many smart contract applications are now in a nascent stage, when should commodities trading companies be involved in this type of project?

(793 words)

[1] PwC, “Use Cases for Blockchain Technology in Energy & Commodity Trading”, 2017, https://www.pwc.com/gx/en/industries/energy-utilities-resources/publications/blockchain-technology-in-energy.html, accessed Nov 2017.

[2] Reuters, 2017. Commodity traders, banks face hard realities with game-changing blockchain. [Online], http://www.reuters.com/article/commodities-blockchain/commodity-traders-banks-face-hard-realities-with-game-changing-blockchain-idUSL1N1IP01K, accessed Nov 2017.

[3] EY, “Overview of blockchain for energy and commodity trading”, http://www.ey.com/Publication/vwLUAssets/ey-overview-of-blockchain-for-energy-and-commodity-trading/$FILE/ey-overview-of-blockchain-for-energy-and-commodity-trading.pdf, accessed Nov 2017.

[4] Trafigura, 2017. “Natixis, IBM and Trafigura introduce first-ever Blockchain solution for US crude oil market” [Online], https://www.trafigura.com/news/natixisc-ibm-and-trafigura-introduce-first-ever-blockchain-solution-for-us-crude-oil-market/21324, accessed Nov 2017.

[5] Deloitte, “Blockchain applications in energy trading”, https://www2.deloitte.com/uk/en/pages/energy-and-resources/articles/blockchain-applications-in-energy-trading.html, accessed Nov 2017.

Thank you for the fascinating analysis of the potential application of smart-contract in the energy/commodity trading sphere. I fully agree with you that the current contracting system is extremely inefficient – processes that are required to open a single Letter of Credit is overwhelming. It is encouraging to know that major trading houses such as Mercuria or Trafigura are starting to provide a platform to ease this transaction, which would benefit the industry as a whole. An interesting angle on this topic would be what would the banks do in reaction to this transition. Banks’ strong balance sheets have long allowed them to act as a key provider of trust, allowing many to transact in this risky sector. However, a well established blockchain system could replace the issuance of trust by system itself – how will the banks fit in this picture? One clear function that banks still hold is the document verification process, where they carry out human-eye checks and double-checks of documentation and assure safe release of funds. However, to take a step further in your analysis, the recent growth of document verification technology could replace this function that traditionally belonged to the banks. Taking even a step further, once the blockchain system is established, would there be even role for the trading houses? Information arbitrage has long been one of the key source of competitiveness for trading houses – blockchain technology is the complete opposite. Your analysis opens many stimulating ideas and debates.

To answer to your question “how will the banks fit in this picture?”, just check out how fast the banks are filing Blockchain related patents. Bank of American has filed close to 60 patents this year on Blockchain tech. This is how the banks want to be part of the transformation. The banks won’t be replaced, but evolve.

Great article. I myself wrote on the same topic!

I think you pose some fantastic questions. One of the key questions I think is whether the companies forging the way on the development of these technologies will have a true first-mover advantage that will create a sustainable competitive advantage. If not, their investment in developing these technologies, while reducing their costs overall, won’t provide them a better footing compared to late entrants who are able to use the technology once it’s fully commercialized. That’s why I believe many companies aren’t investing in the technology at this stage.

I do however believe that first-mover advantage could translate into sustainable competitive advantage in a few ways. One, the first mover will play a part in shaping how regulation is formed for this technology. This enables the first-mover to create regulation that benefits their business specifically, which could provide a sustainable competitive advantage. Additionally, the first-mover has the opportunity to create IP, through patent protection of their technology, that they could then license to others interested in benefiting from operational benefits of the smart contract technology. This could result in millions made in licensing revenues for the company. Alternatively, the company could protect the IP and keep it for themselves in an effort to take over market share.

I’d like to hear your thoughts on my comments!