What Walmart Wants for Christmas: A Digital Supply Chain Makeover

Walmart will need to consider creative digitalization solutions to improve its supply chain and maintain its dominance in retail over its competitors.

What could profoundly cause America’s largest retailer, Walmart, to lose its top ranking among other retail giants in the not-too-distant future?[i] Possibly, its traditional supply chain model. Walmart has historically utilized supply chain management to help it achieve long-term growth and maintain a competitive advantage against its competitors. To date, the retailer has negotiated various costs with suppliers, established an efficient private trucking fleet, and uses a central database to minimize inventory levels.[ii] However, Walmart has experienced an inventory growth rate exceeding its sales growth rate from 2010 to 2017, indicating that supply chain improvements through digitalization are needed to retain market dominance over its competitors who have embraced new technologies.[iii]

Walmart’s largest rising competitor, Amazon, already employs supply chain digitalization by utilizing robots in its warehouse network and smaller delivery hubs in various cities to achieve supply chain agility.[iv] In its recent acquisition of Whole Foods, Amazon plans to replace workers with cost-saving automation to enhance its competitive position against Walmart directly.[v]

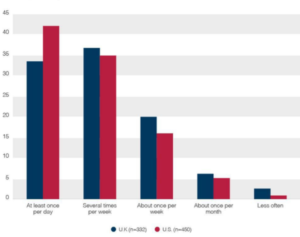

In the short term, to address its digitalization deficiency, Walmart has partnered with Google Express, the preeminent online e-commerce competitor to Amazon, to acquire Google’s data analytics platform and skills in artificial intelligence.[vi] In the U.S., over 40% of individuals use their virtual personal assistant at least once a day and 20% of searches on mobile devices are queries on Google Voice. [vii][viii] Ordering through Google Express will not only provide industry dominance as Walmart items will be presented first in search results, but also information about Walmart’s customer preferences will be collected and analyzed easily.[ix] Ultimately, Walmart customers will sync their Walmart accounts with their Google accounts which will use predictive analytics to better forecast customer demand based on past shopping behavior.[x] This immense data intake will also require a more responsive and agile supply chain.

Source: Gartner included in O’Marah, Kevin. “Google/Walmart: The Brutal Future Of Retail Supply Chains.” Forbes, August 24, 2017. https://www.forbes.com/sites/kevinomarah/2017/08/24/googlewalmart-the-brutal-future-of-retail-supply-chains/2/#59b95fc67642.

Another creative digital solution is Walmart’s consideration and testing of “associate delivery” where employees can opt to deliver packages for extra pay on their way home from work in their personal cars. Walmart uses GPS technology and proprietary algorithms to assign employees, based on their preferences and where they live, to customer orders in the smallest possible distance from their typical work commute.[xi] Walmart is also starting to transform parts of its store to become fulfillment centers for e-commerce.[xii] If customers pick up items purchased online, they may receive a discount and Walmart will experience lower shipping costs.

In the medium term, Walmart is making investments in innovation within the company. It March 2017, Walmart acquired Jet.com, an e-commerce retailer, and formed Store No. 8, an innovation incubator to refresh its online retail business.[xiii] Gains in artificial intelligence, machine learning, and autonomous vehicles could result from innovations in Walmart’s venture arm to better position Walmart to take advantage of supply chain advancements already used by Amazon and other more technologically-advanced online selling platforms.[xiv]

Walmart should consider adopting more ingenious digitalization solutions to improve its supply chain and maintain its dominance in retail over Amazon and other competitors. The retailer may consider leveraging data analytics to behave more responsively to the weather. Historically, Walmart analyzed data on sales during hurricanes and shipped in advance those supplies to its stores while pre-positioning trailers with food and water to quickly adapt.[xv] The challenge and impact of global warming on our world may create more frequent and more quickly occurring storms so Walmart should incorporate predictive modeling to better react to severe disturbances. Monitoring and forecasting weather patterns could allow Walmart to profit from these shocks more rapidly and with reduced costs.

Walmart should also consider adopting supply chain improvements through digitalization in its clothing space. Retailer Zara creates clothes out of a limited number of fabrics and patterns and in-house designers to shorten lead times and uses social media feeds to sense demand and direct information quickly to its supply team.[xvi] Walmart could utilize aspects of the Zara supply chain in a portion of its clothing operation to make it more competitive in the modern retail landscape.

Some important questions still loom for Walmart as it embarks on significant change to adapt to today’s digital technology. Will Walmart actually achieve the best entrepreneurial ideas with its innovation arm internally or is external growth more likely to produce results? Is it wise for Walmart to use store associates to perform delivery when it will soon be robots, coupled with drones and/or driverless cars, replacing those jobs instead? Is it already too late for Walmart win against Amazon in the future of retail?

