Transferwise: No kiosks needed

Transferwise is revolutionising the way we move money around the world. Gone are the days of FX kiosks and money unions…

Transferwise: No Kiosks needed!

Moving abroad has made the costs of transferring money very real. Add in the fx costs of Brexit and the likelihood of finishing business school with a shirt on my back seems slim. Enter Transferwise. TransferWise is a peer to peer money transfer service allowing private individuals & businesses to send money abroad without hidden charges. It was started in January 2011 by Kristo Kaarman and Taavet Hinrikus, the company has attracted $116.37 in funding, with a $26m Series D round in May 2016. The company is valued at $1.1bn making it the UKs fastest growing peer to peer start-up part of the elusive unicorn club! The company, whose backers also include Andreessen Horowitz, Peter Thiel’s Valar Ventures and Sir Richard Branson, now employs over 600 members of staff in offices in the U.K., Europe and the U.S. The company has ‘transferred’ over $5,000,000,000 in currency.[1/2/3]

The problem:

There are over $3 trillion of consumer currency flows around the world each year. [9]

Banks: Over 80% of international currency flows are still transferred through banks, mainly because consumers trust them and don’t know of the alternatives out there. Banks charge flat rate transfer costs, receipt fees and even Anti-Money Laundering costs – the total cost that a bank can charge quickly adds up depending on the size and complexity of the transaction involved. Standard payment fees can go as high as £50 and even those who offer “commission-free” transaction options charge up to 5-7% margin due to the spreads on exchange rates. In totality, the value of these hidden fees can reach anywhere between 4% and 15%. [4]

Credit Cards: Major card providers (Visa etc) handle the transactions between the merchant and your bank, and charge a 1 percent foreign transaction fee. However, bank card providers that use the Visa and MasterCard structure add additional costs on top of that. For instance if you have an RBS Visa you will pay the 1 percent Visa charge plus an additional 2 percent from RBS, reaching a total of 3%. Next comes ATM withdrawal fees – if you are an overseas user withdrawing funds overseas from a ATM, you could pay a 3% foreign transaction fee along with $1.50 per withdrawal. Personally, my bank charges up to £30 per fx transfer and up to 3% on all transfers. [4]

Money Unions: Those who don’t have the luxury of time or who don’t have traditional banking structures set up or available may turn to transfer operators such as MoneyGram and Western Union. These services have the benefit of allowing you to make a transfer that will reach its destination very quickly (and can be withdrawn in cash) but at a very high cost. While there are no set fees (every transaction is calculated depending on factors such as the money’s destination, country of origin, branch or online payment, etc), people can pay anywhere up to 12% for the service. [4]

How does the service work?

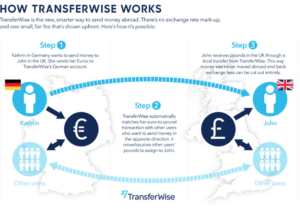

TransferWise is an online money transfer service, which allows you to transfer money up to eight times cheaper than with the bank. The technology is based on a peer-to-peer system. Broadly if someone wants to convert GBP to USD the system will find someone who wishes to convert the same amount from USD to GBP and charges a small for the matching service. Clearly perfect matches are rarely found and so the beauty of the process is Transferwise efficiently allocating the supply and demand of different currency types across millions of fx transactions.

The system automatically matches the money flows at the actual mid-market exchange rate rather than taking a spread and then pays out from the local dollar or sterling account. This means that currency never leaves borders incurring costly fees in the process. Doing things this way means customers can avoid traditional banking fees altogether and you don’t lose money by transferring at an unfair rate.

Transferwise notes that over £3 billion ($4.5 billion) has been transferred on its platform, with cost savings of more than £135 million compared to normal banking transfers; Transferwise fees are roughly 0.5% [5/6/7]

The process:

Making transfers is easy. Go to the TransferWise website –

- Enter the sending and recipient currency and value of transaction

- Enter recipient bank details and pay the desired amount (via debit/credit card or bank transfer) to Transferwise’s bank account in the country of origin

- Wait up to 5 days for the transfer to complete – typically it has taken me 3 business days

Current fees on a £1000 transfer to USD are £5 vs a standard £37.17 across most UK banks.

Next steps:

Transferwise currently operates over 300 routes and its plans are to double the number of currency routes, whilst achieiving formal banking instititution status in the US [8]

Word count: 799

Citations:

- [1] Funding and background: https://techcrunch.com/2015/01/25/a16z-leads-58m-round-in-uks-transferwise-to-ramp-up-p2p-remittance-business/

- [2] Transferwise: https://transferwise.com/us/about

- [3] How does Transferwise work and is it safe: http://www.telegraph.co.uk/money/transferwise/how-does-it-work-and-is-it-safe/

- [4] Currency costs: https://www.currencycloud.com/en-us/news/blog/revealing-hidden-international-payment-costs/

- [5] Try it out: https://transferwise.com/us/

- [6] Skyping dough: http://www.economist.com/blogs/schumpeter/2013/01/international-money-transfers

- [7] Peter Thiel’s Valar chooses London for first European investment: https://www.ft.com/content/9d1b4290-bbcf-11e2-82df-00144feab7de#comments

- [8] Next steps: https://transferwise.com/help/article/1569835/basic-information/supported-currencies

- [9] Skype for cash: http://www.forbes.com/sites/samanthasharf/2016/05/26/skype-for-cash-how-transferwise-is-upending-the-way-consumers-move-3-trillion-around-the-globe/#475bc5714f3a

It was so interesting to read about how TransferWise works. As you alluded to in the article, this application is a key part of every international student’s experience and not only was I impressed with how cheap it was, one of the main attractions is also how EASY it is to use. For those who haven’t used the application, every steps is laid out simply and clearly. Given the requirements to track money for anti-laundering purposes, TransferWise is required to validate your passport. However, this was simple with the app allowing a photo upload which was validated within a few minutes. This is a company with enormous future potential.

This is a very interesting idea. One risk this company faces is the 3-5 days it takes Transferwise to complete a transaction. Given that many ATMs can dispense money in the desired currency on demand and credit cards also operate on an on demand model, Transferwise should aim to reduce the turnaround time so that it is competitive with these platforms. While it may currently appeal to foreigners living abroad who can plan around the transfer time, this will pose an issue as they look to grow their consumer base. They should invest in technologies that simplify the verification process and the matching process so that they are more competitive with the other methods of exchanging currencies.

Interesting stuff.. any idea how blockchain/bitcoin changed the landscape for transferring money across borders? I would love to see the day where friction-less payments and currency transfers happen. I like the mid market and no fee structure I think this is a genius way to work around local transaction rules. Do you use this product frequently? Have you used any black market currency exchanges in your travels and if so how do the prices compare?

Thanks for the interesting post! This is a brilliant example of digital interruption cutting out intermediaries. Right now it seems that the service is mostly used for peer-to-peer transfer in place of Money Unions, but I wonder whether this “ESCROW”-type service can be used for a broader range of commercial transactions. Also, while TransferWise doesn’t necessarily seem suitable for most remittance-type transfers between countries that see much more currency flow in one direction than another, I wonder whether more complex (rather than bi-directional), multi-party transactions can allow for increased share in the remittance service market.