Tired of looking for a free parking space? FastPark tells you where to find it

FastPark's sensorial network enables drivers to find free parking spaces using a mobile app, while helping smart cities monitor and manage parking

The mobility problem

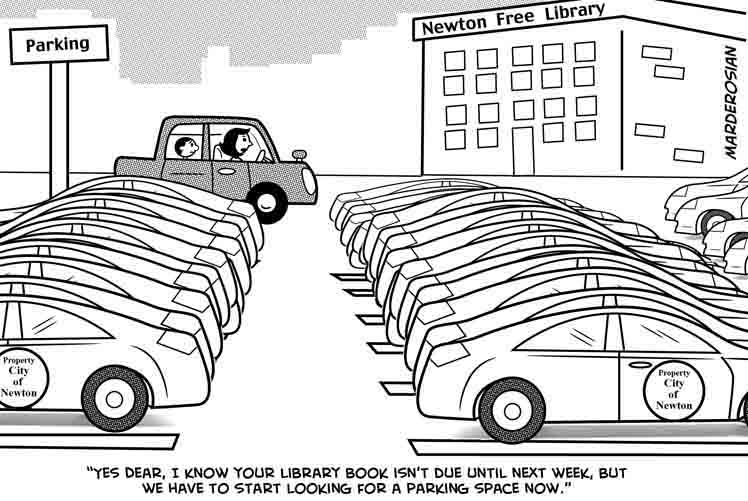

Who hasn’t been circling the block searching for that free parking spot? Drivers in big cities spend an average of 20 minutes hunting for a parking space [1], making parking one of the most inefficient daily activities. This inefficiency has big consequences:

30% of urban traffic is generated by drivers parking [2]

30% of urban traffic is generated by drivers parking [2]- +50 hours of time wasted per driver, annually [3]

- The time and fuel wasted cost consumers and local economies nearly $600M per year [3]

- Carbon dioxide emissions are significant. a study found that drivers in a 15 block district in Los Angeles produced 730 tons of CO2 searching for parking [4]

And this is only going to get worse going forward. Bill Ford, Executive Chairman of Ford Motors, warned in 2011 that “the freedom of mobility is being threatened”, since the world fleet of 800 million cars will grow to 2-4 billion by 2050, when 75% of the population will live in cities. This will lead to a “global gridlock”, which “will stifle economic growth and our ability to deliver food and healthcare”. The solution to this challenge is not to build more roads, but to develop smart roads, smart public transportation, and smart parking, Ford thinks. [5]

The solution: FastPark

Worldsensing is a company that develops Internet of Things (IoT) solutions to improve mobility and industrial activities such as mining or oil and gas exploration. The company’s Mobility branch includes an intelligent parking systems for Smart Cities called FastPark, which helps drivers find parking spaces more quickly and empowers cities to manage their parking resources more effectively. [6]

