Under Armour: Playing the Digital Game

Shirt? Check. Shoes? Check. Largest digital fitness platform in the world? Check. Under Armour is redefining how the sporting goods game is played.

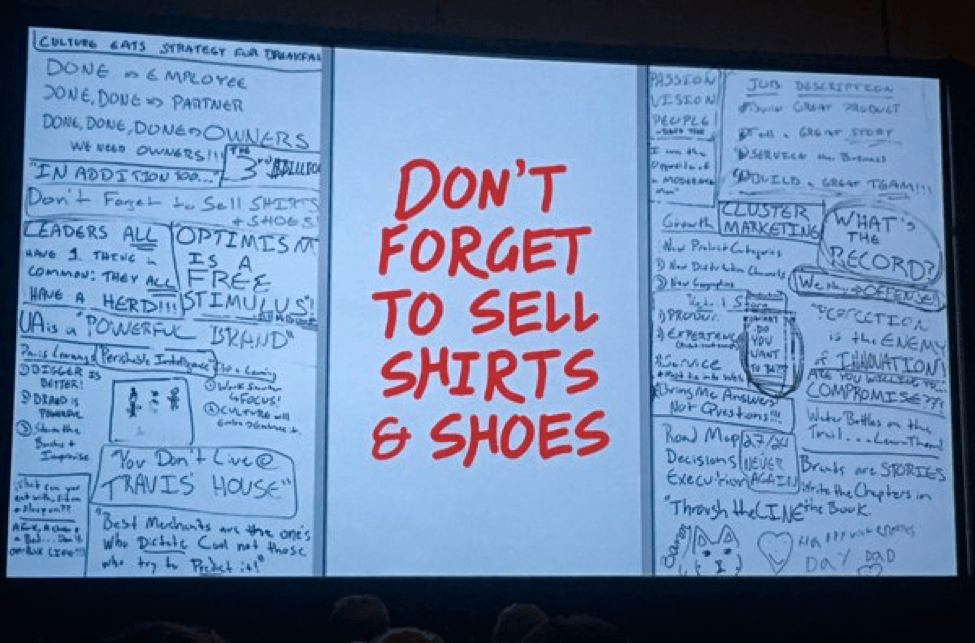

Exhibit 1: Kevin Plank’s Daily Reminder

Under Armour can’t decide what it wants to be when it grows up. Born 20 years ago from a single football shirt, UA has since expanded across all types of sporting apparel and entered new sports at an almost hyperactive rate [1]. And just when you think this company is maturing comfortably from teenage wild-child into its adult life as the second-largest sportswear brand in the US [2], it decides to remake itself into a software provider and hardware manufacturer [2].

UA’s digital foray begun in 2013 when it acquired MapMyFitness, a route-mapping and workout-tracking site. UA then purchased MyFitnessPal (a nutrition-tracking and meal-logging site) and Endomondo (a European-based personal training program) in 2015 [3]. Spending $710M for the three acquisitions, UA got the largest digital fitness community with over 160M registered users, hundreds of engineers, and years of existing user data [4]. All three were integrated into a “Connected Fitness” business unit.

So how does all of this relate to a sportswear company? After all, founder and CEO Kevin Plank has a reminder written on his whiteboard: “Don’t forget to sell shirts and shoes” (see Exhibit 1) [5]. The logic is threefold, and represents evolution of both UA’s business and operating model:

- Athletes find value in the social and analytical aspects of digital platforms. These sites are a viable business by themselves, and UA can capture some of that value through premium subscriptions and advertising revenue.

- Athletes need hardware to track metrics, and UA is well-positioned to provide the accessories. In the last two years, UA has launched a wristband tracker, a wifi-enabled scale, and hear-rate-monitoring earbuds [6]. Eventually, Plank believes, athletes will record this data not with smartphones or plastic monitors, but with tracker-enabled clothing made, conveniently, by UA.[7]

- Data on how athletes train, eat, and sleep provides important visibility into product usage and athlete needs. Previously, customer insight ended at point of sale; now, UA can see into how products are used after purchase and feed these insights into product design and marketing.

These three theses have not played out equally. While Connected Fitness as a stand-alone business unit grew revenue to $23M in the quarter ending August 2016, they lost $7.5M. More importantly, that quarter saw the departure of MayMyFitness’ co-founder, Robin Thurston, who had served as CEO of Connected Fitness and whose vision was critical to the digital pivot [8].

How well hardware sells has yet to be seen, but UA has a spotty history in this area: Team USA speedskaters cast blame for poor performance on UA’s high-tech suits during the 2014 Olympics, while a consumer electronic shirt was scrapped in 2011 for niche appeal and production difficulties [7]. While Nike dropped out of hardware for similar reasons [7], UA bravely forge on.

