Tire Manufacturing Industry Familiar with Protectionist Policies… Will they Expand?

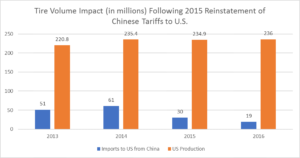

It has been a roller coaster ride for trade regulation in the U.S. tire industry over the last eight years. With Chinese tariffs renewed in 2015 and manufacturers pivoting production towards other Asian countries in order to continue to import tires into the U.S., will trade protection policies increase under Trump and would Goodyear be ready?

Tire Manufacturing Industry Familiar with Protectionist Policies

Long before Trump began tweeting and running a campaign centered on nationalism, manufacturers of tires had their hands full juggling Chinese tariffs on passenger and light truck (“PLT”) vehicle tires. In 2009, Obama advocated for a tariff of 35% on Chinese manufactured tires coming into the United States. [1] Over this period, the output of U.S. tires remained the same with few jobs added domestically as nearly all Chinese imports lost were picked up by neighboring southeast Asia countries. [2]

Source: Modern Tire Dealer’s 2016 Facts Report

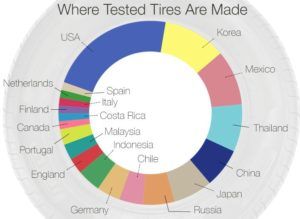

Source: Consumer reports 2016 Study

Source: Pyrolassist July 2016 article [2]

Why Tire Manufacturers Should Take Notice

Some point to this as why Trump’s protectionist policies would have little benefit. [3] Nevertheless, rhetoric around NAFTA being the “worst deal ever” and exiting Trans-Pacific Trade Partner talks has the tire manufacturing industry focused again on anti-dumping and protectionist policies after what has already been a rollercoaster ride around trade over the last eight years. [4] [5] One U.S.-based manufacturer sits at the center of all of this, Goodyear. Approximately 1/3 of Goodyear’s tire units are manufactured in the United States, with ~151k units daily, or 54mm annually (~26% of U.S. production capacity) of capacity. [6] However, when planning a new Americas facility in 2014, it turned away from two potential U.S. towns and instead opted to build a facility in Mexico. [7] [8] If it could have foreseen the election results of 2016, would Goodyear have reconsidered this decision?

Moreover, as rubber, oil and steel are key inputs in tires, Goodyear and those with other domestic plants must be cognizant of the impact that protectionist trade policies in other industries have on their ability to manufacture tires price effectively in the United States. [9]

What have Goodyear and Tire Manufacturers Done to Combat These Issues

Since 2000, 10 U.S.-based tire manufacturing facilities have shutdown, primarily due to union issues. Goodyear made up 3 of these facilities. The last plant opened by Goodyear in the U.S.? 1990. However, U.S. capacity (not production) has risen by nearly 5% in 2016, as Bridgestone, Kumho, Hankook and others have added or expanded facilities. There have been three additional plants announced for opening over the next 3 years in the United States by tire manufacturers who have seen this trend coming. [6]

Manufacturers have also been vocal around the pitfalls of forcing U.S. manufacturers to use U.S. steel and forego purchasing the raw material from China. This summer, the CEO of the U.S. Tire Manufacturers Association went to bat for the steel trade on behalf of Goodyear and others, noting the competitive disadvantage that U.S. tire manufacturers would be left with if forced to purchase expensive U.S. steel that fails to meet volume needs and quality standards. [9]

Goodyear has also set itself up for long-term success by placing its production closer to its demand – whether by country or region. For example, Goodyear broke ground on a facility in the Chinese district of Pulandian in November 2016 with the intent to support its growth in the China PLT market. [10]

What else could be done?

Goodyear has opportunities in the medium-term to de-risk its exposure to protectionist policies in the tire industry by:

- Lobbying with the U.S. government to ensure tariffs that would adversely impact the tire manufacturer are not passed. This would include raw material inputs such as steel noted above and also on certain countries themselves (i.e. Mexico, Thailand) where it may important certain Tier 3 and Tier 4 tires.

