The Verdict is still out – Will Square Survive?

It’s Wednesday 12:10pm and you decide to venture to the food trucks by the parking lot, when a question creeps into your head: Will they accept credit cards? When’s the last time you even had cash? Then you see the little Square and you smile!

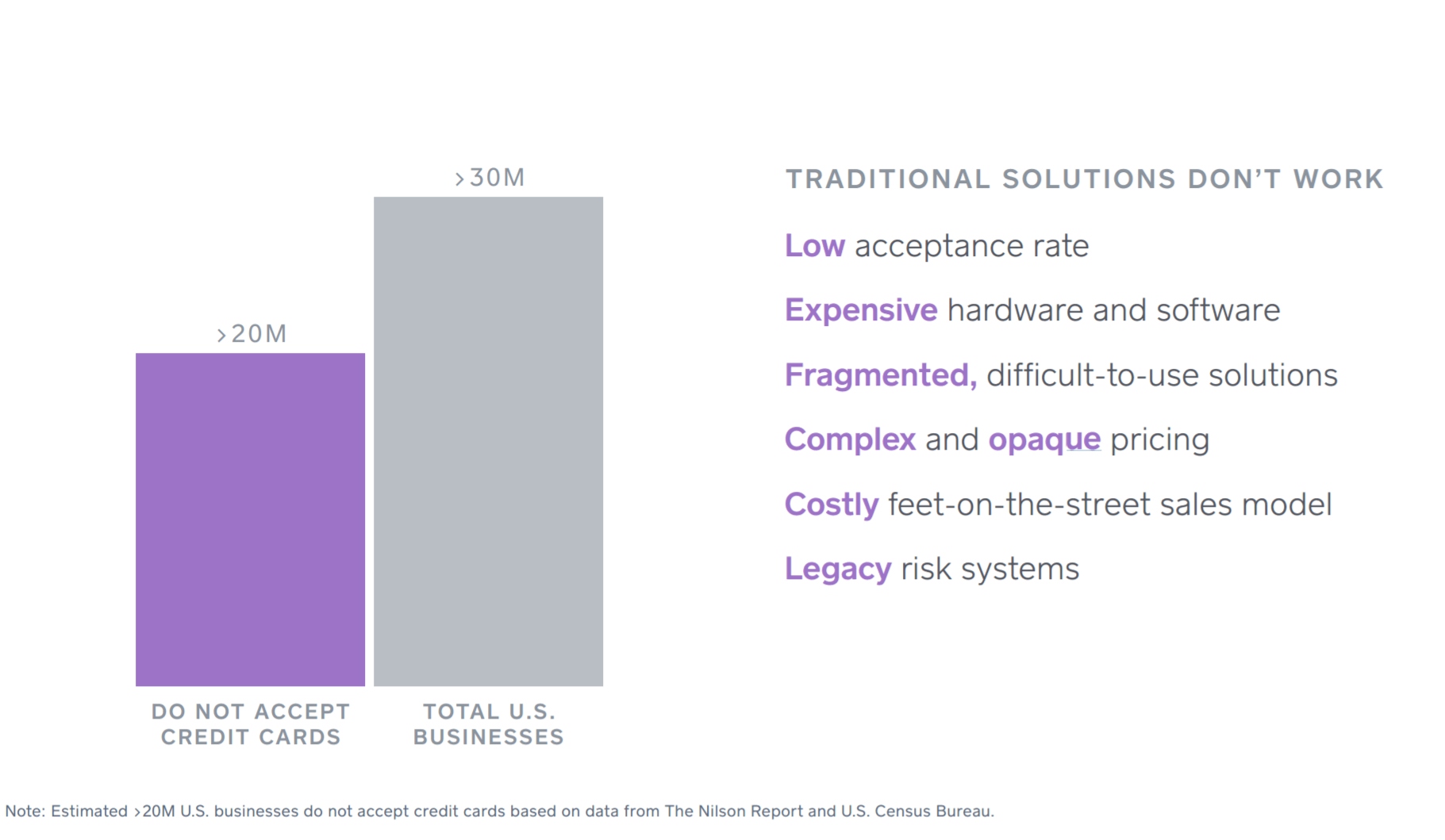

Square was founded in 2009 when founders Jack Dorsey and Jim McKelvey identified a big pain point for both consumers and small and medium enterprises (SME) in the payments market. Before Square, there was no easy or cheap way for small businesses to accept credit card payments. This was particularly troublesome given some sales were not occurring even when consumer’s wiliness to pay was higher than the sellers willingness to sell, simply because of the lack of payment options. According to U.S. Census Bureau and Nilson Report, over $20M businesses do not accept credit cards. Over 48% of U.S. transactions are still being performed by cash, while more than 62% of consumers own at least one credit card and more than 79% own at least one debit card. [1] [2]

Square attacked this problem by introducing Square Reader, which consisted of a simple square that could be connected to an iPhone’s 3.5mm audio jack and could read credit cards. In order to motivate sellers to enter the market, they offered the credit card readers by free and charged at 2.75% fee on every credit card transaction. Square does not have any additional fees beyond the 2.75% per swipe and there are no monthly fees or set-up costs, therefore lowering the barriers of usage. Square claims that its costs are, on average, lower than the costs charged by the conventional credit card processors. “Square changed the game in the micro-merchant segment (merchants with electronic sales volume below $250 million) through innovative “self-service” distribution and seamless wireless connectivity.” [3]

Given it’s immediate success, Square looked at ways to grow its business and was presented with the option to either focus on consumer or on the SME owners. In the consumer space it decided to launch Square Wallet, an app that allowed customers to set up a tab and pay for their order by providing their name (or a barcode) using a stored credit, debit, or gift card. Unfortunately, many merchants did not participate in the system, and thus Square Wallet was removed from the App store in 2014. Although many consumers were willing to try the app, when they opened the Square Wallet, the options of shops that would accept the payment was too little and too random for it to create any type of network effect. In the end, the low number of sellers on the app caused one of Square’s biggest downfalls, as the expected growth by mobile payments became less attractive.

