Twitter at a Crossroads

Key gaps between Twitter's business and operating models slowed down product development and hampered the company in its race for more users–and accompanying digital ad dollars. Faced with a skeptical market, the company needs to refocus on execution and proving out its business model if it is to survive in the face of rising competitors like Instagram and Snapchat.

In recent months, Twitter has gone through hard times as the company falls behind its user growth targets and witnessed its stock (NYSE: TWTR) drop below its IPO price of $26 in 2013. Until the company increases its effectiveness in driving alignment between its operating and business models, it is doubtful that Twitter will be able to meet market expectations in terms of user growth, user engagement, and monetization.

What’s in a tweet? Twitter’s business model and operating model

Twitter is an online social networking service that enables users to send and read short 140-character messages called “tweets” via mobile, online, or SMS. The platform generates value for its core users as follows:

- The platform serves as a community where users can get updates on and interact with other users, both real-world acquaintances as well as celebrities;

- Users can access and search an instant information/news feed for the latest events happening near them as well as in the world at large.

By Q3 2015, Twitter was serving 320 million active monthly users. Similar to any social networking site, Twitter’s user base and the engagement of those users is the lifeblood of the company, as the users generate most of the content on the platform.

For advertising, Twitter creates value by enabling them to purchase “Promoted Products”—mostly on a pay-for-performance basis—that are integrated into the platform as native advertising and are designed to be compelling and useful to users as organic content. Promoted Products consists of:

- Promoted Tweets that target particular users by using Twitter’s proprietary algorithm and understanding of each user’s Interest Graph;

- Promoted Accounts that provide a way for advertisers to grow a community of users who are interested in their business, products or services;

- Promoted Trends where promoted tweets can be displayed to the user at the top of search results relating to the trending topics of the day.

According to Twitter’s 2014 annual report, their technology platform and information database enables them “to provide targeting capabilities based on audient attributes like geography, interests, keyword, television conversation and devices that make it possible for advertisers to promote their brand, products and services, amplify their visibility and reach, and complement and extend the conversation around their advertising campaigns.” The platform also allows for advertising across the mobile ecosystem throughout the user lifecycle, “from acquiring new users through app installs, to engaging existing users who already have the advertisers’ apps on their device.” Twitter’s 2013 acquisition of MoPub, a mobile-focused advertising exchange, enabled the company to offer one comprehensive monetization platform that combines ad serving, ad network mediation and a real-time bidding exchange.

#Fail – Where did things go wrong?

Even though Q3 2015 financials were on target, the company lowered revenue projections for Q4 due to major issues with user growth: Twitter’s 320 million monthly active users represents only a four million increase over the last quarter, compared to the 49 million new monthly users added by Facebook. Industry observers attributed this user growth slowdown to product stagnation. This is particularly worrying as declining user engagement could translate into user defections to competing platforms, and advertisers are likely to follow suit.

There are two major challenges with the operating model which undermined Twitter’s ability to deliver on its business model:

- Lack of a steady leadership team: In 2014-2015, Twitter changed out its CEO, COO, CFO, head of product (twice), head of news, and head of engineering.

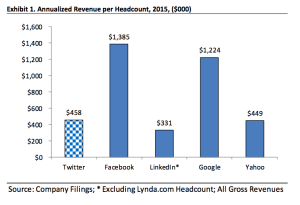

- Teams were too bulky and inefficient: By the end of Q2 2015, Twitter had 4,100 employees, more than double the ~ 2,000 employees it had in Q2 2013 just before the IPO. Compared to Google and Facebook, Twitter was underperforming on the revenue it drives per headcount. Industry observers believed that the company had too much fat, was moving too slowly, and was too bogged down by bureaucracy. In October 2015, Twitter cuts 8% of its workforce in an attempt to move to smaller, more focused and nimble teams.

#WhichWayIsUp – Where will Twitter go from here?

Under new CEO Jack Dorsey, Twitter has made substantial progress in advancing the product, releasing several new innovations such as Moments, NBA Live timeline, interactive ads and click-driven pre-populated tweets. Acquisitions like Vine and Periscope offer opportunities to further expand the platform’s features and attract a broader base of users. In addition, the company has expressed an interest in diversify beyond its core “Twitter product,” and explore opportunities such as monetizing non-users through re-targeting of advertisements (sending advertisement to potential users who have visited the Twitter platform but have not yet made an active profile) and hosting commercial e-storefronts à la Amazon or eBay.

The big question remains, however, as to whether or not Twitter can strengthen its operating model to effectively execute on its many ambitions, and do it quickly before it loses further ground in the competition for digital ad dollars. Given its track record over the last two years, Dorsey might need to narrow the company’s focus in the next 12 months to prove out its business model before expanding in too many directions.

