Why a Chemical Company Embraced Climate Change Regulations

Chemours successfully adapted to anticipated regulatory changes, resulting in a competitive advantage.

On October 15th of this year in Kigali, Rwanda, more than 170 countries agreed upon legally-binding terms to reduce global consumption of hydrofluorocarbons (HFCs). Refrigerant HFCs are widely used in air-conditioners and refrigerators but contribute to global warming by trapping heat in the Earth’s atmosphere. Despite not receiving nearly as much media attention as the recent Paris accords, several deal negotiators stated that the Kigali regulations may be even more important than those reached in Paris. The deal could represent a 0.5° Celsius decrease in global warming by 2100. U.S. Secretary of State John Kerry stated “It (the Kigali agreement) is the single most important thing we can do in one giant step.”[1]

Proponents of the agreement were numerous, but one unexpected supporter emerged as well: Chemours, a large manufacturer of a variety of chemical substances.[2] Chemours manufactures under three business units: Titanium Technologies, Chemical Solutions and Fluoroproducts. The last of these units produces chemical refrigerants and represents $2.2 billion in revenue (40% of the company’s total revenue).[3]

Why exactly would Chemours be interested in enacting regulation restricting refrigerants, one of its core product lines? The answer is that Chemours was looking to take advantage of a new sustainable product offering. In August 2015 Chemours commercialized its Opteon brand of refrigerants, the product cools similarly to other refrigerants in Chemours portfolio but does so without damaging the environment. Essentially, Opteon can be used as a greener alternative to HFCs. The Opteon refrigerants qualify as low global warming potential products and meet the new regulations agreed to in Kigali.

Chemours’ Big Bet on Opteon

Chemours had a lot at stake in Rwanda. If the regulations passed, they were poised to take advantage of the new, stricter guidelines, which most of their competitors wouldn’t be able to do; Chemours and only one other competitor currently hold licenses allowing them to manufacture these green refrigerants.[4]

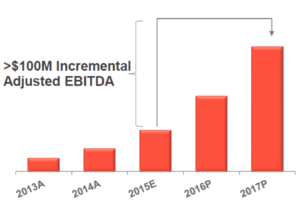

The Opteon product has so far taken off faster than expected, driven by early adopters in Western Europe and the United States. According to Chemours’ President & CEO, Mark Vergano, “We anticipate Opteon will ultimately replace current refrigerant technology and command a higher-than-average margin profile… Opteon will deliver more than $100 million of incremental EBITDA growth for our business between 2015 and 2017.”[5] See figure 1 for Opteon’s recent and projected financial performance.[3] Recently, Chemours announced that it would invest $230 million to construct a new facility in Corpus Christi, Texas that will triple the capacity of its Opteon product line.

Figure 1 Opteon’s Revenue Outlook

However, it remains to be seen if Chemours’ Opteon line will give the company a sustainable competitive advantage in the long-term. Several critics recently announced that they believe the product is unsafe, something that has been refuted by the company and regulators. In addition, the new refrigerant is 10 times as expensive as HFCs previously used.[6] Chemours faces a near-term uphill battle to convince its opponents that Opteon is safe and effective for the high price. It will need to take advantage of its head start and do this quickly before competitors emerge offering a cheaper alternative.

In addition, Chemours will need to constantly monitor its entire product line in the face of dramatically changing regulations. The reality is that before HFCs were widely used for refrigeration purposes, chlorofluorocarbons (CFCs) were the standard. Regulation in the late 1980s led to a change from CFCs to HFCs, which at the time were thought to be better for the environment. Perhaps there will come a time when regulations change in favor of non-Opteon-like products. Given that Chemours is a broad chemical manufacturer, the company should also consider which of its other product lines could be subject to regulatory environment changes in the near future.

Chemours and the new Kigali regulations provide an example of how a company can successfully adapt to anticipated regulatory changes, resulting in a competitive advantage. The broader implications of Chemours’ lobbying of regulators raises several interesting questions for managers. How far ahead should companies forecast regulatory changes in order to preempt necessary product line adjustments? How much should corporations be willing to invest in research and development on products that may never benefit from regulatory tailwinds?

(797 Words)

[1] Davenport, Coral. “Nations, Fighting Powerful Refrigerant that Warms Planet, Reach Landmark Deal.” October 15, 2016, accessed at http://www.nytimes.com/2016/10/15/world/africa/kigali-deal-hfc-air-conditioners.html

[2] Tabuchi, Hiroko and Hakim, Danny. “How the Chemical Industry Joined the Fight Against Climate Change.” October 16, 2016, accessed at http://www.nytimes.com/2016/10/17/business/how-the-chemical-industry-joined-the-fight-against-climate-change.html?emc=eta1

[3] “The Chemours Company” Investor Presentation, accessed at investors.chemours.com

[4] Sanati, Cyrus. “How DuPont Spinoff Chemours Came Back from the Brink.” May 18, 2016, accessed at http://fortune.com/2016/05/18/how-dupont-spinoff-chemours-came-back-from-the-brink/

[5] Thomson Reuters Street Events. Chemours Earnings Call Transcript. August 10, 2016, accessed at thomsonone.com

[6] Hakim, Danny. “New Climate-Friendly Coolant has a Catch: It’s Flammable.” October 22, 2016, accessed at http://www.nytimes.com/2016/10/23/business/energy-environment/auto-coolant-global-warming-at-what-cost.html

Kerrin – thanks for your outstanding example of “how a company can successfully adapt to anticipated regulatory changes, resulting in a competitive advantage”. I wonder though whether Chemour’s experience here will incite the industry to further change. The particular circumstances of Chemour’s experience – allegations of ineffectiveness and a product that is 10x as expensive – may prove a cautionary tale rather than incitement when it comes to sustainability driven chemical product innovation, depending on industry adoption of Chemour’s product as a viable alternative. Further, do you think the agreement could have happened if there was no available alternative to HFC? It seems that the believable threat of regulation and the advantage a first mover experiences when it occurs are critical elements to motivating innovation that will make the chemicals industry more sustainable.