The most promising digital advantage is the opportunity to change how UA does customer insight. President of Innovation Kevin Haley said of the apps, “There’s unbelievable data in there. You know their running pace, how far they go, how often they go. You literally know what brand of Greek yogurt they use.” [4] Although gear design takes on average 18 months, Haley is already incorporating data to inform their product design.

Is this the finish line?

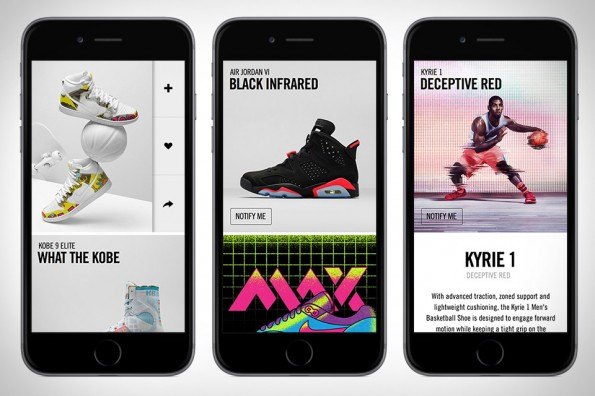

To-date, UA’s digital initiative has focused more on improving athletes than on brand marketing or product-pushing. Comparatively, Nike’s apps (Nike Running Club, Nike Training Club, and Nike SNKRS; now unified under the Nike+ app) place the brand front and center [2]. In fact, SNKRS is essentially a glorified sneaker shopping app [see Exhibits 2, 3]. While UA’s digital initiative comes across as more authentic in creating value for the athlete, they should not forget about the capture value part of the business model. Compared to Nike, UA has not utilized their digital platforms to create brand resonance for their core business.

So how should UA use their digital tools to create customer resonance? They could connect aspirational athletes with elite sponsored athletes. For instance, you could view a sample of Stephen Curry’s training stats on MapMyFitness, or check out a day-in-the-life of Tom and Gisele’s diet on MyFitnessPal [9]. UA could also create original training content for specific sports and feed it to athletes based on their stated training goals, or recommend specific UA products as the seasons change. One way UA has started to do this is to link runners to Zappos.com in order to repurchase UA shoes when their shoe mileage indicates they are worn out [10].

However, given all the information UA holds on individual athletes, this represents only the beginning. After all, UA creates value every time one of their athletes does an extra push-up or runs an extra mile – but UA really wins only if the athlete does so wearing an Under Armour shirt.

Exhibit 2: Nike SNKRS App

Exhibit 3: Under Armour’s MapMyRun vs. Nike Running Club Apps

Word Count: 785

Sources:

[1] “Under Armour, Inc. – History,” Under Armour (2016), accessed 13 November 2016, http://www.uabiz.com/company/history.cfm.

[2] Yuyu Chen, “Under Armour: We’re beating Nike in connected fitness,” Digiday (7 April 2016), accessed 13 November 2016, http://digiday.com/brands/armour-beating-nike-connected-fitness/.

[3] Eric Stromgren, “Under Armour’s Connected Fitness Segment Grows Registered Users, Revenue in Q2 2016,” Club Industry (26 July 2016), accessed 13 November 2016, http://clubindustry.com/manufacturers/under-armours-connected-fitness-segment-grows-registered-users-revenue-q2-2016.

[4] Tom Foster, “Kevin Plank Is Betting Almost $1 Billion That Under Armour Can Beat Nike,” Inc.com (February 2016), accessed 14 November 2016, http://www.inc.com/magazine/201602/tom-foster/kevin-plank-under-armour-spending-1-billion-to-beat-nike.html.

[5] “SXSW 2016: Monday Highlights,” Performics (15 March 2016), accessed 15 November 2016, http://blog.performics.com/sxsw-2016-monday-insights-pn/.

[6] “Under Armour HealthBox Fitness Tracking System,” Under Armour (2016), accessed 13 November 2016, https://www.underarmour.com/en-us/healthbox.

[7] Sara Germano, “Under Armour Turns Ambitions to Electronic Apparel, Monitoring Apps,” Wall Street Journal (27 February 2015), accessed 13 November 2016, http://www.wsj.com/articles/under-armour-looks-to-get-you-wired-with-its-apparel-1425061081.

[8] Jonah Comstock, “Under Armour downplays Connected Fitness on Q2 call,” Mobihealthnews (4 August 2016), accessed 13 November 2016, http://www.mobihealthnews.com/content/under-armour-downplays-connected-fitness-q2-call.

[9] “Under Armour Athlete & Team Roster | US,” Under Armour (2016), accessed 14 November 2016, https://www.underarmour.com/en-us/ua-roster.

[10] Donna Tam, “Zappos, MapMyFitness will tell you when you need new running shoes,” Cnet (14 August 2014), accessed 14 November 2016, https://www.cnet.com/news/zappos-teams-up-with-mapmyfitness-when-its-time-new-running-shoes/.

Photo Sources:

Cover Photo: https://boards.greenhouse.io/connectedfitness#.WCutp3fMyt8.

