Transforming Ford: Supplying Mobility in a Digital World

Will Ford be a winner in the future of mobility or just produce a 'faster horse'?

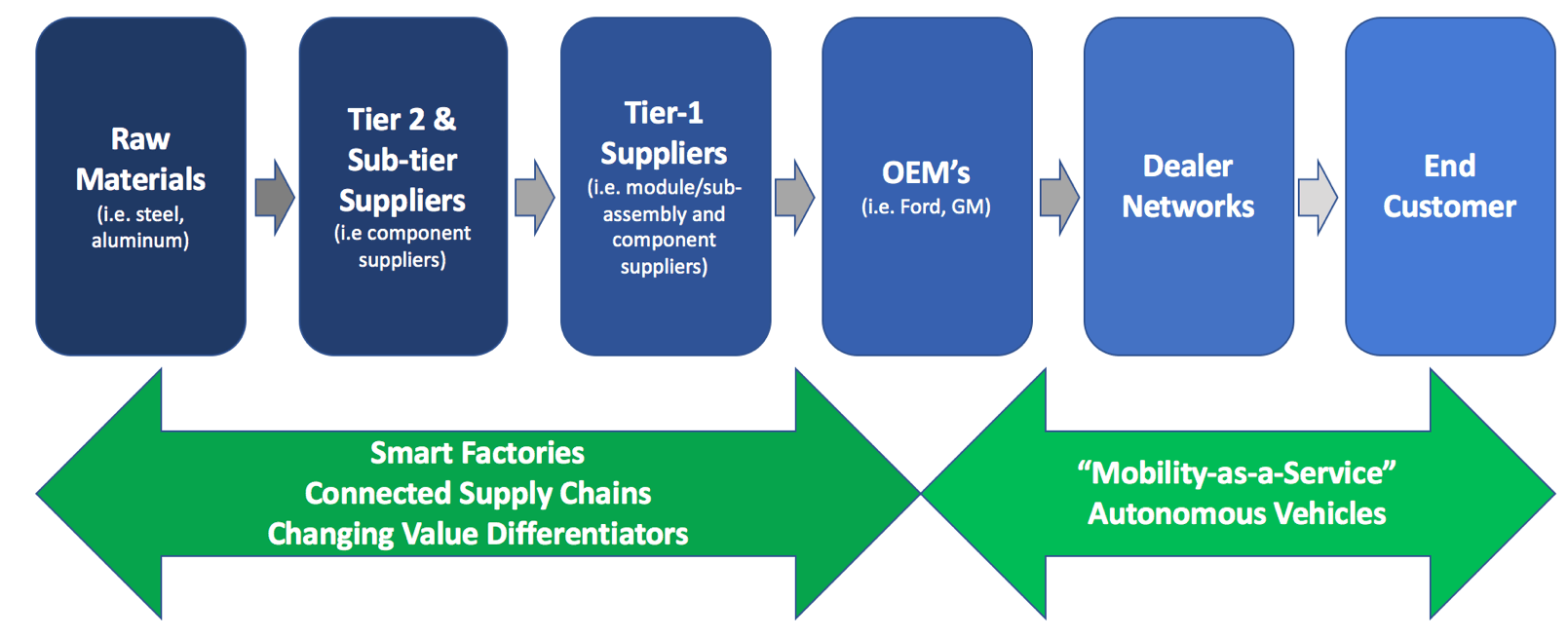

Over a century ago Henry Ford revolutionized mobility for the masses, bringing the moving assembly line to the business of making cars. Fast forward to today, and his great-grandson Bill Ford Jr. and new Ford CEO Jim Hackett are racing to reinvent the company for the future, driven by the new age of digitalization and connectivity. The automotive industry as we know it is poised for a major upheaval, from “mobility-as-a-service” and autonomous vehicles to connected supply chains and smart factories (Fig. 1), and Ford is pushing on all fronts to stay relevant. The urgency is clear, as one analyst noted that Ford is “running 18-24 months behind GM when it comes to cost efficiency and implementing a technology/mobility strategy” [1], and Ford’s share price has dropped from a peak of $18.12 in July 2014 to $12.09 at the beginning of October 2017 [2] in large part due to not having a clearly articulated long-term strategy for success. The question remains: How can Ford can best position itself to win in the future of mobility?

Figure 1: The automotive supply chain and effects of digitalization

Building Vehicles in a Digital World

Vehicles are rapidly becoming smarter, more connected, and more complex, which is forcing companies like Ford to rethink their business model and value chain as new competitive threats and opportunities arise [3].

Digital as a Differentiator

As the major differentiating inputs shift from mechanical to digital components, Ford has been investing in integrating the supply chain to drive faster innovation. In February 2017, Ford announced it acquired a majority stake in start-up firm Argo AI [4], which is focused on developing artificial intelligence technology for autonomous vehicles, and plans to invest $1B in the company. Additionally, Ford recently purchased Princeton Lightwave, following up a $75M investment a year prior in Velodyne, both makers of lidar sensing devices, and made an investment in SAIPS, a visual detection software maker [5, 6]. It seems Ford sees this as an opportunity to control the value chain and reduce risks of relying on suppliers to deliver on innovation, timing, and costs. This is an important strategy for Ford to keep any one supplier from having too much power while striving to deliver a smartphone-like experience for the customer.