(748 words)

[i] STORES National Retail Foundation. 2017 Top Retailers Annual Report. https://stores.org/stores-top-retailers-2017/, accessed November 2017

[ii] Nguyen, Thi Thu Ha. “Wal-Mart’s successfully integrated supply chain and the necessity of establishing the Triple-A supply chain in the 21st century.” Journal of Economics and Management, Vol. 29, 3 (2017) ABI/INFORM via ProQuest, accessed November 2017.

[iii] Ibid

[iv] Soper, Spencer and Sherman, Alex . “Amazon Robots Poised to Revamp How Whole Foods Runs Warehouses.” Bloomberg, June 26, 2017. https://www.bloomberg.com/news/articles/2017-06-26/amazon-robots-poised-to-revamp-how-whole-foods-runs-warehouses.

[v] Ibid

[vi] Wakabayashi, Daisuke and Corkery, Michael. “Google and Walmart partner with eye on Amazon.” The New York Times, August 23, 2017. https://nyti.ms/2vWWj5e.

[vii] O’Marah, Kevin. “Google/Walmart: The Brutal Future Of Retail Supply Chains.” Forbes, August 24, 2017. https://www.forbes.com/sites/kevinomarah/2017/08/24/googlewalmart-the-brutal-future-of-retail-supply-chains/2/#59b95fc67642.

[viii] Ibid

[ix] Ibid

[x] Wakabayashi, Daisuke and Corkery, Michael. “Google and Walmart partner with eye on Amazon.” The New York Times, August 23, 2017. https://nyti.ms/2vWWj5e.

[xi] Walmart. “Serving Customers in New Ways: Walmart Begins Testing Associate Delivery.” https://blog.walmart.com/innovation/20170601/serving-customers-in-new-ways-walmart-begins-testing-associate-delivery, accessed November 2017.

[xii] Ibid

[xiii] de la Merced, Michael J. “Walmart Expands Its E-Commerce Ambitions With a New Investment Arm.” The New York Times, March 20, 2017. https://nyti.ms/2mJmPav.

[xiv] Ibid

[xv] Nguyen, Thi Thu Ha. “Wal-Mart’s successfully integrated supply chain and the necessity of establishing the Triple-A supply chain in the 21st century.” Journal of Economics and Management, Vol. 29, 3 (2017) ABI/INFORM via ProQuest, accessed November 2017.

[xvi] O’Marah, Kevin. “Zara Uses Supply Chain to Win Again.” Forbes, March 9, 2016. https://www.forbes.com/sites/kevinomarah/2016/03/09/zara-uses-supply-chain-to-win-again/#1dd5cf961256.

Great article! With regards to your question on whether or not Walmart can achieve the best entrepreneurial ideas w/ its innovation arm – I think people give Walmart far less credit than it deserves and yes, they can achieve great ideas and potentially even beat Amazon.

1. Walmart still services most of the country and while people on the coast may depend on Amazon, it doesn’t mean the whole country uses Amazon. I think the latest revenue comparison is Amazon is about 1/5 the size of Walmart. 2. What this does mean for Walmart is that if it implements even just a few of the predictive modeling purchase or AI developments, it has the ability to affect a larger number of consumers. and 3. Walmart was in the fresh grocery business far before Amazon and I suspect can be a leader in the supply chain management of pershiable goods — Walmart is already partnering with IBM to create blockchain technology that helps improve transparency in its supply chains.

With regards to your question about whether or not it’s wise to use store associates to perform last mile deliveries – I think it’s a great idea! Not a single company has figured out how to make money out of the logistical nightmare of last mile deliveries (not even Amazon!) and every other company is clamoring to get into the business once it can be proved to be profitable (think ridesharing companies). In testing out this process, Walmart could be discovering very important insights about the last mile delivery market that puts them in the forefront of the delivery industry.

This is such an interesting topic. Walmart has been on a acquisition spree lately (Bonobos, Modcloth, Moosejaw, etc in addition to Whole Foods and Jet.com) — I think through these acquisitions they have both been able to 1) acqui-hire some of the best talent in the consumer-facing retail space, and 2) through Whole Foods, expand their brick-and-mortar square footage for a new customer — all of which builds their internal innovation arm and reduces their need to rely on external innovation.

I agree with Danni that Walmart still has the opportunity to make a huge impact for millions of customers. I don’t think it is at all too late for Walmart to win against Amazon. I also don’t think they are necessarily competing in the same space. Walmart’s grocery business far outstrips Amazon’s, especially because only 2% of consumers shop for groceries online. I see their huge brick and mortar presence to be a big plus as they are able to leverage their large stores as warehouses — this cuts down dramatically on last mile shipping costs. They don’t even need to use their associates if that gets too expensive, but the fact that they have a strong footprint of stores that can act as local warehouses already gives them an edge over Amazon.

An interesting read on how Walmart is trying to use its currently existing physical assets in novel ways to compete against the digitization of the retail experience.