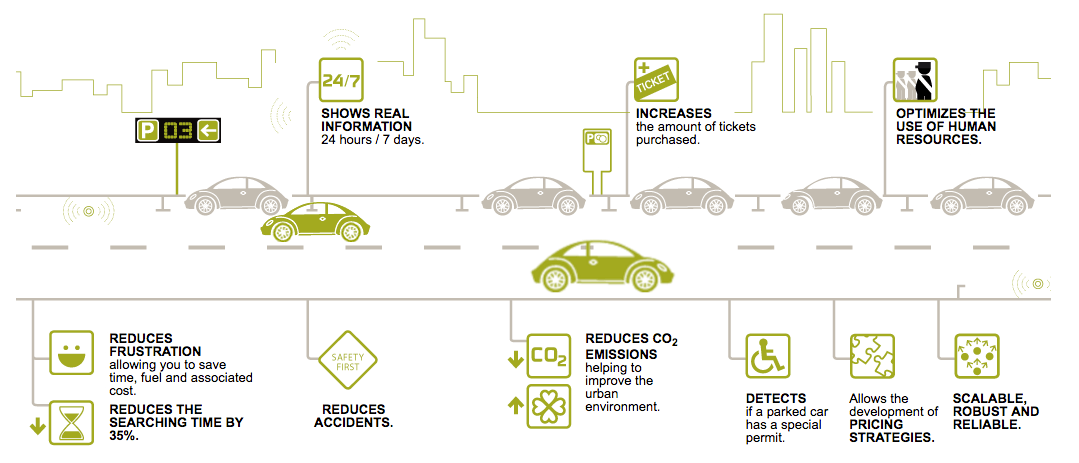

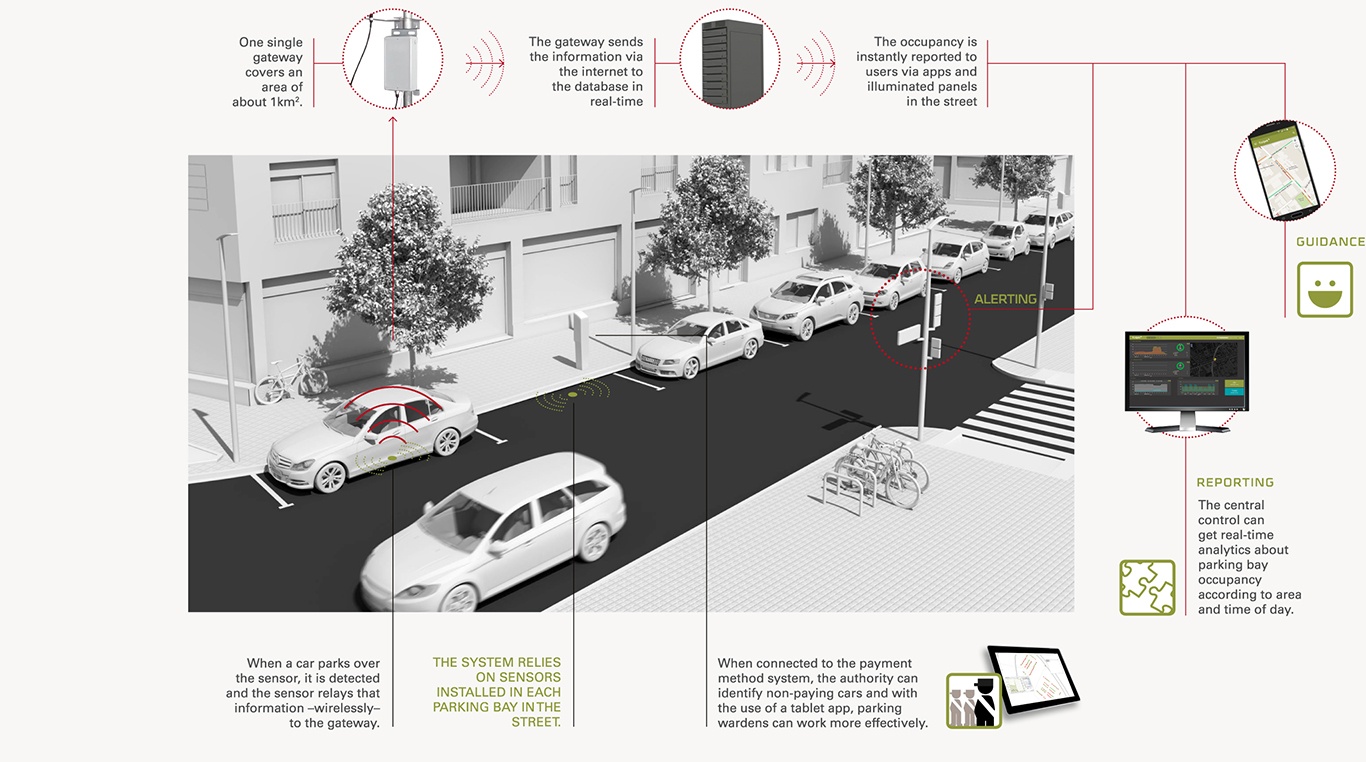

- FastPark locates vacant parking spaces using a sensorial network and then sends the information to drivers via smart phone apps or electronic street panels.

- Drivers will be able to save time and fuel, reducing traffic and CO2 emissions

- Motorists using the FastPark mobile app will be able to pay the parking meter from their smartphones

- Fastprk also facilitates 24/7 monitoring and management of parking bays by local authorities using real-time occupancy and payment information. This data can be used by local authorities for many purposes, such as:

- Dynamic pricing of meters

- Higher utilization of parking spaces, since drivers spend less time searching for parking

- Enforcement of parking regulation, detecting vehicles that have overpassed the time limit or those without special parking permits

- Optimized use of human resources. The system increases the number of cars per hour that each enforcement officer can handle

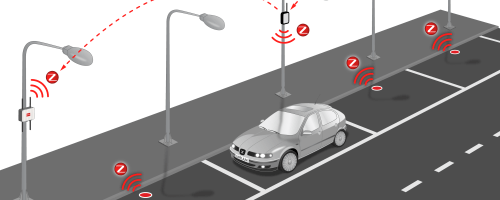

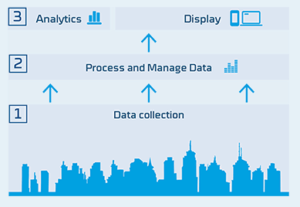

FastPark uses magnetic sensors installed in each parking space to accurately detect the presence of vehicles. Sensor information is sent to the gateways wirelessly. The gateways then aggregate the data from several sensors and send it to the database servers.