Leveraging Connected Supply Chains

Ford has found that digital and connected supply chains give rise to benefits throughout the ecosystem, enabling better responsiveness to demand, increased productivity, and better quality. In one example, Ford has partnered with software firm Kinaxis to implement a rapid response supply chain system in order to efficiently manage their global network with minimum inventory levels [7]. Ford is also experimenting with 3D printing to see where it can add value in the supply chain, but in the near term it will likely be limited to prototype and aftermarket parts [8].

A New Way of Delivering Mobility to the Masses

According to a report by RMI, “peak ownership in the United States will occur around 2020 and will drop quickly after that” [9]. As Ford is in the business of selling cars, this presents a clear threat to Ford’s long-term viability without a strategic shift in how it supplies products and services to the end customer. In order to understand better where they can win in this space, Ford has been running mobility experiments around the world over the past few years, but it is yet to be seen which will come to fruition [10].

In September 2016, Ford purchased Chariot, a “crowd-sourced shuttle service” that now uses Ford Transit vans along with smart routing algorithms to provide an Uber-like shuttle service [11]. In doing so, they found one way to get customers into Ford vehicles and introduce them to Ford as a mobility provider.

Fate of Dealerships

Another stakeholder in the supply chain facing disruption from the digital revolution is the dealership. Ford currently leverages its massive dealer network of over 11,000 dealerships worldwide through which the majority of Ford vehicles, parts, and accessories are sold [12]. As the need for retail services fade, dealerships may become less relevant [13]. Instead, Ford could study pivoting them to provide value in managing shared fleets and maintenance.

Time for Transformation

Ford needs radical transformation – a change in mindset to drive digitalization throughout the value chain from connected supply networks to mobility solutions – in order to create a competitive advantage for the future. This should start by creating agile digital-focused teams to identify gaps in current processes and create system solutions. The challenge in the short term will be investing in these new technologies when the current profit machine is the core business of making incrementally better vehicles. How should Ford manage to blend the traditional and emerging business models? Transformational times create opportunity for great wealth, but will Ford be a winner or just produce a ‘faster horse’?

Word Count: 798.

Sources

[1] Jefferies, “Ford Motor Co.: Falling into place at last,” October 30, 2017, via Thomson ONE database, accessed November 2017.

[2] Fidelity, Ford Motor Company stock data, accessed November 2017.

[3] Porter, M. and J. Heppelmann, “How Smart, connected products are transforming competition,” Harvard Business Review, November 2014.

[4] Tim Higgins, “Ford Acquires Majority Ownership of Self-Driving Car Startup Argo AI,” The Wall Street Journal, February 10, 2017, https://www.wsj.com/articles/ford-acquires-majority-ownership-of-self-driving-car-startup-argo-ai-1486756594, accessed November 2017.

[5] Lienert, P., “Ford’s Argo Self-driving Unit Buying Lidar Maker Princeton Lightware,” Reuters, https://www.reuters.com/article/us-princetonlightwave-m-a-ford/fords-argo-self-driving-unit-buying-lidar-maker-princeton-lightwave-idUSKBN1CW273, accessed November 2017.

[6] “Ford Targets Fully Autonomous Vehicle For Ride Sharing In 2021; Invests In New Tech Companies, Doubles Silicon Valley Team,” Ford Motor Company press release, August 16, 2016, https://media.ford.com/content/fordmedia/fna/us/en/news/2016/08/16/ford-targets-fully-autonomous-vehicle-for-ride-sharing-in-2021.html, accessed November 2017.

[7] Clow, M., “Ford Motor Company: Creating global data standards with SCM software,” Kinaxis, https://blog.kinaxis.com/2017/04/video-ford-motor-company-creating-global-data-standards-scm-software/, accessed November 2017.

[8] “Ford Tests Large-scale 3D Printing With Light-weighting And Personalization In Mind,” Ford Motor Company press release, March 6, 2017, https://media.ford.com/content/fordmedia/fna/us/en/news/2017/03/06/ford-tests-large-scale-3d-printing.html, accessed November 2017.

[9] Johnson, C. and J. Walker, “Peak Car Ownership: The Market Opportunity of Electric Automated Mobility Services,” Rocky Mountain Institute 2016, https://www.rmi.org/wp-content/uploads/2017/03/Mobility_PeakCarOwnership_Report2017.pdf, via Thompson ONE database, accessed November 2017.

[10] “Ford At CES Announces Smart Mobility Plan And 25 Global Experiments Designed To Change The Way The World Moves,” Ford Motor Company press release, January 6, 2017, https://media.ford.com/content/fordmedia/fna/us/en/news/2015/01/06/ford-at-ces-announces-smart-mobility-plan.html, accessed November 2017.