- Building its next manufacturing facility in the United States to 1) facilitate goodwill with the Trump administration in lobby efforts; and 2) de-risk the impact of tariffs emerging in its countries that it imports from today. The U.S. tire market operates approximately at capacity and there is reason to believe replacement tire demand could increase in the Americas as 1) fuel prices remain low; 2) replacement cycle on tires used on SUVs and light truck vehicles that spiked in OEM demand coming out of the financial crisis will begin to come through. The recent plans opened by others have been without unions, which could make this cost effective. [6]

Despite these changes, it remains to be seen if Goodyear could ever have a response for the competitive intensity that is likely to increase in the U.S. market over the next several years. Hankook’s $800mm plant in Tennessee, creating 1,000 manufacturing jobs, that will initially ship 5mm units is a great example of this. [11] It is consistent with a Trump mission of adding manufacturing jobs, but was it in the cards for these jobs to come from a Korean competitor? It remains to be seen if Goodyear’s move to turn-down its hometown, Akron, [8] and opt for a Mexico-based facility will have long-term repercussions as nationalistic policies potentially grow more prevalent under the Trump administration.

(799 words)

Sources

[1] Andrews, Edmund L. “U.S. Adds Tariffs on Chinese Tires.” The New York Times. September 11, 2009. Accessed November 15, 2017. http://www.nytimes.com/2009/09/12/business/global/12tires.html.

[2] King-theme.com. “U.S.’s elevated import duties on passenger and light truck tires from China last year was pronounced.” Pyrolassist – Pyrolysis Consultants. July 13, 2016. Accessed November 15, 2017. https://pyrolassist.com/u-s-s-elevated-import-duties-on-passenger-and-light-truck-tires-from-china-last-year-was-pronounced/.

[3] Lee, Don. “Limited success of Chinese tire tariffs shows why Donald Trump’s trade prescription may not work.” Los Angeles Times. July 24, 2016. Accessed November 15, 2017. http://www.latimes.com/business/la-fi-tariffs-trade-analysis-20160724-snap-story.html.

[4] Severns, M., Nussbaum, M., Grunwald, M., Markovich, J., Lowry, R., & Velasco, E. (2016, September 26). Trump pins NAFTA, ‘worst trade deal ever,’ on Clinton. Retrieved November 15, 2017, from https://www.politico.com/story/2016/09/trump-clinton-come-out-swinging-over-nafta-228712

[5] Rich, A. S. (2017, November 11). Trans-Pacific Trade Partners Are Moving On, Without the U.S. Retrieved November 15, 2017, from https://www.nytimes.com/2017/11/11/business/trump-tpp-trade.html

[6] Ulrich, Bob. “2017 Facts Overview.” Modern Tire Dealer. January 2017. Accessed November 15, 2017. http://www.moderntiredealer.com/uploads/stats/mtd-51st-facts-1.pdf

[7] Plain Dealer business staff. “Goodyear Tire building $500 million high-tech tire factory … somewhere.” Cleveland.com. May 29, 2014. Accessed November 15, 2017. http://www.cleveland.com/business/index.ssf/2014/05/goodyear_tire_building_500_mil.html

[8] Harper, John. “Goodyear to build $500 million tire plant in Mexico.” Cleveland.com. April 24, 2015. Accessed November 15, 2017. http://www.cleveland.com/akron/index.ssf/2015/04/goodyear_to_open_500_million_p.html

[9] Ulrich, Bob. “U.S. Tire Manufacturers Association Asks President Trump to Rethink Steel Tariff.” Modern Tire Dealer. July 8, 2017. Accessed November 15, 2017. http://www.moderntiredealer.com/news/724396/u-s-tire-manufacturers-association-asks-president-trump-to-rethink-steel-tariff.

[10] Shingler, Dan. Crain’s Cleveland Business. November 02, 2016. Accessed November 15, 2017. http://www.crainscleveland.com/article/20161102/NEWS/161109942/goodyear-makes-nearly-500-million-investment-in-china.

[11] Area Development News Desk. “South Korea-Based Hankook Tire Opens Manufacturing Plant in Clarksville, Tennessee.” Area Development. October 18, 2017. Accessed November 15, 2017. http://www.areadevelopment.com/newsItems/10-18-2017/hankook-tire-manufacturing-facility-clarksville-tennessee.shtml.

