Using Software Tools to “Remodel” Home Depot’s Supply Chain

This post explores how Home Depot is using advanced software to evolve its supply chain in order to increase efficiency and better serve its customers.

Need for Improvement

E-commerce has increasingly become a threat to industries that are ripe for online disruption. Many home improvement products meet several criteria that make it more likely to experience online competition, such as commoditization, lower brand loyalty, and lower need for in-store “touch-and-feel.”

Home Depot was historically a brick-and-mortar provider of home supplies, but is evolving into an omni-channel provider to face the growing threat of online competition. To remain competitive, it should prioritize:

(1) delivering online orders as quickly or quicker than its online counterparts, and

(2) lowering costs in order to be able to offer lower prices to consumers and remain competitive

To meet both of these goals, Home Depot needs to look into its supply chain as a source of potential competitive advantage. Digitization of the supply chain will both (1) lead to better/faster delivery for customers and (2) lower inventory, production, and delivery costs.

Home Depot’s Existing Plan

Home Depot has already stepped up to the challenge by beginning the process of digitizing its supply chain.

Source:[1]

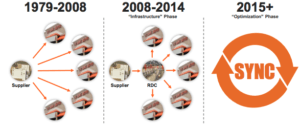

History: Historically, every store had its own logistics management department that interacted independently with the suppliers, which was costly and inefficient[2].

“Infrastructure” Phase: The first phase of improvement involved enabling direct fulfillment and delivery by (1) connecting its stores to the website and (2) building Rapid Deployment Centers (RDC) as centralized intermediaries between suppliers and stores. This technological integration via RDCs addresses both concerns discussed above:

- Faster delivery: the supply chain became more flexible, minimizing lead times and “out-of-stock” by allowing new delivery pathways, such as Buy Online Deliver from Store (BODFS)[1]. By mid-2016, 42% of online orders leveraged store footprint[3]. New distribution centers enable two-day shipping to 90% of the US[4].

- Lower costs: centralizing purchases from suppliers should increase purchasing power and improve demand forecasting by minimizing the variability caused by having each individual store estimate its demand (thereby lowering inventory and costs).

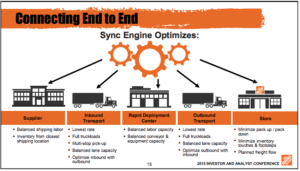

“Optimization” Phase: In order for the above-listed improvements to reach their potential, the entire supply chain needs to be using integrated software so that demand forecasting and utilization can be optimized. Home Depot introduced Project Sync, a software designed to improve metrics from the beginning to end of the supply chain, allowing trucks, workers, and machines to operate as efficiently as possible.

Sync aggregates supplier/carrier information, capacity constraints, pricing, etc. It uses these inputs to develop optimized instructions and schedules. Individuals at each step of the chain view exactly what is on every truck, materials needed to unload, and diagrams of how to position carts/pallets to minimize touches/footsteps. During the first year of the system’s pilot, it reduced 90 miles of walking for each receiving associate. Once at the store, the software instructs how to place products on shelves, estimated to eliminate 1-2 footsteps per carton. Inventory turns are expected to improve from 4.8x in 2015 to 5.7x by 2018. Lead time necessary to respond to shoppers’ demand has already declined, and there have been fewer damaged goods due to minimized touches[5].

Source:[1]

Home Depot has also employed other technologies, including Descartes Systems which tracks delivery for customers[6], Predictix which mines data from the internet to predict demand[7], and a dynamic ETA feature for online purchases[3].

Other Recommendations

Home Depot has already begun to see the effect of its improvements, reporting its best quarter in company history last year shortly after putting in place many of these initiatives[3]. However, there are certainly other areas where Home Depot could use digitization to improve its supply chain.

- Home Depot could consider pushing “Sync” even further back into its supply chain by having its suppliers adopt the same technology. With full visibility across the chain, suppliers might be able to employ just-in-time processes that decrease their costs, and pass some of those savings onto Home Depot via lower prices.