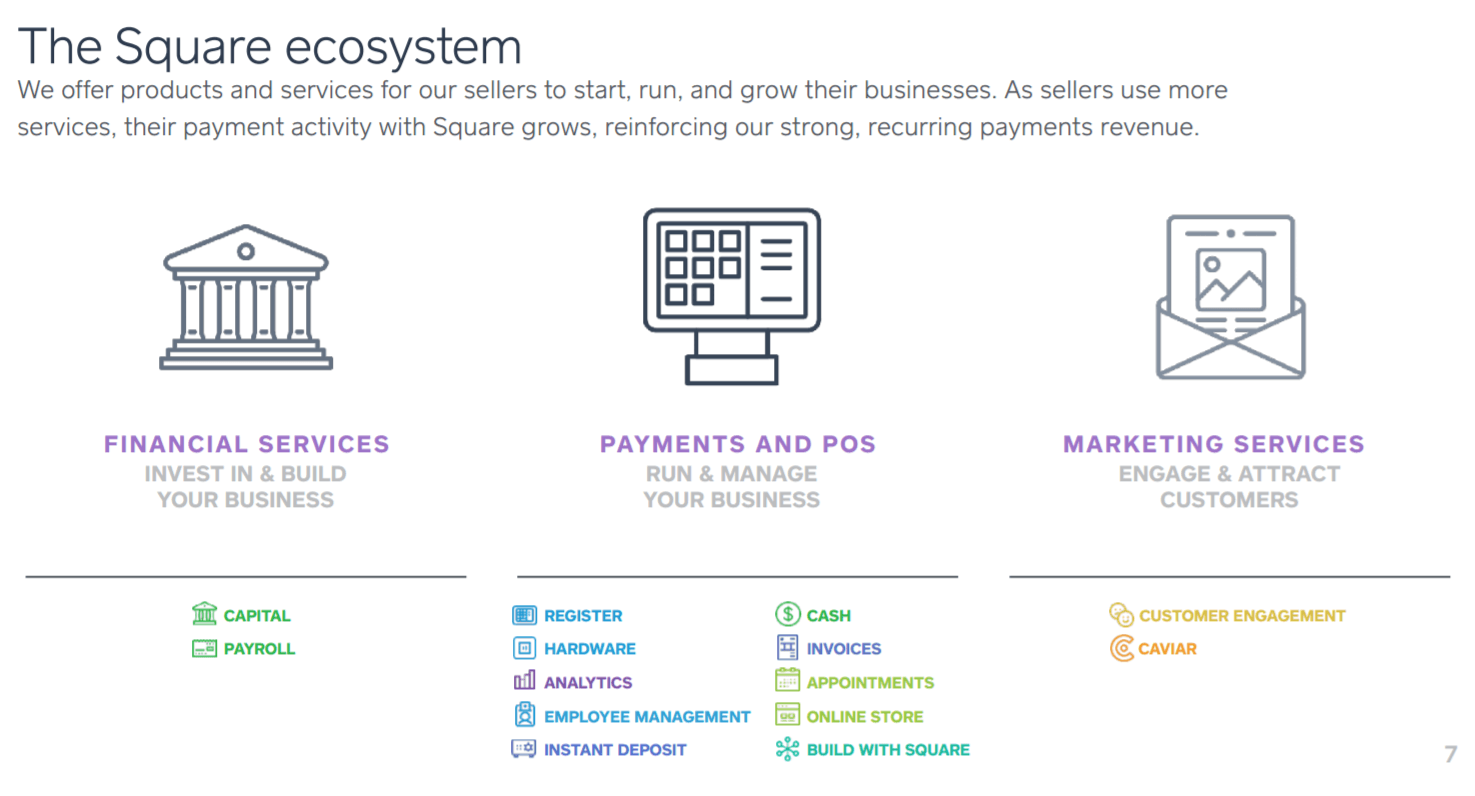

As Square prepared to IPO in 2015, concerns about its growth potential increase among investors. The company ended up going to market at $9 per share, instead of the expected $11-$13 range. Since then, the company has been able to refocus its operating model and works mostly with the B2B segment. Given the payment processing industry has thin margins with little barriers of entry, Square has began to diversify its offering of products. As an early market leader, Square has built an ecosystem of products geared towards business owners, from financial services to marketing and services, trying to provide differentiated value to their customers (business owners).