This article raises the core issue – Competitiveness – that underpins the short term political march toward a protectionist agenda and a rollback of globalization. The examination of Goodyear’s investment in 2014, made without the lens of a Trump agenda, serves to underpin the real business fundamentals that are driving these decisions in boardrooms around the world. How could Goodyear make a US investment profitable? Can they realistically invest into new non-union plants, as their peers have done, or will their current unions simply present to much of a risk to this business case? The article serves to suggest that tire manufacturers do believe in a profitable business model onshore in the US which tends to highlight the entrenched Union issues at Goodyear as the differentiating factor in their investment decision.

If the US wants to bring jobs onshore, should it really be putting up trade barriers or should it be focusing on the root cause of its lost competitiveness. This is a country who has readily reinvented itself time and time again in the face of adversity to come out on top and the cheap energy situation now present solves much of the problem for manufacturers. Why then, is the US resorting to trade barriers when it appears that labor cost remains the final straw on bringing production onshore? Lower wages are not the path to a happy and productive society but tariffs will never beat productivity and cost base, as the shift from China to SE Asia in 2009 clearly showed.

I think the main consideration of a potential new US factory comes down to two points. First, would the new US factory be more profitable than a factory elsewhere in the world both under the current Trump administration and under for example the 2014 administration. Second, how likely is it that the current administration’s view and support for “Made in America” will continue in the long-term. If Goodyear believes that the protectionist “Made in America” is a long-term view within both political parties in the US, Goodyear should seriously consider building the US plant. However, if Goodyear believes that the current government sentiment is only due to Trump and that Trump will be out by the next election, then I would advice Goodyear to think more seriously about a plant in e.g. Mexico, with lower labor rates.

I’d express a similar sentiment to Phil Mickelson. A lot of this comes down to the long-term direction of America. With the Trump administration we’ve seen a heavy push towards nationalism and protectionist policies, but how long will he be around and what will the next administration support? Given the current political climate, lobbying the US government against tariffs on imports could be a lost cause. It’s truly a difficult situation to manage. However, given the rising nationalism in other countries such as China, the push for globalization may be harder pressed. Perhaps Goodyear should attempt to meet demands by expanding their current facilities for the time being until a more stable political climate (hopefully) emerges.

Two more elements of this analysis to consider are the extremely low shipping density of tires and the impact automation will have in bringing down the labor content of an already commoditized good. It is reasonable to assume that high shipping costs per tire (given weight and size) make offshore manufacturing prohibitively expensive, particularly considering the just-in-time manufacturing practices of large auto manufacturers. With regard to labor content, automated manufacturing processes are likely to drive down this down to a point where structurally higher labor costs (given the union presence in US tire manufacturing) become less and less relevant. Weighing these additional benefits makes it highly unlikely that tire manufacturing would ever be offshored.

Another key element in this discussion is what key customers are doing and where they are making investments. In 2012, South Carolina became the nations’s leading tire manufacturer [1] in part because BMW and other automakers were making huge investments in the state. As one spokesperson from Continental Tire, which recently built a $500 million dollar plant in Sumter, SC stated, “we do a ton of business in the east coast and want to be close to our customers” [2]. I do think the case for U.S expansion has merit given rising nationalists sentiments abroad (China being a key example), and roughly half the states in the U.S now have “right-to-work” laws, which gives tire manufacturers much more flexibility with their work forces. That being said, the true question is how long Trump-fueled protectionists sentiments/policies will carry on.

[1]https://www.wsj.com/articles/SB10001424052702304587704577335602200937084

[2] http://www.autonews.com/article/20140719/OEM10/307219991/tire-makers-roll-into-south-carolina

One issue that Jonathan brought up that I believe is important to recognize is energy costs for US manufacturers. With the increase in natural gas production, there has been downward pressure on power costs and manufacturing inputs for US-based manufacturing operations. While this may seem great for US manufacturing on the surface, we are not the only country in North America with shale or access to cheap natural gas. Over the next few years, increased pipeline capacity from West Texas to Mexico will be completed [1], putting Mexican manufacturing operations on even footing from a power cost perspective. This gets us back to the labor issue. While there are advantages to manufacturing products near customers in the United States, unless Goodyear can solve the unionized labor issues it faces along with other manufacturers, it will be unlikely they will be able to compete with other companies that have done so.