Exhibit 1: DutchDigitalAgencies (@DDA_NL), “Don’t Forget to sell shirts and shoes – #KevinPlank #UnderArmour @sxsw #2016 #interactive #transformer,” 14 March 2016 12:46 pm, Tweet.

Exhibit 2: http://www.refinedguy.com/2015/02/12/snkrs-nike-sneaker-app/.

Exhibit 3: http://www.nike.com/us/en_us/c/nike-plus/running-app-gps; http://www.mapmyrun.com/app/.

Great post, Margaret! I had no idea that Under Armour owned services like MapMyFitness and MyFitnessPal. It’s great to see that the company is making a push towards digital.

I’d be interesting to see Under Armour’s estimated sales figures for their wristband tracker, wifi-enabled scale, and heart rate-monitoring earbuds. I suspect that they haven’t been all that successful, and I wonder if they should move away from making some of the hardware. If I think about the wristband tracker market for example, there are so many competitors (and none of them are all that differentiated). Is Under Armour really creating a better experience for users? It’s a tough business with low margins, and we’ve seen players like Nike and Microsoft exit this category in recent years. In the short-term, I would instead like to see the company shift its focus to creating great apps and services that it can push out across all devices.

In the long run, I agree with you that “smart” clothing could be a huge opportunity for Under Armour. I wonder what types of related investments Nike is making and whether Under Armour should more aggressively pursue acquisitions in the space. I think the risk is that there’s a lot of uncertainty in terms of how the market will look in a few years, but it looks like some analysts expect smart clothing to be one of the fastest growing wearables categories. [1]

[1] http://www.androidheadlines.com/2016/06/idc-smart-clothing-eyewear-gain-market-share-2020.html

I think this is such an interesting space that UA is trying to get into. It is no longer about UA providing clothing for fitness, but they are now selling the lifestyle of fitness. I think it’s really important for them to be integrated into the entire fitness realm to better understand their customers, and provide the next generation of products that their customers are looking to buy. I think having the data behind it allows them to be the best company to get into wearable clothing and bring it to market for the masses. I’m looking forward to see the changes they make!

Great post, Margaret! Your post made me wonder if smart clothing will ever be more than a novelty product. As you mentioned above, Under Armour hasn’t been particularly successful with its initial forays into the space (speed skating suits and electronic shirts). People predominantly use clothes as a form of self-expression, especially outside the active wear industry. Thus, it’s hard for me to imagine choosing to wear a shirt because of its functionality.

I did, however, think the idea of feeding data collected on digital platforms back into product design was very smart. At Eileen Fisher, we often wondered exactly what women did in our clothes. We would design items for particular occasions – a big meeting, a holiday party, a weekend of lounging – but we rarely found out what women really did in our clothes. How did they function, or fail to function, for her needs? If we had found similar ways to follow our customer’s habits and lifestyles, we could have met her needs much more effectively.

Margaret, I think you’re spot on in asking how Under Armour can leverage the tools it has acquired to create resonance with its customers in order to capture value. The last line of your article makes me wonder whether all of UA’s hardware newly acquired technology platforms will actually translate into increased purchases of athletic apparel. Our marketing case on Nike suggested that the critical foundation of Nike’s success was its product offering. UA’s attempts at creating “smart” clothing clearly haven’t gone well, but I’m wondering how UA’s general apparel compares to Nike’s (or that of other competitors) in terms of quality and performance. As you noted, Nike’s apps place the brand front and center; while I use Nike Running Club, I don’t purchase Nike products because of the app. It seems like UA may be making an assumption that greater uptake of its software/ hardware will translate into increased apparel sales, but I’m not sure I’d agree with that.

What are the opportunities in moving into this space? As Kevin mentions, it is a pretty low margin business and as Brittany mentions, it does not necessarily convert users to buyers. As a result, I am curious about the possibilities of the data that UA and Nike are able to collect through these applications. Unless the initial investment does not pay off immediately or directly, it is hard to figure the direct monetization opportunity:

“Still, while Connected Fitness makes up less than 2% of the overall business, its absence would have resulted in an increase of 47% in overall operating income. In the first quarter of 2016, Connected Fitness’ contribution to operating income was a loss of $16.5 million.” [1]

I do still believe in the idea that UA need to out-innovate, to get out ahead of customers. One boon this play could provide is in the women’s market, since women are more likely to use fitness apps [2]. This could help prop-up UA’s business that otherwise historically catered more to men.

Ultimately, I hope they are able to leverage their data and community to create new and innovative products (like we saw in the Nike case) in order to have a self-reinforcing loop with its ardent fans. Given them even more to cheer about…!

[1] http://www.fool.com/investing/2016/06/12/the-3-biggest-risks-to-under-armour-incs-business.aspx

[2] http://www.baltimoresun.com/business/under-armour-blog/bs-bz-under-armour-fitness-technology-20150207-story.html