The Limits of FinTech Disruption

Anyone can make a loan… the hard part is getting paid back. OneMain is exploring the intersection of technology with consumer finance

“Silicon Valley is coming” – Jamie Dimon, JPMorgan Chase’s Chairman & CEO [1]

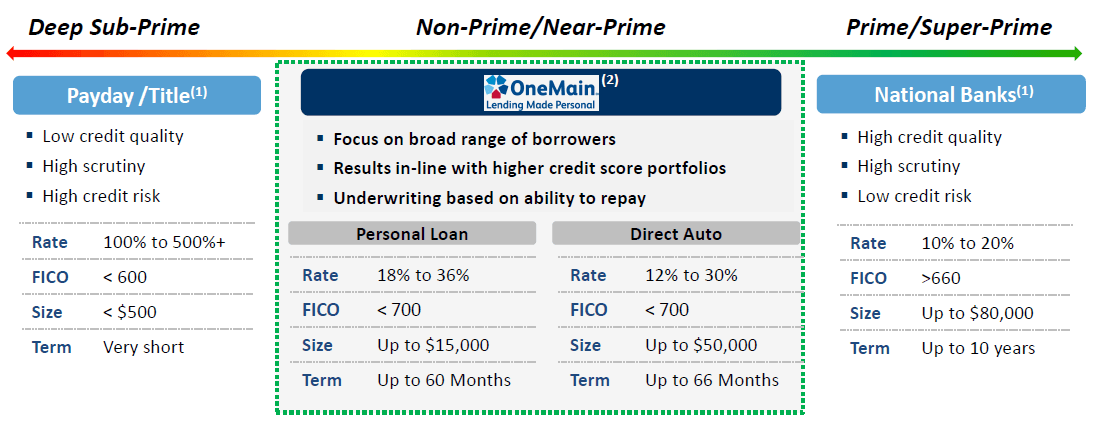

Banks and specialty lenders are facing a growing risk of disintermediation by a class of financial technology startups known as ‘marketplace lenders.’ Historically, banks and specialty lenders served the role of financial intermediaries, arranging loans between those that needed to borrow and those that needed to save. Over the last five years, however, various tech-enabled, marketplace lenders have attempted to disrupt this traditional intermediary role by directly connecting borrowers and investors via an online marketplace. Marketplace lenders have targeted consumer lending (LendingClub, Avant), small business lending (OnDeck, Kabbage), student lending (Sofi, Earnest), and various other asset classes with their scalable, low-touch online origination and servicing platforms. In response, traditional lenders such as OneMain Holdings (“OneMain”) have been forced to evolve and adapt by weighing the decision to digitize against the benefits of their traditional high-touch, customer-facing branch networks.

OneMain Holdings (“OneMain”) is the nation’s largest branch-based nonprime consumer lender in the U.S. with 1,800+ branches in 43 states. In fact, ~90% of Americans live within 25 miles of a OneMain branch giving OneMain greater coverage of the U.S. population than Wells Fargo. [2] Through this extensive branch network, OneMain provides loans to nonprime consumers whose access to credit is otherwise expensive and inefficient.

Recognizing the risks and opportunities posed by technology, OneMain has invested heavily in digitization across three primary functions: (i) origination, (ii) payments, and (iii) servicing. At the same time, however, OneMain has sought to balance the benefits of technology against the hard lessons learned from lending to (and collecting from) nonprime consumers across multiple credit cycles.

First off, OneMain has invested heavily in online origination capabilities, launching an online application portal in early 2013 and a fully digital prime loan origination platform in late 2015. Both platforms were launched in response to consumers searching online for loan options. In fact, today, ~80% of loan applications are started online rather than in the branch. [3] Consistent with its balanced approach to digitization, however, OneMain has worked to incorporate technology into (rather than replace) its core branch-based model. Rather than sourcing, closing, and funding loan applications online, for example, OneMain requires nonprime consumers that apply online to visit a branch before closing and funding a loan. This dramatically reduces online fraud and improves collection performance by requiring a meeting with a loan officer. Moreover, by locating the loan officer in the borrower’s community, the loan officer has a better understanding of the borrower’s financial condition. This strategy allows OneMain to combine the convenience and reach of an online application portal with the benefits of a physical presence to generate attractive through-the-cycle risk-adjusted returns.

Second, OneMain has introduced online and mobile payment options to maximize customer convenience. By making it easier to pay, customers are more likely to remain current on their monthly payments, improving the credit performance of OneMain’s $13bn personal loan portfolio. In fact, today, ~80% of payments are made online or via OneMain’s mobile app. The remaining ~20% of consumers that are either underbanked or prefer to pay in person can pay at one of OneMain’s physical branches, providing customers with the greatest payment flexibility possible. [4]