Kerrin – Thanks for the article. You pose a very interesting question especially given the broader environmental controversy around Chemours. Chemours clearly has positioned itself favorable both from a sustainability and profit maximization perspective given its early investments in Opteon (in advance of the Kigali regulations). Opteon is a great example of the benefits of incorporating environmental, social, and governance (“ESG”) considerations into the product development pipeline. Hopefully, the price of Opteon falls with scale and Chemours is successful at both reducing the impact of HFCs and generating an attractive return on its investment (demonstrating the win-win of ESG investments).

As mentioned, the choice of Chemours is particularly interesting given the controversy over its manufacturing of C8 – also known as PFOA or Teflon. The product has been manufactured since the 1940s and persists indefinitely in the environment as a toxicant and carcinogen. In fact, Dupont (former parent company of Chemours), 3M, and other PFOA manufacturers have had ample evidence for decades that PFOA contaminates the blood of 95%+ of the U.S. population. [1,2] Despite these risks, Chemours has been dumping PFOA byproducts into the environment for over 60 years, leading to hundreds of lawsuits from consumers that claim they have developed cancer because of exposure to PFOA [3]. In fact, in June 2016, Chemours became the target of an activist short-seller, Citron Research, claiming that this environmental liability could be as high as $5bn. [4] While Citron’s claims are likely exaggerated given their investment bias, the PFOA controversy is a poignant example of the risk of NOT incorporating ESG considerations into a company’s operations.

Overall, it would be great if corporations could “forecast regulatory changes in order to preempt necessary product line adjustments.” But, forecasting is inherently hard – sometimes you’re right (Opteon) and sometimes you’re wrong (PFOA). Rather, I would recommend that corporations focus on ESG initiatives in everything that they do. Over the long run, activities that are inconsistent with a strong ESG mission will naturally be unearthed and will put the company’s brand and reputation at risk. The best way to position your company for success in the future is protecting your license to operate today.

[1] http://www.ewg.org/research/pfcs-global-contaminants/pfoa-pervasive-pollutant-human-blood-are-other-pfcs

[2] http://static.ewg.org/reports/2003/pfcs/kid_blood_full.pdf?_ga=1.217415446.1254547564.1478453192

[3] http://www.reuters.com/article/us-du-pont-cancer-idUSKCN0V6312

[4] http://www.citronresearch.com/wp-content/uploads/2016/06/cc-final-a.pdf

Hi Kerrin – great article! To provide additional context around the “big bet”, Chemours was fairly motivated to upend their business model. They were divested from DuPont in July 2015 after DuPont faced pressure from activist investor Nelson Peltz. At the time, Peltz, management, and several Wall Street analysts, believed the volatility in titanium dioxide (TiO2) prices were wreaking havoc on DuPont’s bottom line. DuPont’s management team made the decision to divest “Chemours” shortly before TiO2 prices plummeted [1]. Making matters worse, DuPont saddled Chemours with most of its environmental liabilities related to Teflon, amounting to $290 million as of December 31, 2015 [2], so once Chemours was independent of DuPont, its leverage skyrocketed.

In addition to slashing operating costs, selling business lines, and renegotiating supply contracts, Chemours management needed to supplement the company’s core revenue driver, TiO2, and quickly. That’s where Opteon came into play. Given the hasty nature of its origins, I share your skepticism about whether Opteon is the lowest global warming potential (and most effective) refrigerant in the long-run.

[1] Sanati, Cyrus, “How DuPont Spinoff Chemours Came Back from the Brink,” Fortune, May 18, 2016, http://fortune.com/2016/05/18/how-dupont-spinoff-chemours-came-back-from-the-brink/, accessed November 2016.

[2] The Chemours Company, 2015 Annual Report, p. F-12, https://s2.q4cdn.com/107142371/files/doc_presentations/2016/Chemours-2015-Annual-Report.pdf, accessed November 2016.

Great job on a thought-provoking article. To me, this is a classic illustration of the intersection of policy and private sector innovation. Without the policy change, purchasers of refrigerant HFCs had no bottom-line incentive to purchase the higher-priced Opteon (great product name, imho). I would imagine some shareholders might get upset if a company switched to Opteon in the absence of the policy change, assuming the more expensive Opteon didn’t have any non-environmental benefits to justify the higher cost. The Kigali agreement levels the playing field, though. Chemours has a head start on the competition because it anticipated and championed the new agreement. I wonder which other sectors would be well-served to anticipate and innovate for future climate regulation.

Thanks for exploring this small but very interesting product. There is so much emphasis on renewable energy these days, but it is important to remember that government regulation, credits, and penalties only go so far to incentivize investment in and the sale of such environmentally friendly products. The more companies can see and reap the economic benefits of such technologies, the faster they will proliferate throughout every industry. I think your article also does a great job exploring the regulation aspect and the incentives companies have to work with governments to forecast future regulations which will accelerate the spread of renewable technologies.