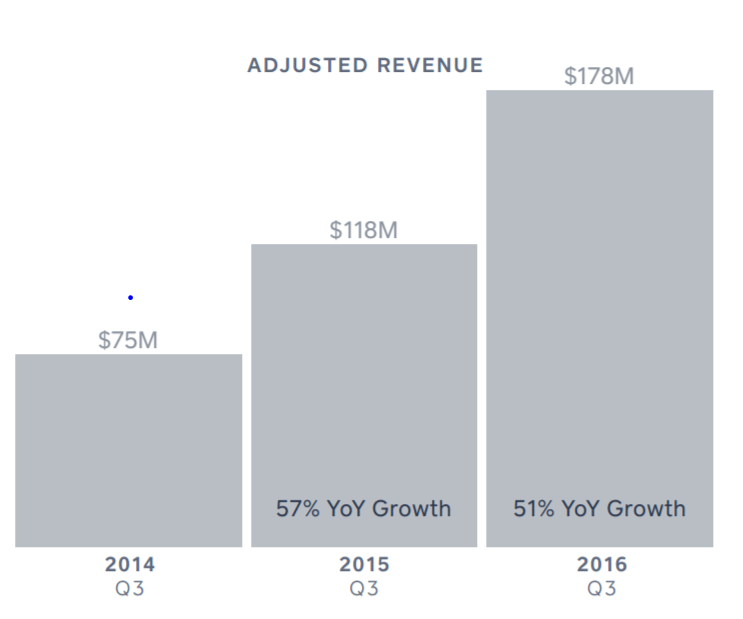

These services offer the potential for much greater margins than Square’s core business, while keeping merchants loyal. Fortunately for Square shareholders, demand for these services has been strong in recent months. Last quarter, Square’s software and data product revenue rose 130% on an annual basis which led to the company’s adjust net revenue YoY Growth of 51%. [4] Even with this growth, the company is still recording profit losses and it is unclear how successful all of their services could ultimately be.