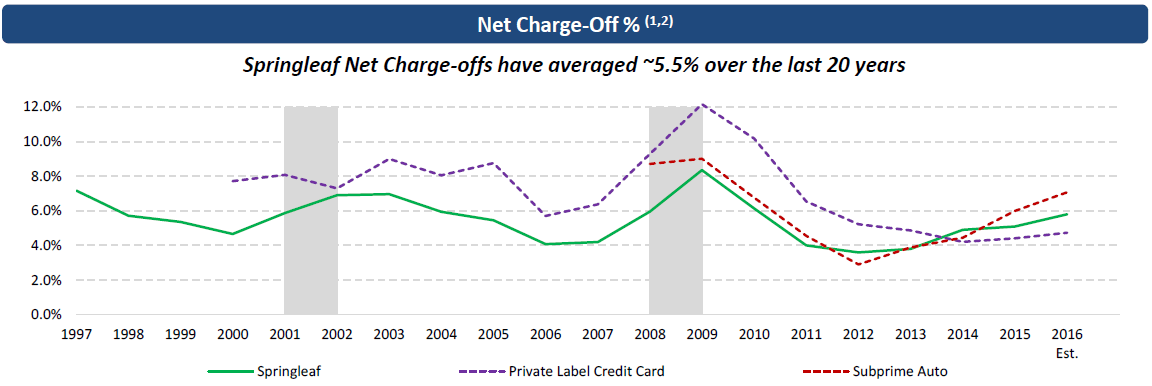

Finally, OneMain has optimized its servicing and collections efforts by incorporating technology into its cycle-tested processes. Historically, OneMain performed most collections at the branch level given that a nonprime consumer is more likely to pay a loan if called by a collections officer they know (e.g., community member, children’s soccer coach) than a faceless call-center employee. In fact, the data shows that branch-based collections significantly outperform centralized servicing, especially in a recession when consumers are forced to prioritize debt payments across various lenders. [4] As a result, OneMain’s (aka, Springleaf’s) loans outperformed both auto loans and private label credit cards during the financial crisis (both of which are centrally serviced).

OneMain recognizes, however, that the appropriate application of technology can further improve its servicing efforts. Thus, OneMain has installed workflow management systems, auto-dialers, and skip-tracking software to support collections efforts. Moreover, OneMain now centralizes late-stage collections efforts, which is only possible given the seamless technology integration between branches and central servicing.

While OneMain has made progress, it still has work to do. In fact, PWC expects marketplace originations to reach ~$150bn by 2025, up from ~$5.5bn in 2014. [5] Given this trend, OneMain should invest further in iLoan, its online origination platform. Moreover, OneMain should explore incorporating non-traditional data sources into its underwriting decisions. Most importantly, however, OneMain should NOT compromise on its core branch-based network. For nonprime consumers, this continued presence in communities will remain a core differentiator during the next credit cycle. Only by combining technology with its “old economy” branch network can OneMain truly position itself to sustainably capitalize on opportunities in nonprime consumer finance.

(800 words)

[1] JP Morgan Chase, 2014 Annual Report – Letter to Shareholders, http://files.shareholder.com/downloads/ONE/15660259x0x820077/8af78e45-1d81-4363-931c-439d04312ebc/JPMC-AR2014-LetterToShareholders.pdf, accessed November 16, 2016.

[2] OneMain Holdings. “Creating the New OneMain,” http://investor.onemainfinancial.com/IRW/Event/4405478, accessed November 2016.

[3] OneMain Holdings, 2015 Annual Report, http://investor.onemainfinancial.com/CustomPage/Index?KeyGenPage=1073752116, accessed November 16, 2016.

[4] Rosemary Kelley and David Shin, “OneMain Financial Issuance Trust 2016-3,” Kroll Bond Rating Agency, June 7, 2016, https://www.krollbondratings.com/, accessed July 2016.

[5] “Marketplace Lending in 2015 – A Year of Performance and Growth,” Prime Meridian Capital Management, December 28, 2015, http://www.pmifunds.com/marketplace-lending-in-2015-a-year-of-performance-and-growth/, accessed November 2016.

Photo Credit

OneMain Holdings. “OneMain: SFIG ABS Vegas Conference,” http://investor.onemainfinancial.com/IRW/Event/4405478, accessed November 2016.

OneMain Holdings. “3Q 2016 Earnings Presentation,” http://investor.onemainfinancial.com/Cache/1001216408.PDF?O=PDF&T=&Y=&D=&FID=1001216408&iid=4405478, accessed November 2016.

Thanks for the post.

It seems your assertion is that OneMain should generally keep all of its brick and mortar branches, which are rather costly, and simply use technology to supplement. This seems contrary to what many other large banks are doing (see below).

http://www.bloomberg.com/news/articles/2015-02-24/jpmorgan-to-close-300-branches-by-end-of-2016-amid-expense-cuts

Also, I wonder if their high-touch, costly footprint could result in OneMain becoming uncompetitive with purely online competitors. It reminds me of the Amazon vs. traditional retailer battle, and from an outside perspective, it would appear as if Amazon is winning.

I guess the key question will be, as you noted, whether when a recession occurs, these online lenders had the right standards/practices in place that enable them to perform adequately through a cycle. The US has generally enjoyed a smooth economy for the last several years, when most of these start-ups came online, so it will be interesting to watch how this plays out. If their loss ratios are actually in-line with OneMain’s, would that change your perspective?