Trunk Club – Helping Men Where They Need It Most

Trunk Club changes men’s shopping. Forever.

Trunk Club (“TC”) may seem to be a squishy business model that smells of a fad in the men’s fashion space, however its effectiveness was proven last year when Nordstrom purchased the personalized delivery clothing business for $350 million. TCs effectiveness comes from solving a simple, timeless problem; men hate shopping but want to look good. This misalignment creates a niche for TC to help their customers via their stylist-centric delivery business model.

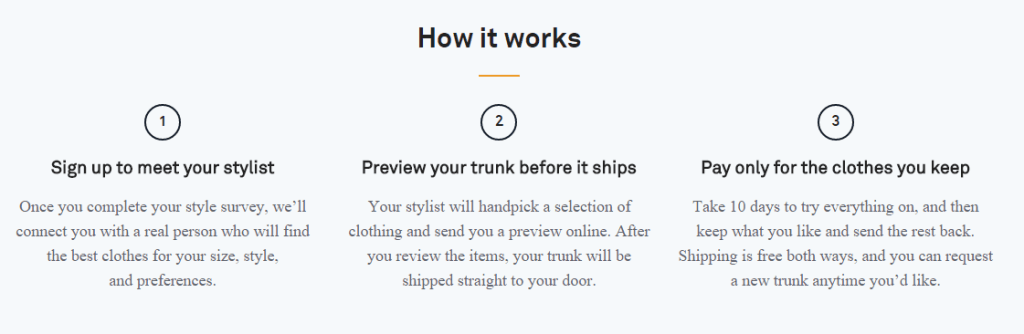

Brian Spaly, the founder and CEO of TC, has aligned the company to generate tangible value for its customers by creating fashion solutions for men who value their time too much to shop or don’t enjoy the traditional shopping experience. TC provides the procurement, selection, sizing and the final delivery of the clothing to the customer’s home. This offers the customer a personalized experience, and reduces the time needed to sort through hundreds of stores and thousands of items. The male customer provides a few guidelines to a TC stylist via an online submission (i.e. size, clothing preferences, etc.). The TC stylist (a full time, paid professional of TC) then selects an array of clothing from their warehouse and sends the package of personalized clothing to the customer’s home. The average customer purchases 30% to 50% of the clothing that is delivered to their home, then sends the rest of the clothing back to TC via a prepaid postage box. TC collects all of the information from the customer’s experience, and uses this for future purchasing recommendations and firm-wide procurement decisions. TC traditionally purchases “last years” clothing at a discount from clothing manufacturers, then marks up the clothing to a full retail price.

TC has avoided a brick-and-mortar business model, which reduces the capital intensity of the operation and allows for a much higher inventory turnover, as they don’t need to purchase a full offering of clothing for dozens of stores. They instead manage all inventory from singular, large warehouses in key geographies across the U.S.

In today’s world where online shopping continues to take share from in-store purchases, the TC model provides a level of additional service and personalized product that offers the customer more value than simply selecting items via a website. The feel of having a personal stylist creates a stickiness to the customer base as well, given they know the stylist has a sense of what is desired and personalized knowledge of your preferences. The customer feels no pressure to purchase, given there is a 10 day at home “try on session”, and the individual can send back all clothing at no cost. The target customer is a ~30 year old male working in an urban setting, who each year seems to generate more income but has increasingly less time.

TC’s business model aligns perfectly with its operating model, as the delivery service allows it to leverage its assets in a more efficient manner at their warehouses. The key assets of the company are the people (mainly the stylists), the inventory and the personalized customer knowledge that is retained. The personalized experience with the customer’s stylist provides a competitive advantage that creates a desire to retain TC as the customer’s preferred clothing partner. The model perfectly fits both the customer’s desires and the firm’s, as the customer perceives the stylist to be a free service that is valued by the individual, and the firm views the stylists as their sales force.

The model also provides very predictive knowledge as to when a customer will buy, how much is purchased and what clothing styles are popular in certain geographies. Aggregating this information provides valuable information to all other stylists at TC, as they can access the data to make better recommendations to their clients. Performance at the firm is driven by the successful product offerings aggregated by the stylists, continued excellence within the procurement of desirable clothing and growing awareness of the firm among men between the ages of 25 and 45.

TC has disrupted the men’s fashion industry in a real way, all because the business model is aligned so well with the operating model; they can continue to provide a higher level of service due to the economies of scale gained by the warehouse and ship-to-consumer model.

Sources:

http://www.forbes.com/sites/kellyreid/2012/07/13/trunk-club/

Great post, Matthew! You’ve identified some very important advantages about TC’s business and operating model. I would also say that TC has actually been very smart in designing their business model, specifically in choosing their target customers. I suspect a big challenge for fashion retail companies is managing the number of SKUs and the resulting inventory. Given the unpredictable and fast-changing nature of fashion, it’s generally hard to predict demand and stock up proper levels of inventory in advance. TC has mitigated such problems for itself by focusing on working men, which significantly narrows down the range of SKUs they need and enhances their demand forecasting ability. This in turn gives them an edge in sourcing and managing inventory.

Thank you for writing this report on a unique business model. I personally prefer Bonobos, which was also founded by Brian Spaly, but that’s me. While TC has been able to avoid having a physical retail presence, they built a ‘clubhouse’ in the Palace Hotel in New York City where they take styling appointments. At Hublot, we often see the ‘bullwhip’ effect, and I know that it is no stranger to the apparel business. Since TC success is built, in part, on excess inventory in the apparel industry, do you think that there is a chance that during a lack of excess their margin structure will break down and they will have to purchase much more expensive or full price inventory? Also, do you think their partnership with Nordstrom will hurt their alignment of business and operating models? Only time can tell. I hope they bring this to Switzerland soon! -JCB

Very interesting post, Matt! Trunk Club’s unique business model allows it to operate without the capital intensity necessary for “brick-and-mortar” retailers. It seems that there will be significant operating leverage for the company as it scales, as it will be able to negotiate better pricing with clothing manufacturers and logistics providers (e.g., shipping and handling). However, I wonder if there are issues or factors that would limit the company’s ability to scale its business model. For example, perhaps current customers are attracted to the curation and unique wardrobes that Trunk Club provides, in addition to the convenience. As more users adopt the service, I wonder if the product offering would lose its appeal with the original customer base that desire unique clothing pieces that are not worn by others.

Great post. I’ve ordered from Trunk Club a few times, and the value proposition is clear to me. I do wonder if Trunk Club will expand its clubhouse concept to other large metropolitan areas in the US. I believe they currently have locations in Chicago, NY, Dallas, DC, and LA. I’ve visited the Chicago location before and have to admit, the customer experience within the clubhouse was fantastic and certainly engendered continued loyalty from me. I think the “stickiness” of the stylist becomes even stronger in the physical location as well.

Excellent observations, Matt. Despite the appeal of TC, I’ve never ordered from them because the prices seemed rather high. I was curious how they were able to maintain a profit margin given the cost of shipping products both to the customer and then the 50-70% that the customer will return; it makes much more sense given that they are purchasing the previous years styles at a discounted price and then re-selling at full price.

I’m curious how sustainable their model is and if they are truly in a defensible position given the relatively low barriers to entry for this segment. There are numerous online retailers, some of which are specifically targeting professional, working men such as Bonobos. TC does not seem to have an intellectual property advantage since their core IP holders (the stylists) can easily leave and go elsewhere. What are your thoughts on new entrants in this market?