[1] https://www.pointlogicenergy.com/market-news/Get-the-Point/2017/2017-5-24-mexico-gas.html

Hopefully for the sake of Goodyear and the rest of America, Trump will not last long enough to do too much damage. Although there are arguably certain benefits to protectionism, the obvious disadvantage of driving prices up for consumers will hopefully keep the current Trump administration away from too much protectionism and Goodyear’s move to Mexico will turn out to be a profitable one. Instead of putting up barriers and restriction, America should focus on the root causes of its loss of competitiveness and try to compensate for higher wages with lower manufacturing costs through innovation and automation.

One of the fundamental tenets of international trade theory is that countries obtain a net gain from trade in products/services favorable to their overall comparative advantage. To sacrifice long-term sustainability to follow Trump rhetoric would be a stupid mistake for a company that is so capital intensive, labor dependent, and vulnerable to external market influences (prices of key inputs like oil and steel). Whether it is Mexico, Canada, or Chile, Goodyear should focus their production in a way that favors their overall P&L, despite what Trump may call fair trade standards. At the same time, comparative advantage could benefit US workers by influencing a higher investment in innovation and modern manufacturing. As your note mentions, some producers in the US have raised the concerns that “US steel lacks the quality and price efficiencies” to be cost sustainable. What if the gains from trade obtained from producing abroad could be used to drive better designs for tires in the future?

Goodyear’s new plant opened in Mexico is a good example showing how overprotected tariffs can be detrimental to competitiveness of American manufacturing companies. I agree with MC that Goodyear and the rest of American companies in tire manufacturing industry should combat trade barriers and increasing competition with market entrants from China or Korea by focusing to improve its technical innovation and customer service to secure its market share. Improving its competitive advantage and pursuing continuous improvement for US customers will help Goodyear resist to unpredictable changes in trade barriers in the long run.

Jane, you raise a question many of the current players in the auto supply space are dealing with – do I succumb to the current administration’s short-term pressures or make long-term decisions in the bubble of a non-protectionist future? I would argue the latter – while it might be good press to give into Trump’s demands today, basing a supply chain that is “off market” and suboptimal is not the move, in my opinion.

Great article! I think this article begs the larger question — how should corporations think about Capex investment in light of political uncertainty. A 2012 article from the University of Chicago indicates that “investment is 40% less sensitive to stock prices during election years compared to non-election years.” (1) In other words, stock movements are noisier signals to follow, since the political outcome is a larger driver of optimal corporate strategy. Thus, in a political climate which may last 4 or 8 years, and may continue with future politicians, Goodyear must have conviction on its worldview. Will our world become more isolationist, or are current trends anomalous?

(1) https://bfi.uchicago.edu/research/working-paper/real-effects-political-uncertainty-elections-and-investment-sensitivity-stock

Interesting piece that is a good representation of what a lot of American manufacturers are facing in the current environment. One interesting question to me is how automation and shipping affects the calculus. My thoughts here are inspired primarily by the Fuyao Glass case. If you look short to medium term, the spike in labor costs due to onshoring may be quite dissuasive to following through with onshoring since while the threat to protectionist policies from the Trump administration are real, they are far from certain. However, as we saw in Fuyao, labor costs may become increasingly less relevant in the onshore vs. offshore consideration over longer periods, and also, extremely low shipping rates right now are likely to rise as supply in the shipping business contracts, increasing the relative advantages of onshore productions. Given the automation and shipping considerations, mitigating the protectionist risk by building factories in the US is relatively more attractive.

Interesting read, but again, more a case of nationalism vs isolationism. Additionally, the nationalism might be a temporary phenomenon associated to the current government and can be subject to change in the future. Hence in the shorter term, Goodyear should focus on expanding capacity in their current facilities vs opening new ones. As far as longer term strategy is concerned, Goodyear is already doing good as they have placed their production facilities closer to demand (as pointed out in the write up above)

I found this article informative.

This was a very interesting article, especially considering our recent case concerning tariff considerations. I would focus less on the protectionist aspect of the tire industry and look more for opportunities to attract companies to our domestic market, if that is appropriate. In the end, creating the proper value for the shareholders and customers must be maximized in both long term and short term decisions. This is certainly an interesting industry that will continue to develop technologically.