Square was able to create and capture the value of payment transactions, but in order to become profitable it will need to expand its’ products into other higher margin segments. It has two advantages:

- Scale and potential Network Effects: The company has millions of active sellers and a strong customer base which they can leverage in order to cross-sell additional products and becomes less commoditized over the long-run.

- Ability to adapt: Although there was original confusion between which business model would be most effective for Square, B2C or B2B, Square was able to bounce back from its failed B2C product and is now back in the path of becoming a full-fledge service provider for companies.

Ultimately, I do believe Square has the potential to become a strong market player in the payments sector.

[778 words]

[1] Raconteur. n.d. Proportion of cash and non-cash payments worldwide in 2015, by region. Statista. Accessed 18 November, 2016. Available from https://www-statista-com.ezp-prod1.hul.harvard.edu/statistics/585858/cash-vs-non-cash-payments-by-region/.

[2] Statista. Accessed 18 November, 2016. Available from https://www-statista-com.ezp-prod1.hul.harvard.edu/outlook/296/109/digital-payments/united-states#market-driver

[3] Jason Hanson & Robert Byrne, “Innovation and disruption in U.S. merchant payments”, McKinsey on Payment, May 2014. Accessed 18 November, 2016.

[4] Square Inc., 2016 Q3 Investor Presentation, https://d1g145x70srn7h.cloudfront.net/documents/investor-relations/presentations/11-16-overview.pdf, accessed 18 November, 2016

Great post, mc23! I’m a huge fan of Square and agree that it has potential to remain a viable payments player. The Square reader has been great for small merchants to be able to sell at outdoor markets and craft fairs, allowing them to charge much more than they would otherwise if people were only carrying cash in my opinion. Payments is such an interesting space, and no one has quite cracked this issue yet, despite so many different attempts – you have ApplePay, retailers and consortiums of retailers trying to create their own systems, banks, hardware like Square and PayPal’s mobile card reader all competing in this space with no clear winner yet. One concern I have for Square is how they’ve innovated given the iPhone 7’s lack of audio jack? (I’m sure they’re addressing this already, but would be curious what their response was) I was pretty surprised by the statistics around number of businesses in the US that don’t take credit card and the 48% of cash payments. I have definitely seen this cash issue in other countries that I’ve visited but would have expected credit cards to be more widely accepted based on my experience in the US.

I have always appreciated the ability of Square to bring the “little man” into the marketplace to compete, from a payments perspective. The readers are incredibly innovative and have definitely filled a void in the market. However, I am less optimistic that Square can remain competitive. There are already other mobile payment options and it would not take much for Visa or some other major credit company to develop the same technology and simply undercut the current rates charged to users of the readers. They would essentially be cutting out the middleman and have the ability to do so because they own the cards. I also fear that these same, more established credit and financial institutions will leverage their more mature financial management assets, from payroll management to capital investment, to further sway SMEs into their product lines. I feel the ability to use one company for full-spectrum financial operations is incredibly powerful.

Interesting info about Square! I could not imagine how businesses such as food trucks would have grown without the technology that square is able to provide. Another question that would be interesting to explore for future growth and expansion is what risk mobile payment technology brings to the market for them, and how they plan to compete in the future. In some countries such as the US mobile payments have not gained much traction, but in many developing countries mobile payments are established systems that make the Square technology irrelevant. I wonder how the Square team is looking at this threat and how they plan to evolve to compete against it in the future.