The Impact of Isolationism on Small US Businesses… Does Protectionism Protect Them?

A small US manufacturer sells 60% of its products to foreign companies. If the US adopts a protectionist trade stance and increases antidumping duties on foreign countries, there's a good chance foreign countries will respond with duties of their own. As a small player in this international market, what can the US manufacturer do to mitigate the risks that duties destroy their future profitability?

Image source: Stefan Bauschard, “Resolved: In matters of international trade, globalization ought to be valued above protectionism” Millennial Speech and Debate Online, December 20,2016, [URL], accessed November 2017.

Rayonier Advanced Materials manufactures cellulose products used in consumer goods such as “televisions, computer screens, …, tires, paint, food, [and] pharmaceuticals.”1 Operating just three plants in the southeastern United States with only 1,200 employees, Rayonier looks like a small domestic player.2 The company, however, is in fact a global entity. With 60% of its sales to foreign countries, Rayonier is “consistently ranked among the nation’s top 50 exporters and delivers products to 80 ports around the world, serving customers in 35 countries.”3 The global trend towards isolationism, therefore, poses a significant risk to Rayonier, a risk they have recently taken steps to mitigate. Facing a future of escalating isolationism, Rayonier may need to escalate both the breadth and pace of these actions. As a small player in a big international market, however, how much can and should they do?

Reason to be concerned?

Rayonier has already experienced the negative impact of isolationist policies. In 2013, for example, China levied a 17% antidumping duty on Rayonier’s commodity products, essentially eliminating their ability to compete in China in this category.4 In 2017, the WTO finally ruled this duty violated international trade agreements, but the only outcome was a recommendation that China change its policy.5

This situation illustrates the general threat duties pose to Rayonier. According to research across industries, “antidumping duties have been shown to significantly reduce exports from named countries, 50%–60% on average, … investigations often drive export suppliers entirely out of the market,… and about half of the trade volume effect of an AD order occurs during the period of investigation” meaning that harm occurs even if the duties are overturned.6

Unfortunately for Rayonier, it looks like duties won’t go away. The US Commerce Department states, “Enforcement of U.S. trade law is a prime focus of the Trump administration.”7 Accordingly, “Commerce has initiated 77 antidumping and countervailing duty investigations – a 61% increase from the previous year.”8 US policy is likely to spur international reactions, as many economists argue “protectionism begets protectionism.”9 And, in fact, some argue that we’ve already started to see China retaliate, increasing antidumping activities to match US behavior.10

Steps to protect themselves

Rayonier is keenly aware of this risk. To mitigate this and other international market risks, Rayonier has started to diversify, adding commodity products to its portfolio.11 Diversification is beneficial because it means that even if foreign governments impose tariffs on some products, Rayonier can still sell others. (This occurred in China in 2013, when Rayonier’s specialty products were exempted from the 17% duty on commodities.)12

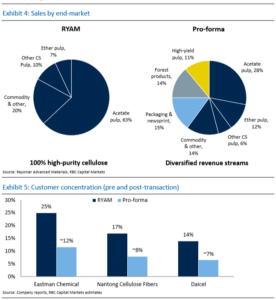

In addition, Rayonier has started to acquire foreign companies, giving it a foothold outside the US so it can avoid future duties if they’re imposed. Most recently, for example, Rayonier acquired Tembec, another cellulose producer with operations in Canada and France.13 RBC analysts applauded this acquisition, highlighting the diversification benefits shown in the charts below.14 Moving forward, in both the short and long-term, Rayonier’s annual report indicates they intend to continue diversifying to minimize risk.15

Other Options to Consider

Despite this diversification, Rayonier remains significantly exposed to duty risk. As Rayonier notes, even “Tembec has a significant exposure … [as] recently, approximately 27% tariffs were announced on lumber exported from Canada to the US”.16 If Rayonier believes isolationism will escalate, the following actions may be necessary.