- Home Depot could also expand its base of suppliers such that it has multiple suppliers for each product. Then, by using interactive technology it could assess which supplier has the supplies (1) at the shortest distance, (2) for the lowest price and dynamically draw from the best supplier for each individual order.

- Home Depot could also use technology to improve the value proposition of its physical stores. For example, it could make the in-person shopping experience more tech-oriented. It could also monitor customer foot-traffic throughout the store in order to optimize shelf allocation appropriately.

Questions

As Home Depot implements these improvements, several open-ended questions remain:

- How can supply-chain digitization improve the in-store experience, and can it help make the physical footprint remain sustainable over the long term?

- Should individual suppliers of Home Depot adopt Sync, and would they be willing to provide full transparency on their operations with Home Depot in order to mutually benefit from cost savings?

Word Count: 798

Footnotes

[1] Mark Holifield, “2015 Investor and Analyst Conference: Supply Chain Optimization,” The Home Depot, http://ir.homedepot.com/~/media/Files/H/HomeDepot-IR/documents/events-and-presentations/mark-holifield-2015-hd-investor-conference.pdf, accessed November 2017.

[2] Ilyas Kucukcay, “A game changer for today’s e-commerce companies: How efficient supply chain management helped Home Depot evolve,” 21st Century Supply Chain, June 6, 2017, https://blog.kinaxis.com/2017/06/game-changer-todays-e-commerce-companies-efficient-supply-chain-management-helped-home-depot-evolve/, accessed November 2017.

[3] Tim Denman, “Home Depot Has Best Quarter Ever, Continues Investment in Interconnected Retail,” Retail Info Systems, September 6, 2016, https://risnews.com/home-depot-has-best-quarter-ever-continues-investment-interconnected-retail, accessed November 2017.

[4] Phalguni Soni, “Why Home Depot Is Enhancing Omni-Channel Options for Customers,” Market Realist, March 10, 2016, http://marketrealist.com/2016/03/home-depot-enhancing-omni-channel-options-customers/, accessed November 2017.

[5] Nona Tepper, “Home Depot turns inventory faster with new supply chain software,” Digital Commerce 360, January 11, 2016, https://www.digitalcommerce360.com/2016/01/11/home-depot-turns-inventory-faster-new-supply-chain-software/, accessed November 2017.

[6] Jennifer Smith, “’Amazon Effect’ Sparks Deals for Software-Tracking Firms; Need for these services grows as retailers and shoppers seek faster, timely delivery,” WSJ Pro. Venture Capital, August 29, 2017, https://search-proquest-com.ezp-prod1.hul.harvard.edu/businesspremium/docview/1956874306/17A6C28BE6FC4231PQ/5?accountid=11311, accessed November 2017.

[7] Loretta Chao, “Infor Will Buy Retail-Demand Software Firm Predictix; Tech giant will blend cloud-based systems with its own supply-chain management software,” Wall Street Journal (Online), June 28, 2016, https://search-proquest-com.ezp-prod1.hul.harvard.edu/businesspremium/docview/1799941404/17A6C28BE6FC4231PQ/1?accountid=11311, accessed November 2017.

Featured Image downloaded from: https://www.glassdoor.com/Photos/The-Home-Depot-Office-Photos-IMG102135.htm

Very interesting and well written article! It is definitely no surprise that digitization has allowed Home Depot to become more efficient and increase inventory turns. I think Home Depot has an advantage that many other retailers don’t have because it sells durable goods that are often expensive, so customers will be willing to handle them in person and get expert advice in the store even as internet sales continue to rise. I think it would be a good idea for their suppliers to also use Sync, but I’m wondering if the suppliers would be willing to accept the cost of implementation. I’m sure Home Depot can lobby and convince them of the benefits. But if those suppliers also supply your competitors, are you giving up some of your competitive advantage? I would be interested to see if Home Depot uses digitization and analytics to better predict product demand from potential natural disasters, which usually causes customers to flock to Home Depot.