The Melting Final Frontier: A Silver-Lining for Cargo Liners

Although climate change generates huge losses for Mother Nature and humankind, it turns out that it’s not all bad news. In fact, the devastating effects of climate change may generate substantial financial gains for some industries. One such industry is the shipping industry, and Eimskip, the oldest Icelandic shipping company in the world, is curbing its carbon emissions while also recognizing the opportunities arising from the melting of our final frontier.

Climate change is transforming the shipping industry’s competitive landscape, literally and figuratively, as the Arctic’s sea ice melts at a staggering pace. The linear rate of decline averages 33,700 square miles per year or 13.3% per decade, and experts believe the Arctic will be ice free before mid-century. (i,ii) As the ice melts over the next several decades, shipping companies, like Eimskip, will be able to navigate previously inaccessible routes between the North Atlantic and Pacific, reducing shipping time by up to two weeks. (iii)

Eimskip, the world’s oldest Icelandic shipping company and a player in the North Atlantic shipping industry, is one of thousands of companies attempting to reduce its carbon footprint while adapting to the challenges of climate change, including new regulations and weather patterns. However, unlike many other companies, the devastating effects of climate change also present opportunities for Eimskip; it is the physical effects of the melting Arctic, not adaptation to regulation, that will drive the most significant change in Eimskip’s operating model in years to come, and we will explore a few of these changes below.

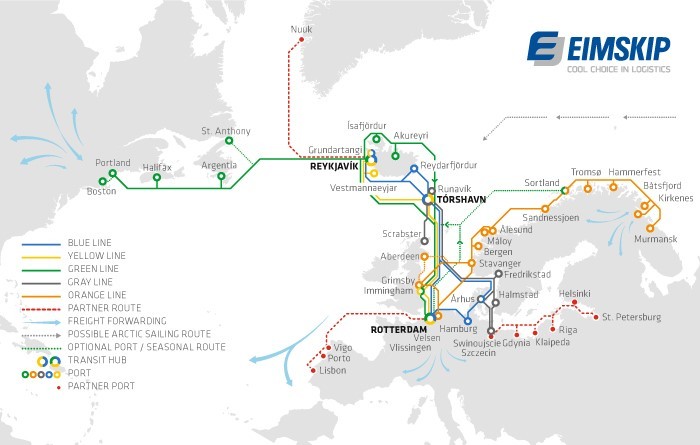

The widespread use of Arctic shipping lanes is still years away, so Eimskip’s operating adjustments thus far are limited and subtle. In 2013, though, Eimskip made its most dramatic move to date when it transferred its U.S. headquarters from Norfolk, VA to Portland, ME, noting that “Eimskip is observing various opportunities in the Arctic, which due to global warming, is rapidly opening up.” (iv) By relocating to Portland, Eimskip can use its forwarding service (instead of sailing time) to efficiently ship goods down the coast and leverage efficiencies from being closer to the Arctic routes.

As Trans-Arctic routes become more accessible, Eimskip must adjust a fundamental aspect of its operating system – its shipping routes. Arctic routes will add new processes, require new capabilities/tasks and introduce new information flows. For instance, if we look at the introduction of “icebreaker escorts” into their routes, we see how this slight change will affect Eimskip’s broader operating system. Icebreaker escorts will help Eimskip navigate the hazardous environment, but current research shows that the travel time of ships “varies due to changes in the time spent waiting for icebreaker escorts.” (iv) In addition to introducing a new process and potential bottleneck, icebreakers will require new information flows between Eimskip and its escort. Similarly, Eimskip will have new information flows with weather centers about ice conditions and the Coast Guard about safety conditions.

While these new routes may dramatically reduce the distance between North America and Asia, improve fuel savings, reduce carbon emissions and increase asset utilization, they boast a large amount of variability. The uncertainty stems from “shallow unmapped seas along the continental coasts, low Arctic temperature [and] risks of encountering drift ice formations.” (vi) This variability will require Eimskip to use buffers to accommodate the variation and adjust its “fixed time” scheduling process, which holds Eimskip accountable for large payments to shippers if deliveries arrive late. The variability will pose a significant challenge for Eimskip and ultimately, determine the feasibility and cost-effectiveness of the routes.

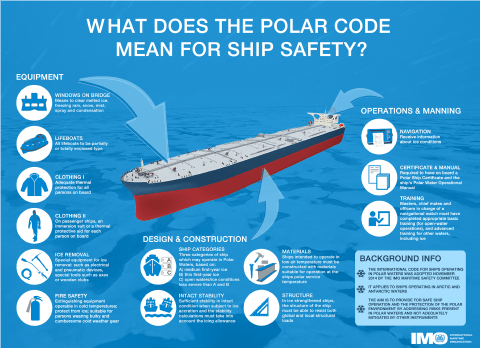

To withstand the hazardous conditions and abide by the Polar Code, an international code requiring specific design, construction, equipment and operations of ships in the Arctic, Eimskip will need special ice-reinforced ships. (vii) In May 2016, Eimskip and Royal Atlantic signed a capacity sharing agreement to expand into Greenland and invest in ships built specifically for the Arctic in accordance with the Polar Code. As this partnership demonstrates, to further penetrate the Arctic, Eimskip must acquire not only new ships and new labor to navigate the conditions but also new partners to facilitate expansion.

