Tigo Energy: can Smarter Solar go Mainstream?

“Around the world, over a billion solar modules have been installed that cannot be individually monitored. [Tigo Energy] can, for the first time, give all solar modules intelligence — in both existing and new plants,” – Pierre-Pascal Urbon, SMA CEO[1]

Shouldn’t the energy of the future be transparent, optimizable and trackable? Tigo Energy is betting that better data and smarter hardware will change the economics of solar and propel it to mainstream energy.

The Promise

Tigo Energy’s solar panel optimizer hardware and cloud-based performance monitoring package isn’t solving a problem that we could never quite articulate before. Tigo addresses the critical energy performance issues and production data opacity faced by the entire industry. The resulting underperformance of solar projects relative even to projected performance compounds the notion that solar is a niche indulgence of the affluent and crunchy.

Tigo promises three main benefits:

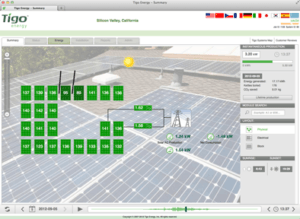

- Better Data: The hardware provides panel-level data visibility from the app, website or whatever you plug the API into. The application alarms owners to performance abnormality and will troubleshoot and diagnose the cause.

- Performance Optimization: ~10% more production through MPPT technology, whether Tigo is part of the original installation or added as a retrofit

- Safety: Instant remote shutdown in case of overheating or failure to either prevent fire allow for firefighters to safely douse installations

This is not data for data’s sake. Tigo’s ability to harvest granular data – in addition to its other benefits – is in pursuit of maximizing total production and minimizing the cost for each kilowatt-hour produced.

For the vast majority of solar systems, we can only track production at either the system or string (7-20 panels) level. Precise knowledge of which panels are impacted by what both minimizes the cost of sending technicians out to remote installations to troubleshoot and resolve issues and enables owners to perform financial evaluations of whether it’s less expensive to deploy maintenance staff now or to wait until more severe issues occur. This is a marked difference from the more standard practice of twice annual major inspections/testing of each module, a costly and ineffective means to confront the performance issues that stack up over the previous half year.

Delivery

Operationally, Tigo has taken its value promise one step further by opening a Chinese office that partners with major global solar panel manufacturers to embed the Tigo junction box directly onto panels at the factory-level. This bundled option reduces labor and logistics costs and opens the product up to be sold through channels aside from specialized installers.

Tigo is the fourth largest producer of module-level power electronics (MLPE) whose advancements represent vast improvement on standard inverters, but still make up only 5% of the total inverter market. That said, the space saw 60% growth in 2015[2] and leading inverter producer SMA’s $20M investment in Tigo last year signaled the industry’s turning attention.

But in order to continue to grow, Tigo will have to take some bigger steps:

- Continued cost reduction: the Tigo-integrated panel comes at a $0.15/W premium, which is still over 10% of the panel itself. While the long-term value of the optimizer platform should command this premium, this requires some additional ask of relatively unsophisticated residential customers, especially when there hasn’t been significant uptake in the commercial or utility sector

- Partnership with leading installers: Tigo and other MLPE providers have not managed to partner with the leading residential installers, SolarCity and Sunrun, who go so far as to question to safety of the products[3]

- Push for stronger regulations: the latest set of electrical codes requires the safety functions that MLPE all feature, but not all US states require adherence to the latest code

- Improved user interface and design: A major portion of Tigo’s value proposition lies within its performance monitoring application and website, which has been entirely focused on function alone

Even if Tigo isn’t successful, MLPE companies are shouldering great expectations. With further cost reductions from panels nearly exhausted, additional cost improvements in solar will have to come from the remaining “balance of system.” We will have to see whether cost parity with brownfuels will ultimately be achieved through sheer cost cutting or major improvements in performance.

(744 words!)

[1] SMA, “SMA Solar Technology AG Acquires Stake in Tigo Energy, Inc. to Tap into the Market for Smart Module Technology,” Press Release

http://www.sma.de/uploads/media/20160408_CN_SMA_Tigo_EN_Final.txt

[2] Greentech Media: “The Global PV Inverter and MLPE Landscape 2016” www.greentechmedia.com/research/report/the-global-pv-inverter-and-mlpe-landscape-2016

[3] Scott Moskowitz, Greentech Media: “Will the US Mandate Module-Level Power Electronics in 2017?” https://www.greentechmedia.com/articles/read/will-the-us-mandate-module-level-power-electronics-in-2017

Leveraging data for solar energy production will be a huge aspect of making solar more cost-efficient and popular for all sorts of customers, so Tigo’s work in this regard is worthy of praise. The whole solar industry is predicated on the idea of a costly upfront outlay with increasing returns over time, so I don’t think that Tigo’s issue should necessarily be this premium. Tigo should consider teaming up with others in the industry working on reducing pain points and increasing value for consumers across the value chain to try and forge a united strategy which will once and for all enable solar energy to be cheaper and more cost effective than other forms. By doing this in a fragmented, piecemeal fashion they will just elongate the process and risk becoming insolvent in the meantime.