This information is then used to monitor and manage on street parking and it is also shared with drivers using a “probability map”: using algorithms, FastPark defines the probability of a parking space being free when a particular driver reaches the spot.

FastPark’s flexible operating model

FastPark’s operating and revenue model may be different in each city.

- In terms of asset ownership, FastPark can either own the sensorial network, the information and the servers (being vertically integrated), or it can sell all the equipment and just provide a build & maintain service.

- In terms of customers served, FastPark is a two-sided platform that can either share its data with the drivers, the local authorities, or both sides of the supply and demand.

For example, in Moscow FastPark sold +12,000 sensors to the city hall, whereas in Barcelona FastPark owns the sensorial network and shares the information with both the local authorities and the drivers.

Going forward: threats and Opportunities

Continuous innovation in the mobility sector can be both a threat and an opportunity. Autonomous cars will reduce the need for parking spaces, threatening FastPark’s business model. On the other hand, drones and video-recognition technology may enable FastPark to more efficiently monitor parking.

Besides being alert on technological innovations, FastPark should explore additional uses of its sensorial network. Future steps may include:

- Use FastPark’s already deployed gateways to accumulate and send information collected by light, noise or water sensors that are being deployed in smart cities. Worldsensing could become the IoT platform and strategic partner for smart cities.

- Partner with local businesses to exploit the parking data. For example, shops could offer coupons to drivers who have parked near their stores.

- Use gateways to detect pedestrian traffic. This information can be sold to real estate companies: high traffic areas could have higher leases.

Worldsensing and its solution FastPark are a step forward in the challenge of making mobility more efficient through digitalization. But will this kind of initiatives be enough to avoid the “global gridlock” Bill Ford predicts?

(793 words)

[1] IBM Global Parking Survey, September 28, 2011, https://www-03.ibm.com/press/us/en/pressrelease/35515.wss#release (accessed November 16, 2016)

[2] Donald C. Shoup, Cruising for Parking, http://shoup.bol.ucla.edu/Cruising.pdf

Department of Urban Planning, University of California, Los Angeles, July 24, 2006

[3] Frost & Sullivan, Strategic Analysis of Smart Parking Market in Europe and North America, April 9, 2015

[4] IBM and Streetline Address One of the Great Unsolved City Problems: Parking, September 2011, http://www-03.ibm.com/press/us/en/pressrelease/35514.wss (accessed November 16, 2016)

[5] Bill Ford, A future beyond traffic gridlock, TED Talks, March 2011, http://www.ted.com/talks/bill_ford_a_future_beyond_traffic_gridlock#t-466336

[6] http://www.worldsensing.com (accessed November 16, 2016)

Your idea of “global gridlock” resonates with me as I vividly recall 100 miles of bumper to bumper traffic driving from Los Angeles to Orange County the day before Thanksgiving in 2013. I think digital solutions such as FastPark represent a movement in the right direction as we create “intelligent” infrastructure that contributes to a more efficient transportation network. Within North America cities, roads, and parking lots alone take up approximately 30-60% of the total surface.[1] Furthermore, at any given time, 95% of highways are not being used due to factors such as lack of traffic, high surface area cars need to travel, and required safety space for avoiding accidents.[2] As autonomous technology develops, platforms like FastPark should continue to innovate to create a complementary value proposition (e.g., smart roadways) that enhances the self-driving experience and improves traffic flow in urban and rural areas. FastPark could also investigate wireless recharging technologies for parked vehicles that allow the transfer of electric power to/from the grid while electric vehicles (perhaps solar) are parked. I am excited at the potential we have for improvements in resource efficiency as the smart grid, home, and transportation network all align.

[1] Tony Seba, “Clean Disruption” (Silicon Valley, California: Clean Planet Ventures, 2014), p. 137.

[2] Ibid, p. 138.

Correction: The third sentence should read “Within North American cities, roads and parking lots…”

Gonzalo thanks for this post! I was truly amazed by the consequences of this inefficient process. One thing that I believe is important to consider when talking about apps used while driving is safety. Nowadays, the use of cellphone (and particularly apps) cause over a quarter of car accidents in the United States, and the trend is increasing (1). I wonder how FastPark is dealing with this issue. Something that the company can enforce is only allowing access to the app when the car is completely stopped or moving below 5 mph (the PokemonGo app has something similar to avoid people using it while driving). The other thing that I would like to know is how the company plans to make money to cover the investments of the new technology? Is it subsidized by cities due to the benefits you mentioned? or will this mean that parking will be more expensive for the citizens? I believe these two questions are important to understand how sustainable the business model is.