Despite the uncertainty around when Trans-Arctic routes will open for commercial use, Eimskip should continue to make incremental investments and operating changes to capitalize on the opportunity. More specifically, Eimskip should:

- Forecast and analyze the cost-effectiveness of Trans-Arctic routes by considering the cost of new ice-reinforced ships coupled with anticipated fuel prices, wait times, lengths of journey, canal fees and different sea conditions.

- Account for variability in new routes and strategize best routes to reduce variability. Eimskip may need to add stops on the route and break-up the long-haul into several, shorter trips.

- Analyze the market opportunity since Trans-Arctic routes will be a new offering. Demand is expected to be high but currently untested. Ensure changes in operations align with the value Eimskip is providing to customers given the drastic operating changes required to navigate the Arctic.

Climate change is in motion and the world must adapt. Part of this adaptation is vigorously working to curb climate change, but another part is looking reality in the eye and preparing for the future. Eimskip understands the shifting dynamics of their competitive landscape and must take-action over the next several years to adjust its operating model for the new economic and environmental reality of the shipping industry.

[Word Count 798]

Footnotes:

i. “Artic Sea Ice News & Analysis,” nsidc.org, November 2, 2016, http://nsidc.org/arcticseaicenews/, accessed November 2016.

ii. Lincoln E Flake (2013) Navigating an Ice-Free Arctic, The RUSI Journal, 158:3, 44-52, http://dx.doi.org/10.1080/03071847.2013.807585, Accessed November 2016.

iii. Costa Paris and Joanne Chiu, “Chinese Shipping Group Cosco Planning Regular Trans-Arctic Sailings,” Wall Street Journal, October 29, 2015, http://www.wsj.com/articles/chinese-shipper-cosco-to-schedule-regular-trans-arctic-sailings-1446133485, accessed November 2016.

iv. Eimskip, 2015 Global News Magazine (Reykjavik: Eimskip, 2015), p. 3.

v. Eimskip, “Sail Schedule,” http://eimskip.is/EN/import/schedule/default.html, accessed November 2016.

vi. Orts Hansen, Gronsedt, Lindstrom Graversen and Hendriksen, “Artic Shipping-Commerical Opportunities and Challenges,” https://services-webdav.cbs.dk/doc/CBS.dk/Arctic%20Shipping%20-%20Commercial%20Opportunities%20and%20Challenges.pdf, accessed November 2016.

vii. “Shipping in polar waters,” imo.org, 206, http://www.imo.org/en/mediacentre/hottopics/polar/pages/default.aspx, accessed November 2016.

Very interesting and thought provoking post on the double-edged sword of climate change. I wrote a similar post focusing on the the same environmental phenomenon (ie. melting of Arctic ice) but instead on how it impacts the cruise industry, specifically Crystal Cruises. I’d imagine that Eimskip is facing a similar tension with how to reconcile its own environmental impact by rationalizing its carbon footprint with pursuing business opportunities that only exist because of climate change. I think Crystal is going to struggle with this inherent contradiction because the effort to reduce its carbon footprint is less linked to its decision to offer trips sailing through the Northwest Passage. For example, Crystal has a company-wide effort to reduce the environmental impact of its operations generally by reducing CO2, conserving energy, water, waste, etc. but the key difference is that those efforts are not directly tied to its reasoning for pursuing business in the Arctic. I think the Eimskip situation is unique in that by pursuing business in the Arctic, and thereby reducing distance traveled, Eimskip is able to reduce emissions and improve fuel savings. The direct link makes the actions more justifiable. Of course then the question becomes weighing those benefits with the costs of exposing the Arctic, which happens to be a particularly vulnerable region.

Extremely interesting and well written post. As you highlighted, I am most interested in evaluating the cost effectiveness of the new route given the large amount of variability that is being introduced, increased investment in ice-enforced ships, increased labor cots given the icebreaker escorts, and possible increase in punitive late payments. While forecasting these costs will be extremely important, I would also want to see information on the approximately 50 ship transits during 2015 (as seen in the WSJ chart). Why has this number of transits decreased in both 2014 and 2015? The chart mentioned fluctuating summer to fall conditions, but could an inability to account for variability have increased costs and also played a part? And given the large investment, what measures/buffers can Eimskip put in place to try to mitigate these potential shifts in weather conditions in any given year? I like the point about analyzing the market opportunity and feel that this is very important but wonder if they will lose a portion of the economic value if they are forced to break the long trip up into several shorter trips, reducing the gap between the Arctic route and Suez Canal route from 13 days to possibly under 10.

Very interesting post!

It’s hard to point at the melting Artic as a positive for climate change, but given the shipping industry’s outsized contribution to greenhouse gases, it does seem like an enticing opportunity to make the best out of a bad situation.

Tagging on to Matt’s point about increases in variability with the use of Arctic routes – I would add that territorial disputes will likely play a role in Eimskip’s decisions on how best to approach its new routes. Specifically, there are conflicting claims between Canada, Russia, and Norway and US as to the ownership of the territories and waters surrounding the North Pole (see here for a brief overview: http://www.bbc.com/news/world-europe-30481309). As ice melting accelerates in this region, it will be interesting to see whether this region becomes an area of high strategic concern for these countries and what impact this has on international shipping.

Hi Emily – thanks for sharing this very interesting perspective on Arctic cargo liners. As a way to make their business more financially sustainable, I was wondering if the company has explored developing travel and tourism capabilities along these routes. As a business based in the region, the company has the opportunity to be a responsible steward of the burgeoning Arctic tourist industry, by leveraging their own operational expertise for the area, and by pursuing a commitment to sustainable development in the sector.