I’m skeptical that retail associates will want to sign up to spend more of their time working unless their is a sufficiently large enough compensation incentive provided to them. Additionally, how able will these employees be at delivering packages? Will they need additional training to be able to provide a consistent experience or will the Walmart buyer not care if their package gets delivered next door or down the street by accident, so long as it’s the cheapest option?

Luckily Walmart has an advantage that Amazon doesn’t have in scale yet, distribution centers that also conveniently double as revenue earners for the company. If Walmart is to effectively compete against Amazon or other online competitors, it must shift its thinking to bringing value via technology such as better shelving techniques and delivery systems that use the already organized goods within its stores to provide delivery options.

Great essay–thank you for your take on this extremely interesting topic!

The initiatives you describe give me greater confidence that Walmart can not only compete with Amazon, but actually beat them for a subset of orders and customers. The major built-in advantage Walmart has over Amazon in fulfilling online orders is their nearly 5000 US stores [1]; if they choose to use all of these as online fulfillment centers, they will have nearly 100x the number of fulfillment centers as Amazon [2]. As a result, their fulfillment centers are closer to their customers on average (and in the case of more rural customers, likely significantly closer); thus, the only part of the delivery problem they have to solve is the “last mile” (or last few miles) of delivery. Both of the major new fulfillment methods you describe (customers picking up their online orders themselves in stores, and employees dropping off orders on their way home from work) represent “last mile” fulfillment methods that should be cheaper than the traditional UPS/FedEx shipping services that Amazon relies on. Thus, Walmart should have a structural cost advantage (for at least a subset of orders) that should keep them relevant in the online retail game.

[1] https://www.statista.com/statistics/269425/total-number-of-walmart-stores-in-the-united-states-by-type/

[2] https://www.amazon.com/p/feature/98dnmkwyztuv8ur

Thanks for sharing! I think your article did a great job highlighting how Walmart is disadvantaged compared to Amazon with regards to consumer shopping data, which impacts their ability to predict and manage inventory. Partnering with Google, as you discussed, will hopefully provide Walmart with a wealth of consumer information that can better inform their inventory management strategy. In addition to understanding WHAT inventory to stock, I’ve read that Walmart is also addressing HOW to stock its inventory more efficiently and cost-effectively by testing Symbotic warehouse automation systems [1]. It’s clear Walmart is making moves to address areas of weakness in its supply chain.

To continue with the discussion from the questions you posed, I do think an internal innovation arm can enable great entrepreneurial ideas if it is organized and incentivized properly. As mentioned, Walmart has built an extensive footprint of stores and distribution centers, massive scale in their business, and several e-commerce acquisitions. These are all unique properties of their business that an internal team will be more familiar and can leverage towards future innovation, whereas external ideas or acquisitions may not always fit seamlessly within the existing Walmart model.

I think using store associates to deliver packages is certainly an interesting one. As you mentioned, I’m skeptical if this will be a strong long-term play as delivery may be replaced with robots, drones, or driverless cars in the future. However, I do think it could be an important short-term play to build Walmart’s e-commerce and delivery business. By making deliveries quicker and more accessible to customers, Walmart could shift consumer mindset from considering Walmart as a brick-and-mortar store to an e-commerce partner. Imagine a world where a consumer checks both Amazon.com and Walmart.com for goods to be delivered, knowing both will deliver within 1-2 days. For some goods, due to Walmart’s low prices and closer distance to the end consumer, Walmart could very well be better positioned to deliver a consumer’s need than Amazon.

1 Boyer, Matthew and Spencer Soper. “Wal-Mart, Google Partner on Voice-Based Shopping to Catch Amazon.” Bloomberg, August 23, 2017. https://www.bloomberg.com/news/articles/2017-08-23/wal-mart-google-partner-on-voice-based-shopping-to-catch-amazon

Thanks for this article, Arthur! The comparison of mega-giants Walmart and Amazon is definitely an interesting one, due to their equally similar and divergent strategies for delivering value to consumers. Walmart has historically focused on cost control and passing those savings onto customers to deliver on their “Every Day Low Prices” customer promise. Amazon, on the other hand, leverages such supply chain scale to build a trusted customer base for it’s web services, as well as to fund technological innovation.

While Walmart has been very successful in its cost control mission, I truly see Amazon as the innovator in this space. For example, Amazon recently announced new technology that creates a check-out free grocery shopping experience. The technology allows you to enter a grocery store, grab everything you want, and then leave, without having to stand in line to check out. The items will be charged directly to your credit card upon exiting the store. This technology creates customer value and eliminates labor costs. Walmart’s digitalization efforts simply lag behind Amazon’s, and this creates a real competitive threat for Walmart.

To answer your question about an internal innovation arm, I think Walmart absolutely has to invest in innovation to remain competitive, not only in response to Amazon, but to new entrants as well. As we learned in Clay Christensen’s Theory of Disruptive Innovation, low-end disruptors overtime become at-par with the other competitors in the market (such as Amazon) and leave room for new disruptors to emerge. Digital innovation is one much-needed step to prevent such disruption.