Sources:

- “Is the Twitter Business Model Broken? (TWTR)” August 17, 2015. Investopedia. http://www.investopedia.com/articles/active-trading/081215/twitter-business-model-broken.asp#ixzz3uGHF7HNc

- “The Circles of Twitter.” February 5, 2015. Backchannel. https://medium.com/backchannel/the-circles-of-twitter-838f44fda4f#.44c9cnspt

- “Jack in a Box: Can Twitter Be Saved?” October 16, 2015: The New Yorker. http://www.newyorker.com/business/currency/jack-in-a-box-can-twitter-be-saved

- “Twitter Drops 7%: Can Rumored Staff Cuts Close Efficiency Gap?” October 12, 2015. Barron’s Tech Trader Daily. http://blogs.barrons.com/techtraderdaily/2015/10/12/twitter-drops-7-can-rumored-staff-cuts-glose-efficiency-gap/

- Twitter Q3 2015 Earnings Report slide presentation. https://investor.twitterinc.com/common/download/download.cfm?companyid=AMDA-2F526X&fileid=856827&filekey=0351A89E-5465-46CD-AC5C-4E089220CDC3&filename=2015_Q3_Earnings_Slides.pdf

- “Will Twitter Inc Ever Be Profitable?” April 11, 2015. The Motley Fool. http://www.fool.com/investing/general/2015/04/11/will-twitter-inc-ever-be-profitable.aspx

- “What Twitter Says, and What Investors Hear.” June 18, 2015. Lowercase Capital. http://lowercasecapital.com/2015/06/18/what-twitter-says-and-what-we-hear/

- Twitter Annual Report, 2014. http://www.viewproxy.com/twitter/2015/1/annualreport2014.pdf

- “Twitter Stock Tanks on Stagnant User Growth, Lowered Expectations.” October 27, 2015. Re/code. http://recode.net/2015/10/27/twitter-expects-lower-sales-current-quarter-as-user-growth-stagnates/

- “Twitter shares crash as user growth stalls.” October 27, 2015. Business Insider. http://www.businessinsider.com/twitter-earnings-q3-2015-2015-10

Twitter’s rocky performance and revolving door of executives over the past couple of years suggests that the company is not adequately supporting its business model. It seems that Twitter’s business model may not actually be appropriate given the nature of its user base and the fact that its users are responsible for generating content through the platform. Twitter’s current business model seems to largely be based on Facebook’s and tries to monetize users by showing them advertisements or promoting mobile app installations. However, Twitter does not have the same targeting capabilities that Facebook does because users can only communicate in 140 characters rather than the wealth of data available through Facebook profiles. In addition, Facebook allows users to keep certain information private, which encourages users to share more information that Facebook can use for advertising. Twitter, on the other hand, is public and users are less likely to share as much information as a result.

Twitter’s recent effort to reach non-Twitter users through re-targeting of advertisements seems like a shift in business model because the current model is not delivering enough growth in revenue or in new users. It remains to be seen whether this shift in business model will be enough to cross-subsidize its existing user base and to prevent the low levels of engagement with Twitter relative to competitors like Facebook, Instagram, and Snapchat.

Finally, the frequent changes in Twitter’s leadership seem to be a symptom rather than a feature of a broken operating model. It may be that Twitter’s search for a better business model has led to the company’s seemingly rash decision to fire its software engineers, change the entire executive team, or to antagonize the developer community. Either way, these changes have limited the company’s ability to change its direction dramatically and may continue to threaten its growth in users.

This is a great post. Twitter fails where other social networking sites have succeeded in that it fails to leverage network effect. Twitter really has yet to prove it’s value for a lot of end-users. Without developing a substantial, active (daily.. or many times daily) user base, Twitter ad revenues will continue to be stagnant. The company also seems unclear on how it should provide value for it’s corporate clients. They offer a Brand Strategy team to help corporates (like beer companies, reality TV series) manage their Twitter presence but haven’t found a way to monetize this specifically.

Great choice for a failed business and operational model. I remember when I was in undergrad, Twitter was a sexy startup to work for and attracted high quality talent, but as the years passed by it increasingly became a place that few engineers wanted to work for due to the lack of an effective monetization model.

Going forward, I think Twitter should concentrate on a couple of areas of opportunity:

1) Create a platform that easily allows users to track events as they happen – To me, one of the major value-adds of Twitter is being able to find out news more quickly than any other information source. For any sort of major announcement (such as elections results, athletic commitments, awards ceremonies), Twitter should develop a platform that easily allows users to search the event, and follow Tweets and videos in real-time before news articles are written. I’ve tried to follow major announcements through Twitter, and the interface as it currently stands is extremely clunky and hard to navigate.

2) Work with companies on advertising announcements – There is a strong incentive for users to follow companies on Twitter if they use it as the primary method for announcing flash sales. For example, if JetBlue is having a too-good-to-be-true promotion with limited supply, then following JetBlue on Twitter actually has value for users as they can find out about the flash sale in real-time. I think the Business Development team at Twitter should focus on developing relationships with companies like JetBlue to create more value for Twitter users.

Thanks for the post. Twitter’s operating model is not compelling to many users, including myself. Individuals can access the same streamlined information directly from various news sources such as WSJ, Reuters, NBC, etc, which leaves access to the “community” as their best course for adding value to customers. Unfortunately, Twitter has not been able to capitalize on its early start and has not been able to cultivate a trendy environment to grow within. I fear that without a major rebrand or introduction of novel features, the platform may drift out of favor. This would inevitably lead to a decay in the company’s current business model, thus requiring a major pivot. Doubtful the public markets will take too kindly to this.

Great Post! Twitter is a really interesting company. I personally find its product very useful for when I want to use it, but I don’t find myself on it very often. I generally use it to track or discover breaking news OR as an enhancement to watching live sporting events, when I receive live commentary and stats. In both cases I believe that twitter has an unparalleled product offering, and I scratch my braining wondering how they haven’t figured out a better way to monetize the platform and promote their product. I think in many ways the Company is trying to do too much and may potentially be more successful if it stuck to its core and did a better job of educating the potential consumers on how the platform can benefit and enhance many of their experiences.