First, as an immediate step, Rayonier can accelerate its R&D efforts to further differentiate its products and thereby decrease the likelihood of competitors successfully lobbying for antidumping tariffs. (In 2013, for example, China excluded Rayonier’s specialty products from duties and Rayonier claimed this was because of the product’s specialization.)17

Second, as a longer-term play, Rayonier can accelerate its international growth by building factories in foreign countries, instead of just growing through acquisition. In recent years, GE has taken this approach, with CEO Jeff Immelt stating “the company can’t depend on new trade deals to ease global commerce, but must scatter production all over the world.”18

Third, and continually, Rayonier can be more proactive fighting attempts to impose duties. The Chinese duties were imposed after Chinese manufacturers lobbied the government for them. Rayonier has 60-80 year relationships with Chinese customers, and thus potentially the leverage to ask these customers to lobby on their behalf to counter manufacturer lobbies.19

The Uncertainty that Remains

Taking the actions above requires Rayonier to invest significant time and capital that might distract Rayonier from its core operations. The right path forward thus hinges on the answer to three difficult questions. One: Is protectionism likely to continue and escalate? (Just this past month, Trump seemed to voice softer trade stance toward China).20 Two: Is it wise to build foreign factories, i.e., make long-term investments, based on unpredictable and potentially short-term political conditions? And, three: Even if a small company like Rayonier does want to fight trade policies (directly or through its customers), does it really have any power to do this?

(Word count, excluding titles, sub-titles, and sources: 799)

1 Rayonier Advanced Materials, “Company Overview,” http://rayonieram.com/performance-fibers/products/, accessed November 2017.

2 Rayonier Advance Materials. 2016 Annual Report. [URL], accessed November 2017.

3 Ibid.

4 Scott Flaherty, “Paper Co. Cries Foul As China Finalizes Pulp Duties”, April 4, 2014, via Law 360 – A LexisNexis Company, accessed November 2017.

5 Jimmy Hoover, “WTO Blows Whistle on China’s Cellulose Pulp Duties”, April 25, 2017, via Law 360 – A LexisNexis Company, accessed November 2017.

6 Besedeš, T. and Prusa, T. J. (2017), “The Hazardous Effects of Antidumping,” Economic Inquiry, 55: 9–30, April 7, 2016, [URL], accessed November 2017.

7 “U.S. Department of Commerce Issues Affirmative Preliminary Antidumping Duty Determination on Aluminum Foil from the People’s Republic of China,” press release, October 27, 2017, on US Commerce website, [URL], accessed November 2017.

8 Ibid.

9 Joe Quinlan, “Insight: The Perils of De-Globalisation”, Financial Times, July 21, 2009, [URL], accessed November 2017.

10 Tim Worstall, “China Will Defend Against US Trade Probes – Including, Apparently, Anti-Dumping Investigation”, Forbes, August 24, 2017, [URL], accessed November 2017.

11 Rayonier Advance Materials. 2016 Annual Report.

12 “China Ministry of Commerce Issues Preliminary Determination for Dissolving Pulp Anti-Dumping Investigation,” press release, November 8, 2013, on Rayonier website, [URL], accessed November 2017.

13 “Rayonier Advanced Materials to Acquire Tembec, Creating a Diversified Global Leader in High Purity Cellulose, Packaging, Paper, High-Yield Pulp and Forest Products,” press release, May 25, 2017, on Rayonier Advanced Materials website, [URL], accessed November 2017.

14 Paul C. Quinn, “Panthers looking to score with the French Connection,” RBC Capital Markets, November 2, 2017, via Thomson Reuters, accessed November 2017.

15 Rayonier Advance Materials. 2016 Annual Report.

16 “Rayonier Advanced Materials Reiterates Commitment to Acquire Tembec on Agreed Terms,” press release, July 17, 2017, on Rayonier Advanced Materials website, [URL], accessed November 2017.

17 “China Ministry of Commerce Issues Preliminary Determination.” [URL].

18 Ted Mann and Brian Spegele, “GE, The Ultimate Global Player, Is Turning Local”, The Wall Street Journal, June 29, 2017, [URL], accessed November 2017.

19 Rayonier Advance Materials. 2016 Annual Report.

20 “Trump China visit: US leader strikes warmer tone with Xi Jinping”, BBC News, November 9, 2017, [URL], accessed November 2017.

This is really interesting – thank you for sharing. It seems like you began to reference this in your questions, but what it raises to me is whether it’s more worth it for them to try to redirect their existing (potentially lost) business in places such as China vs, as you mentioned, trying to fight the policies as a smaller player in the market.

I was struck by the figures you quoted at the beginning– Rayonier, with only 1,200 employees, consistently ranks in the nation’s top 50 exporters. This highlights just how limited the scale of U.S. exports has become. Furthermore, it reinforces the shift from needing to convince management of “why should we move production oversees” to “why we should stay in the U.S.”