(1) http://www.usatoday.com/story/money/cars/2014/03/28/cellphone-use-1-in-4-car-crashes/7018505/

Thanks for the post Gonzalo!

I like the idea of being able to pay through the mobile app, but was wondering if drivers are able to lock down a price or if they are subject to the dynamic pricing throughout the day. If drivers are able to lock down a cheap price, they might be incentivized to leave their cars for longer time periods, resulting in fewer parking options for other drivers. To avoid this from happening I think a good idea would be to cap the amount of time that a driver can park in a single spot and to notify the driver when their time is running out.

Gonzalo – thanks from me as well – enjoyed the post. I’d be curious to hear your thoughts on whether the cell phone is the best media to deliver this kind of information to a driver. It may very well be distracting and potentially dangerous to be fiddling with a smartphone while circling for parking spaces in an urban area. Something tells me that encouraging driver engagement with a cell phone would certainly be a barrier to entry for a number of US cities. As a potential alternative, could FastPark work with various car manufacturers or software providers to integrate the technology directly into the console of the vehicle? For example, Apple has rolled out CarPlay (http://www.apple.com/ios/carplay/) and Visa is developing connected car technology to make car-centric transactions seamless (https://www.youtube.com/watch?v=8HDy1ZIGg78). If FastPark partnered with one of these players, I’d be curious to see if they’d gain even more traction with cities given the big names of their partners.

Great Post Gonzalo! This was very interesting, especially after our marketing class on dynamic pricing of parking spaces. I agree with Patrick and ask if cell phones are really the best media to deliver parking data given the safety concerns of driving. I see a way around this of the city installing LED signs advising drivers of available parking spaces in neighborhoods. China does this with parking garages and has LED signs alert drivers of available spots in upcoming lots. However, this could prove to be a source of competition with FastPark as cities develop their own parking monitoring and advertising technologies. Even if FastPark provided the sensing software to cities for use in their own platforms (such as LED signs), the risk to FastPark would be that it no longer engages directly with customers. Do you think this would be a bad thing? Specifically, do you think FastPark needs to be a customer-facing company, or would it be successful providing the software to municipalities behind the scenes.

Gonzalo– great post! Thanks for sharing. FastPark seems like a great example of the kind of innovative IoT player that City governments in the United States are increasingly partnering with. I really like how you made the case for the value FastPark can offer to local authorities in terms of dynamic pricing, reduced traffic, and other information.

This example made me think about how the City of Boston has partnered with the traffic app Waze to learn more about traffic patterns, in particular flagging double-parked cars in order to ticket them and get them off the streets (1). This success suggests increasing receptivity to this kind of partnership among City governments. I also wonder, though, about the capabilities and IT updates Cities need to build to effectively integrate this kind of technology into their operations. Will FastPark play a role in helping to build up the needed skills and technologies in order to generate sufficient demand? Or will it just depend on this trend evolving over time in Cities?

I also think the element you describe about flexibility in the operating model is absolutely key. Successful Public-Private-Partnerships tend to vary along a spectrum in terms of how much of the risk, cost, and ongoing operating is borne by a private sector provider versus by the government. I’ve seen lots of examples along this spectrum in the infrastructure and development spaces, so it’s really interesting to think about a similar dynamic is relevant with a civic tech product. The National Council on Public Private Partnerships describes this spectrum, noting that no two PPPs are exactly the same. The vary greatly by geography, project type, and moment in time (2). Perhaps FastPark can gain a durable competitive advantage by learning about this range of models and understanding how other private partners to PPPs decide which one applies in which context.

(1) http://www.bostonglobe.com%2Fbusiness%2F2015%2F07%2F08%2Fboston-making-most-waze-traffic-dataafter-tackling-double-parkers-boston-sets-sights-bigger-problems-with-waze-data%2FRltzkBONlFEGefzH4SRE2K%2Fstory.html&usg=AFQjCNGrAIJ67pf3pKoIiMYp-gG_1Dy_jw&sig2=oxZxcaXT7BMR0vRr0JARDw

(2) http://www.ncppp.org/ppp-basics/types-of-partnerships/

Hi Gonzalo! Thanks for the Post. Was wondering what are your thoughts regarding international expansion of FastPark. How scalable is the business? What are the requirements needed to operate? Street parking in many emerging market, such as colombia, is limited, and working with city governments tend to be long, tedious and corrupt processes.