[11] “Ford Partnering With Global Cities On New Transportation; Chariot Shuttle Service To Be Acquired, Ford GOBIKE To Launch In San Francisco,” Ford Motor Company press release, September 9, 2016, https://media.ford.com/content/fordmedia/fna/us/en/news/2016/09/09/ford-partnering-with-global-cities-on-new-transportation–chario.html, accessed November 2017.

[12] Ford Motor Company. 2016 Annual Report. https://corporate.ford.com/microsites/sustainability-report-2016-17/doc/sr16-annual-report-2016.pdf, accessed November 2017.

[13] “By 2030, 25% of Miles Driven in US Could Be in Shared Self-Driving Electric Cars,” Boston Consulting Group press release, April 10, 2017, https://www.bcg.com/d/press/10april2017-future-autonomous-electric-vehicles-151076, accessed November 2017.

Media Sources

Cover Photo: “Ford Service And MOT | Ford Service And Maintenance With Dealerships In Omagh And Strabane”. 2017. Patkirk.Com. https://www.patkirk.com/ford/ford-pass/.

Chariot Photo: “Simple Search | Ford Media Center”. 2017. Media.Ford.Com. https://media.ford.com/content/fordmedia/fna/us/en/search/results.searchresults.image.chariot.0.20.ford-geo_fna~us.contains-all.html.

Very interesting read, Trevor. The Ford Motor Company appears to have come out swinging in an attempt to respond rapidly to imminent changes in the transportation sector. You mentioned that the company has gone out and acquired Argo Ai, Princeton Lightware, Velodyne, and SAIPS. The company is also investing significantly in supply chain systems to reduce inventory holding costs. My one concern here is their broadness of strategy. If the company can implement light sensing technology, 3-D printing, and supply chain optimizing, they will win, like you mentioned, by owning more of the value chain. These may be challenging technologies to integrate simultaneously and though the company views their acquisition as strategic, I wonder if all were required at once?

Some of the experiments being run ([10] “Ford At CES Announces Smart Mobility Plan And 25 Global Experiments Designed To Change The Way The World Moves,” Ford Motor Company press release, January 6, 2017, https://media.ford.com/content/fordmedia/fna/us/en/news/2015/01/06/ford-at-ces-announces-smart-mobility-plan.html, accessed November 2017.) are exciting. Some of the parking and ride-sharing technologies that you referenced are fascinating!

Thanks a lot Trevor for this very insightful read on Ford’s digital transformation efforts. From my perspective, the key difficulty almost all large automotive OEMs are currently facing can be summarized along the lines of “re-inventing the car while driving it”. Not only do technological advancements such a continuous powertrain hybridisation and electrification require OEMs to make significant R&D investments funded through cash flows from “old” combustion engine powered vehicles, but also the entire business model is shifting from a manufacturer of cars to a provider of mobility. While this clearly implies that automotive manufacturers still need to maintain their historical cash generative core, unfortunately automotive OEMs are now focused to engage in a broad set of entirely new technologies, such as AI (e.g. acquisition of Argo) or lidar sensing (e.g. acquisition of Princeton Lightwave), and business models (e.g. car sharing) at once. As it takes significant time to develop new technologies and business models, companies need to engage “all-in” now. From an organizational perspective, it definitely makes sense to separate new business model development initiatives into separate entities (e.g. start-up business units) to ensure out-of-the-box thinking detached from the influence of the historical hierarchical organization. For example, Daimler, the German luxury OEM, recently announced a revamp of its entire corporate structure to align the organization to “a new reality of shared, electric and self-driving vehicles”.

________________

[1] McGee, P., “Daimler plans revamp to prepare for electric vehicles,” Financial Times (Oct 16, 2017)

This is great, Trevor. I appreciated the recognition of the 11,000 strong dealer network – an underappreciated consequence of the next generation of mobility. Perhaps Ford can learn from Tesla, who has taken an innovative approach to dealing with the next generation managing parts, servicing and sales. Tesla states 90% of problems in Tesla’s can be serviced by WiFi [1]. This asset light model is the next generation of the dealer network that Ford has in the past relied on. They will still play a major role moving forward, but Ford will have to communicate to the dealers that they remain a vital part of the ecosystem, but must adapt to the next generation of mobility,

[1] Tesla is serious about its new mobile service effort – here’s a glimpse at its capacity

Thanks for the interesting post Trevor!

The auto industry is facing a trio of disruptive technologies: electric batteries, autonomous vehicles, and the mobile phone. The first two have been long-standing threats, relatively speaking, and are embodied in one company, Tesla [1]. Carmakers have been dealing with these disruptors in different ways and Ford is taking the most interesting approach.

As you alluded to in the post, it launched a spinoff company, Ford Smart Mobility, LLC, which will try to tackle these three potential disruptors at once. Ford claims this is part of their evolution to be both a car company and a mobility company. But the new company is not one designed to meet that challenge. Instead, Ford should go in the other direction: toward integration. Fujifilm, for example, outlasted Kodak not only because it changed from being a film to an image company two decades ago but because it built its entire organization around its new approach.

[1] https://hbr.org/2016/04/if-ford-wants-to-beat-tesla-it-needs-to-go-all-in