That’s the question I’d be asking of Rayonier. Is there a specific reason why production needs to be here in the U.S.? I really liked the first two ideas you posed for options. First, if they can continue to be a specialized producer (assuming some of that specialization depends on being in the U.S.) that would provide good rationale to stay. However, if there aren’t compelling reasons, I would think option 2– moving production to be where the end consumer is– would be the necessary approach. Ultimately, politics will be unpredictable, so finding ways to prevent risk is key.

Very interesting article! In response to your first question, I think the trends of protectionism will be somewhat unpredictable over the long term, and so the company needs to prepare for the worst possible outcome. In that regard, to your second question, I think it could make sense to make factories abroad if that would make them exempt from certain duties. However, they should only choose to open factories in places where it makes economic sense regardless of whether isolationist policies are put in place. For example, if many of their products are shipped to China anyway, it could make economic sense to open up a factory closer to those consumers. That said, it needs to consider that this introduces political and foreign exchange risk in a new geography, and thus needs to pick those geographies wisely.

To your third question, I would not rely on Rayonier’s ability to fight these policies. Not only might it not be successful, but it could entail a large waste of time and resources. Instead, I would focus on specializing the products, as you proposed. An additional idea would be to expand the customer base across as many nations as possible. Diversifying the customer pool would minimize the risk of any one country’s policies having a large impact on the financials of the business. It could also dedicate some R&D to investigating which nations are most likely to be the target of US policies, and therefore have the greatest potential to retaliate against the US with protectionist policies.

Thanks for this – great article! I am particularly interested in the question of Rayonier diversifying their manufacturing base by directly building operations internationally, rather than through acquisition. While Jeff Immelt might see this as the easy option, I wonder whether Rayonier, as a relatively small player, has as deep pockets as GE to be able to fund what I expect would be highly capital-intensive construction and development projects abroad.

More broadly when considering whether Rayonier should expand operations internationally at all, I would be interested to know the final destination of the majority of their exports – firstly to determine Rayonier’s exposure to potential protectionist policies (given the differing likelihood across countries of a move towards isolationism), and secondly to determine how the savings generated from avoiding trade barriers compares to the cost of production in (and onward distribution from) those new geographies.

Very interesting post!! I’ve been very curious about how globalization/isolationism have and will affect small business prospects in the US, so I’m really glad you picked this topic. I believe that any given country should provide subsidies for small businesses if they employ free trade agreements that might provide additional competition for the small businesses.

Your first question is whether or not protectionism is likely to continue and escalate. This is such a difficult question for me to evaluate–how do we probabilistically evaluate the political risk to the cashflows of a business? Any sort of political predicting seems to be arbitrary, and even the most high-profile political “analysts” aren’t able to predict political outcomes correctly (Nate Silver’s pointed this out at fivethirtyeight.com).

Earlier this semester, we examined how a multinational power generation company handles political risk on its balance sheets. How do these companies predict the impact of risk onto their cashflows, and then decide the highest ROI investments to make to diversify or combat these risks?

For instance, how does a company make a reasonable decision whether or not to split its capital between funding lobbyists versus building new factories abroad? Two different types of spending that would affect the balance sheet differently, and likely be funding managed by different departments, but ultimately are to serve the same purpose of mitigating political risk.

Thanks for the read! You really highlighted the WTO’s frustrating inability to enforce its rulings. And the Trump administration is pushing its isolationist stance further by criticizing the WTO, almost to the point of threatening to break with the organization. So to answer your first question, I do believe that protectionism will escalate as the U.S. tries to repair its trade deficit and China grows its local industries.

Given the circumstances, I think Rayonier could take its diversification strategy one step further and acquire companies (American or international) whose product strategy focuses primarily on the domestic market. This sidesteps the issue of tariffs completely and significantly reduces risk related to political vagaries.

Fascinating to learn about this company which seemingly is at the dependence of many of these international trade policies. In reply to the first question posed, yes, I believe that there is great cause for concern with the ongoing increase of protectionist trade policies. What has certainly been made clear in Europe is that as the pressure rises on the middle class, governments will seek to force companies to invest locally and therefore hire locally. The most effective way to do so is through the the trade agreements, or indeed monetary policies, it does or does not adhere to.